In many countries, corruption is not prosecuted, resulting in the silent anger of a large part of the population and the ignorance of most. One of the most striking cases is that of Finland, a country in which the political elite is strongly compromised with financial and industrial power and is willing to put huge sums of money and the protection of its environment at stake in order to ensure a comfortable life for its political leaders. This is clear from the Talvivaara mine affair and the suspicious agreements made this century between the Helsinki governments and one of the giants of the global mining sector: Trafigura, one of the most controversial companies on the planet.

The Talvivaara mine (as well as its following company Terrafame Inc.) is a major producer of nickel and zinc, but it uses bioleaching to extract the metals from the ore – i.e. dissolving them using bacteria[1], a very low-cost process[2]. Its deposits contain a huge amount of nickel sulphide (340 million tons) which, according to experts, will last for several decades[3], also producing copper, zinc and cobalt[4].

The Kuusilampi and Kolmisoppi deposits, discovered in 1977 by the Geological Survey of Finland, were assigned to the Outokumpu Corporation, which since 1914 had brought together the country’s wealthiest families in the development of a nascent Finnish mining industry[5]. As Outokumpu specialised in steelworks over the decades, the two oldest mines in Talvivaara were sold at the end of the last century for 1 Euro[6] to a member of the management, Pekka Perä, who then for more than a decade[7], thanks to various government subsidies and bank loans, managed to expand the mine and make it the giant it is today[8].

In 2004, the mine was expanded to cover the entire territory of Sotkamo Municipality, and the following year, in December 2005, given the size of the project, Pekka Perä signed a cooperation agreement with Metso Minerals, the country’s largest supplier of mining equipment, which is in the hands of Finland’s[9] wealthiest families and is responsible for research and development of the Talvivaara deposits[10]. In 2006 the project was completed and financed with 33 million euros[11], and Talvivaara announced that it would start production before the end of 2008 and remain operational for at least 24 years at a rate of 33,000 tons of nickel per year[12]. In June 2007, Talvivaara is listed on the London Stock Exchange (with a capitalisation of 302 million euros)[13], and two years later it is also listed on the Helsinki Stock Exchange[14].

The inauguration is a major national event, and takes place in the presence of Environment Minister Paula Lehtomäki[15], Trade Minister Mauri Pekkarinen[16] and former Prime Minister Matti Vanhanen[17]. The Lehtomäki family bought almost 300,000 euros worth of shares in Talvivaara, and announced that, in addition to nickel, Pekka Perä’s technicians had also discovered a uranium deposit – a formidable boost to the Finnish economy[18].

17 October 2017: Pekka Perä, the founder of Talvivaara, weeps as he reads the verdict that he will lose his mine and his freedom, while his wife flees Finland with their children and filed for a divorce [19]

In 2007 Talvivaara has a 10-year off-take agreement for 100% of its main nickel and cobalt production with Norilsk Nickel[20] and has a 15-year strategic zinc off-take agreement with Nyrstar[21]. The Belgian industry is paying $335m for 1.25m tons of zinc, plus a fee of €350 per ton mined[22]. The two agreements make Talvivaara safe from any surprises: the company’s debts are covered and a possible liquidity crisis linked to the beginnings of any mine, when huge costs are not yet compensated by earnings, is avoided. It is estimated that the mine will produce 350 tons per year[23], which could mean an extra 20 million euros in annual turnover[24].

But dark clouds are gathering on the horizon. Many workers fall ill due to the chemical fumes from refining the minerals collected from the mine, people in the area take to the streets in protest, and opposition parties demand an independent investigation into the pollution at Talvivaara. Then Minister Paula Lehtomäki was caught in the act: she had received bribes from a Finnish industry to falsify environmental certificates to finance her party’s election campaign and boost her bank account[25].

The scandal swept through the entire Finnish political world in just a few weeks: suspicions arose about all the companies that might be polluting the environment, and the leaders of Finland’s industrial aristocracy, as well as many investors, began to panic and sell: in June 2011 Outokumpu Corporation, which had invested in the new mine, sold 4. 3% of Talvivaara Mining Company Plc to Solidium Oy (a wholly Finnish state-owned holding company and the largest shareholder in Metso Minerals[26]) for €60 million and a percentage to several shareholders via the Helsinki stock exchange[27].

Paula Lehtomäki falls on her feet: her political career is over, but she now works at the United Nations as a lobbyist for Finnish industry and sits on the same Arctic committee as the chairman of Trafigura, Jeremy Weir[28]. The Finnish minister had already been in contact with Trafigura in 2009, when it came to judging possible environmental crimes committed by this multinational in Côte d’Ivoire[29]. Over the past decade, Lehtomäki has been elected to Solidium’s board of directors and, in this capacity, joint to the State manager Paul Anttila[30], negotiated the agreements between Nyrstar, Trafigura and Terrafame – as Solidium was simultaneously a shareholder of Terrafame, Talvivaara and Metso Minerals[31]. This raises concerns about a possible conflict of interest.

