The name eagle (Adler) had earned it almost 150 years ago by building the fastest bicycles in the world, and from then on its Frankfurt factory was synonymous with greatness, power and modernity. Until it also became a speculative object, and the management began to play with figures, exaggerating the risks, hiding losses as much as possible, like a gambler who hopes, by doubling the stakes at each turn of the card, to recoup his lost money, and is reduced to total bankruptcy.

This is happening in a Germany that was burned about three years ago by Europe’s biggest financial scandal in over a century of history, costing a sum that has not yet been fully quantified by the judiciary, but which led Wirecard (an online payment system) to an official loss of 1.3 billion Euros, but to a real fraud of even greater proportions[1]. Hence, since the state’s response in the case of Wirecard was contradictory, opaque and uncertain – and therefore strongly criticised – this time there is no compromise, and Adler must come under the axe if he really deserves it.

This is a fundamental issue since added value, in today’s world, is achieved in a very delicate balance between industry, finance and commerce, instrumentally boosted by derivative financial instruments, which allow figures to appear on balance sheets that are much higher than the real ones, the only way to avoid implosions at a global level, as in 2008, when the entire housing credit system collapsed, dragging with it the savings of millions of people and some banks that believed themselves indestructible.

Human beings do not learn from their mistakes but, as Giambattista Vico predicted, repeat history cyclically[2] (and, as the American philosopher John B. Bury explained, at an increasing speed[3]). Some of the resounding failures of companies of cyclopean proportions in the last three years cast an ominous shadow over our future: politics is too weak to impose rules and enforce them, and auditing firms – capitalism’s chosen tool for self-regulation – are almost always conniving with those who cheat. As far as Wirecard is concerned, the judiciary has so far traced almost EUR 2 billion made disappear through a network of offshore financial companies. Now there is a risk that the bankruptcy of Adler will have equivalent dimensions.

The history of the Adler Group

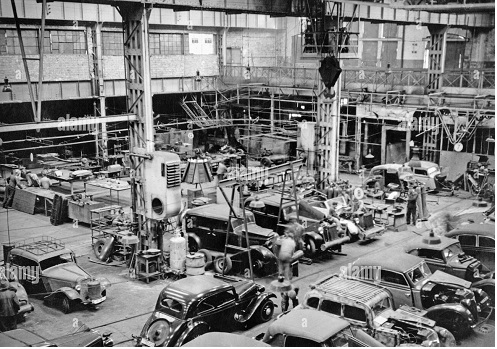

The Adler car factory at the end of the First World War[4]

The Adler Group was one of Germany’s leading real estate companies, established to overcome the chronic shortage of living space by ‘offering quality flats in which people will want to live for a long time’ in the belief that ‘it is beneficial for everyone to create satisfaction among tenants and communities’, both for the present and the future[5]. Adler has been a pioneer of German entrepreneurship since 1880, although in the beginning it was only a bicycle factory in Frankfurt. From 1889 production expanded to tricycles and cars with French engines from De Dion[6]. From 1898, the production of typewriters was added, followed in 1901 by the production of motorbikes with De-Dion engines and, from 1904, the first German automobile engine[7].

In 1909, Adler-Werke also started the production of airship engines, and in the following years, 20% of the cars on the road in Germany were manufactured by Adler-Werke[8]. In the first half of the 1930s, Adler-Werke was the third largest car manufacturer after Opel and Auto Union, ahead of Mercedes-Benz[9]. During the years of National Socialism, the company grew, especially in military production, thanks to the extensive employment of political prisoners and later concentration camp victims[10].

For this reason, during the American occupation, Adler came under the control of OMGUS[11], and in 1948, when production resumed, everything related to the military past was cancelled, and the Adler factories produced bicycles, office machines and then switched to racing motorbikes in the 1950s[12]. In 1957 Adler became part of the Grundig group, and limited itself to the production of office machines[13]. In 1961 Triumph-Adler was sold to the American Litton Group, in 1979 to the Volkswagen factory and in 1987 to Olivetti – but the computer age began, which decreed the death of the Adler factories[14] and the sale of the offices to the Philipp Holzmann AG real estate group[15]. From 2005, following the economic problems of Philip Holzmann, Adler became a construction company in the hands of an American investment fund[16].

