Two and a half centuries ago, the physicist Antoine-Laurent Lavoisier uttered a phrase that has become a mantra of our civilisation of progress: ‘Nothing is created, nothing is destroyed, everything is transformed’[1] . In these difficult months of war and skyrocketing inflation, the media is full of information about the economic losers of the invasion of Ukraine and the sanctions against Russia. What no one is reporting is who is gaining – because money is not being destroyed, it is being moved. And managing these movements (acquiring a not insignificant slice of it) are the big multinational banks, first and foremost Goldman Sachs which, from Romano Prodi to Mario Monti, and today to Mario Draghi, has had so much influence on the destinies of Italy – and those of many EU countries.

No conspiracy, everything happens in the light of day. The trouble is that we look the other way, and in the meantime, the bank claims to be on the side of the ‘good guys’: Goldman Sachs CEO David Solomon officially announced to the press on 10 March 2022 his bank’s firm intention to withdraw from Russia because of the sanctions imposed by the United States[2] . But he was careful to point out: ‘I do not know whether it is the task of large financial institutions to ostracise Russia’[3]. a statement that caused a stir, because at the end of 2021 the bank had a financial exposure in Russia of more than 700 million dollars[4], and yet it was the first major bank to leave Russia. This decision is hard to believe, given Goldman Sachs’ role in the global energy business.

The Global Oil and Gas Exit List[5] says that the global hydrocarbons market is the prerogative of a few companies (the top 20 are responsible for more than half of the sector) and that banking support for these companies is in the hands of the world’s leading banks, which provide as much as 63% of the necessary financing: JPMorgan Chase, Citibank, Bank of America, BNP Paribas, HSBC, Barclays, Morgan Stanley, CréditAgricole, Société Générale and, last but not least, Goldman Sachs[6]. The big banks, despite their official claims, still invest $742 billion a year in hydrocarbons, so much for environmental protection[7]. For this reason, if Goldman Sachs today claims to be breaking off relations with Russia, it must be seen whether this is true[8] .

Ugly stories of conflicts of interest

Goldman Sachs’ first headquarters in a New York basement[9]

The story of the bank begins in 1869: a German immigrant of Jewish descent, Marcus Goldman, moved to New York and opened an office in the basement, next to a coal chute, of 30 Pine Street in Lower Manhattan[10] . During a period of limited and expensive bank credit, Goldman offered local merchants their promissory notes[11] that he would later resell to commercial banks. Together with his son-in-law, Samuel Sachs, in 1882, and his son Henry (1885), the company took on its current name and landed on the New York Stock Exchange (1896), and had representative offices in all the major US cities[12] . From 1897, Goldman Sachs established relationships with financial companies in the main European capitals, providing foreign exchange and letters of credit services[13], as well as gold transport and commercial arbitrage[14].

In the early 1900s Goldman Sachs entered investment banking[15] . It ended up overwhelmed by the failure of its investment funds Shenandoah Corporation and Blue Ridge Corporation, and only recovered with the economic boom following the end of World War II[16] . In 1976, it became one of the world’s largest banks and was the first to offer derivative financial instruments (futures[17], options[18] and swaps[19]) to customers. These were the years when industrial capitalism ceased its expansive phase, the market being saturated, and we moved on to financial capitalism, which imploded in 2008[20], when the volume of derivatives reached the insane figure of 33 times the world’s GDP (2.2 million billion Euros)[21] . In this new virtual world, Goldman Sachs plays a leading role, speculating on overvalued securities and mortgages, without any guarantees, and continually risking producing global collapses – as happened in 2008-[22] .

This is not only a question of global finance but, of course, a question of conflicts of interest and democratic control of the levers of power. Goldman Sachs was one of the first banks to offer a career to established politicians, or to finance a political career for its most loyal executives, achieving something that goes far beyond lobbying, even to the extreme extent that it is permissible in the United States. The phenomenon was born in the years of the great recession, and has been very successful. Some enlightening examples: Henry Paulson, US Treasury Secretary from mid-2006 to January 2009, worked at Goldman Sachs from the 1970s until becoming its CEO (1999-2006)[23] . Mark Patterson, the Goldman Sachs lobbyist, was on the staff of Treasury Secretary Timothy Geithner during the Obama administration[24], whose presidential campaign was supported by Lloyd Blankfein, Chairman of Goldman Sachs[25].

Robert Rubin, United States Secretary of the Treasury from 1995 to 1999, was a partner at Goldman Sachs from 1966 to 1992 and co-chairman of the same from 1990 to 1992[26] ); Robert Zoellick (United States Trade Representative from 2001 to 2005, Deputy Secretary of State from January 2005 to July 2006 and President of the World Bank from 2007 to 2012), held various senior positions at Goldman Sachs between 2006 and 2013[27] ); Joshua Bolten (White House Chief of Staff to George W. Bush from 2006 to 2009) was executive director of Goldman Sachs London from 1994 to 1999[28] . Not to mention John Whitehead who left Goldman Sachs at the end of 1984 to be appointed Deputy Secretary of State to President Ronald Reagan.

