There are names of huge, powerful multinational companies that hardly anyone has ever heard of – like Trafigura. There are sprawling hydras, made up of hundreds of companies in tax havens, whose real owners may not be known, but are estimated to be the 700 managers who run them, along with powerful politicians who protect them[1] – like Trafigura. The ownership is so fragmented that it is difficult to put a face to it, apart from CEO Jeremy Weir – who has never broken any laws.

Perhaps this is the strength of the Trafigura galaxy: because its particles always remain in the shadows, it is easier to make extremely unscrupulous choices. And yet, this almost infinite multicellular entity, which is the second largest oil trader and the first minerals trader in the world, and which earns (with the emerged part of the corporate iceberg alone) almost $150 billion a year[2], remains not only one of the darkest points of the globalization economy, but also, effectively, one of the greatest dangers to the social and environmental balance of the planet.

Trafigura was born in Switzerland in 1993 from a rib of the global mining trading empire headed by the controversial Israeli businessman Marc Rich, the founder of another multinational trading giant, the Glencore Group[3], and the ambition of one of its main collaborators, Claude Dauphin, who later died of cancer in Colombia in 2015[4]. But while Glencore, especially because of the great media and political exposure of Marc Rich, has always tried to create as few puddles as possible, Trafigura was born to wallow in them and look for, in every controversial situation, a commercially winning strategy, at any cost, as happened already at the end of the last century with the embargo against Iraq, in whose Oil for Food scandal, besides Trafigura[5], dozens of other important companies were involved.

To describe the activities of Trafigura we have chosen the chronological criterion, so as to show, at least, how the activities of the group have developed in the last 15 years, therefore from the moment when Jeremy Weir was approached by Claude Dauphin who, very young, had started to fight against cancer.

2006: caustic soda on the Ivory Coast

Ten years after the disaster, the work of cleaning up the areas poisoned by toxic waste must still be finished[6]

In the early years, in order to grow fast, Trafigura also buys poor quality oil, trying to sell what others refuse to do. In 2006, it hires the tanker Probo Koala to transport 84,989 tons of cocker naphtha[7], which is the residue of oil processing called “caustic washing”, the result of which is extremely dangerous: Trafigura mixes the “caustic” cocker naphtha with petrol and sells it as fuel[8]. After unsuccessful attempts in Malta, Italy, Gibraltar, the Netherlands and Nigeria[9], Trafigura tries to dump it off the Dutch coast, resulting in an environmental accident, and a Dutch toxic waste[10] disposal company arrives and offers to clean it up for $620,000 – a sum Trafigura refuses because it is considered exorbitant.[11]

In August, the Probo Koala tries its luck off the coast of Nigeria and pays $7,000 to a local firm, which is unable to do the job[12]. In the end Trafigura entrusts the job, on the advice of the Ivorian authorities[13], to Compagnie Tommy Inc. Québec for only $17,000[14] – a company struck off the Canadian register[15]. Compagnie Tommy illegally dumps 528,000 cubic meters[16] of toxic material (which Trafigura denies[17]) in 18 illegal dumps near Abidjan[18] on August 19, 2006, causing a huge environmental disaster and poisoning many residents[19]: in addition to the fuel, 500 tons of a mixture (hydrogen sulfide and sodium hydroxide) known as caustic soda are poured on the ground, killing 15 people[20] (in excruciating pain[21]) and leaving over 100,000 people intoxicated.[22]

On 14 September 2006, Trafigura sent a team: a team of doctors, a geologist, an engineer, Claude Dauphin, Jean-Pierre Valentini and Captain N’Zi Kablan (Puma Energy Abidjan). The three are arrested and imprisoned for five months[23]. Trafigura tries unsuccessfully to falsify the accounts relating to Probo Koala[24], but is discovered in trials (all lost) in Côte d’Ivoire, Holland and the United Kingdom. [25]

In addition, the company is forced to pay $198 million to the Ivory Coast government for environmental clean-up and damages to victims[26], €1.3 million to the Netherlands, and £32 million[27] to compensate 29,614 claimants represented by the London[28] law firm Leigh Day & Co. But it does not end there: the compensation is pocketed by a group that falsely claimed to represent the victims, leaving around 6000 of the claimants empty-handed. [29]

Adama Bictogo, Côte d’Ivoire’s Minister for African Integration, who was in charge of distributing compensation to the victims[30], resigned on the accusation of having stolen £700,000 from a compensation fund (an accusation also levelled against Interior Minister Desire Tagro)[31]. At the trial, Trafigura had the opportunity to influence witnesses[32] and continued to claim innocence[33], saying that ‘those refusals may at worst have caused a number of low-level flu symptoms and some anxiety’[34]. But then dozens of internal emails between Trafigura managers appeared, showing that the operation was dangerous and that management knew it. [35]

2006: Oil tanker explodes in Norway

The devastation of Sløvåg Harbour after the explosion on 24 May 2007[36]

In 2006 Vest Tank ApS Hvide Sande (Denmark[37]) negotiated a 100 million kroner contract[38] (which according to Vest Tank’s owner Trond Emblem was never signed[39]) with Trafigura for the desulfurization of very low-quality sulfur petrol from Mexico[40]. The quality of the cargo was so low that it could not be sold in Europe[41] and was therefore shipped to Africa: 150,000 tons in 6 shipments[42]. The judiciary investigates: it seems that Trafigura is involved in the transport of toxic waste, and that Norway is a possible destination due to the poor control of the local authorities.[43]

On 24 May 2007 (after eight Vest Tank ships had already arrived in the port of Sløvåg)[44], during the treatment of the ships’ cargo residues, Vest Tank proceeded to wash the tank using hydrochloric acid, creating a very unstable volatile mixture[45]. Due to an ignition produced by a defective carbon filter, an explosion is inevitable: the first explosion causes a fire in the port’s industrial area[46]. The accident creates a huge toxic cloud that reaches Eivindvik, a town about 20 km away, where a thousand inhabitants live[47]: a lot of people get sick, vomiting and pneumonia, but no one comes to help them.[48]

The investigation into the Vest Tank opened a disturbing chapter: Trafigura, which is not directly responsible for the incident, appears to be commonly using these practices to refine low-quality[49] fuel cheaply, turning its own tankers into cargo ships carrying toxic waste[50], an activity strictly prohibited in Europe[51], which led to the company being convicted in July 2010 for illegal waste trafficking, given the repetition of the crime after the Probo Koala case[52]. It was also discovered that one of Vest Tank’s ships (the Probo Emu) was carrying the same type of waste that its sister ship Probo Koala had dumped in the Ivory Coast months before.[53]

In May 2007, a chilling discovery: Vest Tank was acquired a few days before the accident by an Estonian oil company, Alexela Logistics, in which Trafigura is a minority shareholder[54]. According to the court ruling, Vest Tank’s former owner had to pay 160 million Norwegian kroner (NOK) to Alexela Solvaag to cover the costs of emptying the containers, renovating the terminal and cleaning up the damage caused by the explosion[55]. Alexela Logistics board member Heiti Hääl claims that the court ruling found that Vest Tank knowingly provided false information about the contents of the containers.[56]

2013: the biggest scandal in Brazilian history

2 December 2016: Almost half a million people march through Copacabana to protest against the politicians caught in the “Lava Jato Operation”, which leads to the resignation and conviction of President Lula[57]

Operation Car Wash began in March 2014 as an investigation into suspected corruption of executives at Brazil’s state-owned oil company Petrobras[58]. As the months passed, the investigation became more complicated and the case, which began in Curitiba (the capital of the state of Paraná), spread to the whole world, becoming the biggest scandal in the history of Brazil[59], involving 42 countries[60], so that the investigation passed into the hands of the Federal Supreme Court[61]. The investigation has been going on for seven years, and in Switzerland funds worth 1.1 billion dollars have been frozen, 20% of which have already been seized[62], as more than 130 businessmen and politicians[63] have been convicted in Brazil, including the popular ex-President Luiz Inácio Lula da Silva[64], who in April 2018 began serving a 12-year prison sentence for corruption[65], and was then rehabilitated by the Supreme Court in March 2021, so that Lula could run in the 2022 presidential elections.[66]

The first to confess and to launch the investigation was a Trafigura agent, Carlos Henrique Nogueira Herz[67], who implicated two other managers in his group, José Maria Larocca[68] and Mike Wainwright[69], plus Trafigura’s former boss, president Claude Dauphin[70]. According to Herz[71], Trafigura executives were aware of millions of dollars in bribes paid to Petrobras management[72]. In total, prosecutors say Trafigura paid at least $6.1 million in bribes between 2009 and 2014, of which $4.6 million was handled by Herz.[73]

Another former senior manager of Trafigura, Marciano Marcondes Ferraz, in 2018 was sentenced to 10 years in prison[74], and received a discounted sentence for handing over to magistrates documents showing how Petrobras managers, using code names, negotiated a bribe of 10 to 20 cents per barrel of fuel oil sold to Trafigura[75]. Between 2011 and 2014, Ferraz made payments of more than $800,000 to then Petrobras director Paulo Roberto Costa.[76]