The environmental disaster

5 November 2012: Leaks from the Talvivaara ore washing system turn into a poisonous river that sweeps through the surrounding forests[32]

The trouble started with seemingly random incidents: some gypsum sediment leaked into the reservoir and ended up in the surrounding streams and forests, but then, in November 2012, the membrane containing the gypsum sediment reservoir tore, and some 1.2 million cubic metres of metallic water and poisonous sediment leaked into the drainage field – 240,000 of which ended up outside the mining concession[33]. The Finnish environmental authorities claim that around 150 tons of manganese and iron were discharged into watercourses within hours, and that immediately afterwards, following the flow of polluting liquids, the mine released more than two tons of nickel, about a tonne of zinc and more than 70 kilograms of radioactive uranium[34].

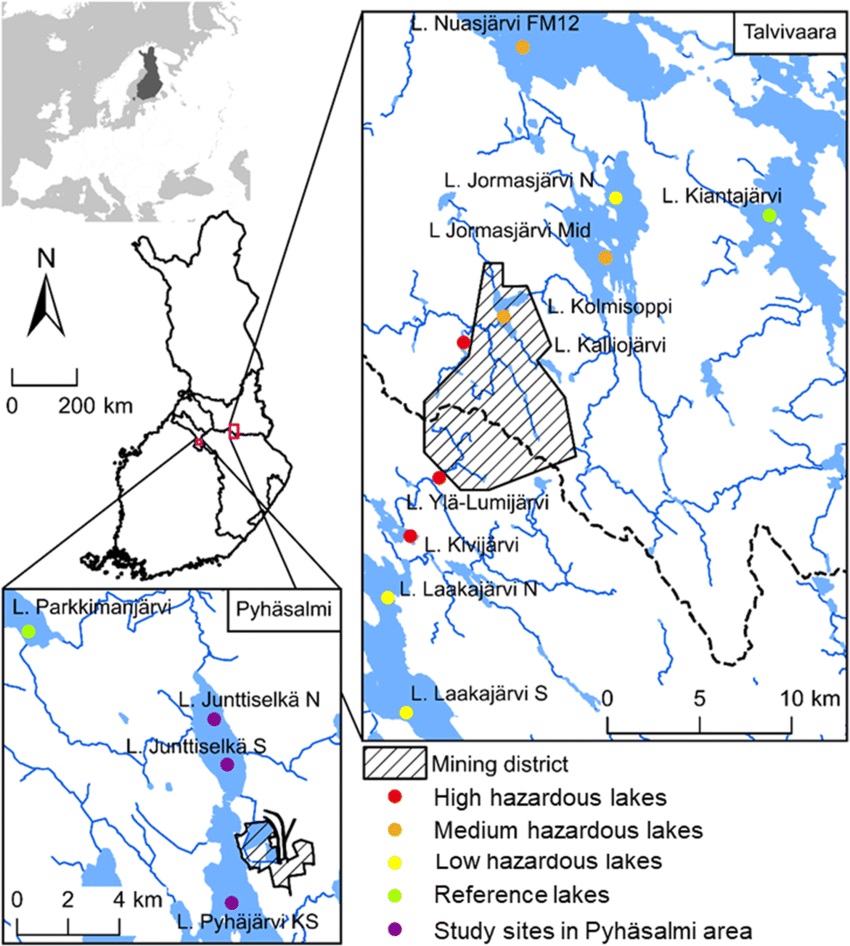

There are criminal investigations, and it turns out that, between 2008 and 2013, gypsum sediments spilled four times[35], polluting the waterways closest to the mine. Some of the surrounding lakes, such as Lake Jormasjärvi, have been directly and severely polluted[36]. The local people’s accusations went unheeded until 2014, when the international environmental community began to follow the matter as a consultant in the filing of 138 criminal complaints with the Kainuu District Court[37]. Since then almost eight years have passed and nothing has happened, and of those 138 complaints only nine remain (claiming damages totalling around €200,000): the others have either given up or been persuaded[38] to keep quiet by Terrafame and the Finnish government – such as Metsähallitus, which was claiming €8.6 million in damages for the poisoning of its water systems[39], and which was bought by Terrafame[40].

The only one to pay was the founder of Talvivaara. The Rovaniemi Court of Appeal sentenced Pekka Perä to six months in prison for environmental disaster[41]. Harri Natunen, who was Talvivaara’s managing director, was sentenced to 100 days; Lassi Lammassaari, the mine’s director, was sentenced by the Court of Appeal to 60 days for environmental disaster[42]. All sentences were suspended by parole. But the legal story of the Talvivaara environmental disaster is not over yet: in 2017, the Rovaniemi public prosecutor’s office opened a new file against Talvivaara’s management, which took over from Pekka Perä and his managers, and demanded a fine of €850,000 for environmental damage in the years following the accidents dealt with in the first case, and accused the new management of obtaining criminal proceeds worth €13.3 million[43].

According to a Finnish scientific study, the mine has never stopped polluting, and is in not likely to change[44]: the water used to dissolve the minerals during refining is filled with poisonous chemicals and cannot be disposed of in any environmentally friendly way, so it spreads through the water, poisoning the entire water system of the region, and into the air, creating permanent damage to flora and people that has not yet been thoroughly investigated – precisely because the Finnish government, driven by economic needs, has no intention of risking having to close Talvivaara[45].