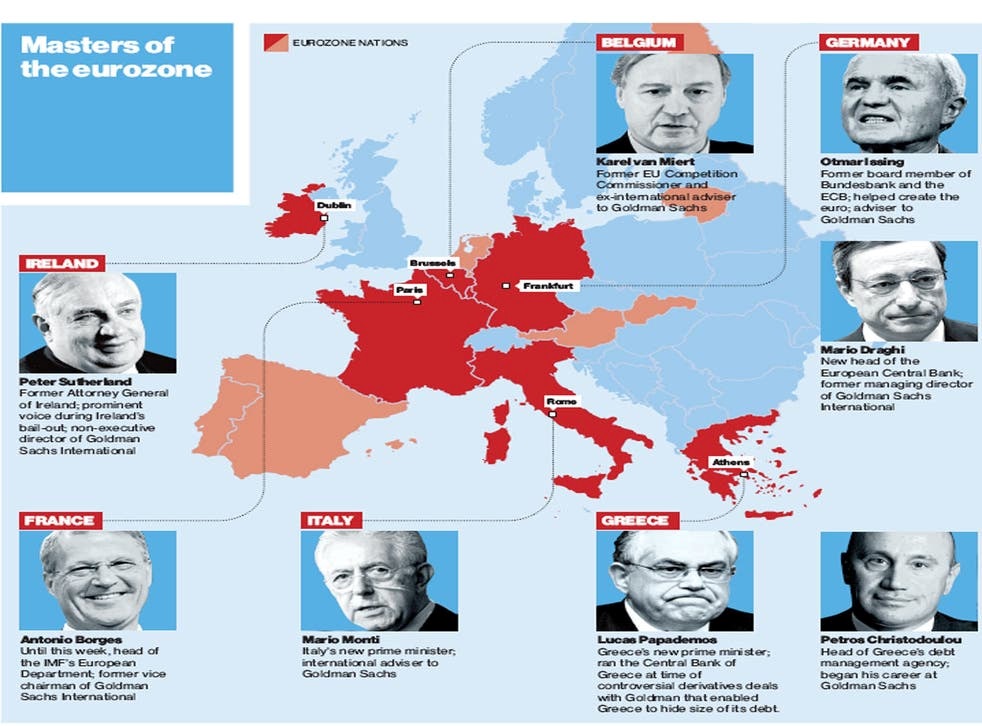

The list is not limited to the United States. Italian Prime Minister Mario Draghi, Governor of the Bank of Italy from 2006 to 2011 and of the European Central Bank from 2011 to 2019, was Vice-President of Goldman Sachs Europe from 2002 to 2005[29] . His staff included Gianni Letta, Undersecretary of State to the Prime Minister’s Office in the governments led by Silvio Berlusconi[30] . Mario Monti, European Commissioner from 1994 to 2004, President of the Council of Ministers of the Italian Republic from 2011 to 2013, was an advisor to Goldman Sachs for many years and a member of the Research Advisory Council of the Goldman Sachs Global Market Institute[31]. Lucas Papademos, former head of Goldman Sachs, was Prime Minister of Greece from 2011 to 2012[32]. Mark Carney, Governor of the Bank of Canada from 2008 to 2013, worked for thirteen years at Goldman Sachs[33]. Romano Prodi, President of IRI from 1982 to 1989 and from 1993 to 1994, Prime Minister of Italy from 1996 to 1998 and from 2006 to 2008, President of the European Commission from 1999 to 2004, was a consultant to the bank from 1990 to 1993 and after 1997[34]. Massimo Tononi, Undersecretary for the Economy in the second Prodi government from 2006 to 2008 and Chairman of the Italian Stock Exchange since 2011, was a partner and advisory director at Goldman Sachs[35].

The role of Citigroup and Goldman Sachs in the Russian-Ukrainian conflict

Goldman Sachs managers who managed Eurozone finances[36]

Of course, such a large and powerful bank cannot remain immune from scandals, the biggest of which is probably the involvement of former manager Roger Ng in the fraudulent bankruptcy of the Malaysian 1MDB group – at the end of which trial NG was convicted of complicity in fraud[37]. Roger Ng was responsible for managing the money embezzled from projects to support the poor, which was secretly reinvested in Abu Dhabi[38] . Through Ng, Goldman Sachs diverted some USD 6.5 billion between 2009 and 2015[39] . But in this case the bank’s headquarters remained untouched, the blame was shifted to Malaysian officials.

Quite another matter is the current role Goldman Sachs plays in relation to the war in Ukraine – a role that automatically stems from the bank’s massive presence in the hydrocarbon sector. A role that calls into question the value of the sanctions applied by Western countries against the Kremlin. In May 2015, Russian oligarch Sergey Petrov (car trading), responding to a German newspaper that asked him whether sanctions or the drop in oil and gas prices were worse for Russia, replied: ‘Both are serious, in almost equal parts. I would say: 30 per cent the drop in oil prices, 25 per cent the sanctions. And the rest is homegrown by the behaviour of officials’[40] .

In order to avoid the burden of sanctions and control the price of hydrocarbons, Moscow and Berlin started building the submarine pipeline Nordstream 2, which, taking the place of the one running through Ukraine and several other EU countries, would make Russia almost unassailable, as long as its alliance with Germany held. In this regard, Alexej Miller, CEO of Gazprom, not surprisingly stated: ‘The construction of additional transport infrastructure on the shortest route between the gas fields in northern Russia and markets in Europe will help increase the security and reliability of supplies under the new contracts”[41] . But the war in Ukraine is changing everything, and, in Germany, even Chancellor Scholz’s Social Democrats, traditionally great friends of Putin, have been forced to block the construction of the pipeline.