The entire system of trade with Petrobras became the subject of criminal investigation, and in November 2019 this led to the search of the offices of Trafigura and Vitol in Geneva[77]. Trafigura entered into agreements, between 2004 and 2015, worth more than $9 billion, part of which ($1.5 million[78] ) was paid to obtain various concessions[79]. Trafigura denies all the accusations[80], but the prosecutors go ahead, convinced that they have detailed evidence of the corruption episodes.[81]

2013: corruption becomes systematic

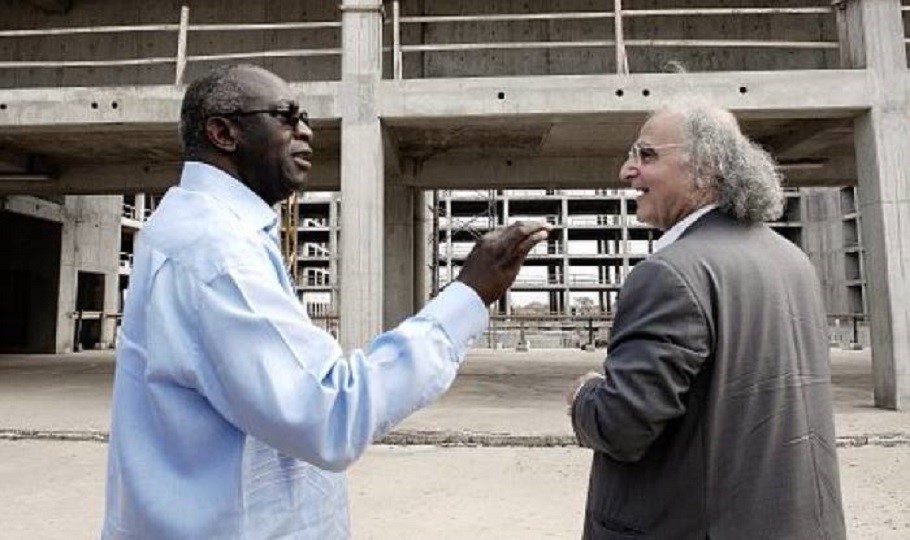

13 February 2007: Congo’s President Laurent Gbagbo and Roald Goethe sign a contract for Trafigura[82]

In order to coordinate the intermediation operations in Africa, Worldwide Energy Marketing & Consulting Inc. was created. Dubai[83]: the company is a covert intermediary of Trafigura in Congo-Brazzaville[84], with central offices in Fujairah and Dubai[85]. In January 2001, it participated (through its President Frédéric Fatien[86]) in a meeting of the most influential Congolese, during which an agreement was reached to restructure the state debt of over USD 900 million and lower the interest rates charged by Congo to Trafigura. [87]

Some of the debt (from which the Congolese political elite benefits[88]) comes from unsecured loans from Société Générale and ABN AmRo, a system that has been in place since the 1990s, when Glencore, Vitol and Trafigura/Worldwide Energy Marketing obtained loans guaranteed by oil that had not yet been extracted[89], bringing Congolese public debt to 105% of GDP[90]. The perverse spiral of this system not only finances corruption but also exports the country’s currency reserves to tax havens, while the state struggles to repay a 135 million euro loan from France that would otherwise have been paid off in just three years.[91]

Frédéric Fatien, consul general of Côte d’Ivoire in the United Arab Emirates[92], arrived in Congo in 1996 following his father Raymond[93], who founded a construction and real estate group in Brazzaville with Roald Goethe (a racing car driver[94] and Jean-François Piacentini[95] (a Swiss manager[96] and director of SOCAR Trading SA Geneva[97], a trading company also based in Dubai[98] that works with the government of Azerbaijan[99] and several African countries. [100]

Fatien started earning money working (between 2003 and 2007) for Yachting Engineering & Services Ltd. London[101], which is based in the same building as Trafigura’s London office[102]. In September 2004, together with Roald Goethe and Jean-François Piacentini, he founded LML Location Materiel Lourd SA Luxembourg, whose shareholders are Lauren Business Ltd Tortola (50%)[103] and Emerald Management SA Tortola (50%), and started working in logistics and oil trading.

This is a job that cannot be improvised. Fatien got there because, through his father, he met the architect Pierre Fakhoury (Yam’s Petroleum), an influential advisor to former Ivorian President Félix Houphouët-Boigny[104]: the man who, out of a mania for grandeur, had the Notre-Dame de la Paix church built in Yamoussoukro (the construction of the church doubled the country’s debt[105]), and the Palais des Congrès in Abidjan[106]. Before that, Fakhoury had worked for Laurent Koudou Gbagbo (in power from 2000 to 2010, indicted and acquitted in 2019 on charges of crimes against humanity[107]), building (among other things) the new presidential palace, that of the Senate and that of the National Assembly in Yamoussoukro.[108]

President Laurent Gbagbo and architect Pierre Fakhoury[109]

In 2011, Fakhoury founded the construction company PFO AFRICA (many projects, especially in Côte d’Ivoire[110], paid for with oil concessions for his Yam’s Petroleum[111] and a gift of 1.6 million barrels of crude oil[112]) and put his son Clyde in management[113]. After that, Fakhoury devoted himself to networking in France: lawyer Robert Bourgi, Jacques Foccart, and other staff members of the controversial MP Claude Guéant[114]. Even the very promising CI-100[115] drilling license he did not exploit[116], but sold it to Total (60%) and Petroci – Société nationale d’opérations pétrolières de Côte d’Ivoire (10%, bought with a bank loan brokered by Worldwide Energy[117]), keeping 25%[118]. Yam’s share of barrels is sold by Worldwide Energy to Dubai: seven annual shipments of 650,000 barrels of oil each[119]. With the money earned, Fakhoury looks for gold in Ivory Coast[120] and Guinea[121].

Other friends also earn good money thanks to Fakhoury. Roald Fridtjof Goethe, head of African Oil Trading at Trafigura, has a number of oil brokerage companies: the Delaney Petroleum Corporation Tortola (offices in Geneva and Dubai[122]), and a plethora of other commercial and financial companies scattered around the world[123]. Jean-Pierre Baptiste Valentini, although he has officially left Trafigura, still works with his former colleagues in Dubai[124] and continues to race, along with Trafigura COO Mike Wainwright and Roald Goethe, in car races organized by Fatien’s stable, GPX Racing Fze. Dubai. [125]

Valentini did not leave voluntarily, but was forced to: as of February 2021, he was involved, by the Marseille public prosecutor’s office, in a criminal investigation for money laundering linked to investment projects in Courchevel[126] (along with Antony Perrino, a well-known builder[127], shareholder of the Ajaccio football club, the island’s shipping company and former CEO of the newspaper “Corse-Matin”. [128]

Together with Valentini, also a Corsican, according to the judiciary, Perrino was part of a criminal gang known as ‘Le Petit Bar’[129], involved in international trafficking. involved in international drug trafficking and extortion[130]. Valentini is now an independent[131] advisor[132] to Frédéric Fatien[133] and, with Perrino, is planning several real estate operations in addition to the Courchevel[134] operation for which he is under investigation. Valentini is also a board member of the French company AMR Alliance Minière Responsable.[135]

Commodity prepayment (in other words, a loan that is repaid in future shipments of oil or minerals) is an age-old tool used by international traders. Traders earn between 8% and 10%[136], which is why these agreements are signed in secret. Countries like Congo and Chad have found themselves on the verge of bankruptcy after the collapse of commodity prices, partly because the International Monetary Fund refuses to help them until they restructure their debt to traders.[137]

Puma Energy petrol stations, one of the most common gasoline stations on African roads[138]

Over the years, Trafigura’s prepayments have grown from $700 million (2013) to more than $5 billion (2019) through loans controlled and structured by more than 130 offshore financial structures around the world[139]. In one case, that of Côte d’Ivoire, the growth in debt exposure to Trafigura created a de facto monopoly of sorts: when Worldwide Energy entered into the $295 million advance payment contract for one million barrels of oil[140] with Petroci[141], headed by Laurent Gbagbo’s[142] brother-in-law, in 2015, the subsequent and unexpected commodity price crisis procured a 75%[143] dry loss for the Abidjan government. To renegotiate the deal, it had to promise more barrels to Worldwide Energy in February 2018 and sold its chain of petrol stations (37 stations) to Puma Energy (Trafigura group ). [144]

Although the Government changed Petroci’s General Manager, appointing Ibrahima Diaby[145], who was given the difficult task of restructuring the company[146], one thing was impossible to change: the agreement between Petroci and Puma Energy that includes the creation of a joint venture, Puma Energy Petroleum Côte d’Ivoire, of which the State controls only 20%, but contributes 50% of the raw material[147]. In an attempt to save Petroci[148], Diaby sacked 40 managers and incurred the wrath of Ivorian politicians.[149]

