In the West, we believe in an efficient, orderly, innovative, welcoming, open Japan, the child of a tradition based on a strict code of honour and a genuine spirit of service – the creators of the corporate identity concept. Well, this picture of a country of hard-working, happy little ants died with Haruki Murakani’s masterpieces, and the effects are now there for all to see: the crisis of the Toshiba group, one of the industrial and commercial giants of the post-war global economy, has triggered reactions of disbelief, anger, hysteria and despair among Japanese people, employees, and financial operators[1].

The New York Times had already written about it back in 1988: the article concerned the Recruit Corporation scandal, which was extremely embarrassing for the then Prime Minister Kakuei Tanaka, who was convicted of accepting bribes from the Lockheed Corporation as part of ‘a secret and costly struggle by an ambitious young company and its founder to gain political influence and privileged treatment, mainly by spreading money and shares among a small circle of Japanese corporate and government decision-makers’[2]. Further on in the text: ‘the scandal has offered rare glimpses of how deals are done in Japan, raising doubts as to whether Japan’s drive towards internationalisation – its effort to integrate its economic behaviour with that of the rest of the world – has been able to overcome the opaque and corrupt way of doing business’[3].

The world gasps: ”Recruit recalls that in Japan there is still a general acceptance of payments – on the borderline between gifts and kindness – with a sort of vague expectation of help in the future”, despite the fact that there was no doubt that the Recruit-related gifts had ‘gone beyond the kind of donation and exchange of favours that have long greased the wheels of Japanese society’, with payments to individual politicians which, in the course of the investigation, brought to light the fact that some twenty thousand Japanese managers were making annual contributions to a political slush fund[4] : something far removed from the image we Westerners have of the country of the Samurai.

A year before the Recruit scandal, Toshiba had been caught red-handed: Toshiba Machine, a company 50.8%[5] owned by Toshiba Corporation, sold to the Soviet Union, in violation of agreements made at CoCom, a series of machines (equipped with the control hardware and management software of the Norwegian company Kongsberg) intended for milling quieter propellers for submarines in order to avoid tracking[6]. A scandal that had no consequences, neither politically nor judicially[7]: “On 15 May 1987, shortly after Japanese Prime Minister Yasuhiro Nakasone had learned of the incident, two senior executives of Toshiba Corporation. resigned due to embarrassment over the sale of sensitive technology to the Soviet Union. In addition, the president and three other executives of Toshiba Machine resigned and two employees of the company were arrested after the disclosure of the sales”.

Toshiba’s top management pretends to have known nothing about the affair: “From the very beginning of the incident, Toshiba Corporation claimed that few Toshiba Machine employees were aware of the actual power or use of the equipment shipped to the Soviet Union and that parent company officials were completely unaware of the transaction”[8]. A blatant lie, as Toshiba was only able to proceed with the sale after seeking and obtaining approval from the Ministry of International Trade and Industry (MITI), which was well aware of the involvement of Tekmashimport, a Soviet company linked to the KGB[9]. Toshiba Machine was banned from exporting to communist countries for a year, a penalty of over $100 million (12% of the company’s exports at the time)[10].

History of a colossus with feet of clay

23 February 2017: Toshiba’s management is forced to admit the severity of the crisis[11]

Since as far back as May 1987, things have continued in the usual way: turnover grows thanks to acquisitions financed by the banks, so the overall debt grows out of all proportion – a debt that is met with the systematic bribery of politicians and public officials, in order to win state tenders and to continue operating despite the fact that the industrial substance has now been overtaken by debts. These are concealed by the reiteration of accounting irregularities and by an absolute omertà among the employees, due to the climate of strict obedience demanded of all company executives, on pain not only of dismissal, but of public humiliation of the entire family. A system that has been in place since the company was founded in 1875, and which is the true hallmark of the Japanese industrial revolution[12].

Until, on 12 November 2021, Reuters announced: ‘The Toshiba Corporation will split into three companies in a bid to appease investors who are demanding a radical overhaul after years of scandals. The conglomerate is battered by accounting scandals, massive write-downs on its nuclear assets, the sale of its valuable chip unit and the discovery of collusion to prevent foreign investors from gaining influence at shareholder meetings”[13].

Toshiba’s free fall began in 2015, and has been irreversible ever since[14]. When preparing the accounts for the shareholders’ meeting, the accountants realised an inexplicable hole of 230 billion yen ($2 billion), because the figures of the individual group companies considered pre-tax figures as final – and in that way made non-existent profits appear. To fill the hole, Toshiba buys (with bank loans) a nuclear power plant construction company that, as it turns out a year later, has billions of dollars in debt – nobody knows how much. In March 2017 this company, Westinghouse Electric, announces bankruptcy for $6 billion, covered by selling one of the Toshiba group’s most successful companies, the computer chip factory Toshiba Memory (renamed to Kioxia) to a consortium led by the financial group Bain Capital for $18 billion[15].

As the stock market data proved to be false for two years in a row, the Tokyo Stock Exchange demanded that Toshiba shares be delisted. The management reacted by selling shares worth USD 5.4 billion to more than 30 foreign investors, including such powerful groups as Elliott Management, Third Point and Farallon. In order to silence the historical shareholders (the big Japanese industrialist families), the management appoints Nobuaki Kurumatani, who comes from the Sumitomo Mitsui Financial Group, Toshiba’s main creditor, as CEO. Not enough: the new shareholders obliged the group to appoint four non-Japanese directors to its board. A few weeks later, they discover new accounting irregularities and inexplicable debts[16]. The old Japanese management opposes an internal investigation and blocks the nomination of five governance experts proposed by the foreign shareholders, but then it is discovered that, in order to achieve this, the management falsified the result of the shareholders’ meeting vote, and in September it is revealed that the auditing firm, which has been trying to count the shareholders’ meeting votes for almost twenty years now, failed to do so, and provided figures agreed with the management[17].