Goldman Sachs had already sensed the air in the air for some time. Its international fund GQG (the only one burdened with financial exposure in Russia due to its remaining holdings in the energy companies LUKOIL, Rosneft and Gazprom), on 4 March 2022, with perfect timing to say the least, reduced its financial commitment from USD 1.7 billion to only USD 222.3 million[42], i.e. less than 1% of the GQG fund’s net assets[43].

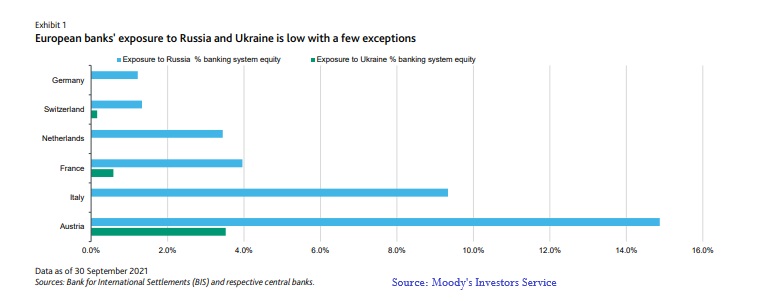

On 27 February 2022, Western countries decided to exclude major Russian banks from SWIFT, excluding those needed to pay for gas sold by Russia to Europe[44], and to freeze the assets of the Central Bank of the Russian Federation, which holds $630 billion in foreign exchange reserves, to prevent it from offsetting the impact of sanctions[45]. At the same time, Western economies started talking about eliminating dependence on Russian gas ‘by the end of 2022’[46] . This does not apply to everyone, because the dependence of some EU countries on Russian supplies is more than half of the necessary quantities – so it is hoped to be free of Kremlin ties by 2030[47].

European Banks’ Exposure to Russia[48]

It is not as bad as it sounds. The decrease in Russian revenues on global markets is compensated by the rising price of gas: +250% compared to a year ago[49], which has allowed Moscow to double its earnings[50]. According to Finnish experts at CREA, the Finnish Centre for Energy and Clean Air Research, Russia not only continues to benefit from Europeans’ energy dependence, but will also benefit in the future, as rising prices compensate Russia for lost sales volume[51]. The only way to stop the war by throttling the Russian economy would be a quick and complete rejection of their energy products – a course of action that is patently impractical[52] .

In reality, trade in Russian gas and oil knows no restrictions, except those ordered by Moscow, which forces buyers to pay in hard currency that has to be exchanged into roubles before being paid[53]. The fact that, between war, sanctions and the flight of foreign companies, Moscow risks losing 8.5% of its GDP this year (the biggest drop since the -14.5% recorded in 1992[54], at the fall of the Soviet Union) matters little in a Global World Conflict that, in the West, is hoped to be short-lived, and Moscow seems to be aiming to make it last as long as possible – a war of attrition to expose the Atlantic Alliance’s weaknesses.

Russian countermeasures were not long in coming: on 28 February 2022, the Governor of the Russian Central Bank, ĖlviraNabiullina, decreed a freeze on stock exchange trading and banned foreigners from short selling[55]. Alongside this measure, and in order to limit dangerous capital flight from the country and support the rouble, the Russian Central Bank immediately raised the discount rate by 10.5% to 20%[56] .Together with the rise in the price of gas, the strict capital control measures imposed by Moscow after the introduction of sanctions, the demand for payments in roubles[57] for natural gas supplies, and the obligation for exporting companies to sell their foreign currency reserves, have meant that from an initial slump following the start of the war, the Russian currency gained over 11% against the dollar in 2022[58].

Among the additional exceptional measures in defence of the rouble, taken after the start of the war, is one with a vague retro flavour: the introduction of fixed gold convertibility at a price of 5000 roubles per gram, below market values, in order to rake in gold from the country’s financial institutions and lay the groundwork for the creation of a new fixed-standard monetary system, similar to that of the United States before the cancellation of the Bretton Woods agreements (1973): a direct attack on the US[59] . This is the background to the strategy of Goldman Sachs, which is grappling with sanctions, while maintaining its complex links with the Russian oligarchs and the Moscow financial market. On the one hand, it drastically decreases its investments in Russia, claiming to enforce sanctions, but on the other hand, it clearly states that it will not break its commitments to protect the interests of its clients[60]. As of 3 March, only some of the 80 employees of Goldman Sachs remained in Moscow – but those who stayed work[61].

We are not talking about peanuts, but $650 million, of which $133.9 million in derivatives[62], $176.8 million in loans, and $339.3 million in secured credits[63]. Add to this the receivables from the Russian domestic market, and with that we exceed $1 billion[64]: a figure that Goldman Sachs does not intend to include in its balance sheet liabilities[65]. Half of that billion was sold to US hedge funds by exploiting a legal loophole in the sanctions[66], which allowed it to act as an intermediary between Moscow’s creditors and US investors, offering clients the opportunity to take advantage of the initial paralysis of the Russian economy resulting from the war by buying its debt securities at low prices at the time to sell them high later[67].

