The invasion of Ukraine is a comprehensive strategic move by the Russian government, carefully prepared, and for years, and reasoned out in minute detail. It is not only about finding political, diplomatic, and military allies, but also about finding companies that will keep the Russian economy moving by circumventing sanctions. Moscow has many allies in Africa[1], but not only. Everywhere in the world there are businessmen who have been working with Russia for years and who, for mutual convenience, are loyal to it. Many of these come from countries that traditionally do big business in Africa: Israel and Lebanon. In recent decades, the Russian community in Israel has grown to have significant political and economic clout[2].

Until the spring of 2022, these ties remained hidden, and there is still a lack of awareness of how much the war is changing Africa’s industrial and banking sector. Well, the time has come to ask questions and to start looking critically at the development of some of the most controversial companies and banks in the African economy – such as Afriland First Bank, a Cameroonian giant and powerhouse of the Congolese economy, which until now has only been seen as an extreme expression of Western neo-colonialism, and may instead be something else.

Neo-colonialism does not only exist because of Western multinationals. Among those who commit crimes against the environment and the population, there are many African citizens who, once successful, ally themselves with the multinationals in the exploitation of their country. Sometimes they are politicians: people who, in order to come to power, use mercenary militias and money from those who exploit black people. Sometimes they are businessmen who, with great cynicism, sell the future of the continent, allying themselves with and supporting those who, in Africa, have always only been after booty.

As in the case of Afriland – a Cameroonian bank, officially founded to give people access to micro-credit, and thus to finance their emancipation from poverty and market the fruits of their labour. A bank that, on the contrary, is allied with unscrupulous companies and businessmen and, for this reason, opens branches all over the world, looking for partners in the exploitation of Cameroon, before expanding at home. With success[3]. A long road that began with the dream of Pan-Africanism[4], as described by Henry Sylvester Williams: ‘protesting against land theft in the colonies, racial discrimination and discussing the problems of black people’, encouraging and strengthening the bonds of solidarity between ethnic groups and the diaspora of African origin, unity for economic, social and political progress – as Alphone Nafack sums up, ‘not only what you do in life, but also what you inspire others to do’[5].