The financial crisis

The geographical area severely polluted by the Talvivaara mine[46]

This is why the disaster is growing and expanding: a study by the University of Helsinki indicates that, since 2015, the waste water treated by the Talvivaara mine, via a drainage pipe installed directly into the Nuasjärvi lake basin, has practically annihilated the fauna of the lake area[47]. Apart from this, nothing has yet been done to solve the perhaps even more serious problem of radioactive uranium overflows[48]. All these facts are unknown to the judiciary and to political decisions, but they are not unknown to experts and investors, who therefore began selling their shares in Talvivaara in 2012, fearing that sooner or later the plant would be closed.

In the spring of 2013, Talvivaara is in obvious financial difficulty, and has saved itself with a new share issue, thanks to which it can solve the incipient liquidity shortages: Solidium becomes the largest shareholder, and Pekka Perä also buys the shares of the investors who are fleeing and, with the help of the banks, which still support him, comes to own shares in the mine for around €124 million[49]. At this point he realises he has gone too far, and tries to sell – unsuccessfully: embroiling himself in a web of lies and contradictions, he makes it appear that he has sold €50 million of shares, only to deny having done so – as he allegedly simply froze them in a separate bank account giving them as collateral for some massive debts incurred with insurance companies, thus saving the company some €1.3 million in debt[50].

In November 2016, the Talvivaara Mining Company will offer its creditors the possibility of converting their debts into shares by issuing four billion new shares (at a price of €0.1144 per share) to complete the work initiated by Pekka Perä to reduce the company’s debts[51]. In March 2019, the Helsinki Court of Appeal will rule that Pekka Perä has limited responsibilities in conducting this little game[52], fine him €240 and instead fine the company that, at that time, is responsible for the mine – Ahtium Oy (formerly Talvivaara Mining Company – Talvivaara Kaivososakeyhtiö) – for €20,000[53]. However, note that the Espoo District Court had declared Ahtium Oy’s bankruptcy final on March 6, 2018[54].

Not enough. Hit by falling nickel prices and repeated production stoppages, Talvivaara in 2013 has to suspend operations and negotiates with the court to avoid bankruptcy, which leads to delisting in 2014[55]. The company is indebted to Nyrstar, Nordea Bank, Svenska Handelsbanken, Danske Bank, Varma, Cameco, Finnvera (the official export credit agency) and a variety of equipment suppliers and other companies[56]. On 15 November 2013, Talvivaara Mining Company Plc and Talvivaara Sotkamo Ltd submitted a restructuring plan to the Espoo District Court, and the court, on 29 November, accepted it, giving three weeks to complete the documentation[57].

In December 2013, Nyrstar expressed its support for the restructuring project[58]. In January 2010, the Belgian company had paid 232 million euros in advance for zinc deliveries, delivers were down by more than 50% in 2013 compared to 2012.Talvivaara is now looking for a possible buyer for the mine[59]. There are rumours that Norilsk Nickel might participate, but nothing has ever been concrete[60]. In April 2014, Talvivaara and Nyrstar signed an agreement (Streaming Holiday Agreement) providing for loans secured by future zinc deliveries[61].

28 May 2016: Paula Lehtomäki, together with Terrafame executives, visiting the Talvivaara mine[62]

In the meantime, Nyrstar has lent €12.8 million to Talvivaara Sotkamo[63], but the Finnish company does not have the liquidity to pay it back[64]. For this reason, the company declares bankruptcy[65], and endangers the rights of all investors and creditors[66], including Nyrstar, which is why a new rescue plan is drawn up, but Nyrstar does not accept it[67], and the Helsinki Stock Exchange suspends Talvivaara’s shares[68]. To avoid worse damage, the state decides to find a solution to the mine’s misdeeds.

On 12 March 2015[69], Audley Capital Partners agrees with Talvivaara Mining Company Plc on a conditional asset purchase agreement with regards to Talvivaara Sotkamo’s mining operations[70]. Less than 24 hours later, Nyrstar fully impairs its €200 million investments in Talvivaara[71]. On August 5, 2015[72], it was announced Audley Capital Partners would pull out of the conditional arrangement despite the Finnish government stating they would be willing to invest more. And that they were talking to new partners[73].

On 7 August 2015, the state takes control of Talvivaara Mining through the state-owned company Terrafame Ltd[74], established in February 2015[75], which acquires Talvivaara’s mining operations[76] and assets and bails it out with 209 million euros[77]. On 1 September 2015 Terrafame resumes production[78].During the first year, the mine will go on to prepare 12.5 million tons[79]. Despite this, Nyrstar does nothing to preserve its zinc concentrate rights on the Talvivaara mine and does not reverse the impairment it took on 13 March 2015, supposed due to the Audley Partners announcement, the partner that has now pulled out leaving the Finnish government and the mine with no partner.

Instead on 9 November 2015 Nyrstar signs a zinc commercial agreement with Trafigura. On 10 November, 2015 Nyrstar registers a Special Purpose Vehicle in Finland, Winttal Oy[80]. On 20 November 2015, Chris Eger, Director of M&A at Trafigura in Switzerland joins Nyrstar as CFO[81]. On 30 November 30, 2015 Nyrstar transfers all of its rights, claims and interests in Talvivaara to Winttal Oy[82]. “On 4 December 2015, Terrafame Group Ltd. acquired the entire share capital of a limited liability company named Winttal Oy from Nyrstar Sales & Marketing AG. Winttal Oy owns and manages receivables from Talvivaara Mining Company Plc whose original creditor was Nyrstar Sales & Marketing AG”[83]. This payment is for a partial repayment of EUR 3.8 million related to the loan facility[84] up to a maximum amount of EUR 20.0 million that was made available to Talvivaara in 2014. In Nyrstar’s 2015 Annual Report there is no mention of the sale of the Talvivaara Zinc in Concentrate Rights, no mention of Winttal Oy, and by this mechanism these rights are sold to Terrafame Group Ltd for zero euros.