In March 2021, the investigation is opened, and multi-billion dollar losses are discovered that were never declared. CVC Capital Partners submits a bid of USD 21 billion to acquire Toshiba – a bid that is rejected, but which forces Kurumatani to resign, shortly before the first results of the investigation are made known: Toshiba, in collusion with the Japanese Ministry of Commerce, has for years been falsifying all its accounts in order to prevent foreign investors from buying the group out of its debts. On 25 June 2021, Kurumatani’s successor also resigned, and on 12 November, the Japanese shareholders pulled a rabbit out of the hat: Toshiba will be split into three separate companies – one dealing with energy, one with infrastructure, and one, which will retain the name Toshiba, will manage its minority stake in Kioxia, which is the only asset with future prospects left to the group[18]. The clay-footed giant owns dozens of companies in semiconductors, electronics, construction, home appliances and medical equipment, has a turnover (2020) of more than 3.38 trillion Yen ($31 billion[19]) and employs 125,000 people worldwide[20].

5 June 2022: in the hope of saving Westinghouse Electric from bankruptcy, the US federal government financially supports an agreement between this company and the Ukrainians of Energoatom[21]

Seven years have not yet passed since 2015, during which an industry, the pride of the country, is on its knees. The criminal investigations concern the activities of three different CEOs, and about each one they say the same: they did not explicitly instruct their employees to falsify the accounts, but exerted enormous pressure to make the company’s results look positive, ‘waiting for the company culture to produce the desired results’[22]. Since the first report in 2015, there has been direct evidence of fanciful accounting practices, of overstated profits in subsidiaries producing televisions, computers and semiconductors[23].

The accounting misconduct began under CEO Atsutoshi Nishida in 2008, in the midst of the global financial crisis, which cut deeply into Toshiba’s profitability, and then continued under Norio Sasaki, culminating in the Tanaka-era scandal. The techniques are manifold: early budgeting of future profits, write-offs of losses and charges, downwardly falsified invoices to reduce debts or upwardly falsified invoices to increase revenues[24]. Management only sends quarterly targets to the various departments at the end of the quarter, when there is no more time to influence performance and, based on a corporate culture that demands unquestioning obedience and success at any cost and by any means, at every level of the hierarchical chain, the only possible remedy is falsification[25].

The 2015 report includes specific recommendations to prevent a recurrence of the disaster: the elimination of the Profit Optimisation Challenge System, the restoration of internal controls, the creation of a robust system of internal advisors to whom employees can turn without fear of retaliation[26], and, of course, the obligation to report quarterly targets in a timely manner[27]. In the 2020 report, it emerges that these recommendations were ignored, and that in the five years since the first internal report, what has changed is that it was necessary to pretend to have exercised the controls proposed by the 2015 report, mainly in order not to anger foreign shareholders, by falsifying the shareholders’ meeting vote when necessary[28]. The new fact that emerged is that Toshiba executives acted in concert with the Japanese Ministry of Trade[29].

Since Toshiba, in order to improve its results, received from that Ministry an impressive series of assignments (especially in the nuclear sector), and obtained 5.4 billion dollars of liquidity from no less than 60 foreign investors (to avoid delisting[30]), Toshiba’s bankruptcy, with a domino effect, also means the bankruptcy of the Ministry – both political and financial – as claimed on 23 September 2020 by the Singaporean shareholder Effissimo Capital Management, which had noticed the 31 July 2020[31] shareholders’ meeting fraud and demanded the election of a new board of directors that would exclude those guilty of the previous mismanagement[32].

The 2020 report shows[33] that Toshiba executives had not only colluded with senior officials of the Japanese Ministry of Trade (METI), but that it had gone so far as to lead those officials to exert pressure on the shareholders: ‘Toshiba is believed to have devised a plan to prevent shareholders from exercising their right to make proposals and vote at the general meeting, exerting undue influence on shareholders Effissimo, 3D and HMC’[34]. A way of working that, implicitly, has been applied by METI to all major Japanese industries, and which portends the possibility of more disasters to come[35].

27 July 2020: at the Toshiba Shareholders’ Meeting, CEO Kurumatani announces that he will not accept any of the proposals from foreign shareholders[36]

The collapse of the traditional, nineteenth-century system of corporate governance also came about under the pressure of traumatic international events, starting with the global banking crisis of 2008, and then exacerbated by the Fukushima accident and, more recently, the pandemic and war in Ukraine. Mismanagement and the unfavourable international economic situation wiped out the advantage that the Japanese industry had had during the economic boom years (high-tech products at low prices), which annihilated the group’s[37] earning power[38].