Afriland and Dan Gertler

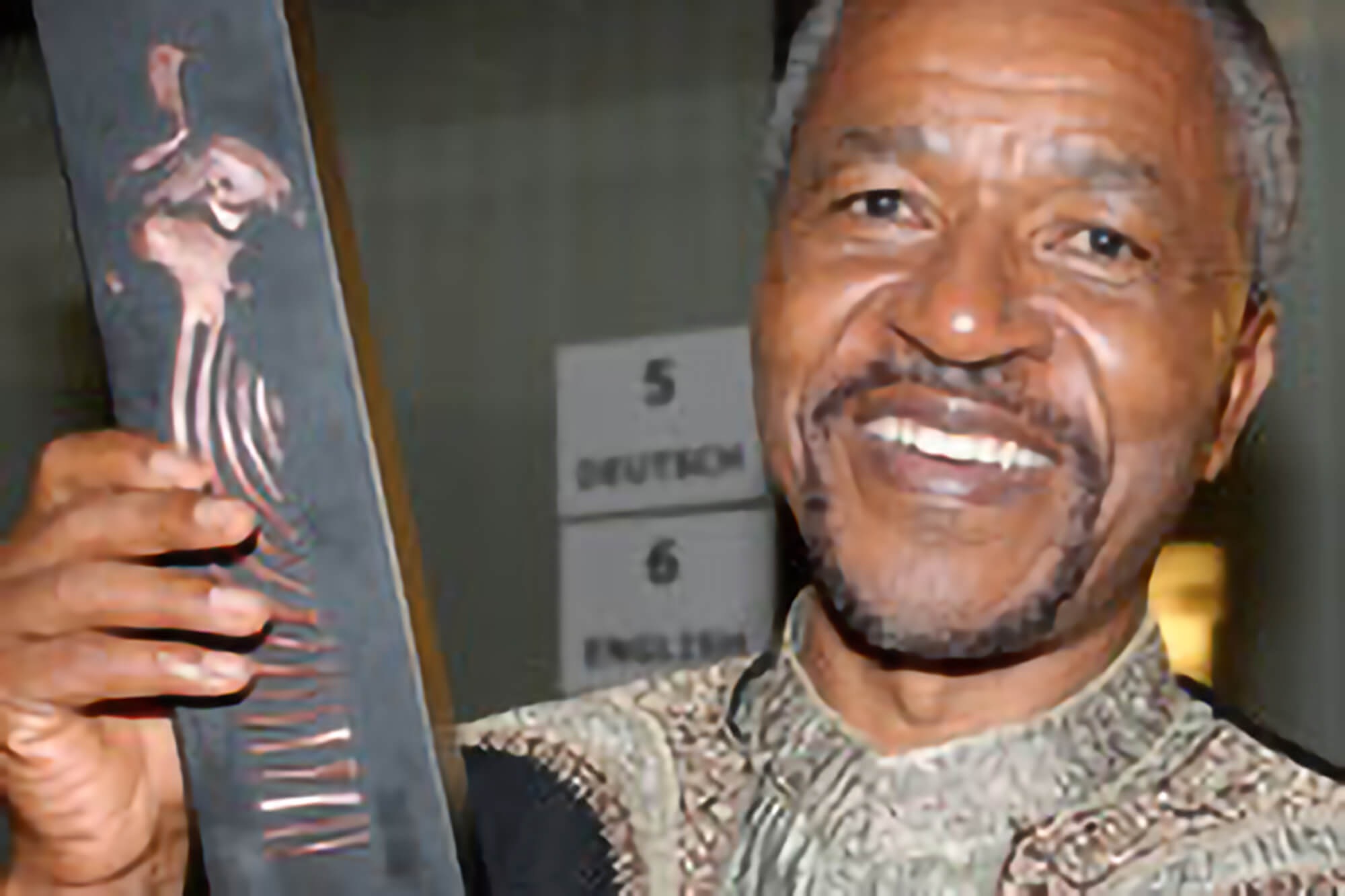

Former Congolese President Kabila and his Israeli friend Dan Gertler[6]

Afriland First Bank, in order to avoid problems with the disappointment of its compatriots, moved its holding company to Switzerland[7] – a full service bank[8], offering not only credit, but also strategic, commercial, and marketing consulting services, born in 1987 from the idea of Paul K. Fokam[9], and realised by two parties in Yaoundé: Jean Paulin Fonkoua[10] and Célestin Guela Simo[11]. The idea grew to be the largest financial services group in Cameroon, with branches in the Democratic Republic of Congo, Guinea, Equatorial Guinea, Liberia, South Sudan, Zambia and São Tomé and Príncipe[12].

In the 1990s, it achieved a fifth of the local market share, with a total balance sheet of CHF 1150 billion CFAF (EUR 1.75 billion) at the end of 2019[13], enabling it to compete with multinationals, is the main provider of financing for the Central African Economic Community (CEMAC) and the most important partner of the Banque des Etats de l’Afrique Centrale (BEAC), which is the central bank of CEMAC[14]. In December 2010, customer deposits amounted to approximately USD 951 million, and the institution’s global assets exceeded USD 2.3 billion[15]. Impressive figures that, of course, cannot be achieved with microcredit and support for the local economy.

The bank has grown by doing business with controversial businessmen, arms and diamond traffickers, mercenaries and swindlers of all sorts – so that Afriland is suspected of illegal activities involving mining companies with billions in interests[16]; two informants receive death threats after exposing bank fraud in the DRC subsidiary[17], because attacking Afriland takes on a political value anyway[18]: Paul K. Fokam is accused of illegally enriching himself on the backs of his clients and of being an accomplice of one of Africa’s most powerful racketeers, Israeli businessman Dan Gertler[19].

The latter has been sanctioned by the US Treasury Department[20] for having woven an international money laundering network and for having forged links with former President Kabila and other influential politicians in the DRC, a country that Gertler considers ‘his second home’[21]. Afriland is said to have covered the trafficking of the Israeli tycoon’s holding company, Gerco, and dozens of other front companies belonging to him, registered in tax havens[22]. International NGOs document the existence of a system designed to hide payments and deposits of tens of millions of dollars, which would allow Gertler, despite the sanctions, to continue to make huge profits from his business activities in the DRC[23].

Gertler’s activities that have come under judicial scrutiny mainly involve ‘blood diamonds’, i.e. smuggled diamonds used as currency for criminal transactions[24]. Afriland offers itself as a key player in their trade: it accepts the diamonds, without checking their origin, turns them into money (in valuable currency such as dollars, euros or pounds sterling), and then transforms this criminally earned money into a clean investment[25], managed by Gertler[26] in complicity (as in the case of the company Evelyne Investissement) with former DRC President Joseph Kabila[27] and the Kinshasa state mining company, Gécamines[28].