Within a few years, it became one of the largest listed residential real estate companies in Europe – a company capable of covering the entire life cycle of a property, from planning and construction to leasing, management and maintenance[17]. For tax reasons, the group’s holding company is moved to the offshore paradise of Luxembourg[18]. At its head is chosen a man with over twenty years of experience in the sector, the Frenchman Thierry Beaudemoulin[19], who remained in charge during the period when the Adler empire imploded, leading to one of the most important bankruptcy cases in German history[20]. Next to him, on the board of directors, are all managers with years of experience and great influence not only in the economic field, but also in the political field[21].

The scandal

Building site blocked: the Steglitzer Kreisel skyscraper in Berlin[22]

The news was made public in the newspapers on 30 April 2022: ‘KPMG refused the troubled group approval of its annual accounts. In addition, long-standing allegations of fraud could not be clarified to the satisfaction of shareholders’[23]. KPMG’s refusal to give an opinion on the Adler Group’s balance sheet is motivated by the inconsistency of the documents presented by the management and the banking and industrial situation that is in the public eye, and leads the Adler share to a vertical collapse on the stock exchange[24]. But this is nothing new: in the autumn of 2021, analysts at Viceroy Research had already accused Adler of serious manipulations in project evaluation[25], insider trading and accounting tricks, accusations to which Adler responded by denying everything[26]. Behind Viceroy is Fraser Perring, a shark of international finance, who had uncovered similar irregularities in the Wirecard group in 2020 and, with his complaint, had led that group to have to announce bankruptcy[27].

As of 30 April 2022, Adler managed around 54,000 rental flats, mainly in large cities such as Berlin and Düsseldorf, had 10,000 more in the pipeline and its real estate investment portfolio amounted to EUR 12.6 billion[28]. As soon as the first allegations surfaced, the stock market price dropped by 50 per cent (about 12 Euro), after which the collapse continued, slowly and inexorably, to 2.80 Euro on 31 August 2022, meaning that each shareholder in 2021 lost 18.72 Euro per share[29]. Adler’s official document claims that it cannot bring evidence of illegality, but only of a general lack of transparency and control failures concerning some more or less suspicious transactions[30]. The Handelsblatt newspaper comments, on 29 April, that the evidence of illegality is not there because Adler, out of 1.3 million e-mails exchanged between management and with customers, refused to hand over 800,000, invoking the right to privacy[31].

Construction sites are at a standstill, first and foremost the immense one at the Steglitzer Kreisel in Berlin, the value of which, according to KPMG, is 25% lower than that stated in Adler’s balance sheet – halted, like many others, for lack of liquidity[32]. A quick analysis by the federal supervisory agency BaFin, on 22 June 2022, brought to light serious deficiencies in the balance sheet and is now placing the entire accounting control procedure under criminal investigation, starting with the balance sheets for the years 2019 and 2020[33] – a measure welcomed by the financial centre, after the hesitant reactions to the explosion of the case[34]: there are in fact ‘concrete indications that relationships and business transactions with related persons or companies (…) may not have been fully and correctly recorded and represented in the group accounts’[35].

The real problem is that the competent authorities can only examine the financial statements of Adler Real Estate AG, the German holding company, but not those of the almost 97% shareholder, Adler Group, which is based in Luxembourg[36]. This Luxembourg-based holding company states on 21 April: ‘Adler announces that KPMG Forensic has provided the company with the final report of its comprehensive review of Viceroy Research’s allegations (…). KPMG Forensic has identified deficiencies in the documentation and process management of these transactions. Regarding the so-called Gerresheim transaction (…), the allegation that the sale price of the project company was excessive cannot be refuted by KPMG Forensic. According to KPMG Forensic, it is doubtful that the EUR 375 million valuation on which the transaction is based represents fair value (…)’[37]. On another set of criticisms from KPMG there is only one comment: the auditing firm either confused or tried to include in its analysis data that is not in the public domain[38].