Yet not everyone forgets that easily, and when Terrafame Group Ltd uses the rights that Nyrstar had, memories are refreshed as to the guarantees made to Nyrstar in 2014 and the value of these rights: “On 30 June 2016 Talvivaara and Terrafame signed agreements, in which the parties agreed on the sale of Talvivaara’s assets related to the Sotkamo mining operations and settlement of Talvivaara’s guarantee liabilities under the Loan and Streaming Holiday Agreement (“Holiday Agreement”), with the principal amount of approximately € 14 million (including interest up until 30 June 2016), and the Zinc in Concentrate Purchase Agreement (“Streaming Agreement”), amounting to approximately € 203.4 million. The purchase price for the assets sold consists of two components: (i) a full and final settlement of the guarantee liabilities of the Company under the Holiday Agreement and the Streaming Agreement, and (ii) a cash component of € 1.4 million payable by Terrafame, which has been paid to the Company at closing”[85].

After the Terrafame Ltd agreement of 30 June 2016, Talvivaara Mining Plc’s difficulties continued. On 29 March 2017, Finnish financial institutions (Finnvera, Nordea Bank, Danske Bank, OP Corporate Bank and Svenska Handelsbanken) return the bankruptcy petition filed in Espoo court on 22 March 2017[86]. Talvivaara Mining Plc is rebranded as Ahtium Oyj[87] and resumes production – but once the money obtained from the state has run out, it is forced to declare insolvency for the last time[88].

After Nyrstar’s operating assets are 98.5% owned by Trafigura as of 31 July 2019, Nyrstar will even try to imply that Winttal Oy was always Terrafame’s due to the date of Terrafame’s press release, yet one can note that this is three days after Nyrstar sold Winttal Oy to Terrafame![89] An incomprehensible sequence of decisions and declarations, if not seen in historical perspective: during that period, in fact, Nyrstar was already infiltrated and under attack by Trafigura, which had managed to take a majority stake in the Belgian industry giant and was stripping it down piece by piece[90].

As of 1 July 2016, Terrafame Ltd controls the mine[91]. Between August 2015 and the end of 2016, the State had invested over half a billion euros[92], closing the factory can no longer be an option[93]. Prime Minister Juha Sipilä claims that the decision to close the mine would have cost the Finnish tax authorities almost €400 million[94], in addition to all the other millions already paid. Since Autumn 2016 discussions were started with another industrial partner – which will be (another coincidence) the Trafigura group. A term sheet was signed on 15 December 2016 and the agreement is signed on 3 February 2017[95]. The agreement was signed by Economy Minister Mika Lintilä, who was later found to be linked to suspicious payments to offshore banks and was accused of a conflict of interest because of his professional links with the Trafigura group[96].

On 10 February 2017 the Trafigura agreement goes into effect for an investment of €75 million Galena Equity Resource Fund, a Cayman Islands Fund, receives a 15.5 per cent shareholding of Terrafame Ltd[97], Trafigura V B.V. granted a loan of €75 million[98]. In return, Trafigura gets the entire cobalt and nickel production and 80% of the zinc production for seven years[99].

Yet another coincidence, Jesus Fernandez, who is on the Nyrstar Board since April 2016[100], is also a manager of the Galena Private Equity Resource Fund[101]. Jesus Fernandez will join the Terrafame Ltd Board in February 2017; Henry Emmanuel of Trafigura will join the Board at the same time as part of the agreement. Yet another coincidence, Nyrstar’s Annual Report of 2016 will come out just a little later this year, thus Jesus Fernandez can record his new 2017 Terrafame Director nomination as ‘current in Nyrstar 2016 Annual Report (perhaps this was done to reduce suspicions)[102]. Galena Asset Management is the private investment arm of the Trafigura Group.

On 29 March 2017, Finnish financial institutions (Finnvera, Nordea Bank, Danske Bank, OP Corporate Bank and Svenska Handelsbanken) return the bankruptcy petition filed in Espoo court on 22 March 2017[103]. Talvivaara is rebranded as Ahtium Oyj[104] and resumes production – but once the money obtained from the state has run out, it is forced to declare insolvency again[105]. Trafigura steps in, buying 15.5 per cent of Terrafame through its Cayman Islands investment fund – the Galena Fund, which pays the stake 70 million euros[106], plus a cash injection of 16 million euros[107]. In return, Trafigura gets the entire cobalt and nickel production and 80% of the zinc production for seven years[108].