To its clients, Goldman Sachs offers to add each one’s Russian debt to its hedge fund portfolio, hiding it in its personal account to avoid possible scrutiny[68]. Again, there is no mention of the crumbs that fell off the table: on 4 March 2022, Bloomberg reported that Goldman Sachs and JPMorgan Chase were allegedly hoarding Russian-linked corporate bonds, at a time when hedge funds specialising in buying cheap credit were trying to fill up on assets: betting on distressed securities is a normal activity on Wall Street – even if doing so in the wake of the invasion of Ukraine entailed a not inconsiderable assumption of risk… A well-calculated risk, which in the end guaranteed a gain estimated at hundreds of millions of dollars[69] . The question remains as to why the sanctions applied to Russia have not completely banned trading in these assets, among which are corporate debts of giants such as Evraz, Gazprom and Russian Railways maturing within the next two years, as well as Russian sovereign bonds[70].

Development of default risk assessment on swaps with Russia[71]

Personally, I believe that the US wants to reduce Putin’s political clout, but not destroy Russia. The stakes are high: the sanctions have also made 41 billion dollars of insurance against the risk of default available, so it is not surprising that Goldman Sachs simultaneously negotiated CDS (Credit-Default Swaps) on names such as Evraz and Gazprom despite the fact that there was no certainty that the contracts concluded for the aforementioned 41 billion dollars of sovereign debt could not be nullified by the sanctions[72].

But the attitude of the banks shows that, if there are no loopholes, the interdependence between national economic systems does not allow the sanctions to be effectively applied, without creating a short circuit that would put in trouble, even before Russia, the individual western companies that have invested in that country, starting with the clearing – that is, the calculation system that, in real time, estimates the amount of cash and bank transfers that, every day, are exchanged from one currency to another[73] .

This does not happen without repercussions. Should the creditors receive what they are owed, i.e. should Citigroup have paid what it received in funds processed by JP Morgan, the whole world would have had proof of the concrete and substantial futility of the sanctions regime and Russia’s ouster from SWIFT, to which must be added the costs of counter-sanctions and the fallout on global trade in manufacturing and agribusiness (which is driving commodity prices sky-high). Citigroup acts as a stockbroker for almost 50 Russian corporate bonds, including those of MMC Norilsk Nickel, Gazprom, Severstal (steel) and EuroChem, a leading fertiliser company (a strategic sector on which Moscow has banned exports, sending farmers across half of Europe into a panic). By the time JP Morgan confirmed the transfer of funds to Citigroup and the latter entrenched itself behind a noisy no comment, one of the two bonds on which the interest was accruing saw its price jump by ten dollars in the space of minutes, clear proof that someone had openly violated the sanctions in the general silence.

Without violating any laws, therefore, the big American banks are earning big money from the conflict in Ukraine[74] . This gives rise to some legitimate questions: how come President Biden and his administration gave investment companies the green light to trade in Russian assets?[75] How come, in March 2022, when the US sanctioned Russian banks, the Treasury Department’s Office of Foreign Assets Control (OFAC) affirmed the legitimacy of Russian asset trading in secondary markets (i.e. those not directly involving Russian banks), making it possible for Goldman Sachs to act as a broker?[76] .

The sanction action, according to OFAC, ‘does not prohibit trading in the secondary markets of debt securities or shares’ of the Russian Central Bank, the Russian National Wealth Fund, or the Russian Ministry of Finance, provided that these institutions are not parties to the trades and that the debts were not issued before 1 March[77] : a ludicrous political ploy by the US presidency[78] to protect US investors, including major pension funds, at the very moment when allies are being urged to be resolute and European chancelleries are clumsily preparing to deal with the consequences of de facto damaging sanctions on domestic economic policies and the maintenance of the welfare state[79] .

The Abramovich case

Outline of Roman Abramovich and Michael Matlin’s secret operations in Austria[80]