Cevdet Caner[39]

Added to this is the fact that Viceroy Research is a far from transparent entity: (a) it is not formally registered with any financial regulator, so its activities are not audited by anyone; (b) Fraser Perring, in 2014, was convicted in the UK of misconduct; (c) the company’s management is made up of Australian nationals in their early 20s and with no professional experience in finance; (d) if anything, Viceroy takes advantage of the upheavals caused by its analyses (which would be insider trading, or bribery), this cannot be audited, as no one knows the corporate structure of this group[40].

According to Viceroy, it is almost impossible to ‘find any truly legitimate transactions that Adler has undertaken in its corporate history’, which would be guilty of using ‘looting transactions’ (Adler sells shares or buildings to companies in its group at an inflated price, which is paid by the shareholders), ‘marking transactions’ (i.e. sales at an inflated price that are never paid in full, but still collected by the shareholders), and of plundering the substance of the acquired companies with these tricks, while continuing to account for their value prior to the plundering[41]. Among the other accusations made by Fraser Perring was the explicit reference to a network of profiteers in this carousel revolving around the entrepreneur Cevdet Caner, who, according to Perring, was secretly in charge of Adler[42]. Accusations later confirmed by an in-depth documentary produced by German state TV[43]. Accusations that Cevdet Caner, of course, denies[44].

In any case, at the time the scandal broke, Adler was seriously in debt, and admitted this publicly, promising to resolve the matter with a wholesale sale of thousands of vacant flats[45]. Adler is in arrears with the payment of its bills – to the tune of more than EUR 78 million[46]. The company pays its bills with increasing delay, blackmailing both the craftsmen who built the buildings and the customers who have paid them and are not seeing them delivered[47]. After the opening of the criminal investigation, Caner is forced to come out of the closet and announces that he will withdraw the group from the stock exchange and merge the German holding company with the Luxembourg holding company – Aggregate Holdings SA[48]. The announcement follows a few hours after BaFin found inexplicable consultancy payments of €12.6 million to Caner, which naturally increases the credibility of Viceroy’s claims[49].

Caner’s appointment as CEO of Aggregate, which had a net debt of EUR 4.5 billion at the end of 2021 and sees its bonds traded at a third of their nominal value, comes at the same time as interest rates rise, which aggravates the debt situation[50]. Aggregate is forced to sell off a stake in Adler and holdings in other real estate companies, desperately trying to refinance a major development project in Portugal[51]. At the time of writing, no one knows how this affair will end.

Gentrification

A typical diachronic pattern of the development of an industrial area due to gentrification[52]

Gentrification is a term coined in 1964 by the English sociologist Ruth Glass, which derives from the word ‘gentry’, i.e. the Anglo-Saxon petty gentry, and is used to represent the redevelopment and change in the social composition of marginal urban areas – for the benefit of the wealthy[53]. Gentrification is a process peculiar to contemporary metropolises, and it displaces the population living in neighbourhoods hitherto considered poor outside the city, replacing council houses with lofts for the super-rich[54]. The result is the replacement of the local population, which occupies a marginal place in the social hierarchies, with the new ‘settlers’ of the upper-middle class, which causes rents and the cost of living to rise dramatically[55].

In these redeveloped neighbourhoods, so-called ‘creative districts’ spring up, i.e. areas colonised by artists, galleries and museums, bars, restaurants and a ‘creative chic’ class, attracted by the new atmosphere of creative ferment in the neighbourhood – so that artists, driven out of the poor neighbourhoods, contribute to the wealth of the new chic neighbourhoods with their work[56]. The German correspondent of The New Yorker writes about Berlin: ‘By next New Year’s Eve, there could be more than a thousand new residents on our block. Last year, on a thin three-acre strip of land that hugged the wall, a dozen new buildings sprang up, containing more than seven hundred new flats, part of a complex called So Berlin. When I first visited Berlin ten years ago, the city was still recovering from decades of neglect; there was a surplus of housing and the empty industrial buildings were still occupied by artists, DJs and squatters. But, since 2004, property prices have more than doubled’[57].