March 2021: Rabbi Avraham Moyal (left), President Félix Tshisekedi and Pastor Paul-David Olangi (right) negotiate the agreements between Gertler and the new Congolese government in Kinshasa[29]

Things haven’t changed since the change in power: the new president, Felix Tshisekedi, shortly after his election in January 2019 and the subsequent formation of the new government, met with Dan Gertler – and with him he uses velvet gloves, provoking media irritation: ‘Under the new president, the Congolese government has promised to prioritise the fight against corruption. If the administration is serious about this, it must start by freezing Dan Gertler’s assets and checking all his deals with state-owned companies‘[30]. This is pragmatism because, as Global Witness points out, the DRC, while fearing slaps from the International Monetary Fund or even sanctions, needs traders who create wealth in foreign currency[31].

Dan Gertler is a ‘child of the art’: born into a family dedicated to trading and cutting diamonds, he started when he was 20 years old in Angola and Liberia trading ‘diamonds for weapons’. At the age of only 23, Gertler landed in Mobutu’s former Zaire, and put himself at the service of Laurent-Désiré Kabila, self-proclaimed president in May 1997, after Mobutu had fled to Morocco. In return, Gertler obtained agreements on the country’s key mining concessions: diamonds, cobalt and copper[32]. At the dawn of the new millennium, Dan Gertler becomes the exclusive exporter of Congolese diamonds, and earns billions – money that ends up in Afriland First Bank[33] and makes it grow, until greed drives the bank’s management to implosion: frequent, even fatal, brawls between managers[34].

On 26 February 2021, the NGO PPLAAF (Platform for the Protection of Whistleblowers in Africa) claims, through the testimony of two former employees, that Afriland First Bank DRC protected money laundering networks and circumvented international sanctions[35]. On 25 February 2021, Afriland’s lawyer, Eric Moutet, declared at a press conference that the two whistleblowers had been sentenced to death by a court in Kinshasa[36]. But the investigations go on: according to an article in Haaretz, documents submitted to arbitration proceedings in Israel on behalf of Israeli mining magnate Dan Gertler implicate the latter in a scandal concerning the payment of USD 360 million in bribes to officials in the Democratic Republic of Congo[37].

Some US senators ask the Treasury Department to punish those who circumvent sanctions. Subsequently, some 40 MEPs are calling for the EU to adopt a regime to sanction individuals like Gertler, especially after it was discovered that, thanks to Gertler, Hezbollah also entered the blood diamonds business and laundered its earnings through Afriland[38]. Documents collected by Navy Malelan (auditor of Afriland Kinshasa) show how an account opened without an account holder (in other words, a ghost account), called disposition à payer, allowed companies in Dan Gertler’s network to launder illegally obtained money – as well as tens of millions of dollars in loans granted by Afriland without collateral[39].

21 million dollars were transferred to accounts outside DRC, and another 25 million dollars were transferred to Gécamines, DRC’s state-owned mining company[40]. On 15 January 2021, the Trump administration granted a licence to Gertler and his companies to access (until 31 January 2022) the accounts seized by the judiciary[41]. The result is a series of feverish operations in DRC territory, as Gertler and his accomplices make the evidence of any illicit or suspicious transactions disappear as best they can – so much so that the Kinshasa judiciary is now accusing former Prime Minister Richard Muyej of being unable to justify 40 per cent[42] of his cabinet’s expenditures[43]. Bank documents reveal that €4.4 million was withdrawn in cash between 28 December 2018 and 14 January 2019 in the middle of the electoral process[44]. By whom, this is not known.

Richard Muyeji[45]

No surprise: Afriland First Bank does not hesitate to open accounts for controversial politicians and businessmen like Richard Muyej, whose name is intertwined with that of China in the ‘cobalt contagion in Kasulo’[46]. Muyej granted the mining rights in Kasulo to Congo Dongfang International Mining, a subsidiary of the Chinese Zhejiang Huayou[47]. Muyeji is suspected of having facilitated suspicious banking transactions with several companies, affected by US sanctions, suspected of belonging to Hezbollah, a Lebanese anti-Zionist Shia paramilitary organisation, which was founded in June 1982[48]: Afriland First Bank manages the accounts of IFCO, involved in the deforestation of the Congolese jungle, owned by Ahmed Tajeddine, a member of a very powerful family[49], whose members have been affected by US sanctions since 2010[50].