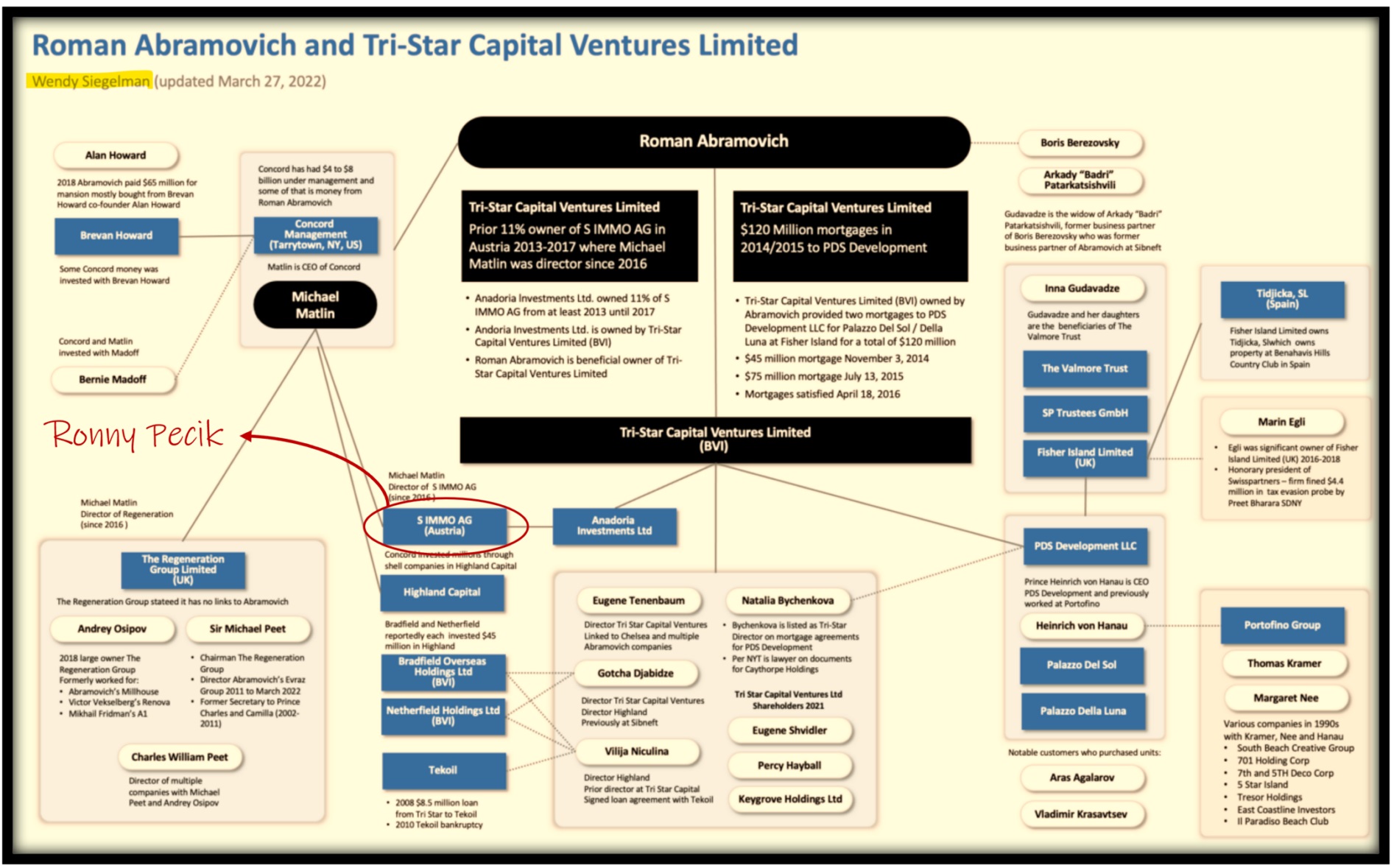

To try to better understand the interdependence linking Russian economic power with Goldman Sachs, it is worth dwelling on the links between the bank, Concord Management, Millennium Management and the Russian tycoon Roman Abramovich[81]. These entities, centralising accounting operations in a shell company registered in the Virgin Islands, secretly transferred 20 million dollars to a Cayman Islands financial company: this first operation gave way to a whole series of similar activities which, over a period of 20 years, saw Abramovich rely on a series of shell companies, channelling the money through a small Austrian bank and exploiting the knowledge of important Wall Street companies, to silently place billions of dollars with important hedge funds and US private equity firms[82].

The keystone of the whole operation was that every professional involved could honestly say they did not work for Abramovich (in some cases, they really did not know) [83]. The same is likely to happen with the assets of the oligarchs on the sanctions list of Western countries. As for Abramovich, his name is not on the US black list (although it is in Canada, the UK and the EU)[84] . Be that as it may, Abramovich’s estimated fortune is believed to be around $13 billion and his assets in the US include many millions of dollars of real estate, such as a couple of luxury residences near Aspen, Colorado, to which must be added the large sums of money deposited with various financial institutions[85].

Many of Abramovich’s investments in the US, according to people familiar with the transactions, were facilitated by Concord Management Llc Tarrytown (NY), a tiny company headed by one Michael Matlin who describes his company as ‘a consulting firm that provides independent third-party research, due diligence and investment monitoring’ [86]. Concord Management, which has no website and is not registered with US regulators), allegedly did not handle Abramovich’s money but merely acted as an advisor on behalf of secret clients of Credit Suisse, Morgan Stanley and Goldman Sachs[87] . Over the years, Concord has ‘advised’ more than 100 investments in various hedge funds and private equity firms, mainly on behalf of Abramovich[88]– funds managed by BlackRock, Sarissa Capital Management, Carlyle Group, De Shaw, Bear Stearns and Millennium Management[89], i.e. the most fashionable names on Wall Street.

The lion’s share was taken by Millennium Management, a hedge fund with a portfolio of over USD 48 billion in assets under management, headed by former top officials of Goldman Sachs[90]: Paul Russo (former global chief operating officer of a subsidiary of the bank until 2018), Scott Rofey (the new head of rate and risk management at Goldman Sachs), Jeffrey Verschleiser (the head of credit risk management and collateralised securities until 2019)[91] and Stacy Selig, for 17 years co-head of sales strategy, one of the most senior women at Goldman Sachs[92] . In addition to these four top executives, there are another half-dozen lower-level executives[93] . A fact that explains Millennium’s reticence in giving explanations, and suggests that this company, as well as the entire galaxy of micro-companies involved in hiding Abramovich’s wealth, is part of a conscious Goldman Sachs strategy of alliance with the Kremlin and its oligarchs.