The strategy of Toshiba’s management was to proceed with continuous acquisitions, financed by bank debt, guaranteed by METI, hoping that the acquired companies would increase turnover – with tragic results. On 14 February 2017, the group disclosed that it had a $6.3 billion hole produced by its (newly acquired) nuclear business in the US for 2016, and that that hole generated a chasm of almost 900 billion yen ($3.5 billion) in the following six months as well, with a forecast of further losses of at least 170 billion yen[39]. There is not only the hole: after this disaster, the share value of Westinghouse Electric is zero, and it cannot be resold – nobody wants it[40]. To cover the hole, the management proposes to sell Kioxia, the semiconductor company which is Toshiba’s only asset that is really earning a lot of money, with the result of jeopardising not only the 2017 accounts, but those of all the following years, with a spiralling fall like that of a plane hit in flight[41].

The Japanese blame the American managers of CB&I Stone & Webster, the company that was just acquired and then turned out to be a trap. Not a word about the mistake of those who bought that company sight unseen, without checking its merits and flaws, but only the announcement that, because of the Yankees, Toshiba would give up the project to build 45 nuclear reactors[42]. Those of Greenpeace put their finger on the sore spot: “the dramatic situation in which Toshiba has plunged is entirely dependent on an irresponsible bet on nuclear power even in the post-Fukushima era”, criticising the government of Shinzō Abe “for having set itself the goal of exporting nuclear technology”[43]. As we have already mentioned, the solution was to sell Toshiba shares to foreign companies, which immediately began to fight for transparency within the group[44]. For this, the government immediately produced a countermove: ‘Japan has passed new legislation limiting foreign investment opportunities in certain strategic companies. And Toshiba is active, among others, in the nuclear industry’[45].

METI does not only cover Toshiba’s misdeeds. On 15 September 2020, the Financial Times complains that former Government Pension Investment Fund chief and Tesla board member Hiro Mizuno personally intervened to influence the Harvard University Endowment Fund and thus the vote of a Toshiba shareholder, NarvNarvekar, managing director of Harvard Management Company[46], who held 4.5 per cent of Toshiba’s shares[47]. A successful transaction, since Narvekar, in the shareholders’ meeting, abstained from voting[48].

The never-ending horror of Fukushima

11 March 2011: Following an earthquake, a 34-metre-high wave swept over the Fukushima nuclear power plant[49]

The accusations levelled at Toshiba in relation to safety standards cannot be overlooked: all issues that quickly emerged in the wake of the tragic accident, the dramatic consequences of which were blamed on the Japanese multinational[50], as confirmed by an executive of the International Atomic Energy Control Agency (IAEA): ‘I visited the Fukushima Daiichi plant a few months after the accident and saw for myself the destructive impact of the tsunami’[51].

A visit that baffled him: ‘An important factor contributing to the accident was the widespread belief in Japan that nuclear power plants are so safe that an accident of this magnitude would be unthinkable. This assumption was accepted by the operators of the nuclear power plants and was not questioned by the government. Consequently, Japan was not sufficiently prepared for a major nuclear accident. The Fukushima Daiichi accident exposed some weaknesses in Japan’s regulatory framework. Responsibilities are divided among several entities and it is not always clear which authority is responsible. There were also some shortcomings in the design of the plant, in emergency preparedness and response arrangements, and in planning for the management of a major accident. The possibility of several reactors in the same plant experiencing a crisis at the same time was not taken into account. Furthermore, the possibility of a nuclear accident occurring in conjunction with a major natural disaster has not been taken into account’[52].

The coup de grace to the myth of Japan’s safe nuclear power comes from the former director of the Fukushima plant, Masao Yoshida[53], with a testimony long kept secret by the government[54]: “the nuclear plant had lost power and needed a lot of batteries to restart after the devastating earthquake/tsunami, but Tepco had supplied batteries with insufficient voltage and too large to be transported easily. NHK[55] writes that ‘investigative reports say most of the batteries were not used’. Yoshida claims that Tepco headquarters sent the batteries without informing the nuclear power plant of their specifications. The ‘liquidators’ at Fukushima Daiichi were thus forced to examine the batteries one by one. Yoshida also referred to a stoppage of supplies of generators and other equipment for the nuclear power plant after radiation levels rose across the site. According to him, ‘most of the supplies reached a depot 50 kilometres from the plant, where workers had to pick them up’[56].

The issue is a delicate one, as Toshiba and METI have an alliance on nuclear power that is existential for both: still in March 2017, it had dozens of reactors in service, which must be maintained and supplied with parts and fuel[57]. In order to prevent foreigners from meddling too much in the affairs of the disaster, the clean-up of the Fukushima plant is assigned to Toshiba, by METI, for 8 trillion yen (about 71 billion dollars) – a figure immediately considered ridiculous, and which would have been enough just for the decommissioning of the plant, while the timeframe for the complete clean-up speaks of about a century – a hundred years in which Toshiba guarantees itself a secure multi-billion dollar income[58]. To which must be added the maintenance of twenty other reactors which, even if shut down, constitute decades of guaranteed income – especially if no one checks whether the work has really been carried out[59].

At least, until the day when foreign shareholders start asking awkward questions… METI is running for cover, and proposes a merger between the three main suppliers of the Japanese nuclear industry: Westinghouse Electric (Toshiba), Mitsubishi Heavy Industries (MHI) and Hitachi[60] , despite the fact that the three companies use different systems and technologies[61]. But the directors of this plan are the same managers who miscalculated all the Toshiba acquisitions, estimating princely increases in turnover that never materialised and, in fact, for this new holding company, which should have been created at a time when the government decided to close nuclear power plants, they calculate an annual increase in turnover of around 8%, despite the fact that it is now clear that Japan must invest in renewable energy: 74% of energy is produced from foreign oil products[62].