In August 2020, a new scandal broke out: according to The Sentry, even North Korea used Afriland for illegal operations[51]. In cahoots with then-President Kabila’s party, a company, Congo Aconde, was founded, which finances a Kabila ally, Emmanuel Ramazani Shadary, a friend of the company’s North Korean owner – and into the company’s accounts at Afriland pass the North Korean dictatorship’s operations to circumvent sanctions and provide Pyongyang with Western currency[52]. The system works: one year after the beginning of the business relationship with Dan Gertler, Afriland’s Congolese subsidiary doubles its balance sheet[53].

The bank’s activities also undermine the Congolese government’s skimpy social policies: Vital Kamerhe, former chief of staff of President Felix Tshisekedi, is accused of embezzling more than USD 50 million intended for the construction of 4500 prefabricated houses as part of an emergency programme promoted by the newly elected president[54]. Kamerhe is paying with imprisonment, but the scandal affects the highest echelons of the DRC civil service[55]. Besides them, businessmen from all over the world are also involved, such as the Lebanese Samih Jammal[56], already on trial for fraud and corruption in the US[57].

For the bank, nothing changes. There are no consequences. As in the trial in which Afriland management is involved in a scam against a former employee[58]. Until finally, in 2019, the BCC Central Bank of Congo launches an investigation[59]. It is not only about corruption, but also about skills and efficiency. This is why many within the Congolese Association of Banks have been advocating the creation of a risk control centre for years. Former BGFI banker Jean-Jacques Lumumba is one of the forerunners of the risk centre idea. In protest against the management methods in his bank, Lumumba fled to Europe and used the documents he had brought with him to disclose the ‘Lumumba Papers’, a wealth of information showing that the Congolese banking system is far from meeting the minimum criteria of security and professionalism[60].

The Belgian newspaper Le Soir loudly supports the banker’s protest, and denounces the suspicious activities of BGFI, precisely by analysing the documents disclosed by Lumumba: corruption, illegal financing and embezzlement[61]. The documents also show suspicious transactions between the BGFI and the National Electoral Commission. ‘The DRC has all the right texts to have a healthy banking system, but what is lacking is oversight,’ says Lumumba. “There is a serious problem of identification. In such a system, Dan Gertler can open an account with one passport and open another with a Congolese voting card’[62].

Jean-Jacques Lumumba[63]

On 9 July 2020, the Congolese Association of Banks reiterates in a communiqué its commitment to have the regulatory framework changed in line with the FATF and Basel Committee recommendations: it announces the revision of its statutes to make them more binding, and asks Congolese banks to conduct independent audits; finally, it states that it is aware of the inescapable nature of the dollar in the Congolese financial system. In the mining sector, some companies work with artisanal diggers: this implies payments of millions of dollars in cash, without any control, and the bank can hide those figures on the balance sheet, if it wants to, as part of the execution of a public contract for the construction of social housing[64].

Or a contract for public transport; Afriland First Bank is accused, among other things, of illegally withholding commissions with which they were supposed to finance improvements to the railway network[65]. All this is allegedly closely linked to the emergency programme of President Felix Tshisekedi, whose inner circle and his dispute over mining deals are in the crosshairs of NGOs[66]. And they continue to monitor the links between Gertler and the bank[67].

According to the report of PricewaterhouseCoopers (PwC), the auditing firm in charge of financial certification, there are at least three companies accused of being linked to Dan Gertler among the bank’s corporate accounts: Ventora Development, Dorta Invest SA, Interactive Energy DRC SA[68]. The NGOs are furious[69]. Afriland First Bank then launches a media counter-offensive[70], accusing Global Witness and PPLAAF of ‘using falsified testimonies and evidence’. But the Congolese trade unions discover that the bank’s claims are based on forged documents[71].

Of course Dan Gertler also denies the accusations against him[72], supported by his lawyer, Éric Moutet, who also defends Afriland. The bank’s reputation is in any case compromised, because the whole of Africa knows very well who the Israeli billionaire is and what he is guilty of – not least of having facilitated the interests of large multinational mining groups such as Glencore or the Kazakhs of Eurasian Natural Resources Corporation, by bribing politicians and DRC officials[73]. According to the US Treasury, Dan Gertler caused more than one billion dollars in lost revenue for the Congolese state between 2010 and 2012[74] and more since then[75].