Returning to the Congo, Denis Marie-Auguste Gokana, president of SNPC Société Nationale de Pétroles du Congo[150], a friend and advisor to President Denis Sassou-Nguesso[151], and the management of Trafigura have devised a spectacular method of financing the party that supports the Brazzaville government: Trafigura lends to two companies indicated by Gokana (Sphynx Bermuda Ltd. Hamilton and Africa Oil and Gas Corporation SA Brazzaville) 650 million dollars, and in return he delivers, in the form of loan repayments (plus interest), oil worth 1.4 billion dollars, produced by SNPC, of which he is the chairman[152]. The complaint by the London-based NGO Global Witness has so far had no consequences.[153]

In October 2020, Trafugura announced that he wanted to restart his Mawson West copper mine (north of Lake Mweru in the province of Haut-Katanga) in the Democratic Republic of Congo, which had been closed due to unstable copper prices[154]. A month later, Trafigura signs an agreement with the Congolese state-owned Entreprise Générale du Cobalt (95 per cent owned by Gecamines and 5 per cent directly by the government[155]) to “improve the conditions of the mining sites“[156] in exchange for cobalt supplies (Congo DRC is the world’s largest producer). [157]

2014: Banks rebel

A meeting between Omar al-Bashir (right), President of Sudan, and Salva Kiir (left), President of South Sudan, at the 2010 peace talks[158]

In June 2014, BNP Paribas paid a fine to the US government ($8.97 billion or €6.6 billion) for violating economic sanctions against Cuba, South Sudan and Iran – a fine imposed after the bank admitted responsibility and accepted a 2015 suspension of clearing operations established by the Federal Reserve for those doing business with Third World countries[159]. Among the reasons for the severe decision was the fact that the volume of transactions was very large and that there was evidence of the bank’s awareness of violating the embargo.[160]

BNP Paribas admitted to participating in nearly $9 billion in prohibited transactions between 2004 and 2012, especially in South Sudan: the illicit transactions included a Dubai-based oil company that was actually covering for an Iranian oil company[161]. This name has not been disclosed, but there is a suspicion that it is Trafigura, because BNP Paribas, as soon as it received the fine, cancelled the relationship and cut off three-year funding and loans for commodities trading to Trafigura Dubai.[162]

However, BNP had already supported Trafigura and Vitol’s[163] trade relations in South Sudan. With the ongoing war, the secessionist authority sold its future oil, sinking into debt [164]: as of 25 June 2014, South Sudan owed $256 million to China’s National Petroleum Corporation and another $78 million to Trafigura[165], under a contract signed in 2012[166]. For this reason, in 2014 Trafigura was excluded from the investment portfolio of some US state pension funds (Kansas, Colorado, Iowa and South Dakota.[167]

Trafigura’s management has excellent contacts in embargoed countries. In January 2016, as soon as sanctions on oil exports from Tehran were lifted, Trafigura was ready[168]: at the end of June, it had its first cargo of Iranian crude oil on the tanker Olympic Target, beating off competition from Glencore and Vitol[169]. But the links were there even before: in October 2011 Trafigura delivered aluminum to Iralco Fze. Arak (the company supplying Iran’s nuclear program) – according to UN experts, it is ‘a means of violating restrictions on trade with Iran’[170]. The person responsible for the agreements is Christophe Salmon, a BNP Paribas manager who joined Trafigura’s contract staff in 2001.[171]

The relationship with South Sudan is a long-standing love affair. In January 2012, Trafigura was accused of buying the crude oil (for $815m) that Sudan’s militias looted during the war.[172] South Sudan is landlocked and is forced to export oil (which accounts for 98% of the country’s income) via a pipeline through Sudan, for the use of which Khartoum either demands multi-million dollar fees from its neighbors, or ‘seizes’ and resells the crude – which has led to South Sudan’s oil production grinding to a halt.[173]

South Sudan’s state-owned oil company, Nilepet, is under the direct control of the president and the head of South Sudan’s internal security office (NSS)[174], General Akol Koor Kuc[175]. Much of the oil revenues have been paid to the NSS and tribal militias[176]. Meanwhile, however, Nilepet, together with the Ministry of Petroleum and Mines, is at the center of a controversial oil-backed loan program that has become a scandal: the government finds partners willing to pay for oil that has not yet been extracted on extremely favorable terms, and these advances provide the government with liquidity. [177]

Nilepet plants, pride of South Sudan and reason for war with Khartoum[178]

125 million were negotiated with Trafigura[179]. The following year, the Ministry of Finance paid back $184 million[180], in a perverse spiral that worsened the country’s economic situation[181]: “After repayments to Trafigura and other deductions (…), South Sudan received only 24% of gross oil revenues, but could not refinance itself with oil advances. After net oil advances, the government received only 14% of gross oil revenues”.[182]

In November 2016, Africa Intelligence mentions a letter in which a Trafigura Director offered the Ministries of Finance and Petroleum $10 million to “facilitate the award of the [November 2016 oil] cargo and also support the Ministry in its activities”[183]. Trafigura’s management declined to comment: since South Sudan is not among the EITI members, Trafigura is not obliged to disclose information about the payments: “Trafigura delivered refined products to Nilepet and was paid in return”[184]. And that’s it.

In 2019, in South Sudan, Trafigura is involved in a case of arms trafficking: the NGO Public Eye discovers two documents, dated January 2016, in which it reads of a payment of $45 million, paid by Trafigura to a bank account in the name of ZIVHG Ltd. to finance “agricultural projects”, plus another $35 million paid to the Ministry of Finance of South Sudan[185], plus $85.2 million for the period 2017/2018 and $48.6 million for 2018/2019. [186]

Behind ZIVHG Ltd is Israel Ziv, a retired Israeli army general who, according to OFAC, Office Foreign Assets Control[187], allegedly supplied arms and ammunition to both the government of South Sudan and the opposition to the tune of about $150 million using a farm paid for illicitly by Trafigura: Ziv also allegedly planned mercenary attacks on South Sudan’s oil fields and infrastructure in an attempt to create a problem that only his company could solve[188]. Ziv knows Trafigura’s management: he worked with them in Colombia, with his company CST Global, on the Impala Terminals project.[189]

2017: a disaster in Finland

The flooded and poisoned mine of Talvivaara[190]

In 2017, Trafigura bought 15%[191] of the state-owned Talvivaara Nickel[192] mine for €75 million[193], a mine with a bad reputation due to its alleged links to Russia, alleged tax evasion and toxic waste scandals[194]. The Finnish government says Trafigura was thoroughly vetted before being accepted as a shareholder in the state-owned holding company Terrafame, which controls Talvivaara. [195]

Over time, Trafigura increased its shareholding[196] through its two subsidiaries Galena Asset Management SA Geneva and Galena Private Equity Resources Fund[197], and now holds 44.3% of Terrafame[198]. With Trafigura’s help, the Finnish government is building the world’s largest nickel sulphate plant: the new chemical plant for batteries for electric vehicles will be in operation before Christmas 2021, and Trafigura will act as exclusive sales agent for all nickel and cobalt production until 2027. [199]

Talvivaara Mining has a long history of environmental problems, as the concentration of sulphate produced by the plant has often exceeded permitted levels, causing serious pollution of the region’s[200] lakes and rivers, which is why the company has received several fines[201], culminating in November 2012 with a large leak from the gypsum waste pond that was contaminated with nickel, uranium and other toxic metals, the damage to which is permanent. [202]

The controversy in Finland has not subsided, as Trafigura’s share of investments continues to increase, but not in a clear and linear way[203]: by the time it bought its first stake in Terrafame in 2017, over 100 Bahamian companies, 21 Swiss companies, 18 Luxembourg companies, 16 Maltese companies and 10 in the Marshall Islands revolved around Trafigura – Trafigura is registered in Singapore, is owned by Farringford NV Willemstad (Curaçao), and no one knows who controls it.[204]

Banks have repeatedly made reports to the relevant authorities of suspected money laundering[205]. Deutsche Bank, for example, has filed a report with the US authorities on suspicious transfers of more than $30 billion[206] by Trafigura. Trafigura transfers hundreds of millions of euros almost daily to companies in tax havens that appear to be dormant, many of them founded by the famous Panama law firm Mossack y Fonseca[207], which has been under investigation[208] since the Panama Papers[209] scandal. Investigations in the United States are continuing.[210]

Chinese crime boss Liu Han as he is sentenced to death[211]

An example: in October 2013 and March 2015, Trafigura sent approximately one hundred million euros to a company called Landfall Universe Limited[212] Landfall communicates Standard Charter Bank three different addresses: Tanzania ($620,347,589 in 182 between July 2013 and January 2016)[213], China and the Virgin Islands – but the bank, which reported the payments to the authorities, has not been able to find out the owners of the company or where it actually is. [214]