10 February 2017. From left: Terrafame CEO Lauri Ratia, Trafigura CEO Jeremy Weir, an interpreter, Finnish Minister of Economy Mika Lintilä and Terrafame CEO Matti Hietanen[109]

The first consequence is that Nyrstar can now smelts the Talvivaara zinc concentrate at a discount price to benchmark of about 57% in 2017, increasing to 75% in 2018[110]; less cash for Nyrstar yet more for Trafigura who owns a little less than 25% of Nyrstar at this time. These discounts were not revealed to the markets until 27 September 2019, that is after Belgian Nyrstar NV was restructured using a UK NN2 Newco company, giving Trafigura 98.5% of Nyrstar’s operating assets[111].

The first decision of the new ownership is to invest in the production of nickel and cobalt for the electric vehicle battery industry, estimating that, by 2030, 25% of cars will be electric or hybrid, which would correspond to 400,000 tons of nickel[112]. Maximilian Tomei, CEO of Galena Asset Management, announces this: “The demand for nickel and cobalt sulphates in the production of batteries for electric cars is set to grow strongly. We will be able to benefit from this development by further improving Terrafame’s know-how and production capacity. As a result, Terrafame will position itself as an important Northern European metal producer for the battery industry[113]“.

Trafigura has financed a €240m battery chemistry plant to be built at the mine and which is set to come on stream in October 2018[114]. Part of the funding comes from a share transfer from the Finnish state to Trafigura, which now controls 29.7% of Terrafame[115], while 69.8% is transferred to a new state-owned holding company, Suomen Malmijalostus Oy (Finnish Minerals Group), with the remaining 0.5% sold to the private financial group Sampo plc.[116] Suomen is merged with the old Terrafame holding company, and Trafigura also takes over 23% of this company[117]. Finland’s Minister of the Economy Mika Lintilä, who is also an advisor to Trafigura, comments: “State holdings in companies in the mining industry that produce the raw materials needed for electric car batteries can be developed into a strategic entity in the future. (…) This would result in new jobs as well as tax revenues[118].

The saviours from Trafigura

The chemical battery plant under construction[119]

In June 2020 Terrafame received permission from the government, after a three-year wait[120], to start refining uranium oxide, a material used as fuel for nuclear power plants: the 250 tons produced by Terrafame put Finland in 13th place among the world’s uranium producers, just behind South Africa, although far behind Kazakhstan’s production figures (22,000 tons per year)[121]. As soon as Trafigura took ownership of the mine and related facilities, as if by magic, Talvivaara started earning millions again.

The population, not only in the area of the mine, continues to be against the mine, mainly for reasons related to environmental damage. Environmentalist Ansa Rajala has a clear opinion: “Of course it sucks. Terrafame has destroyed the environment and taken the money abroad. It is terrible[122]. Another environmentalist, Pentti Nurmi, calls for a clearer law to regulate tax havens: “Let everyone pay taxes and black money can no longer be transferred[123]. By now everyone knows that, ever since the Probo Koala ship accident in the Ivory Coast[124], Trafigura’s entire history is marked by several very serious pollution-related incidents. Defending the company once again is Minister Mika Lintilä: “They are not coming here as actors. They are shareholders and financiers, and Terrafame is still in charge of operations[125].

In 2020, Trafigura is the subject of numerous cases of suspected money laundering, or at least tax evasion, through hundreds of millions of transfers[126] to fictitious companies for contracts that were never executed[127]. Economy Minister Mika Lintilä and Labour Minister Tuula Haatainen admit that they had access to the documents, but claim that there was nothing in them that would make them back down from their decision to leave the salvation of the Talvivaara project in the hands of Jeremy Weir and his managers[128].

For Ms Haatainen, “the main interest of the state is, of course, to ensure that Terrafame’s operations are irreproachable and sustainable. There should be no ambiguity about this”[129]. Trade unionist Jukka Vetola, a delegate of Terrafame’s workers, is surprised: “We have improved Terrafame’s reputation through our own efforts. We don’t need such negative publicity[130]. Mika Kilpeläinen, the mayor of Sotkamo, also thinks it is important to keep Terrafame’s reputation intact, because the factory is a large employer: 1900 people[131] in an area with high unemployment[132].

Since the beginning of this affair, the constant has been this: regardless of the political orientation of the government in office, Finnish politicians have competed to see who is friendliest to Trafigura, to the point of jeopardising their careers, in order to be loyal to the Swiss multinational. Half a billion of Finnish tax money was swallowed up in order to make it possible for this multinational company to take over one of the most polluting mines in the world, without paying its creditors, and to obtain special conditions so that it could continue to produce in defiance of the evidence. This is a sign of extreme weakness on the part of one of the most advanced and correct democracies in Europe.

[1] http://web.tiscalinet.it/biomining/concetto.htm

[2] https://www.yahoo.com/news/talvivaara-mining-company-plc-nyrstar-091700339.html?guccounter=1&guce_referrer=aHR0cHM6Ly93d3cuZ29vZ2xlLmNvbS8&guce_referrer_sig=AQAAAFNSSOMTG-GymnZgzZaaAKA6oHIdHNirK0jHsSDBnlOm5sTKcTtjrv_A8H3XF5AKb0-Qr37zThFYOLXTjrySmw4qxH0BhZ-Av4hbwnkN9eo2WXjcRLH8hA8eIugdxy8sf0m6Sp7dP9Rajj8CyWtxHzJBBFA3HU_ik3optOxh6CmR