International NGOs dig deeper and deeper, and discover the accounts of a Russian business lawyer, specialising in international mergers and acquisitions, Kirill Parinov. He, unknown in the DRC, nevertheless owns a company created on 22 August 2019, Riverside Project Management, and is linked to Starstone DRC, in which he is a partner of Brazzaville businessman Serge Pereira. Between September 2018 and February 2019, the Russian lawyer withdrew more than 50 million in cash from his account with Afriland on behalf of Riverside[76]. Source of the money: unknown.

Kirill Parinov[77]

When questioned by magistrates, Afriland’s managing director claims that the levies are related to the construction of a road bridge in Kinshasa, estimated to be worth $1.3 billion. But according to a government source, the project has not yet started in 2019 and the costs associated with the work do not require more than $7 million, and were awarded to Starstone, not Riverside. If this is the case, why should the bank pay 50 million to Parinov’s company?[78] A legitimate question, when one considers that the bank is in such dire straits that in March 2023 it convinced the DRC government to support the bank’s liquidity with the gift, through Gécamines, of $27 million[79].

Global Witness adds another piece to this immense puzzle, and discovers that Gertler, together with Afriland, brokered the negotiations between the Kinshasa government and a Swiss company, Interactive Energy AG Lucerne, which belongs to a Russian businessman, Ruben Katsobashvili, who is evidently (he is 90 years old and lives in Moscow in anything but luxury) – a man behind whom lies some as yet unknown Russian political and industrial interests[80].

A coincidence: since the invasion of Ukraine began, Cameroon, which until then had had practically zero trade with Russia (0.04% of Cameroon’s trade balance), has opened several new trade accounts with Afriland First Bank selling, from Cameroon Belarussian fertilisers and Russian agricultural products for figures that exceeded (in 2022) 96.6 billion CFA Francs ($180 million), despite the fact that Cameroonian imports from Russia have dropped below one million[81] and there is no contact between the government in Yaoundé and Russia.

Unfortunately, the West is distracted – especially the European Union. First in Libya[82], then in the whole of Africa[83], it did not realise in time what was happening, and is now too compromised with its multinational companies to react. The entanglements of Russian and European interests are inextricable, no matter what the policy positions are, and the US is deluding itself if it believes it can change this with sanctions and war supplies to Ukraine: these are fine, but they are not enough. To win the war, it will be impossible for Europe to beat Russia on its own if it is unable to defeat Russia within itself.

[1] LAVROV, L’AFRICA E IL NUOVO ORDINE GLOBALE | IBI World Italia

[2] https://library.fes.de/pdf-files/bueros/israel/50427.pdf ; https://www.timesofisrael.com/25-years-later-russian-speakers-still-the-other-in-israel-says-mk/

[3] https://www.afrilandfirstgroup.com/index.php/en/

[4] https://www.treccani.it/enciclopedia/panafricanismo

[5] https://www.alphonsenafack.com/

[6] https://www.jeuneafrique.com/dossiers/dan-gertler-dieu-le-congo-et-lui/

[7] Afriland First Bank Group, Neuchâtel, Switzerland – Top Local Places CONTACT (afrilandfirstgroup.com)

[8] https://www.afrilandfirstbank.com/index.php/en/

[9] Board of Directors (afrilandfirstgroup.com)

[10] M. Jean Paul FONKOUA, Executive vice-president (afrilandfirstgroup.com)

[12] https://pressroom.ifc.org/all/pages/PressDetail.aspx?ID=16542

[13] Annual_Report_AFB_2019.pdf (afrilandfirstbank.com)

[14] Beac authorizes the operations of Afriland Bourse & Investissement – Business in Cameroon

[15] Annual report 2010 (afrilandfirstbank.com)

[16] Bank officials ‘expose money-laundering network’ | Article | Africa Confidential (africa-confidential.com)

[17] Afriland First Bank (occrp.org)

[18] https://www.businessincameroon.com/index.php/finance/2406-12640-afriland-first-bank-cd-shaken-by-internal-conflicts-fueled-by-malpractice-accusations

[19] Undermining_Sanctions_-_July_2020.pdf

[20] https://www.theafricareport.com/234166/drc-dan-gertler-the-inevitable-rise-of-kabilas-businessman/

[21] Exclusive – Dan Gertler: ‘Everyone was afraid of the Congo, but not me’ (theafricareport.com)