After that, Landfall Universe received more than €300 million from the Chinese company SHG Sichuan Hongda Group Company Ltd[215] (a Hanlong-controlled mining company listed on the Shanghai Stock Exchange, which in September 2011 signed a $3 billion deal with Tanzania to mine coal and iron[216], whose owner Liu Han was sentenced to death and executed in 2015[217] for murder, arms trafficking, illegal gambling and other crimes[218]. Another company probably controlled by Trafigura[219], Mercuria Energy Trading SA Singapore[220], which trades in pharmaceutical consumer goods, paid Landfall Universe 18 invoices totaling $110,622,043 between 21 January 2014 and 5 January 2015.[221]

2018: trouble in Colombia and revolution in Zimbabwe

Impala Terminals’ state-of-the-art port facilities in Barrancabermeja[222]

In December 2018[223], Trafigura, together with IFM Global Infrastructure Fund[224], invested in equal parts[225] in the project called Impala Terminals – the creation of a network of 28 port infrastructures in Mexico, Spain, Colombia, Peru and Uruguay to boost the transport by ship of lead, zinc and copper[226]. Impala Terminals[227] Group Sarl Luxembourg existed since 1996, then in 2011 Impala Terminals Colombia SAS[228] was created. Impala Terminals Group later sold all its companies (2016) except Impala Terminals Colombia SAS[229], whose assets were sold to Simba Holding Sarl Luxembourg[230], whose 50% was sold to IFM Global Infrastructure Fund[231], while the company, now an empty shell, remained 100% owned by Trafigura.

Impala has invested more than USD 1 billion (about USD 500 million for the inland port of Barrancabermeja, another USD 450 million for a fleet of river barges and the rest for facilities and administrative costs[232]) to develop the river network on the Magdalena River, the largest and most important in Colombia, so as to have control over the port of Barrancabermeja where the country’s two main oil refineries are located, as well as the rail terminals for coal mines and the import of fertilizers and cereals[233]. A very big and profitable business.

Problems arose when the state project to build embankments (without which the river would not be navigable) was awarded to Navelena SAS Barrancabermeja (a joint venture between the Brazilian company Oderbrecht[234] and the private consortium Valores y Contratos SA Barranquilla[235]) in exchange for money and a license to manage the river for seven years[236]. The Odebrecht scandal broke: millions of dollars in bribes to former Transport Minister Gabriel Ignacio Garcia Morales, paid to win the contract to build the final part of the Ruta del Sol Highway.[237] Navelena does not even begin work, and in April 2017 the state revokes the license[238], so Impala Terminals is only able to transport 30 per cent of the planned amount of goods[239]. The Colombian government is still studying the new rules for the tender… [240]

Trafigura’s pressure on governments, when management feels in control, can lead to surprising political changes: Zimbabwe, for example, has always been plagued by fuel and foreign currency shortages and the economy is facing the worst crisis in its history[241]. Trafigura has been supplying the government with fuel on credit for years, yet for months President Robert Mugabe has had to face popular anger because of long queues at petrol stations[242]. Trafigura supplies Zimbabwe through Puma Energy, which in turn uses a 500km pipeline from Mozambique to the Indian Ocean[243] port of Beira. Although Puma is becoming increasingly flexible with payments[244], the government cannot pay and the need for supplies is growing.[245]

Kuda Tagwirei (right) tries to explain Sakunda Holding disaster to President Robert Mugabe[246]

In 2018, Puma’s main partner on the side of the Harare government and businessman Kudakwashe Regimond Tagwirei, owner of Sakunda Holding, which has an exclusive license for the Feruka pipeline, linking Mozambique to the Zimbabwean capital and which, surprisingly, instead of collecting claims, gives the government a loan of $22.75 million, paid to the state oil company, NOIC National Oil Infrastructure Company[247]. Thanks to this loan, Trafigura raises fuel prices[248]. Tagwirei is also a politician, and is very close to ZANU-PF, the party of Mugabe and his then right-hand man, Emmerson Mnangagwa.[249]

The confusion only clears up in 2020: Tagwirei has a minority stake in Sekunda Holding, which in February last year was bought by the majority shareholder, Trafigura[250]. In the meantime, Tagwirei is an adviser to the new government, chaired by Emmerson Mnangagwa, who, until his election, had an external contract with Puma Energy[251]. The population interprets the facts in this way: Mnangagwa, Tagwirei and Trafigura had colluded to force Mugabe’s resignation and to strangle Zimbabwe in the grip of debt, from which only they could save it – with an act of clemency.

The judiciary went on a rampage against Tagwirei[252] and accused him of fraud[253], corruption and plunder and favoring access to hard currency[254]. In 2019, the Reserve Bank of Zimbabwe freezes Sakunda’s bank accounts after the IMF warned that it was state payments to that company, worth hundreds of millions of dollars (printed by the Central Bank of Zimbabwe), that triggered the collapse of the Zimbabwe dollar[255]. Popular suspicions are then substantiated by an authoritative source, and Sakunda Holdings Pte Ltd Harare is placed on the US economic sanctions list, as is Tagwirei.[256]

In 2020 Tagwirei creates a new company, Sotic International Ltd. Port Louis (Mauritius), which buys mines in Zimbabwe[257] and provides a $1.2 billion loan to the NOIC National Oil Infrastructure Company[258]. Despite the fact that Sotic’s management is composed of former Trafigura and Puma Energy employees, Trafigura denies any connection with Sotic[259] except for the partnership in Sakunda Petroleum (51% Sotic, 49% Puma).

2019: the intermediaries scandal and lawsuits against clients

Trafigura chairman Jeremy Weir announces change in brokerage strategy with African countries[260]

Contracts in the commodities market are obtained through the work of local intermediaries – people with networks of relationships in governments, whose actions are always somewhere between professionalism, personal influence and corruption. Trafigura has always been one of the groups with the most efficient brokers, but in 2019 it was forced to sever relations with many of them because the US[261] Department of Justice and prosecutors in Switzerland and Brazil[262] are investigating many of them on suspicion of corruption – even if Trafigura’s CEO, Jeremy Weir, assures that port and airport technicians, as well as insurance and security experts, are not affected by the measure[263].

According to the initial results of the investigations, Trafgura’s brokers paid bribes in Brazil, Nigeria, Algeria, the Republic of Congo and the Democratic Republic of Congo[264], reaching a record $22 million for a bribe in Ecuador[265]. After all, in some countries it is impossible to obtain a contract without corruption. In Brazil, where Trafigura is alleged to have paid bribes of USD 1.5 million[266], investigations also concern all competitors: Glencore and Vitol are also alleged to have regularly paid unfaithful managers at Petrobras (the state oil company Petroleo Brasileiro SA).[267]

Another example: in 2006, Trafigura allegedly donated $31 million to Jamaica’s governing party (PNP Opposition People’s National Party[268]) in exchange for fuel contracts purchased in Nigeria[269]. Since March 2021, Jamaica’s top government officials of the time have been in court[270]: Prime Minister Portia Simpson Miller[271], Energy Minister Phillip Paulwell[272], former PNP President Robert “Bobby” Pickersgill[273], former PNP General Secretary and Information Minister Colin Campbell[274], and middleman Norton Wordsworth Hinds, then head of the Jamaica Transport Control Authority.[275]

The same accusations have been levelled at former Zambian Justice Minister Wynter Kabimba[276], who was investigated in 2012 for accepting a bribe from Trafigura for a $500 million fuel contract with Midland Energy Zambia, of which Kabimba is a board member and majority shareholder[277]. Despite his denials, Kabimba is called to testify before the Anti-Corruption Commission[278]: he is saved by President Michael Sata, who prevents the magistrates[279] from completing the trial against his Minister of Justice[280], and orders them to acquit him for insufficient evidence.[281]

But this is Africa. Elsewhere, where it is more difficult to bribe, commercial contracts often end up in complicated and expensive court disputes. An example: Nyrstar NV Balen (Belgium)[282] is one of the largest zinc and lead refineries in the world and has long had financial and operational problems. Trafigura acquired 98%[283] of Nyrstar[284] in an attempt to save the company[285]. Some minority shareholders who were almost forced to sell have filed a lawsuit against Trafigura and allege that the Group used its influence over Nyrstar’s management to negotiate contracts and deals favorable only to Trafigura (such as large trade discounts – $37 per ton of ore processed for Trafigura versus $147 per ton at the market[286]). These agreements, according to the prosecution, only created more losses for Nyrstar[287] from 2016 onwards, worsening its financial state. Investigations by the Belgian financial authority (FSMA) and auditor Deloitte found that there was much evidence to suggest that Nyrstar’s management had voluntarily stopped defending the interests of Nyrstar’s shareholders, except for one: Trafigura[288]. The case is still pending.