[3] https://www.yahoo.com/news/talvivaara-mining-company-plc-nyrstar-091700339.html?guccounter=1&guce_referrer=aHR0cHM6Ly93d3cuZ29vZ2xlLmNvbS8&guce_referrer_sig=AQAAAFNSSOMTG-GymnZgzZaaAKA6oHIdHNirK0jHsSDBnlOm5sTKcTtjrv_A8H3XF5AKb0-Qr37zThFYOLXTjrySmw4qxH0BhZ-Av4hbwnkN9eo2WXjcRLH8hA8eIugdxy8sf0m6Sp7dP9Rajj8CyWtxHzJBBFA3HU_ik3optOxh6CmR

[4] https://www.globenewswire.com/news-release/2005/12/01/336917/90584/en/Metso-to-take-part-in-Talvivaara-Mine-Development-as-Technological-Partner.html

[5] https://www.outokumpu.com/en/about-outokumpu/history-of-outokumpu

[6] https://suomenkuvalehti.fi/wp-content/uploads/sk/files/pdf-liitteet/068_071SK4807L.pdf

[7] https://ejatlas.org/print/talvivaara-mining-company

[8] https://www.globenewswire.com/news-release/2005/12/01/336917/90584/en/Metso-to-take-part-in-Talvivaara-Mine-Development-as-Technological-Partner.html

[9] https://www.mogroup.com/corporate/investors/shares/shareholders/

[10] https://www.ymparisto.fi/fi-fi/Asiointi_luvat_ja_ymparistovaikutusten_arviointi/Ymparistovaikutusten_arviointi/YVAhankkeet/Talvivaaran_kaivoshanke_Sotkamo

[11] https://web.archive.org/web/20120213174113/http://www.teollisuussijoitus.fi/in_english/news/?x22283=1547424

[12] Talvivaara Mining Company Ltd, Annual Report 2007: http://ir3.quartalflife.com/data/talvivaara/igb_html/pdf_print.php?pdf_name=1000001_e.pdf&anzahl=1&print_all=1&lang=ENG&bericht_id=1000001 p.3

[13] Talvivaara Mining Company Ltd, Annual Report 2007: http://ir3.quartalflife.com/data/talvivaara/igb_html/pdf_print.php?pdf_name=1000001_e.pdf&anzahl=1&print_all=1&lang=ENG&bericht_id=1000001 p.9

[14] https://www.investegate.co.uk/article.aspx?id=200905070830018237R

[15] https://www.norden.org/en/information/paula-lehtomaki-cv

[16] https://www.europarl.europa.eu/meps/en/197563/MAURI_PEKKARINEN/home

[17] https://www.eduskunta.fi/EN/kansanedustajat/Pages/414.aspx

[18] https://yle.fi/uutiset/3-5637358

[19] https://www.kaleva.fi/pekka-pera-kuumeni-hovioikeudessa-syyttajan-todist/1896416

[20] https://www.nornickel.com/upload/iblock/1ae/file1311_full.pdf

[21] https://www.globenewswire.com/news-release/2010/01/25/151290/0/en/Talvivaara-Enters-into-Zinc-in-Concentrate-Streaming-Agreement-with-Nyrstar-and-Refinances-Project-Term-Loan-Facility.html

[22] https://www.globenewswire.com/news-release/2010/01/25/151290/0/en/Talvivaara-Enters-into-Zinc-in-Concentrate-Streaming-Agreement-with-Nyrstar-and-Refinances-Project-Term-Loan-Facility.html

[23] https://web.archive.org/web/20120725205429/http://www.talvivaara.com/files/talvivaara/Uranium/Talvivaara_Uranium_presentation_09_02_2010_ENG.pdf

[24] https://web.archive.org/web/20120725205429/http://www.talvivaara.com/files/talvivaara/Uranium/Talvivaara_Uranium_presentation_09_02_2010_ENG.pdf

[25] Matti Ylönen, „Veroparatiisit – 20 ratkaisua varjotalouteen“, INTO Pamfletti, Helsinki 2018, ppp. 108-120

[26] https://www.solidium.fi/en

[27] https://stainless-steel-world.net/outokumpu-sells-part-of-ownership-in-talvivaara/

[28] https://unfccc.int/sites/default/files/resource/cp2021_inf03p02_adv.pdf

[29] https://www.asso-sherpa.org/wp-content/uploads/2013/09/Annual-report-2006.pdf

[30] https://www.reuters.com/article/us-ahtium-bankruptcy-idUSKCN1GI11Z

[31] https://www.aktiespararna.se/nyheter/solidium-oy-solidium-oys-half-year-report-january-june-2016-and-annual-financial-statement

[32] https://yle.fi/uutiset/3-12126869 ; https://yle.fi/news/3-9873349

[33] https://yle.fi/uutiset/3-11080691

[34] https://yle.fi/uutiset/3-11080691

[35] https://yle.fi/uutiset/3-12126869

[36] https://yle.fi/uutiset/3-12130921

[37] https://yle.fi/uutiset/3-12126869

[38] https://yle.fi/uutiset/3-12130921

[39] https://yle.fi/uutiset/3-7444488

[40] https://yle.fi/uutiset/3-12126869 ; https://yle.fi/uutiset/3-11320329

[41] https://yle.fi/uutiset/3-11079511

[42] https://yle.fi/uutiset/3-11079511

[43] https://yle.fi/news/3-9873349

[44] https://im-mining.com/2018/08/22/former-talvivaara-nickel-mine-rebound-terrafame/