[22] Diamanti di sangue: la brutta storia continua in Congo – Società Missioni Africane

[23] Undermining Sanctions: How mining magnate Dan Gertler appears to have dodged US penalties | Global Witness

[24] Everything you need to know about Glencore, Dan Gertler and their interest in DRC | Glencore | The Guardian

[25] Undermining Sanctions: How mining magnate Dan Gertler appears to have dodged US penalties | Global Witness

[26] We stand in solidarity with Congolese whistleblowers | Global Witness

[27] Dan Gertler and Afriland First Bank start legal fight in Paris (theafricareport.com)

[28] Des ONG réitèrent leurs accusations contre la Gécamines – DW – 30/11/2018

[29] https://www.africaintelligence.com/central-africa/2022/08/22/rabbi-moyal-in-last-ditch-attempt-at-mediation-between-dan-gertler-and-felix-tshisekedi,109805956-ge0

[30] Controversial billionaire Dan Gertler appears to have used suspected international money laundering network to dodge US sanctions and acquire new mining assets in DRC | Global Witness

[31] New EU sanctions regime is an important achievement but leaves the door open to dirty money | Global Witness

[32] Rd Congo, una storia di diamanti troppo sporchi anche per i Panama Papers | Rivista Africa (africarivista.it)

[33] Afriland First Bank CD shaken by internal conflicts fueled by malpractice accusations – Business in Cameroon

[34] DRC – Deux lanceurs d’alerte révèlent des schémas frauduleux – PPLAAF

[35] En DRC, le jeu trouble du milliardaire israélien Dan Gertler face aux sanctions américaines (lemonde.fr) ; ‘Gertler and Associates Would Come to the Bank, and a Teller Would Take a Sack and a Bill Counter Up to Management’ – Israel News – Haaretz.com ; Sanctioned Billionaire Dan Gertler’s Haven: A Tiny Congolese Bank – Bloomberg

[36] DRC – Extremely serious attacks on whistleblowers, the press and civil society – PPLAAF ; Africa News: Congo Whistleblowers Win Defamation Case Against French Lawyer – Bloomberg

[37] ‘Bribe Totaling $360m’: Docs Presented by Israeli Billionaire Dan Gertler Embroil Him in One of Biggest Graft Probes Ever – Israel News – Haaretz.com

[38] Dan Gertler Revelations – PPLAAF ; Hezbollah and Israel’s Richest Were Both Welcome at a Congo Bank – Bloomberg ; Affaire Afriland First Bank en DRC: en quoi les lanceurs d’alerte sont-ils crédibles? (rfi.fr) ; ‘Gertler and Associates Would Come to the Bank, and a Teller Would Take a Sack and a Bill Counter Up to Management’ – Israel News – Haaretz.com ; Bank officials ‘expose money-laundering network’ | Article | Africa Confidential (africa-confidential.com) ; Marc Bonnant épinglé dans le cadre d’une affaire de fuite bancaire – rts.ch – Suisse ; Dossier Afriland First Bank : le coup de gueule des actionnaires minoritaires, Dr Fokam pointé du doigt | Actualite.cd ; Exposing a Congolese bank’s dirty secrets – The Mail & Guardian (mg.co.za)

[39] Bank officials ‘expose money-laundering network’ | Article | Africa Confidential (africa-confidential.com)

[40] Dan Gertler aurait échappé aux sanctions américaines – DW – 02/07/2020

[41] Gradi Koko & Navy Malela – PPLAAF

[42] DRC: qui peut retirer des millions à Afriland First Bank? (rfi.fr)

[43] PPLAAF su Twitter: “8/ Richard Muyej, Congolese governor accused by Congolese authorities of failing to justify 40% of his cabinet’s expenses, is also withdrawing hundreds of thousands of dollars from Afriland. https://t.co/DGPBNX5V9u” / Twitter

[44] DRC: main basse sur les fonds de la Chambre haute du Parlement (rfi.fr)

[45] https://zoom-eco.net/developpement/richard-muyej-aucun-chinois-nest-mort-lors-des-incidents-de-lwilu/

[46] https://www.newyorker.com/magazine/2021/05/31/the-dark-side-of-congos-cobalt-rush ; https://www.business-humanrights.org/pt/latest-news/drc-workers-protest-the-working-conditions-in-congo-dongfang-mine/ ; https://www.amnestyusa.org/wp-content/uploads/2017/11/Time-to-recharge-online-1411.pdf