Nyrstar’s huge hangars empty due to company crisis[289]

Another example. In January 2016, Nautica Marine Ltd. Monrovia (Liberia) offered the vessel “Leonidas” (for hire) to transport crude oil from the Caribbean to the Far East, and reached a non-binding agreement[290] with Trafigura. Waiting for a signed contract, Nautica Marine agreed to reduce its fee by $75,000 and, as soon as Trafigura had this offer in hand, cancelled the charter[291]. It went to court, because Nautica considered the agreement valid, and Trafigura did not[292]. In the end the Liberian company, in order to at least cover its costs (a ship, even if stationary, needs a crew and maintenance), accepted a contract for $491,690.67 less – without a signed document, in fact, for the court, there is no obligation[293].

One more example. The trader Curaçao Oil (Curoil) NV Willemstad[294] enters into a contract with Trafigura for the purchase of 150,000 barrels of marine fuel oil that includes an independent inspection on the quality of the product[295]. Upon delivery in May 2018, technicians hired by Curaçao Oil declare it to be compliant – but in June, when Curoil starts using it, it turns out that that declaration is false, and that that oil damages engines[296]. Curoil unsuccessfully filed a lawsuit against Trafigura, claiming around $9 million in damages, but in February 2020 the arbitration tribunal dismissed the claim because, according to the judges, the experts, not Trafigura, were at fault for the error, and the suspicion that these experts were manipulated or advised was not proven.[297]

The same thing had happened in October 2019, when a Texas refinery, Valero Energy Corporation[298], filed a lawsuit against Trafigura in Houston District Court because it bought 186,000 barrels of marine fuel from Trafigura that seriously damaged the engines of the ships on which they were used[299]. While Trafigura was fighting to move the court venue out of Texas[300], the Mexican chemical company Indelpro SA filed a lawsuit against both Trafigura and Valero[301], claiming that the latter already knew about the harmfuless of that fuel[302]. The same happened between 2019 and 2020: Valero sued Chembulk Ocean Transport Llc Majuro (Marshall Islands[303]), then the National Shipping Company of Saudi Arabia[304], whose ship was left adrift for two days and whose repairs cost $1.1 million[305] – and in December 2019 they both won: it was Valero who had to pay, not Trafigura.[306]

Sometimes the suspicion of fraud is combined with the suspicion of corruption: in July 2020, Trafigura reports to Credit Suisse compliance a suspicious invoice, paid by the Australian company Greensill Capital Pty. Ltd Bundaberg (Queensland[307]), very close to British Prime Minister David Cameron [308]), which paid part of a debt owed by Trafigura to the Liberty Commodities of controversial Indian businessman Sanjeev Gupta – controlled via his commodities trading company GFG Alliance Ltd London[309]. A series of unsecured loans granted by Greensill to various parties were discovered, which were repaid through a joint account with Credit Suisse[310]. Liberty Commodities (illicitly) raised funds from Greensill against an invoice of 30 million dollars issued to Trafigura: which means that the investors of that account at Credit Suisse would have received interest on an illicit operation, when Trafigura had paid that invoice, which it was very careful not to do.[311]

Credit Suisse’s hidden fund of $10 billion worth of Greensill Capital invoices obviously infuriates the bank’s clients who have poured billions into it[312]. Credit Suisse announces that $1.2 billion has disappeared into the jaws of Gupta, which has since declared bankruptcy and will not return it[313]. The clients are appealing to the Court, claiming that they know nothing about Gupta’s GFG group, but that they have always believed that the fund was fed by internal tax optimization within the Trafigura group[314] : in support of this thesis they bring some contracts for the purchase of metals by Trafigura from GFG, and the loan (guaranteed by Greensill Capital) of 350 million dollars with which Trafigura helped GFG to buy a French aluminum smelter, in Dunkirk, in 2018[315]. Meanwhile, all the entities involved have filed for bankruptcy.[316]

2020: growing alliance with Rosneft

21 June 2013: Claude Dauphin (left) and Igor Sechin (right) sign the first major cooperation agreement between Trafigura and Rosneft[317]

Trafigura has offices in 48 countries around the world[318], including Ukraine (Trafigura Ukraine TOO Kiev[319]) and Russia (Trafigura Eurasia OOO Moscow)[320]. So Trafigura has become an increasingly important player in the Russian oil market[321], as it works even when other traders back out because of sanctions for the war with Ukraine, helping firms like Rosneft, blocked by the embargo. [322]

In April 2015 alone, Trafigura bought almost 9 million barrels of crude for a total of more than $500 million, and in May the figures were similar: a fact that was noted, given that, in 2014, Trafigura and Rosneft had never traded more than 1 million barrels per month[323]. To avoid violating the embargo, Trafigura granted credits to Rosneft, which it then paid in crude oil, avoiding the exchange of money.[324]

In August 2017, Trafigura (through its Kesani Enterprises Ltd) was part of the consortium (with United Capital Partners – Ilya Scherbovich’s[325] UCP Investment Group[326] ), led by Rosneft, that took control of Nayara Energy Ltd [327](buying together 98% of the company), formerly Essar Oil Ltd. Mumbai[328], which includes refining, marketing, production and a network of over 6,000 service stations, as well as operating India’s second oil refinery in Vadinar, Gujarat.[329]

In December 2020, Trafigura bought 10% of Vostok Oil, from Rosneft, for around €7 billion[330] : an ambitious project personally backed by Vladimir Putin[331] to bring together Rosneft’s vast resources in the Arctic and connect them via the so-called North Sea Route to markets in Europe and Asia[332], a purchase that will provide Trafigura with official entry into the important Taymyr region (Siberia)[333], with its huge reserves[334] exceeding 1 billion tons of oil[335]. When the project began, Igor Sechin, the head of Rosneft, presented Putin with a bottle of the project’s first oil, claiming it was better than Middle Eastern oil[336]. Now Trafigura is the first investor in the project and aims to trade 50 million tons a year through the project at the start, and more than 100 after its completion[337].

2021: Strange transactions in Angola and Dubai

Jeremy Weir and Hamdan Bin Zayed Al-Nahyan discuss Trafigura’s future in the UAE[338]

In April 2021, Trafigura, Puma Energy Holdings Pte Ltd and Sonangol completed a transaction that made no apparent sense. Puma Energy, the Trafigura subsidiary that has been loss-making since 2018, and which, in order to avoid bankruptcy, has sold off its operations in Indonesia, Paraguay and Australia[339], which, in the past, had generated large profits, is demobilizing[340]. Sonangol is also in trouble: the oil company of the Angolan state, until 2011 earned well[341], then was plundered by politicians and, when the Angolan currency collapsed and the government froze prices (2018) things started to go wrong.[342]

The transaction has the following path: Trafigura buys 31.78% of Sonangol for $600 million, and thus controls over 90%[343]. Puma Energy sells all its assets in Angola (including Pumangol petrol stations, airport terminals and marine terminals[344]) to Sonangol for the same $600 million. So no one pays a penny, and the last Angolan stake in Sonangol remains the 5% that former President José Eduardo Dos Santos had guaranteed to General Leopoldino ‘Dino’ do Nascimento[345]. Meanwhile, Puma Energy issued new shares for $1.1 billion[346], and its CEO, Emma Fitzgerald[347], resigned with immediate effect[348]. The sale of the shares will begin at the end of October 2021[349]. In this way, virtually for free, Angola has sold its country’s entire oil system in exchange for a couple of truck stops.

By now Trafigura has also stopped following the advice of popular wisdom that you don’t create dirt where you eat. In April 2021, the Rasmala Trade Finance Fund[350] (a financial fund of Dubai’s Rasmala Investment Bank) sued Trafigura’s management for using false documents to recover debts: according to the indictment, Rasmala allegedly paid around $22.6 million to Farlin Energy & Commodities FZE Dubai[351] for coal purchases from Trafigura[352]. However, it appears that that amount was used to meet old debts Farlin Energy had to Trafigura, and that Farlin ceased operations as early as 2018, which could not have happened without the active and knowing intervention of Trafigura.[353]

If you have read this far, you will now have an overview of what Trafigura is and how it acts, and can perhaps make your own judgement. For us, the fact that the multinational has managed to avoid major trouble with the law does not absolve it of the environmental and social responsibilities of its behavior. You will say: there is no point in saying that. That is not true. What is needed is for someone, no matter where, to preserve the memory of all that has happened, and to make it available to the public. Otherwise it will be impossible to predict and prevent the next tragedy.