[45] https://www.nature.com/articles/s41598-017-11421-8

[46] https://www.researchgate.net/figure/The-Pyhaesalmi-PS-left-box-and-Talvivaara-TV-right-box-study-area-pink-boxes-and_fig2_351356057

[47] https://www.helsinki.fi/en/news/life-sciences/talvivaaraterrafames-treated-wastewater-discharge-pipeline-leading-lake-nuasjarvi-has-caused-oxygen-depletion-and-degraded-benthic-community-lake

[48] https://www.reuters.com/article/talvivaara-uranium-idINL6N0C40FW20130312

[49] https://yle.fi/uutiset/3-9682890

[50] https://yle.fi/uutiset/3-9682890

[51] https://yle.fi/uutiset/3-9314934

[52] https://yle.fi/uutiset/3-10806130

[53] https://yle.fi/uutiset/3-10710741

[54] https://www.paivanlehti.fi/entisen-talvivaaran-kaivososakeyhtion-konkurssi-vahvistettiin-kassa-tyhjeni-miljoonien-palkkakuluilla/

[55] https://www.reuters.com/article/talvivaara-delisting-idUSWEB00N6I20140514

[56] https://www.iltalehti.fi/talous/a/201311220143412

[57] https://www.yahoo.com/news/talvivaara-mining-company-plc-nyrstar-091700339.html?guccounter=1&guce_referrer=aHR0cHM6Ly93d3cuZ29vZ2xlLmNvbS8&guce_referrer_sig=AQAAAFNSSOMTG-GymnZgzZaaAKA6oHIdHNirK0jHsSDBnlOm5sTKcTtjrv_A8H3XF5AKb0-Qr37zThFYOLXTjrySmw4qxH0BhZ- ; https://www.reuters.com/article/nystar-talvivaara-idUSL5N0MT1S320140401

[58] https://www.yahoo.com/news/talvivaara-mining-company-plc-nyrstar-091700339.html?guccounter=1&guce_referrer=aHR0cHM6Ly93d3cuZ29vZ2xlLmNvbS8&guce_referrer_sig=AQAAAFNSSOMTG-GymnZgzZaaAKA6oHIdHNirK0jHsSDBnlOm5sTKcTtjrv_A8H3XF5AKb0-Qr37zThFYOLXTjrySmw4qxH0BhZ-Av4hbwnkN9eo2WXjcRLH8hA8eIugdxy8sf0m6Sp7dP9Rajj8CyWtxHzJBBFA3HU_ik3optOxh6C

[59] https://www.reuters.com/article/nystar-talvivaara-idUSL5N0MT1S320140401

[60] https://www.is.fi/taloussanomat/porssiuutiset/art-2000001857607.html

[61] https://www.reuters.com/article/nystar-talvivaara-idUSL5N0MT1S320140401 ; https://www.investegate.co.uk/talvivaara-mining-co–0p6x-/gnw/new-agreement-with-nyrstar-to-improve-talvivaar…/20140401075048H3233/

[62] https://www.hs.fi/talous/art-2000002903575.html

[63] https://www.nyrstar.be/~/media/Files/N/Nyrstar-IR/shareholder-meetings/english/2020/30-june/written-questions-and-answers-en.pdf p. 26

[64] https://www.is.fi/taloussanomat/porssiuutiset/art-2000001858283.html

[65] https://www.helsinkitimes.fi/business/12670-talvivaara-sotkamo-to-file-for-bankruptcy.html

[66] https://docplayer.fi/664172-Talvivaaran-kaivososakeyhtio-oyj-selvittajan-taydennetty-ehdotus-saneerausohjelmaksi.html

[67] https://www.globenewswire.com/news-release/2015/03/13/1628791/0/en/Nyrstar-Update-on-the-zinc-streaming-agreement-with-Talvivaara.html

[68] https://yle.fi/uutiset/3-7604031

[69] https://valtioneuvosto.fi/-/audley-capital-advisors-llp-n-johtama-sijoittajakonsortio-investoi-talvivaara-1?languageId=en_US

[72] https://www.helsinkitimes.fi/business/13482-government-to-take-full-responsibility-for-talvivaara-bailout.html?ref=tf_iHSisboksi630b

[74] https://www.reuters.com/article/us-finland-talvivaaran-idUSKCN0QC1FC20150807

[75] https://www.terrafame.com/media/yhtiojarjestys/terrafame-articles-of-association-17022017.pdf

[76] https://yle.fi/uutiset/3-9314934

[77] https://www.reuters.com/article/us-finland-talvivaaran-idUSKCN0QC1FC20150807

[78] https://www.terrafame.com/news-from-the-mine/news/2015/08/terrafame-to-restart-operations-of-the-talvivaara-mine-mines-business-transaction-finalised.html

[79] https://www.terrafame.com/news-from-the-mine/news/2016/09/terrafame-achieved-its-key-targets-during-the-companys-first-year-of-operation.html

[80] https://tietopalvelu.ytj.fi/yritystiedot.aspx?yavain=2594408&tarkiste=AFE908D382DF8042EED0D4BBA68B287D3E65CBCF&rekhist=True&leihist=false&path