Tepco workers involved in the clean-up of the Fukushima nuclear power plant go on strike due to non-payment of wages[63]

The war in Ukraine saves the idea behind this absurd project[64]: commodity prices have gone crazy, including those of liquefied natural gas, of which Japan is the world’s second largest importer, and the price increase has been reflected in electricity prices. Today, the electricity bill is 400% higher than a year ago, with all the consequences this has on retail prices and GDP, which is already burdened by the depreciation of the yen against the dollar – a fact that further increases energy costs[65]. In Japan, in fact, the energy industry is private, and the government has no way of lowering prices[66], so that the issue of nuclear power plant safety, according to the government, becomes irrelevant[67] in the face of the risk of a national blackout[68].

The experts react with a clear warning: ‘if the Nuclear Regulatory Authority approves the restart of nuclear reactors based strictly on scientific findings and not on political decisions, the current pace will not change soon’[69].Nevertheless, the NRA Nuclear Regulation Authority is encountering enormous safety problems in attempting to restart reactors that have already been shut down[70]. METI’s reaction: demand to hand over the entire process and safety and maintenance guarantees to Toshiba[71]. The plan, developed by Tepco, is to build (by 2023) an underwater tunnel that will spit the waste into the ocean[72]. With the imaginable consequences for the fishing industry[73].

China, of course, is up in arms, especially after the revelations of a Japanese journalist, Tomohiko Suzuki, who, equipped with a hidden camera, worked for a month in the heart of the Fukushima Daiichi plant in the disguise of a worker: his report tells of unacceptable working conditions, no protection from radiation, no checks, squabbles between Toshiba and Hitachi, and negative information covered up[74]. Contaminated water from the cooling of the reactor continues to accumulate in the tanks and even what has been given for clean-up is, for the most part, still in the situation of the day after the disaster[75]: ‘All information kept from the Japanese about the severity of the disaster (…). Tepco, in order to save money, refuses any proposals. It is more of a cosmetic operation than a safety operation. In the meantime, it begs contractors to send men who don’t care if they die’[76].

Behind this madness lies the shadow of another determining factor in Japan’s traditional industry – the presence of the Yakuza mafia interest: ‘the Japanese mafia, according to Suzuki, was in charge of recruiting workers for the construction companies involved in the reconstruction. At least 10 per cent of the workers would come from the intervention of the mafia, which benefits, of course, from part of the salary. If one considers that Tomohiko Suzuki was paid as a labourer between €147 and €197 per day or between €735 and €985 per week for 5 days, one realises how much the Yakuza has to gain from this operation (…). The entanglements between Japanese gangsters and the nuclear industry were known even before the accident, (…), which is why the criminal organisation sent, immediately after the disaster, 70 truckloads of water, food, blankets and basic necessities to evacuation centres in the devastated northern region, for a total value of 350,000: they were probably already preparing to recruit for Tepco the army of desperate people ‘who don’t care if they die’[77].

The facts are incontrovertible: Toshiba has not yet carried out the promised clean-ups, but it has received far more than the initially planned 35 billion dollars, a substantial part of which has gone to 773 companies, which have given temporary work to more than 10,000 people (officially), many of them recruited without any control or security measures among the homeless[78]. In an interview with a Yakuza affiliate, he reported that the mafia had infiltrated the government procurement network using the Obayashi company, one of the country’s leading construction companies[79]. The figures of the operation make one dizzy: ‘Over 21 trillion yen (about 170 billion euro): this is the most recent estimate of the total cost of the clean-up and decommissioning of the Fukushima Daiichi nuclear power plant’[80]: a river of public money of which it is not known how it was used or by whom. This is also why the Chinese are so worried: ‘Japan is preparing to restart 9 nuclear reactors by next winter’[81]. Who will be the workers in these nuclear power plants? Who will choose them?