What is happening in Berlin is emblematic of what happened after reunification in the big cities of the GDR, first and foremost in Leipzig and Göttingen[58] : by the 1990s, the two cities had lost half their population, which went further west in search of work, but in the last two decades gentrification has turned Leipzig and Göttingen into a garden district for rich people who don’t want to live in Berlin and who don’t want to be too far from Munich, Hamburg and Frankfurt – a change in which Adler has played the lion’s share[59]. In 2019, Adler announced that it would invest EUR 74 million in the renovation of the approximately 1100 flats it already owned with the specific intention of ‘redesigning the living environment of the area’[60]. The influence of Adler and the other big real estate groups on politics becomes evident here: despite citizens organising and protesting, gentrification proceeds unstoppably, thanks to the building permits granted by the local government[61].

The Adler scandal shows the limits of this trend: the rich are getting richer and richer, but their numbers keep decreasing. For this reason, as the current crisis is mainly affecting the middle class, those who speculated on construction and gentrification, thinking that prices would rise forever, now find themselves in serious debt, with almost no hope of selling the vast majority of the luxury flats that have been built, unless they drop in price far below the costs that were necessary to build them. As the Evergrande case shows[62], this is happening everywhere, even in China, where until recently the word crisis was an unknown word. What is needed today is a profound reform of the rules concerning auditing companies, and an activity of state agencies that is not conniving with them, but really willing to remove those who break the rules from the market. If this is not done soon, times of growing crisis of biblical proportions await us, starting with construction, which has always been the primary industry with which human beings hope to generate personal wealth.

[1] https://praxistipps.focus.de/wirecard-skandal-einfach-erklaert-so-lief-der-betrug-ab_147154

[2] Giambattista Vico, Opere a cura di Fausto Nicolini, Laterza, Bari 1914-40, volume III

[3] John Bugnell Bury, The Idea of Progress: An Inquiry into Its Origin and Growth, Dover Publications, New York 1920

[4] https://www.alamy.com/stock-photo/adlerwerke.html

[5] https://www.adler-group.com/en/company/about-us

[6] Hermann Schneider: Fünfundsiebzig Jahre Adler. 90 Jahre Tradition. Hoppenstedts Wirtschafts-Archiv, Darmstadt 1970; Heinrich Schmitt: Adler-Werke, vorm. Heinrich Kleyer A.-G. Frankfurt-M. Abriss der Werks- und Fabrikationsgeschichte 1880–1926, M. Schröder, Berlin-Halensee 1926

[7] Hermann Schneider: Fünfundsiebzig Jahre Adler. 90 Jahre Tradition. Hoppenstedts Wirtschafts-Archiv, Darmstadt 1970; Heinrich Schmitt: Adler-Werke, vorm. Heinrich Kleyer A.-G. Frankfurt-M. Abriss der Werks- und Fabrikationsgeschichte 1880–1926, M. Schröder, Berlin-Halensee 1926

[8] Hermann Schneider: Fünfundsiebzig Jahre Adler. 90 Jahre Tradition. Hoppenstedts Wirtschafts-Archiv, Darmstadt 1970; Heinrich Schmitt: Adler-Werke, vorm. Heinrich Kleyer A.-G. Frankfurt-M. Abriss der Werks- und Fabrikationsgeschichte 1880–1926, M. Schröder, Berlin-Halensee 1926

[9] Helmut Schubert: Anfänge der Luftfahrt im Raum Darmstadt und Frankfurt, in Blätter zur Geschichte der deutschen Luft- und Raumfahrt. Band 14, DGLR, Bonn 2002; Dieter Jorzick, Johann Kleine Vennekate: Adler Motorräder. Kleine Vennekate, Lemgo 2000

[10] Joanna Skibińska: Die letzten Zeugen. Gespräche mit Überlebenden des KZ-Außenlagers „Katzbach“ in den Adlerwerken Frankfurt am Main. CoCon-Verlag, Hanau 2005; Ernst Kaiser, Michael Knorn: Wir lebten und schliefen zwischen den Toten. Rüstungsproduktion, Zwangsarbeit und Vernichtung in den Frankfurter Adlerwerken. Campus-Verlag, Frankfurt 1998; https://kz-adlerwerke.de/de/orte/kz/einleitung.html ;

[11] Davis, Franklin M., Jr. Come as Conqueror: The United States Army’s Occupation of Germany, 1945-49, Macmillan, New York 1967