[1] https://www.theguardian.com/world/2009/sep/16/inside-trafigura-pollution-conservatives

[2] https://www.trafigura.com/financials/2020-the-year-in-review

[3] Daniel Amman, “The King of Oil: The secret lives of Marc Rich”, St. Martin Press, New York 2009

[4] https://www.businessinsider.com/r-trading-legend-dauphin-leaves-void-at-trafigura-2015-10?IR=T

[5] http://www.un.org/Docs/sc/committees/IraqKuwait/1341e.pdf

[6] https://www.bbc.com/news/world-africa-10735255

[7] https://www.trafigura.com/probo-koala/

[8] Dirty Diesel: How Swiss traders flood Africa with toxic fuels. A Public Eye Investigation, September 2016. See: https://issuu.com/erklaerungvbern/docs/2016_dirtydiesel_a-public-eye-inves ; https://www.theguardian.com/world/2016/sep/15/trafigura-vitol-bp-dump-dirty-diesel-africa-swiss-ngo-public-eye

[9] https://www.amnesty.org/en/latest/news/2016/04/trafigura-a-toxic-journey/

[10] https://www.africa-confidential.com/article-preview/id/1883/Toxic_timeline

[11] https://www.amnesty.org/en/latest/news/2016/04/trafigura-a-toxic-journey/ ; https://www.trafigura.com/probo-koala/

[12] https://www.trafigura.com/media/1787/2016_trafigura_and_the_probo_koala.pdf pag 7 ; https://www.amnesty.org/en/latest/news/2016/04/trafigura-a-toxic-journey/

[13] https://www.trafigura.com/probo-koala/ ; https://www.trafigura.com/media/1787/2016_trafigura_and_the_probo_koala.pdf page 8

[14] https://www.amnesty.org/en/latest/news/2016/04/trafigura-a-toxic-journey/

[15] https://opencorporates.com/companies/ca_qc/1145165974

[16] https://www.liberation.fr/terre/2006/09/22/les-eaux-du-probo-koala-remontent-jusqu-a-amsterdam_52132/

[17] https://www.theguardian.com/environment/2009/may/13/trafigura-ivory-coast-documents-toxic-waste

[18] https://www.trafigura.com/probo-koala/ ; https://www.trafigura.com/media/1787/2016_trafigura_and_the_probo_koala.pdf page 6

[19] https://www.theguardian.com/environment/2009/may/13/trafigura-ivory-coast-documents-toxic-waste

[20] https://www.theguardian.com/world/2012/may/24/ivory-coast-minister-quits-trafigura-money

[21] https://www.amnesty.org/en/latest/news/2016/04/trafigura-a-toxic-journey/

[22] https://www.lemonde.fr/planete/article/2010/07/24/premiere-condamnation-de-trafigura-dans-l-affaire-du-probo-koala_1391777_3244.html ; https://www.amnesty.org/en/latest/news/2016/04/trafigura-a-toxic-journey/

[23] https://www.trafigura.com/media/1787/2016_trafigura_and_the_probo_koala.pdf page 9 ; https://www.businesstimes.com.sg/the-raffles-conversation/trading-secrecy-for-transparency

[24] https://www.amnesty.org/en/latest/news/2016/04/trafigura-a-toxic-journey/

[25] https://www.bbc.com/news/world-africa-10735255 ; https://www.trafigura.com/probo-koala/ ; https://www.trafigura.com/media/1787/2016_trafigura_and_the_probo_koala.pdf pag 15

[26] https://www.businesstimes.com.sg/the-raffles-conversation/trading-secrecy-for-transparency ; https://www.trafigura.com/media/1787/2016_trafigura_and_the_probo_koala.pdf pag 13

[27] https://www.bbc.com/news/world-africa-10735255

[28] https://www.trafigura.com/probo-koala/

[29] https://www.amnesty.org/en/latest/news/2016/04/trafigura-a-toxic-journey/

[30] https://www.theguardian.com/world/2012/may/24/ivory-coast-minister-quits-trafigura-money

[31] https://www.bbc.com/news/10366945

[32] https://www.theguardian.com/environment/2009/may/13/trafigura-ivory-coast-documents-toxic-waste

[33] https://www.trafigura.com/media/1787/2016_trafigura_and_the_probo_koala.pdf pag 14

[34] https://www.amnesty.org/en/latest/news/2016/04/trafigura-a-toxic-journey/

[35] https://www.theguardian.com/world/2009/sep/16/trafigura-african-pollution-disaster ; https://www.theguardian.com/world/2009/sep/16/trafigura-email-files-read

[36] https://www.aftenposten.no/norge/i/L0J9R/alexela-sloevaag-maa-tilbakebetale-vest-tank-erstatning

[37] https://datacvr.virk.dk/data/visenhed?enhedstype=virksomhed&id=26844444

[38] “La mia nave è caricata con…”, NRK1, Brennpunkt, 19 giugno 2008, https://fido.nrk.no/7e3289cadd00f45c3e240507861a17b99dc9a415ed1e93c7acb38af7152abc91/METODERAPPORT%20-%20Mitt%20skip%20er%20lastet%20med.pdf , pag 16

[39] https://www.nrk.no/dokumentar/vest-tank-sweetened-coker-gasoline-1.6104693

[40] https://www.nrk.no/dokumentar/coker-gasoline-_-low-quality-1.6105347

[41] In Europa, il livello massimo di zolfo approvato nella benzina è di 50 ppm. In Africa occidentale, 5000 ppm è il limite approvato. See: https://www.nrk.no/dokumentar/vest-tank-sweetened-coker-gasoline-1.6104693

[42] https://www.nrk.no/dokumentar/vest-tank-sweetened-coker-gasoline-1.6104693 ; Dirty Diesel: How Swiss traders flood Africa with toxic fuels. A Public Eye Investigation, September 2016. See: https://issuu.com/erklaerungvbern/docs/2016_dirtydiesel_a-public-eye-inves ;

[43] “La mia nave è caricata con…”, NRK1, Brennpunkt, 19 giugno 2008, https://fido.nrk.no/7e3289cadd00f45c3e240507861a17b99dc9a415ed1e93c7acb38af7152abc91/METODERAPPORT%20-%20Mitt%20skip%20er%20lastet%20med.pdf , pag 3

[44] https://www.nrk.no/dokumentar/vest-tank-sweetened-coker-gasoline-1.6104693

[45] https://www.nrk.no/dokumentar/coker-gasoline-_-low-quality-1.6105347 ; https://www.nrk.no/dokumentar/a-small-pawn-in-the-game-1.6104888

[46] Accident investigation following the Vest Tank explosion at Sløvåg, see: https://technokontrol.com/pdf/report-accident-vest-tank.pdf

[47] https://www.nrk.no/emne/trafigura-og-slovag-eksplosjonen-1.2847739

[48] “La mia nave è caricata con…”, NRK1, Brennpunkt, 19 giugno 2008, https://fido.nrk.no/7e3289cadd00f45c3e240507861a17b99dc9a415ed1e93c7acb38af7152abc91/METODERAPPORT%20-%20Mitt%20skip%20er%20lastet%20med.pdf , pag 13

[49] https://www.independent.co.uk/news/world/europe/trafigura-refuses-to-aid-fire-inquiry-1793502.html

[50] https://www.amnesty.org/en/latest/news/2016/04/trafigura-a-toxic-journey/

[51] https://www.nrk.no/dokumentar/a-small-pawn-in-the-game-1.6104888

[52] https://www.bbc.com/news/world-africa-10735255

[53] https://www.nrk.no/dokumentar/vest-tank-sweetened-coker-gasoline-1.6104693

[54] Alexela Logistics ha acqustato il 100% di Silamae Oil Terminals. Estonia dai russi Yevgeniy Malov e Andrei Katkov con aiuto di Trafigura Group che ha impegnato 60 milioni di euro per aiutare ad acquistare il terminale, see: https://www.reuters.com/article/estonia-oil-idUKL17806920070718

[55] https://www.tankstoragemag.com/2009/07/13/vest-tank-to-pay-alexela-logistics%C2%92-terminal-costs/

[56] https://www.tankstoragemag.com/2009/07/13/vest-tank-to-pay-alexela-logistics%C2%92-terminal-costs/

[57] https://pt.m.wikipedia.org/wiki/Ficheiro:Manifesta%C3%A7%C3%A3o_em_favor_da_opera%C3%A7%C3%A3o_Lava_Jato,_dezembro_de_2016.jpg

[58] http://www.mpf.mp.br/grandes-casos/lava-jato

[59] https://www.theguardian.com/world/2017/jun/01/brazil-operation-car-wash-is-this-the-biggest-corruption-scandal-in-history

[60] https://www.publiceye.ch/fr/thematiques/negoce-de-matieres-premieres/affaire-petrobras

[61] http://www.mpf.mp.br/grandes-casos/lava-jato/entenda-o-caso

[62] https://www.publiceye.ch/fr/thematiques/negoce-de-matieres-premieres/affaire-petrobras

[63] https://www.swissinfo.ch/eng/sprawling-brazilian-probe_swiss-prosecutors-search-vitol-and-trafigura-offices-as-part-of-car-wash-probe/45385906