The recession and the hive-off of Toshiba

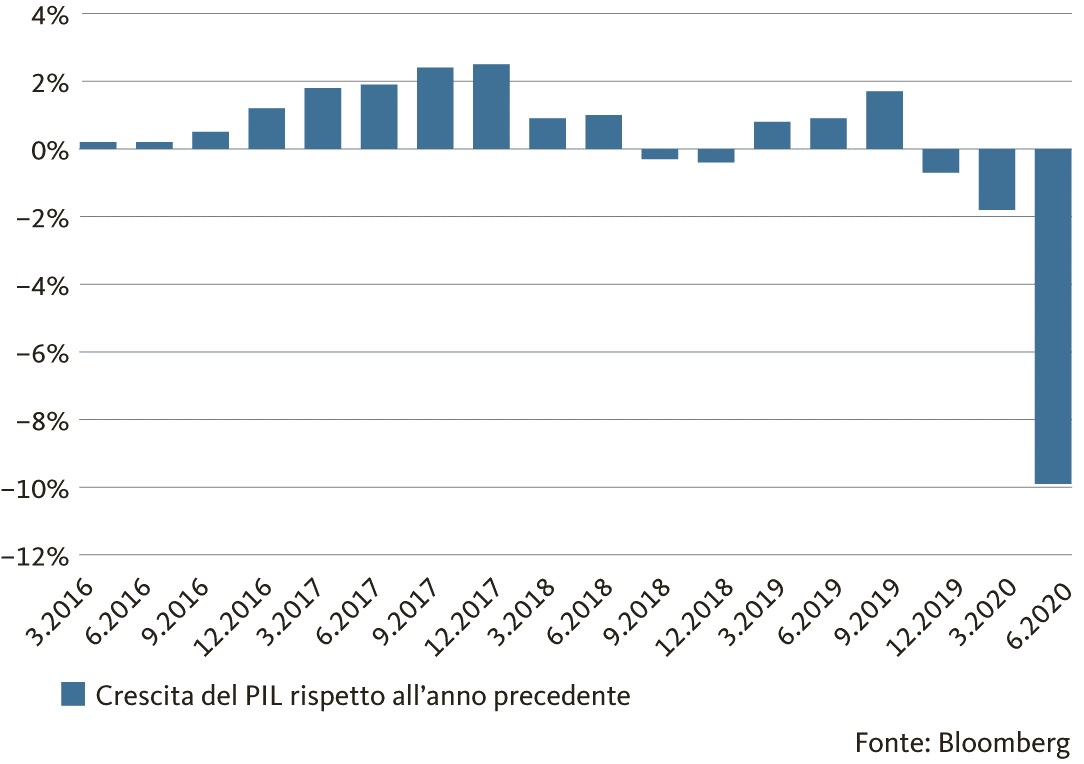

As the graph shows, Japan’s recessionary phase predates the Covid[82]

At the end of 2021, the Kishida government presented a package of tax reforms, in line with the old Abe government’s plan: an increase in tax credits granted to companies that increase wages and invest in the training of stable workers, in a scenario that sees Japan’s GDP falling by more than 3% in 2021[83]. Increasing wages is the main objective: even before the war in Ukraine there was a drop in domestic consumption (-1.3%) and investments (-2.3%), two figures that contributed to a decrease in industrial production of 4.1%, accompanied by the lack of growth in foreign demand[84], which for two decades had hidden the effects of substantial stagnation in the domestic market[85].

Given the closed borders to tourism, not even the Olympic year was able to contribute to the revival of the economy, just as the effect of the so-called Sayonara Tax, or the Go To Travel package of incentives for tourism, was essentially nil[86]. The foreign trade balance is negative: EUR 25.6 billion in 2020 alone, a stable trend[87], mainly due to the import of petroleum products[88].

The sum of all that we have explained is the decision to spin off Toshiba in November 2021 into three divisions: the infrastructure business, which would also include power plants, the electronic devices business and the semiconductor memory business[89]. The plan envisages that the core business, the one linked to higher profitability, will remain within the parent company Kioxia Holdings, a memory chip maker that had been spun off from Toshiba and, for months, had been on the brink of being sold off to cover some of the losses[90]: “The spin-off will create two separate companies with unique business characteristics that will lead their respective businesses in achieving carbon neutrality and infrastructure resilience. The separation allows each company to facilitate more agile decision-making with leaner cost structures. Therefore, both companies will be in a much better position to capitalise on their distinct market positions, priorities and growth drivers to deliver sustainable profitable growth and increased shareholder value. At the same time, Toshiba intends to monetise the shares of Kioxia by maximising shareholder value and return the net proceeds in full to shareholders”[91].

The reason for the spin-off is encapsulated in the final sentence: ‘return the net proceeds in full to shareholders as soon as possible’: in other words, the plan is, at least in part, aimed at encouraging foreign shareholders to sell[92]. Paraphrasing Tomasi di Lampedusa, ‘if we want everything to remain as it is, everything must change’. On 7 February 2022 comes a twist: ‘Toshiba no longer in three, spin-off into two companies by 2023’: the spin-off plans, released on 12 November 2021, have already changed – two companies, one focused on infrastructure and the other on devices[93]. Toshiba wants to sell its stake in Toshiba Carrier to the Carrier Group for $877 million, and wants to sell Toshiba Elevator & Building Systems, and Toshiba Lighting & Technology, to make cash and focus on more profitable businesses: a proposal that is subject to shareholder and state approval[94].

Given Toshiba’s typical maneuvering, this has not gone unnoticed, and is seen as an attempt to defuse the opposition of those shareholders, primarily foreign funds, who had greeted the previous proposal with little favour, and to make credible the promise to return $2.6 billion to shareholders in two years[95]. An attempt at compromise between traditional Japanese entrepreneurship and the demands of foreign investors[96]. An attempt that failed: on 24 March 2022, the shareholders’ meeting blew up the plan, voting against it[97]. Since then, silence has fallen, new clarifications are awaited, but it is obvious that negotiations are continuing[98] with the aim of resolving the issue as soon as possible: if nothing is done, there is a real danger that Toshiba will end up bankrupt. So much so that Toshiba’s share price on the Tokyo stock exchange has fallen by around 5% since the March shareholders’ meeting[99].

The debate on the present and future of the economies that emerged victorious from the post-war period remains open: their feigned modernity, their corruption, their dependence on state largesse, their need to exploit the population in order to save diminishing profits, their deficits in political, economic, financial and industrial management, are all formulas that, hidden until now by propaganda, are being debunked by the evidence of failure. However, Japan and the Western democracies have an ace up their sleeve: to convince the population they do not need the blind violence of dictatorships, but can find the courage, if they want, to build a solidarity-based and shared way out of crises.