[12] http://www.gallustheater.de/ges/adler.htm

[13] http://www.gallustheater.de/ges/adler.htm

[14] http://www.gallustheater.de/ges/adler.htm

[15] http://www.gallustheater.de/ges/adler.htm

[16] https://adler-ag.com/unternehmen/

[17] https://adler-ag.com/unternehmen/ ; https://sec.report/lux/doc/101868425.pdf

[18] https://gettotext.com/adler-group-does-not-receive-an-attestation-from-kpmg/

[19] https://adler-ag.com/unternehmen/management/

[20] https://www.euronews.com/next/2022/04/30/adler-group-board

[21] https://adler-ag.com/unternehmen/management/ ; https://adler-ag.com/en/company/aufsichtsrat/

[22] https://www.zeit.de/wirtschaft/unternehmen/2022-06/adler-group-immobilienkonzern-rechnungen-wohnungsmarkt

[23] https://gettotext.com/adler-group-does-not-receive-an-attestation-from-kpmg/

[24] https://gettotext.com/adler-group-does-not-receive-an-attestation-from-kpmg/

[25] https://viceroyresearch.org/wp-content/uploads/2021/10/Viceroy-Research-Adler-Group.pdf

[26] https://gettotext.com/adler-group-does-not-receive-an-attestation-from-kpmg/

[27] https://gettotext.com/adler-group-does-not-receive-an-attestation-from-kpmg/

[28] https://gettotext.com/adler-group-does-not-receive-an-attestation-from-kpmg/ ; https://www.adler-group.com/unternehmen/ueber-uns

[29] https://gettotext.com/adler-group-does-not-receive-an-attestation-from-kpmg/ ; https://www.google.com/finance/quote/ADJ:ETR?sa=X&ved=2ahUKEwji_dDYxfH5AhVSh_0HHemzAdYQ3ecFegQIGxAc&window=1Y

[30] https://gettotext.com/adler-group-does-not-receive-an-attestation-from-kpmg/

[31] https://gettotext.com/adler-group-does-not-receive-an-attestation-from-kpmg/

[32] https://gettotext.com/adler-group-does-not-receive-an-attestation-from-kpmg/

[33] https://www.tagesschau.de/wirtschaft/unternehmen/bafin-adler-real-estate-bilanz-pruefung-101.html

[34] https://www.tagesschau.de/wirtschaft/unternehmen/bafin-adler-real-estate-bilanz-pruefung-101.html

[35] https://www.tagesschau.de/wirtschaft/unternehmen/bafin-adler-real-estate-bilanz-pruefung-101.html

[36] https://www.tagesschau.de/wirtschaft/unternehmen/bafin-adler-real-estate-bilanz-pruefung-101.html ; https://irpimedia.irpi.eu/openlux-perche-criminali-scelgono-lussemburgo/

[37]https://dl.bourse.lu/dl?v=3KZXVvp/ctj2I7gl4ctombFvmQO9r8ljaopQNcBMK1GyMrWzDi263m2fMD9YKTk9IU/sHXb+m56saLQkVNRcOtnQVLKRA/VAeA2hMTrQGx7QL0fJjm18bcv+/X4SzYgxcss5aEsWRHzbGtl91AplAtNiR06vlA99n+q1Pb5uwWBlaULy0TvJ+A4etPpSvkPPidhC64LRw5JkOw5+atApoJtRpL8uxGnCDpw+6YFOKtbgU7TqMoc1K4+Asl/WZE6HDwGBxLy+/lyec/YXPQkuuMS8qZXpgivrMOvXC7sFEF8=

[38]https://dl.bourse.lu/dl?v=3KZXVvp/ctj2I7gl4ctombFvmQO9r8ljaopQNcBMK1GyMrWzDi263m2fMD9YKTk9IU/sHXb+m56saLQkVNRcOtnQVLKRA/VAeA2hMTrQGx7QL0fJjm18bcv+/X4SzYgxcss5aEsWRHzbGtl91AplAtNiR06vlA99n+q1Pb5uwWBlaULy0TvJ+A4etPpSvkPPidhC64LRw5JkOw5+atApoJtRpL8uxGnCDpw+6YFOKtbgU7TqMoc1K4+Asl/WZE6HDwGBxLy+/lyec/YXPQkuuMS8qZXpgivrMOvXC7sFEF8=