Concord Management is blatantly just one element in a constellation of American and European advisors, including some of the world’s biggest law firms, who have long been helping the oligarchs[94]. We only realise this now, because the world has turned its attention against the Ukrainian invaders, and because, due to sanctions, this galaxy is currently engaged in a super job of further secretly shifting assets[95]. Take this into account when you go shopping and don’t have enough money, or when the politician on duty fills his mouth with dispassionate love for Ukraine, but lets it be known that he is powerless in the face of the tumult of events…

[1]https://www.mmcm.it/nulla-si-crea-nulla-si-distrugge-tutto-si-trasforma-autore-della-frase-e-significato/

[2]https://www.agenzianova.com/news/goldman-sachs-lascia-la-russia-e-la-prima-grande-banca-usa-a-farlo/

[3]https://time.com/6157107/david-solomon-goldman-sachs-ceo-interview/

[4]https://www.nytimes.com/2022/03/10/business/goldman-sachs-russia.html

[5]https://gogel.org/system/files/uploads/urgewald%20GOGEL2021V2.xlsx

[6]https://wwwqa.goldmansachs.com/what-we-do/investing-and-lending/direct-private-investing/alternative-energy/index.html?view=mobile

[7]https://www.ft.com/content/3eeee0f7-bb02-4950-a6d6-49da39c3cc41

[8]https://www.reuters.com/business/finance/goldman-sachs-exit-russia-bloomberg-news-2022-03-10/

[9]https://www.goldmansachs.com/our-firm/history/moments/1929-30-pine.html

[10]https://www.goldmansachs.com/our-firm/history/a-brief-history-of-gs.pdf

[11]The term promissory note refers to a speculative financial instrument (loan collateral, receivables settlement) that can become a highly profitable investment by virtue of the fact that the higher risk of default compared to a corporate bond is offset by higher interest rates.

[12]https://www.goldmansachs.com/our-firm/history/a-brief-history-of-gs.pdf

[13]A letter of credit is a form of payment without the use of cash represented by an irrevocable obligation on the part of the bank to pay against presentation by the beneficiary of documents corresponding to the conditions contained in the letter of credit.

[14]The term arbitrage refers to a transaction that allows a certain profit to be obtained without the party entering into it incurring any risk. Usually, arbitrage consists of the purchase/sale of an asset or financial activity and a simultaneous opposite transaction on the same instrument traded on a different market, or on a different instrument, but having the same characteristics as the former in terms of payout. In this way, price differences are exploited in order to make a profit. The transaction is of course possible if the gain obtained exceeds the costs of transferring the asset from one market to another.

[15]https://www.goldmansachs.com/our-firm/history/a-brief-history-of-gs.pdf

[16]https://www.goldmansachs.com/our-firm/history/a-brief-history-of-gs.pdf

[17]A future is a derivative contract by which buyer and seller undertake to exchange a certain quantity of a certain financial or real asset at a predetermined price and with deferred settlement at a predetermined future date. The trader buying the future (committing to buy the underlying asset on maturity) takes a long position, while the trader selling the future takes a short position.

[18]The term ‘option’ refers to that particular type of contract which confers on the holder the right, but not the obligation (the option), to buy or sell the security on which the option is entered at a predetermined price (strike price) by a certain date, in return for a non-recoverable premium paid. Options can have the most diverse underlying values: shares, commodities, interest rates, etc. The fundamental difference between options and other derivative instruments consists in the holder’s right of withdrawal: he or she is not obliged to buy (or sell) the underlying, but may do so if by exercising the option he or she derives a real benefit.

[19]A swap is a derivative contract whereby two parties undertake to periodically exchange sums of money calculated by applying to the same principal two parameters referring to two different market variables. Swaps are not traded on regulated markets, but are entered into from time to time through bilateral agreements between the parties involved (over-the-counter market).

[20]https://www.e-periodica.ch/cntmng?pid=wis-001%3A1990%3A10%3A%3A361

[21]https://amp24.ilsole24ore.com/pagina/AErENbtG

[22]https://www.adusbef.it/articoli-e-studi/goldman-sachs-la-spectre-che-gioca-con-i-derivati-sui-destini

[23]https://web.archive.org/web/20111007193804/http://www.whorunsgov.com/Profiles/Henry_Paulson

[24]https://abcnews.go.com/Blotter/story?id=6735898

[25]https://web.archive.org/web/20110408181921/http://washingtonexaminer.com/blogs/beltway-confidential/2011/02/obamas-top-funder-also-lead-nation-white-house-visits

[26]https://www.washingtonpost.com/wp-srv/politics/govt/admin/rubin.htm

[27]https://www.goldmansachs.com/media-relations/press-releases/archived/2013/robert-b-zoellick-to-serve-goldman-sachs.html

[28]https://georgewbush-whitehouse.archives.gov/government/bolten-bio.html

[29]https://www.lemonde.fr/europe/article/2011/11/14/goldman-sachs-le-trait-d-union-entre-mario-draghi-mario-monti-et-lucas-papademos_1603675_3214.html ;https://www.telegraph.co.uk/finance/markets/2809685/Italians-claim-country-run-by-Goldman-Sachs.html