[1]https://www.reuters.com/technology/toshibas-lurch-crisis-crisis-since-2015-2021-11-11/

[2]https://www.nytimes.com/1988/12/27/business/seamy-side-of-business-in-japan-is-uncovered-in-a-stock-scandal.html

[3]https://www.nytimes.com/1988/12/27/business/seamy-side-of-business-in-japan-is-uncovered-in-a-stock-scandal.html

[4]https://www.nytimes.com/1988/12/27/business/seamy-side-of-business-in-japan-is-uncovered-in-a-stock-scandal.html

[5]https://www.kcl.ac.uk/news/the-toshiba-kongsberg-case

[6]https://digitalcommons.wcl.american.edu/cgi/viewcontent.cgi?referer=&httpsredir=1&article=1673&context=auilr;

Wrubel, Wende A. “The Toshiba-Kongsberg Incident: Shortcomings of Cocom, and Recommendations for Increased Effectiveness of Export Controls to the East Bloc.” American University International Law Review 4, no. 1 (1989), pages 241-273

[7]Wrubel, Wende A. “The Toshiba-Kongsberg Incident: Shortcomings of Cocom, and Recommendation for Increased Effectiveness of Export Controls to the East Bloc.” American University International Law Review 4, no. 1 (1989): pages 241-273.

[8]Wrubel, Wende A. “The Toshiba-Kongsberg Incident: Shortcomings of Cocom, and Recommendations for Increased Effectiveness of Export Controls to the East Bloc.” American University International Law Review 4, no.1 (1989): pages 259-261

[9]https://www.kcl.ac.uk/news/the-toshiba-kongsberg-case

[10]https://www.kcl.ac.uk/news/the-toshiba-kongsberg-case

[11]https://www.nippon.com/en/currents/d00296/

[12]George Cyril Allen, “A short economic history of modern Japan”, Allen & Unwin, London 1972

[13]https://www.euronews.com/next/2021/11/12/toshiba-results-timeline ; https://www.ft.com/content/ebc2e719-8b0a-4834-bc0a-46e8485862ab

[14]https://www.euronews.com/next/2021/11/12/toshiba-results-timeline

[15]https://www.euronews.com/next/2021/11/12/toshiba-results-timeline

[16]https://www.euronews.com/next/2021/11/12/toshiba-results-timeline

[17]https://www.euronews.com/next/2021/11/12/toshiba-results-timeline

[18]https://www.euronews.com/next/2021/11/12/toshiba-results-timeline

[19]https://www.global.toshiba/content/dam/toshiba/migration/corp/irAssets/about/ir/en/finance/ar/ar2020/tfr2020e.pdf?utm_source=www&utm_medium=web&utm_campaign=since202203CorpIr ; https://www.investopedia.com/articles/investing/081315/toshibas-accounting-scandal-how-it-happened.asp

[20]https://www.investopedia.com/articles/investing/081315/toshibas-accounting-scandal-how-it-happened.asp

[21]https://www.power-technology.com/news/ukraine-energoatom-westinghouse/

[22]https://www.global.toshiba/content/dam/toshiba/migration/corp/irAssets/about/ir/en/news/20151208_2.pdf?utm_source=www&utm_medium=web&utm_campaign=since202203CorpIr

[23]https://www.global.toshiba/content/dam/toshiba/migration/corp/irAssets/about/ir/en/news/20151208_2.pdf?utm_source=www&utm_medium=web&utm_campaign=since202203CorpIr

[24]https://www.global.toshiba/content/dam/toshiba/migration/corp/irAssets/about/ir/en/news/20151208_2.pdf?utm_source=www&utm_medium=web&utm_campaign=since202203CorpIr

[25]https://www.global.toshiba/content/dam/toshiba/migration/corp/irAssets/about/ir/en/news/20151208_2.pdf?utm_source=www&utm_medium=web&utm_campaign=since202203CorpIr

[26]https://www.global.toshiba/content/dam/toshiba/migration/corp/irAssets/about/ir/en/news/20151208_2.pdf?utm_source=www&utm_medium=web&utm_campaign=since202203CorpIr

[27]https://www.global.toshiba/content/dam/toshiba/migration/corp/irAssets/about/ir/en/news/20150729_1.pdf?utm_source=www&utm_medium=web&utm_campaign=since202203CorpIr

[28]https://www.law.ox.ac.uk/business-law-blog/blog/2021/09/toshiba-incident-and-its-implications

[29]https://www.law.ox.ac.uk/business-law-blog/blog/2021/09/toshiba-incident-and-its-implications

[30]https://www.reuters.com/technology/toshiba-set-announce-split-into-three-firms-shareholder-reaction-focus-2021-11-12/

[31]https://www.law.ox.ac.uk/business-law-blog/blog/2021/09/toshiba-incident-and-its-implications

[32]https://wipolex-res.wipo.int/edocs/lexdocs/laws/en/jp/jp187en.pdf

[33]“Investigation Report” , Translation, June 10, 2021, Page4 https://www.global.toshiba/content/dam/toshiba/migration/corp/irAssets/about/ir/en/news/20210610_1.pdf#page66 ; https://www.ft.com/content/ebc2e719-8b0a-4834-bc0a-46e8485862ab

[34]“investigation Report” , Translation, June 10, 2021, Page 138-139https://www.global.toshiba/content/dam/toshiba/migration/corp/irAssets/about/ir/en/news/20210610_1.pdf#page66 ; https://www.ft.com/content/ebc2e719-8b0a-4834-bc0a-46e8485862ab

[35]https://www.reuters.com/technology/toshiba-set-announce-split-into-three-firms-shareholder-reaction-focus-2021-11-12/ ; https://www.law.ox.ac.uk/business-law-blog/blog/2021/09/toshiba-incident-and-its-implications