[39] https://www.ft.com/content/7c2ccf73-97e3-4b9e-9cc0-470e037b6de0

[40] “Investment Research in the Era of Fake News” Stuart Theobald, PhD, CFA – Graunt Kruger, PhD – Orin Tambo, CFA -Colin Anthony; Copyright Intellidex (Pty) Ltd. ; 2018 ; Pag. 4 e 5 https://www.intellidex.co.za/wp-content/uploads/2018/07/Intellidex-Report_Investment-Research-in-the-Era-of-Fake-News.pdf

[41] https://viceroyresearch.org/wp-content/uploads/2021/10/Viceroy-Research-Adler-Group.pdf

[42] https://www.tagesschau.de/wirtschaft/unternehmen/adler-immobilien-perring-bilanz-101.html

[43] https://www.baunetz.de/meldungen/Meldungen-Dokumentation_ueber_Adler_Group_in_der_ARD-Mediathek_7973344.html

[44] https://www.tagesschau.de/wirtschaft/unternehmen/adler-immobilien-perring-bilanz-101.html

[45] https://www.tagesschau.de/wirtschaft/unternehmen/adler-immobilien-perring-bilanz-101.html

[46] https://www.ndr.de/der_ndr/presse/mitteilungen/Wohnungskonzern-Adler-offene-Rechnungen-in-Millionenhoehe,pressemeldungndr23276.html

[47] https://www.ndr.de/der_ndr/presse/mitteilungen/Wohnungskonzern-Adler-offene-Rechnungen-in-Millionenhoehe,pressemeldungndr23276.html

[48] https://www.baunetz.de/meldungen/Meldungen-Dokumentation_ueber_Adler_Group_in_der_ARD-Mediathek_7973344.html

[49] https://www.ft.com/content/7c2ccf73-97e3-4b9e-9cc0-470e037b6de0

[50] https://www.ft.com/content/7c2ccf73-97e3-4b9e-9cc0-470e037b6de0 ; https://www.bloomberg.com/news/articles/2022-07-04/caner-takes-stake-in-adler-s-investor-aggregate-becomes-ceo

[51] https://www.bloomberg.com/news/articles/2022-07-04/caner-takes-stake-in-adler-s-investor-aggregate-becomes-ceo

[52] https://www.cnu.org/publicsquare/2017/07/26/gentrification-examined-wider-time-frame

[53] https://www.treccani.it/enciclopedia/gentrification

[54] https://www.treccani.it/enciclopedia/gentrification

[55] https://www.treccani.it/enciclopedia/gentrification

[56] https://www.treccani.it/enciclopedia/gentrification

[57] https://www.newyorker.com/news/dispatch/the-causes-and-consequences-of-berlins-rapid-gentrification

[58] HAASE, A., RINK, D. (2015): Inner-city transformation between reurbanization and gentrification: Leipzig, eastern Germany. Geografie, 120, No. 2, pp. 226–250. https://www.researchgate.net/profile/Dieter-Rink/publication/306192036_Inner-city_transformation_between_reurbanization_and_gentrification_Leipzig_Eastern_Germany/links/5ad0b6b2a6fdcc29357ad58b/Inner-city-transformation-between-reurbanization-and-gentrification-Leipzig-Eastern-Germany.pdf?origin=publication_detail

[59] https://www.stadtradio-goettingen.de/beitraege/soziales/infoveranstaltung_von_adler_real_estate_zu_baumassnahmen_in_grone_sued/

[60] https://www.goettinger-tageblatt.de/lokales/goettingen-lk/goettingen/faellt-die-entscheidung-zugunsten-der-adler-real-estate-ZQMCEUJMTJCCIFEFZ5XEB74744.html

[61] https://www.goettinger-tageblatt.de/lokales/goettingen-lk/goettingen/steht-grone-vor-tiefgreifenden-veraenderungen-LCSX2EL5U4ZBNA5CVZCX74XYOY.html

[62] https://www.glistatigenerali.com/imprese/indebitamento-in-cinese-si-traduce-evergrande/

Leave a Reply