[82] https://www.globenewswire.com/news-release/2015/12/07/793269/0/en/Nyrstar-has-assigned-its-receivables-from-Talvivaara-to-Terrafame-Group.html

[83] Terrafame Annual Report 2016, ’Acquisition of Winttal Oy’, page 161 Financial statements, Accounting policies for consolidated financial statements, and notes

[84] Nyrstar Annual Report 2015, Note 19, Page 149

[85] globenewswire.com/news-release/2016/08/11/863452/0/en/Talvivaara-s-Extraordinary-General-Meeting-approved-the-sale-of-mining-related-assets-to-Terrafame.html

[86] https://www.globenewswire.com/fr/news-release/2017/03/29/946421/0/en/Status-of-Talvivaara-s-corporate-reorganization-Banks-requested-cancellation-of-the-bankruptcy-application.html

[87] https://view.news.eu.nasdaq.com/view?id=b8fc3b8a1c7362bc3a54c95f530eb5efc&lang=en

[88] https://www.reuters.com/article/us-ahtium-bankruptcy-idUSKCN1GI11Z ; https://www.globenewswire.com/news-release/2018/03/15/1437743/0/en/DELISTING-FROM-NASDAQ-HELSINKI-AHTIUM-PLC.html

[89] https://www.nyrstar.be/~/media/Files/N/Nyrstar-IR/shareholder-meetings/english/2020/30-june/written-questions-and-answers-en.pdf p.25

[90] https://ibiworld.eu/2022/01/13/nyrstar-lagonia-del-gigante-negli-artigli-di-trafigura/ ; https://ibiworld.eu/2021/08/20/trafigura-perche-dobbiamo-averne-paura/

[91] https://www.terrafame.com/news-from-the-mine/news/2016/07/terrafame-acquires-assets-related-to-mining-operations-from-talvivaara-mining-company-plc.html

[92] https://yle.fi/uutiset/3-9453739

[93] https://yle.fi/uutiset/3-9453739

[95] Terrafame Annual Report 2016, Page 136, Financial statements, Annual review of Terrafame Group Ltd.

[96] https://yle.fi/uutiset/3-9461773 ; https://yle.fi/news/3-9455577

[97] https://yle.fi/uutiset/3-9453739

[98] https://yle.fi/uutiset/3-9925227

[99] https://yle.fi/uutiset/3-9453739 ; https://yle.fi/uutiset/3-11380723

[100] Nyrstar NV 2016 Annual Report, page 30

[102] Nyrstar NV 2016 Annual Report, page 38

[103] https://www.globenewswire.com/fr/news-release/2017/03/29/946421/0/en/Status-of-Talvivaara-s-corporate-reorganization-Banks-requested-cancellation-of-the-bankruptcy-application.html

[104] https://view.news.eu.nasdaq.com/view?id=b8fc3b8a1c7362bc3a54c95f530eb5efc&lang=en

[105] https://www.reuters.com/article/us-ahtium-bankruptcy-idUSKCN1GI11Z ; https://www.globenewswire.com/news-release/2018/03/15/1437743/0/en/DELISTING-FROM-NASDAQ-HELSINKI-AHTIUM-PLC.html

[106] https://yle.fi/uutiset/3-9453739

[107] https://yle.fi/uutiset/3-9925227

[108] https://yle.fi/uutiset/3-9453739 ; https://yle.fi/uutiset/3-11380723

[109] https://yle.fi/news/3-9455577

[111] https://ibiworld.eu/2022/01/13/nyrstar-lagonia-del-gigante-negli-artigli-di-trafigura/

[112] https://www.terrafame.com/media/terrafame-ltd.-plans-nickel-and-cobalt-chemicals-production-for-battery-applications.pdf

[113] https://yle.fi/uutiset/3-9925227

[114] https://www.trafigura.com/press-releases/investment-decision-on-battery-chemicals-plant/

[115] https://yle.fi/uutiset/3-9453739 ; https://www.is.fi/taloussanomat/art-2000005876435.html

[116] https://yle.fi/uutiset/3-11380723

[117] https://im-mining.com/2018/07/10/finnish-minerals-group-established/

[118] https://im-mining.com/2018/07/10/finnish-minerals-group-established/

[119] https://yle.fi/uutiset/3-11380723

[120] https://world-nuclear-news.org/Articles/Finnish-mining-company-to-apply-to-extract-uranium

[121] https://yle.fi/uutiset/3-11193671

[122] https://yle.fi/uutiset/3-11555171

[123] https://yle.fi/uutiset/3-11555171

[124] https://ibiworld.eu/2020/10/09/le-mele-marce-del-paradiso-terrestre/

[125] https://yle.fi/uutiset/3-9454054

[126] https://yle.fi/news/3-11556280 ; https://yle.fi/news/3-11555220

[127] https://yle.fi/uutiset/3-11554881

[128] https://yle.fi/uutiset/3-11555868

[129] https://yle.fi/uutiset/3-11555868

[130] https://yle.fi/uutiset/3-11554920

[131] https://yle.fi/uutiset/3-11554920

[132] https://www.trafigura.com/press-releases/new-financing-package-from-the-owners-for-terrafame-s-development/

Leave a Reply