[30]https://st.ilsole24ore.com/art/SoleOnLine4/Finanza%20e%20Mercati/2007/06/letta-goldman.shtml

[31]https://www.lemonde.fr/europe/article/2011/11/14/goldman-sachs-le-trait-d-union-entre-mario-draghi-mario-monti-et-lucas-papademos_1603675_3214.html ; https://ec.europa.eu/economy_finance/bef2009/speakers/mario-monti/index.html ; https://web.archive.org/web/20121103170302/http://archiviostorico.corriere.it/2005/dicembre/14/Goldman_Sachs_Monti_nell_advisory_co_9_051214069.shtml

[32]https://www.lemonde.fr/europe/article/2011/11/14/goldman-sachs-le-trait-d-union-entre-mario-draghi-mario-monti-et-lucas-papademos_1603675_3214.html

[33]https://st.ilsole24ore.com/art/finanza-e-mercati/2011-11-04/canadese-mark-carney-succede-161453.shtml?refresh_ce=1

[34]https://www.telegraph.co.uk/finance/markets/2809685/Italians-claim-country-run-by-Goldman-Sachs.html

[35]https://www.telegraph.co.uk/finance/markets/2809685/Italians-claim-country-run-by-Goldman-Sachs.html ; https://web.archive.org/web/20131004235349/http://archiviostorico.corriere.it/2010/marzo/29/Tononi_prepara_addio_Goldman_ce_0_100329049.shtml

[36]https://www.independent.co.uk/news/business/analysis-and-features/what-price-the-new-democracy-goldman-sachs-conquers-europe-6264091.html

[37]https://www.theguardian.com/world/2022/apr/08/roger-ng-1mdb-scandal-fraud-found-guilty

[38]https://www.theguardian.com/world/2022/apr/08/roger-ng-1mdb-scandal-fraud-found-guilty

[39]https://www.theguardian.com/world/2022/apr/08/roger-ng-1mdb-scandal-fraud-found-guilty

[40]https://www.welt.de/wirtschaft/article140711075/Putin-fuehlt-dass-ohne-ihn-alles-zum-Teufel-geht.html

[41]https://www.offshore-energy.biz/gazprom-e-on-shell-and-omv-in-nord-stream-boost/

[42]https://www.gsam.com/content/dam/gsam/pdfs/us/en/fund-resources/investment-education/GQG_Commentary.pdf?sa=n&rd=n

[43]https://www.privatebankerinternational.com/news/goldman-sachs-gqg-fund-russia/

[44]https://www.ilpost.it/2022/02/27/swift-banche-russe-escluse/

[45]https://www.informazione.it/a/20D7D5D5-6755-4D39-A6D9-D0E98F4DDA91/Le-sanzioni-bloccano-le-riserve-in-valuta-Crolla-la-fortezza-russa ; https://www.scoa.it/2022/03/lisolamento-russo-quanto-pesano-le-sanzioni-finanziarie-su-mosca/

[46]https://www.scoa.it/2022/03/lisolamento-russo-quanto-pesano-le-sanzioni-finanziarie-su-mosca/

[47]https://www.scoa.it/2022/03/lisolamento-russo-quanto-pesano-le-sanzioni-finanziarie-su-mosca/

[48]https://www.reuters.com/markets/stocks/which-banks-europe-are-exposed-russia-2022-02-28/

[49]https://www.rainews.it/articoli/2022/05/la-guerra-del-gas-leuropa–nella-morsa-tra-russia-e-ucraina-dce90cb2-a34c-4f47-b313-23785e54aaf8.html

[50]https://www.rainews.it/articoli/2022/04/dallinizio-della-guerra-la-russia-ha-raddoppiato-gli-incassi-dalla-vendita-di-idrocarburi-alla-ue-924fa6f8-9d35-4535-a096-78c1d20b2f19.html

[51]https://www.rainews.it/articoli/2022/04/dallinizio-della-guerra-la-russia-ha-raddoppiato-gli-incassi-dalla-vendita-di-idrocarburi-alla-ue-924fa6f8-9d35-4535-a096-78c1d20b2f19.html

[52]https://www.rainews.it/articoli/2022/04/dallinizio-della-guerra-la-russia-ha-raddoppiato-gli-incassi-dalla-vendita-di-idrocarburi-alla-ue-924fa6f8-9d35-4535-a096-78c1d20b2f19.html

[53]https://www.wired.it/article/gas-rubli-pagare-russia-ucraina-guerra-putin/

[54]https://www.scoa.it/2022/03/lisolamento-russo-quanto-pesano-le-sanzioni-finanziarie-su-mosca/

[55]https://www.rainews.it/articoli/2022/03/dopo-quasi-un-mese-riapre-la-borsa-di-mosca-chiusura-a-+437-la-casa-bianca-accusa–una-farsa-238f518d-bcde-427d-84e8-56e41364da84.html

[56]https://www.ilmattino.it/economia/news/rublo_ucraina_russia_moneta_crescita_cosa_succede-6685303.html?refresh_ce

[57]https://www.ilpost.it/2022/04/01/decreto-russia-putin-gas/

[58]https://www.ilmattino.it/economia/news/rublo_ucraina_russia_moneta_crescita_cosa_succede-6685303.html?refresh_ce