[64] Petrobras è sempre stato connesso al Leader del Partito dei Lavoratori Luiz Inácio Lula da Silva, durante la Sua presidenza nel 2003-2010 sono stati offerti incarichi esecutivi in Petrobras agli alleati politici di “Lula”, per aiutare a costruire il sostegno al Congresso. Inoltre gli investigatori hanno dimostrato che Luiz Inácio Lula da Silva ha ricevuto tangenti sotto la forma di un appartamento sulla spiaggia segretamente ristrutturato da una delle società di ingegneria OAS indagate inizialmente, in cambio del suo aiuto nell’ottenere contratti con Petrobras. Lul da Silva ha negato tutto. See: https://www.theguardian.com/world/2017/jun/01/brazil-operation-car-wash-is-this-the-biggest-corruption-scandal-in-history ; https://www.reuters.com/article/us-brazil-corruption-idUSKCN11K2C6 ; https://www.bbc.com/news/world-latin-america-35810578

[65] https://www.ansa.it/sito/notizie/topnews/2018/03/27/brasileconfermata-condanna-12-anni-lula_06b47cc7-d5f0-48e0-b734-5299b985994d.html ; https://www.ansa.it/sito/notizie/topnews/2018/04/08/lula-arrivato-a-curitiba-notte-in-cella_f0a40115-5656-464d-a177-d3d340525f5c.html

[66] https://www.ispionline.it/it/pubblicazione/brasile-il-ritorno-di-lula-29564

[67] https://www.globalwitness.org/en/campaigns/corruption-and-money-laundering/senior-executives-top-world-oil-companies-implicated-brazil-bribery-scandal/

[68] https://www.trafigura.com/about-us/leadership/jose-maria-larocca/

[69] https://www.trafigura.com/about-us/leadership/mike-wainwright/

[70] Miliardario Francese e uno dei storici fondatori di Trafigura Beheer BV, è morto dal cancro ai polmoni nel Settembre 2015, see: https://www.trafigura.com/claude-dauphin-obituary ;

[71] https://www.bloomberg.com/news/articles/2020-12-01/oil-trader-trafigura-denies-brazil-prosecutor-bribery-claims

[72] https://www.reuters.com/article/us-brazil-corruption-traders-exclusive-idUSKCN1VQ2AV

[73] https://www.globalwitness.org/en/campaigns/corruption-and-money-laundering/senior-executives-top-world-oil-companies-implicated-brazil-bribery-scandal/

[74] https://www.reuters.com/article/us-brazil-corruption-ferraz/brazil-judge-sentences-decal-do-brasil-executive-to-over-10-years-idUSKBN1GH32U

[75] https://www.bloomberg.com/news/articles/2020-12-01/oil-trader-trafigura-denies-brazil-prosecutor-bribery-claims

[76] http://www.mpf.mp.br/pr/sala-de-imprensa/noticias-pr/lava-jato-mandado-de-prisao-e-cumprido-no-aeroporto-de-guarulhos

[77] https://www.swissinfo.ch/eng/sprawling-brazilian-probe_swiss-prosecutors-search-vitol-and-trafigura-offices-as-part-of-car-wash-probe/45385906

[78] https://mpf.jusbrasil.com.br/noticias/659136401/executivos-da-trafigura-sao-alvo-da-primeira-denuncia-da-lava-jato-sobre-esquema-criminoso-de-trading-na-petrobras

[79] http://www.mpf.mp.br/pr/sala-de-imprensa/noticias-pr/68a-fase-da-operacao-lava-jato-realiza-busca-e-apreensao-na-suica/view ; https://www.theguardian.com/world/2018/dec/14/brazil-charges-former-trafigura-executives-with-corruption

[80] https://www.bloomberg.com/news/articles/2020-12-01/oil-trader-trafigura-denies-brazil-prosecutor-bribery-claims

[81] https://www.reuters.com/article/us-brazil-corruption-trafigura-idUSKBN28A376

[82] https://www.gettyimages.ch/fotos/roald-goethe

[83] http://www.worldwenergy.com/

[84] https://www.africa-confidential.com/article-preview/id/13308/Trafigura%27s_middleman_emerges ; https://www.theafricareport.com/60781/republic-of-congo-is-brazzaville-finally-close-to-reaching-an-agreement-with-trafigura/ ; https://www.liberation.fr/futurs/2008/11/10/droit-de-reponse-malgre-l-intoxication-d-abidjan_563136/

[85] http://www.worldwenergy.com/

[86] https://www.snaplap.net/driver/frederic-fatien/ ; https://www.driverdb.com/drivers/frederic-fatien/ ;

[87] https://www.theafricareport.com/60781/republic-of-congo-is-brazzaville-finally-close-to-reaching-an-agreement-with-trafigura/

[88] https://africa24.it/2021/06/11/il-congo-un-pioniere-del-debito-oscuro-globale/ ; https://foreignpolicy.com/2021/05/21/the-republic-of-congo-is-a-dark-debt-pioneer/

[89] https://africa24.it/2021/06/11/il-congo-un-pioniere-del-debito-oscuro-globale/ ; https://foreignpolicy.com/2021/05/21/the-republic-of-congo-is-a-dark-debt-pioneer/

[90] https://www.theafricareport.com/60781/republic-of-congo-is-brazzaville-finally-close-to-reaching-an-agreement-with-trafigura/

[91] https://africa24.it/2021/06/11/il-congo-un-pioniere-del-debito-oscuro-globale/

[92] http://cotedivoire.ae/aboutuae-profile.html

[93] Che ha insieme alla sua moglie Martine un hotel storico particolare and a Wine House a Beaune, Francia. See: http://www.hotel-fatien-beaune.com/en/familly-fatien ; https://www.maison-fatien.com/

[94] https://collectorscarworld.com/interview-roald-goethe-the-rofgo-collection/ ; https://www.motorsport.com/driver/roald-goethe/12896/ ; http://www.helenaracing.eu/driversG/GoetheRoaldCP/

[95] Tra il 2001 ed il 2006 lavorava per il gruppo Addax Oil: https://opencorporates.com/companies/gb/04182573

[96] Ha anche un’altra società in Francia, insieme a Laurence Piacentini, la Charhad SA Saisy, fondata nel 2006 e ancora attiva: https://www.societe.com/societe/charhad-493037675.html

[97] https://ec.europa.eu/energy/sites/ener/files/documents/baylarbayov_socar_-_trading_lng_presentation_-_eastern_partnership_forum.pdf

[98] https://www.socartrading.com/about-us/offices

[99] SOCAR – State Oil Company of the Azerbaijan Republic; https://socar.az/socar/en/home

[100] https://ch.linkedin.com/in/jean-fran%C3%A7ois-piacentini-834532116 ; https://www.socartrading.com/ ; https://socar.az/socar/en/news-and-media/news-archives/news-archives/id/10346 ; https://www.africaintelligence.com/oil–gas/2011/06/22/socar-sets-up-shop-in-lagos,90857967-art

[101] https://www.companydirectorcheck.com/frederic-michel-jeaques-fatien

[102] https://offshoreleaks.icij.org/nodes/81039933

[103] http://www.etat.lu/memorial/2004/C/Pdf/c122901C.pdf pag. 58966

[104] Africa Yearbook Volume 5: Politics, Economy and Society South of the Sahara, pag. 85, see: https://books.google.it/books?id=xOVYchAfCYYC&pg=PA85&lpg=PA85&dq=Yam%27s+Petroleum,+Fakhoury&source=bl&ots=Nssywlt-IJ&sig=ACfU3U2IRx1fRwet8V3XO85lOpdAEjHHRQ&hl=it&sa=X&ved=2ahUKEwi1hPzEtMzxAhWJHewKHdPkAuwQ6AEwEnoECBsQAw#v=onepage&q=Yam’s%20Petroleum%2C%20Fakhoury&f=false ; https://www.treccani.it/enciclopedia/felix-houphouet-boigny/

[105] https://www.theguardian.com/cities/2015/may/15/yamoussoukro-notre-dame-de-la-paix-ivory-coast-worlds-largest-basilica-history-of-cities-in-50-buildings-day-37

[106] https://web.archive.org/web/20200813164132/https://www.corian.com/hotel-ivoire-architectural-design ; https://www.corian.com/hotel-ivoire-architectural-design

[107] https://it.wikipedia.org/wiki/Laurent_Gbagbo

[108] Africa Yearbook Volume 5: Politics, Economy and Society South of the Sahara, pag. 85, see: https://books.google.it/books?id=xOVYchAfCYYC&pg=PA85&lpg=PA85&dq=Yam%27s+Petroleum,+Fakhoury&source=bl&ots=Nssywlt-IJ&sig=ACfU3U2IRx1fRwet8V3XO85lOpdAEjHHRQ&hl=it&sa=X&ved=2ahUKEwi1hPzEtMzxAhWJHewKHdPkAuwQ6AEwEnoECBsQAw#v=onepage&q=Yam’s%20Petroleum%2C%20Fakhoury&f=false

[109] https://lynxtogo.info/cote-d-ivoire-bombardement-de-la-residence-de-gbagbo-pierre-fakhoury-savait-accuse-ben-soumahoro/