[36]https://asia.nikkei.com/Opinion/Toshiba-activist-Effissimo-fails-to-convince-with-board-seat-demands

[37]Earnings Power Value is a valuation technique popularized by Bruce Greenwald of Columbia University. It is a better methodology for analysing the value of a company than financial models, which are predominantly based on uncertain growth assumptions due to the need to project flows over very long-time horizons. The basic concept of EPV is to base the value of a company on the current cash flow and not on future projections that may not even materialise. This valuation technique excludes the growth potential that the company might experience in order to analyse it separately. Since future growth is excluded, only the investments necessary for the maintenance and upkeep of the facilities are considered. The aforementioned amount of investments is deducted from the operating incomehttps://cdn.fiscoetasse.com/upload/Epv-Luxottica-Group-spa-allegato.pdf

[38]https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3856185

[39]https://www.ilsole24ore.com/art/toshiba-sull-orlo-crack-svalutazioni-63-miliardi-dollari-si-dimette-presidente-AEOrHhV?refresh_ce=1

[40]https://www.ilsole24ore.com/art/toshiba-sull-orlo-crack-svalutazioni-63-miliardi-dollari-si-dimette-presidente-AEOrHhV?refresh_ce=1

[41]https://www.ilsole24ore.com/art/toshiba-sull-orlo-crack-svalutazioni-63-miliardi-dollari-si-dimette-presidente-AEOrHhV?refresh_ce=1

[42]https://www.ilsole24ore.com/art/toshiba-sull-orlo-crack-svalutazioni-63-miliardi-dollari-si-dimette-presidente-AEOrHhV?refresh_ce=1

[43]https://www.ilsole24ore.com/art/toshiba-sull-orlo-crack-svalutazioni-63-miliardi-dollari-si-dimette-presidente-AEOrHhV?refresh_ce=1

[44]https://www.askanews.it/economia-estera/2022/05/26/toshiba-apre-a-rappresentanti-fondi-contestatri-nel-board-pn_20220526_00160/

[45]https://www.askanews.it/economia-estera/2022/06/07/toshiba-a-d-shimada-vendere-solo-per-rendere-grande-compagnia-pn_20220607_00207/

[46]https://www.ft.com/content/bdfff63b-93a4-451c-a98f-a22548106327

[47]https://www.ft.com/content/bdfff63b-93a4-451c-a98f-a22548106327

[48]https://www.ft.com/content/bdfff63b-93a4-451c-a98f-a22548106327

[49]https://www.theguardian.com/world/2011/nov/29/fukushima-daiichi-operator-tsunami-warning

[50]https://st.ilsole24ore.com/art/notizie/2014-03-17/dopo-fukushima-mondo-e-piu-sicuro-101104.shtml?uuid=ABijOY3

[51]“The Fukushima Daiichiaccident”— Vienna: International Atomic Energy Agency, 2015. Foreword by Yukiya Amano Director General https://www-pub.iaea.org/mtcd/publications/pdf/pub1710-reportbythedg-web.pdf

[52]“The Fukushima Daiichiaccident”— Vienna: International Atomic Energy Agency, 2015. Foreword by Yukiya Amano Director General https://www-pub.iaea.org/mtcd/publications/pdf/pub1710-reportbythedg-web.pdf

[53]http://www.asahi.com/special/yoshida_report/en/

[54]http://www.asahi.com/shimbun/20140912english.pdfhttps://greenreport.it/news/energia/fukushima-dopo-3-anni-arriva-verita-disastro-centrale-atomica/

[55]NHK is the State owned TV channel

[56]https://greenreport.it/news/energia/fukushima-dopo-3-anni-arriva-verita-disastro-centrale-atomica/

[57]https://www.reuters.com/article/us-toshiba-nuclear-idUSKBN17211S

[58]https://www.reuters.com/article/us-toshiba-nuclear-idUSKBN17211S

[59]https://www.reuters.com/article/us-toshiba-nuclear-idUSKBN17211S

[60]https://www.reuters.com/article/us-toshiba-nuclear-idUSKBN17211S ; https://www.nihonjapangiappone.com/pages/geostoria/geo/energia.php

[61]https://www.reuters.com/article/us-toshiba-nuclear-idUSKBN17211S

[62]https://www.asianews.it/notizie-it/Nucleare:-Kishida-vuole-riaccendere-le-centrali-giapponesi–55751.html

[63]https://www.bbc.com/news/business-29041403

[64]https://www.asianews.it/notizie-it/Nucleare:-Kishida-vuole-riaccendere-le-centrali-giapponesi–55751.html

[65]https://www.asianews.it/notizie-it/Nucleare:-Kishida-vuole-riaccendere-le-centrali-giapponesi–55751.html ; https://www.asahi.com/ajw/articles/14598206 ; https://www.bloomberg.com/news/articles/2022-04-06/nuclear-power-s-growing-fan-base-in-japan-faces-a-reality-check

[66]https://www.japantimes.co.jp/news/2022/04/13/national/kishida-nuclear-hints/

[67]https://www.bloomberg.com/news/articles/2022-04-27/nuclear-power-is-crucial-amid-pricey-fuel-crisis-japan-pm-says

[68]https://www.reuters.com/world/asia-pacific/kishida-support-edges-up-post-election-hurdles-linger-agenda-2022-07-13/