[59]https://www.milanofinanza.it/news/la-russia-torna-agli-accordi-di-bretton-woods-una-manna-per-il-rublo-202203311227494860

[60]https://finanza.lastampa.it/News/2022/03/10/goldman-sachs-lascia-la-russia-prima-big-di-wall-street-a-farlo/MTUxXzIwMjItMDMtMTBfVExC

[61]https://finanza.lastampa.it/News/2022/03/10/goldman-sachs-lascia-la-russia-prima-big-di-wall-street-a-farlo/MTUxXzIwMjItMDMtMTBfVExC

[62]Over-the-counter, OTC, derivatives are privately negotiated contracts between two parties, without going through an exchange or other intermediary. Since they are not listed on any exchange, the rules of the OTC contract are not only decided privately but are also changeable at any time. OTC derivatives are widely used by investment banks. Swaps and forward rate agreements belong to this type of derivatives, as do exotic options and other exotic derivatives that are almost always traded in the same way.

[63]https://www.globaldata.com/gross-exposure-around-1-billion-goldman-sachs-announces-exit-russia-says-globaldata/

[64]https://finanza.lastampa.it/News/2022/03/10/goldman-sachs-lascia-la-russia-prima-big-di-wall-street-a-farlo/MTUxXzIwMjItMDMtMTBfVExC

[65]https://www.nbcnews.com/politics/politics-news/goldman-sachs-profits-ukraine-war-loophole-sanctions-rcna19584

[66]https://www.nbcnews.com/politics/white-house/biden-administration-sanctions-additional-russian-oligarchs-rcna18604

[67]https://www.nbcnews.com/politics/politics-news/goldman-sachs-profits-ukraine-war-loophole-sanctions-rcna19584

[68]https://www.nbcnews.com/politics/politics-news/goldman-sachs-profits-ukraine-war-loophole-sanctions-rcna19584

[69]https://www.bloomberg.com/news/articles/2022-03-03/wall-street-is-already-pouncing-on-russia-s-cheap-corporate-debt

[70]https://www.bloomberg.com/news/articles/2022-03-03/wall-street-is-already-pouncing-on-russia-s-cheap-corporate-debt

[71]https://www.money.it/Russia-evitato-default-scoperchiato-vaso-Pandora

[72]https://www.bloomberg.com/news/articles/2022-03-03/wall-street-is-already-pouncing-on-russia-s-cheap-corporate-debt

[73]https://www.money.it/Russia-evitato-default-scoperchiato-vaso-Pandora

[74]https://www.mic.com/impact/goldman-sachs-russia-ukraine-debt

[75]https://www.nbcnews.com/politics/politics-news/goldman-sachs-profits-ukraine-war-loophole-sanctions-rcna19584

[76]https://www.nbcnews.com/politics/politics-news/goldman-sachs-profits-ukraine-war-loophole-sanctions-rcna19584

[77]https://home.treasury.gov/policy-issues/financial-sanctions/faqs/1005 ; https://home.treasury.gov/system/files/126/eo14024_directive_4_02282022.pdf ; https://home.treasury.gov/system/files/126/russia_directive_1a.pdf

[78]https://www.nbcnews.com/politics/politics-news/goldman-sachs-profits-ukraine-war-loophole-sanctions-rcna19584

[79]https://www.nbcnews.com/politics/politics-news/goldman-sachs-profits-ukraine-war-loophole-sanctions-rcna19584

[80]https://fintelegram.com/chasing-russian-oligarchs-and-their-assets-a-cia-report-and-the-austrian-connection/

[81]https://www.nytimes.com/2022/03/21/business/russia-roman-abramovich-concord.html

[82]https://www.nytimes.com/2022/03/21/business/russia-roman-abramovich-concord.html

[83]https://www.nytimes.com/2022/03/21/business/russia-roman-abramovich-concord.html

[84]https://www.leggo.it/esteri/news/zelensky_abramovich_sanzioni_trattative_pace_ultimissime_oggi_23_marzo_2022-6582625.html ; https://www.nytimes.com/2022/03/21/business/russia-roman-abramovich-concord.html

[85]https://www.nytimes.com/2022/03/21/business/russia-roman-abramovich-concord.html ; https://www.nytimes.com/2022/03/11/world/europe/roman-abramovich-russian-oligarch-sanctions.html

[86]https://www.nytimes.com/2022/03/21/business/russia-roman-abramovich-concord.html

[87]https://www.nytimes.com/2022/03/21/business/russia-roman-abramovich-concord.html

[88]https://www.nytimes.com/2022/03/21/business/russia-roman-abramovich-concord.html

[89]https://www.nytimes.com/2022/03/21/business/russia-roman-abramovich-concord.html

[90]https://www.ft.com/content/bda53479-431f-45de-9c0a-8a53073680c2

[91]https://www.ft.com/content/bda53479-431f-45de-9c0a-8a53073680c2

[92]https://www.efinancialcareers.com/news/2021/03/stacy-selig-millennium-management

[93]https://www.efinancialcareers.com/news/2021/03/stacy-selig-millennium-management

[94]https://www.nytimes.com/2022/03/09/business/russian-oligarchs-money-concord.html

[95]https://www.nytimes.com/2022/03/09/business/russian-oligarchs-money-concord.html

Leave a Reply