[47] The Dark Side of Congo’s Cobalt Rush | The New Yorker

[48] DRC: qui peut retirer des millions à Afriland First Bank? (rfi.fr)

[49] IL BUSINESS MILIONARIO, NEMMENO TANTO SEGRETO, DI HEZBOLLAH IN GAMBIA | IBI World Italia ; https://today.lorientlejour.com/article/1282561/how-did-the-network-of-tajeddine-companies-circumvent-us-sanctions-against-hezbollah.html

[50] Buyers Beware: How European timber companies could be importing illegal Congo timber and possibly breaching EU legislation | Global Witness

[51] Affaires risquées – The Sentry ; OvertAffairs-TheSentry-August2020.pdf

[52] https://drcactu.cd/2020/08/21/afriland-first-bank-et-le-clan-kabila-au-coeur-dun-scandal-de-blanchiment-des-capitaux-rapport-affaires-risquees-de-the-sentry/

[53] Afriland First Group listed in a fraud and corruption case in the DRC – Business in Cameroon

[54] https://www.africanews.com/2022/06/24/drc-vital-kamerhe-acquitted-of-embezzlement-conviction//

[55] https://www.africanews.com/2022/06/24/drc-vital-kamerhe-acquitted-of-embezzlement-conviction/

[56] Procès des 100 jours en DRC: Samih Jammal le bouc-émissaire de la lutte politique ? – Financial Afrik

[57] https://law.justia.com/cases/federal/appellate-courts/ca4/15-1247/15-1247-2015-06-09.html

[58] Cliff Masagazi v Afriland First Bank (U) Limited (Company Cause 8 of 2020) [2021] UGHC 48 (24 June 2021); | Ulii

[59] Congo Central Bank Takes Over Afriland Amid Concern of Contagion – Bloomberg

[60] Jean-Jacques Lumumba – PPLAAF

[61] Corruption au Congo: les preuves qui accablent le régime Kabila – Le Soir

[62] BGFIBANK-DRC-censure.pdf (pplaaf.org)

[63] https://commons.wikimedia.org/wiki/File:Jean-Jacques_Lumumba_1.png

[64] Afriland, Gertler, the dangerous links of the banking system : Orishas-finance

[65] DRC : Kinshasa orders Afriland to pay treasury millions levied on transporters – 21/01/2022 – Africa Intelligence

[66] DRC : Felix Tshisekedi’s inner circle in a panic over mining deal dispute – 10/01/2022 – Africa Intelligence

[67] Affaire Afriland en DRC: «Il y a une entreprise criminelle installée à la banque» (rfi.fr)

[69] Despite Sanctions, Millions Flowed Into DRC Bank Accounts Linked to Israeli Tycoon – Israel News – Haaretz.com

[70] Listed in a fraud case in DRC, Afriland group lodged a complaint against its accusers in Paris – Business in Cameroon

[71] France : Les représailles contre PPLAAF et Global Witness s’intensifient avec de nouvelles procédures-bâillons | Solidaires ; https://www.pplaaf.org/cases/afriland-drc.html

[72] Mining magnate Gertler denies skirting U.S. sanctions in Congo | Reuters

[73] https://www.globalwitness.org/en/archive/ftse-100-mining-company-enrc-must-openly-address-congo-corruption-concerns/

[74] https://home.treasury.gov/news/press-releases/jy0515

[75] https://www.raid-uk.org/blog/drc-congo-stands-lose-3-71-billion-mining-deals-dan-gertler

[76] Affaire Afriland First Bank en DRC: les bonnes affaires du Russe Kirill Parinov (rfi.fr)

[77] https://e.korpurist.ru/525261

[78] https://www.pplaaf.org/cases/afriland-drc.html

[79] Banque: 27 millions US$ soutirés de la Gécamines pour sauver Afriland (mediacongo.net)

[80] https://www.pplaaf.org/downloads/business_as_usual.pdf, pag. 14-15

[81] https://www.businessincameroon.com/index.php/public-management/2403-12451-cameroon-buys-a-lot-from-russia-and-ukraine-but-sells-them-almost-nothing-report

[82] HAFTAR, THE SPY WHO CAME IN FROM THE COLD | IBI World UK

[83] LAVROV, L’AFRICA E IL NUOVO ORDINE GLOBALE | IBI World Italia

Leave a Reply