[69]https://www.bloomberg.com/news/articles/2022-04-06/nuclear-power-s-growing-fan-base-in-japan-faces-a-reality-check

[70]https://www.bloomberg.com/news/articles/2022-04-06/nuclear-power-s-growing-fan-base-in-japan-faces-a-reality-check

[71]https://www.bloomberg.com/news/articles/2022-04-06/nuclear-power-s-growing-fan-base-in-japan-faces-a-reality-check

[72]https://www.tvsvizzera.it/tvs/fukushima–autorità-nucleare-giapponese-approva-piano-tepco/47775296?utm_campaign=teaser-in-querylist&utm_source=tvsvizzerait&utm_medium=display&utm_content=o

[73]https://www.tvsvizzera.it/tvs/fukushima–autorità-nucleare-giapponese-approva-piano-tepco/47775296?utm_campaign=teaser-in-querylist&utm_source=tvsvizzerait&utm_medium=display&utm_content=o ; https://www.nytimes.com/2022/05/04/world/asia/japan-nuclear-power.html

[74]https://www.greenme.it/ambiente/fukushima-giornalista-spia/

[75]https://www.greenme.it/ambiente/fukushima-giornalista-spia/

[76]https://www.greenme.it/ambiente/fukushima-giornalista-spia/

[77]https://www.greenme.it/ambiente/fukushima-giornalista-spia/

[78]https://www.avvenire.it/mondo/pagine/la-yakuzza-arruola-i-senzatetto

[79]http://mascheraaztecaeildottornebbia.blogspot.com/2014/01/la-yakuza-e-la-bonifica-di-fukushima.html

[80]https://www.ilfattoquotidiano.it/2017/03/11/fukushima-sei-anni-dopo-bonifiche-a-rilento-e-lombra-dello-sfruttamento-di-lavoratori-senzatetto-e-stranieri/3444772/

[81]https://www.rainews.it/articoli/2022/07/il-giappone-pronto-al-riavvio-di-9-reattori-nucleari-per-contenere-i-blackout-energetici-ed9d9ea0-e888-4632-8a94-ba62aa7a2665.html

[82]https://blog.migrosbank.ch/it/quanto-ci-vorra-perche-il-giappone-esca-dalla-crisi/

[83]https://www.ilsole24ore.com/radiocor/nRC_15.02.2022_08.00_9110091?refresh_ce=1 ; https://www.fiscooggi.it/rubrica/dal-mondo/articolo/giappone-punta-sul-bonus-salari-rilanciare-consumi-ed-economia

[84]https://www.fiscooggi.it/rubrica/dal-mondo/articolo/giappone-punta-sul-bonus-salari-rilanciare-consumi-ed-economia

[85]https://it.investing.com/analysis/crolla-pil-in-giappone-sulla-contrazione-della-domanda-interna-17274

[86]https://www.fiscooggi.it/rubrica/dal-mondo/articolo/giappone-punta-sul-bonus-salari-rilanciare-consumi-ed-economia

[87]https://www.infomercatiesteri.it/quadro_macroeconomico.php?id_paesi=126#

[88]https://www.infomercatiesteri.it/quadro_macroeconomico.php?id_paesi=126#

[89]https://www.ansa.it/sito/notizie/economia/criptovalute/2021/11/12/toshiba-annuncia-scorporo-in-tre-divisioni-autonome_c0b66316-2c44-40b6-9576-2cf65b2edb50.html ; https://www.corrierecomunicazioni.it/digital-economy/toshiba-e-ufficiale-via-allo-scorporo-in-tre-societa-distinte/

[90]https://www.ansa.it/sito/notizie/economia/criptovalute/2021/11/12/toshiba-annuncia-scorporo-in-tre-divisioni-autonome_c0b66316-2c44-40b6-9576-2cf65b2edb50.html ; https://www.corrierecomunicazioni.it/digital-economy/toshiba-e-ufficiale-via-allo-scorporo-in-tre-societa-distinte/

[91]https://www.corrierecomunicazioni.it/digital-economy/toshiba-e-ufficiale-via-allo-scorporo-in-tre-societa-distinte/

[92]https://www.corrierecomunicazioni.it/digital-economy/toshiba-e-ufficiale-via-allo-scorporo-in-tre-societa-distinte/

[93]https://www.affaritaliani.it/economia/toshiba-non-si-fa-piu-in-tre-lo-scorporo-in-due-societa-entro-il-2023-778858.html

[94]https://www.affaritaliani.it/economia/toshiba-non-si-fa-piu-in-tre-lo-scorporo-in-due-societa-entro-il-2023-778858.html

[95]https://www.affaritaliani.it/economia/toshiba-non-si-fa-piu-in-tre-lo-scorporo-in-due-societa-entro-il-2023-778858.html

[96]https://www.affaritaliani.it/economia/toshiba-non-si-fa-piu-in-tre-lo-scorporo-in-due-societa-entro-il-2023-778858.html

[97]https://www.corrierecomunicazioni.it/digital-economy/toshiba-tutto-da-rifare-gli-azionisti-bocciano-lo-spezzatino/

[98]https://www.corrierecomunicazioni.it/digital-economy/toshiba-tutto-da-rifare-gli-azionisti-bocciano-lo-spezzatino/

[99]https://www.corrierecomunicazioni.it/digital-economy/toshiba-tutto-da-rifare-gli-azionisti-bocciano-lo-spezzatino/

Leave a Reply