[110] https://www.pfoafrica.com/nos-realisations/

[111] https://business.abidjan.net/AL/a/64891.asp ; Africa Yearbook Volume 5: Politics, Economy and Society South of the Sahara, pag. 85, see: https://books.google.it/books?id=xOVYchAfCYYC&pg=PA85&lpg=PA85&dq=Yam%27s+Petroleum,+Fakhoury&source=bl&ots=Nssywlt-IJ&sig=ACfU3U2IRx1fRwet8V3XO85lOpdAEjHHRQ&hl=it&sa=X&ved=2ahUKEwi1hPzEtMzxAhWJHewKHdPkAuwQ6AEwEnoECBsQAw#v=onepage&q=Yam’s%20Petroleum%2C%20Fakhoury&f=false

[112] https://www.liberation.fr/futurs/2008/10/16/le-fmi-epingle-gbagbo-sur-son-budget_139509/

[113] https://www.pfoafrica.com/notre-vision/

[114] https://www.liberation.fr/futurs/2008/10/16/le-fmi-epingle-gbagbo-sur-son-budget_139509/

[115] https://www.agenceecofin.com/hydrocarbures/1512-2545-cote-d-ivoire-total-englue-dans-les-affaires-de-pierre-fakhoury

[116] https://www.theafricareport.com/5487/oil-gas-growth-sector-seeks-investors-in-cote-divoire/

[117] https://www.afrique-sur7.ci/371107-cote-divoire-petroci-au-bord-de-la-faillite-des-licenciements-abusifs-secouent-la-boite

[118] https://www.jeuneafrique.com/32513/economie/total-et-fakhoury-dans-l-offshore-profond/

[119] https://survie.org/billets-d-afrique/2008/174-novembre-2008/article/trafigura-en-offshore

[120] https://www.jeuneafriquebusinessplus.com/en/804813/cote-divoire-yams-mining-pfo-africa-decroche-ses-premiers-permis-dans-lor/ ; http://www.agenceafrique.com/24168-la-cote-divoire-delivre-trois-nouveaux-permis-de-recherche-miniere.html

[121] https://www.africaintelligence.com/mining-sector_exploration-production/2021/04/30/ivorian-fakhoury-family-keen-to-tap-into-guinean-gold,109662112-bre

[122] https://offshoreleaks.icij.org/nodes/10132443 ; http://www.quarhess-trading.com/delaney.html ; https://panama.data2www.com/e/10132443

[123] Duncan Hamilton Rofgo Ltd Winchester (https://opencorporates.com/companies/gb/10673783), PE Investments Ltd Malta (tra i cui azionistici sono i managers di Trafigura Claude Dauphin, Jean Pierre Valentini, Jeremy Charles Weir e Jose Maria Larocca (https://offshoreleaks.icij.org/nodes/55048654), Global PE Investors Ltd Gzira (Malta), che è un’azionista di minoranza di Puma Energy Holdings Pte Ltd. e di Puma Energy Holdings Malta Ltd Gzira (https://offshoreleaks.icij.org/nodes/56082577), Napoil (Bermuda) Ltd Hamilton – una joint-venture tra Trafigura Group (49%) e NNPC Nigerian National Petroleum Corporation (51%) (https://offshoreleaks.icij.org/nodes/82001347 ; https://www.publiceye.ch/fileadmin/doc/Rohstoffe/2013_PublicEye_Swiss_Traders_opaque_deals_in_Nigeria_Report.pdf , page 7), Comoditex International Fze. Dubai (https://www.bizmideast.com/AE/comoditex-international-04-881-4658), diverse società immobiliari in Francia (SCI Beniver Nizza, SCI Bentley Nizza, Dino SCI Nizza e Olimin Sarl Nizza (https://www.verif.com/societe/SCI-BENIVER-487685059/ ; https://www.verif.com/societe/SCI-BENTLEY-513621904/ ; https://www.verif.com/societe/DINO-502225253/ ; https://www.verif.com/societe/OLIMIN-494281421/)

[124] https://www.lemonde.fr/societe/article/2021/02/03/affaire-du-petit-bar-jean-pierre-valentini-mis-en-examen-pour-blanchiment_6068669_3224.html

[125] https://www.africaintelligence.com/oil–gas_courts-and-cash/2021/03/17/the-eventful-new-life-of-trafigura-s-ex-africa-director-jean-pierre-valentini,109650936-art ; 2021.03.17 Africa Intelligence on Trafigura

[126] https://www.lemonde.fr/societe/article/2021/02/03/affaire-du-petit-bar-jean-pierre-valentini-mis-en-examen-pour-blanchiment_6068669_3224.html

[127] https://dirigeants.bfmtv.com/Antony-PERRINO-4192107/

[128] https://www.corsematin.com/

[129] https://www.tellerreport.com/news/2021-02-04-%0A—a-businessman-indicted-in-the-investigation-of-the-%22petit-bar%22%0A–.Hyg4f9rYlO.html ; https://www.lefigaro.fr/flash-actu/enquete-sur-la-bande-du-petit-bar-un-homme-d-affaires-mis-en-examen-20210203

[130] https://www.corsicaoggi.com/sito/lamministratore-delegato-di-corse-matin-in-custodia-cautelare-per-uso-improprio-dei-beni-aziendali-e-riciclaggio-di-denaro-e-frode-fiscale/?doing_wp_cron=1625732651.4944190979003906250000

[131] http://www.lambertcommodities.com/uploads/7/4/7/9/74798285/oil_trader_trafigura_rebuilds_reputation_while_making_billions_-_bloomberg.pdf

[132] https://www.aljazeera.com/news/2006/9/19/two-charged-over-ivory-coast-waste ; https://www.thenewhumanitarian.org/fr/node/227958

[133] https://www.africaintelligence.com/oil–gas_courts-and-cash/2021/03/17/the-eventful-new-life-of-trafigura-s-ex-africa-director-jean-pierre-valentini,109650936-art ; 2021.03.17 Africa Intelligence on Trafigura

[134] https://www.africaintelligence.com/oil–gas_courts-and-cash/2021/03/17/the-eventful-new-life-of-trafigura-s-ex-africa-director-jean-pierre-valentini,109650936-art ; 2021.03.17 Africa Intelligence on Trafigura ; https://www.lemonde.fr/societe/article/2021/02/03/affaire-du-petit-bar-jean-pierre-valentini-mis-en-examen-pour-blanchiment_6068669_3224.html

[135] AMR è stata fondata nel 2015 da due francesi, Romain Girbal e Thibault Launay. Diversi importanti uomini e donne d’affari siedono nel suo consiglio, tra cui l’ex CEO di Areva, Anne Lauvergeon e Alain Mallart, fondatore e capo di Energipole Group, azienda di logistica e gestione dei rifiuti industriali. L’unico progetto di AMR è un lucroso contratto con la società mineraria Société Minière de Boké (SMB) in cui Lo Stato di Guinea ha una quota del 10%. AMR possiede una miniera di bauxite nella regione di Boké, gestita da SMB. L’azienda cede ad AMR una quota degli utili derivanti dall’estrazione della bauxite. Entrando nel board di AMR Valentini è diventato anche membro del consiglio di amministrazione della holding belga che ha azioni di AMR, Enermines. See more: https://dirigeants-entreprise.com/entreprises/alliance-miniere-responsable-amr/ ; https://www.africaintelligence.com/oil–gas_courts-and-cash/2021/03/17/the-eventful-new-life-of-trafigura-s-ex-africa-director-jean-pierre-valentini,109650936-art ; 2021.03.17 Africa Intelligence on Trafigura ; https://amrbauxite.com/ ; https://www.responsiblemines.org/fr/qui-sommes-nous/a-propos-arm/ ; https://www.africaintelligence.com/oil–gas_courts-and-cash/2021/03/17/the-eventful-new-life-of-trafigura-s-ex-africa-director-jean-pierre-valentini,109650936-art

[136] https://www.jeuneafrique.com/1137500/economie/mines-petrole-les-etats-africains-aux-mains-des-traders/

[137] https://www.jeuneafrique.com/1137500/economie/mines-petrole-les-etats-africains-aux-mains-des-traders/

[138] https://www.namibiansun.com/news/puma-accused-of-price-gouging

[139] “Prepayments Demystified”, An addendum to the Commodities Demystifies guide, Trafigura. See more: https://www.trafigura.com/brochure/prepayments-demystified

[140] https://www.africaintelligence.com/oil–gas/2016/12/13/worldwide-energy-dictated-its-conditions-to-petroci,108193435-art

[142] “Governance, Natural Resources and Post-Conflict Peacebuilding” a cura di Carl Bruch, Carroll Muffett, Sandra S. Nichols, see: https://books.google.it/books?id=6f4nDwAAQBAJ&pg=PT239&lpg=PT239&dq=trafigura+et+societe+nationale+des+operations+petrolieres&source=bl&ots=TfAzzgCDXG&sig=ACfU3U0cSLyyaC1Tv8o6u8_7r-iZsCzYMw&hl=it&sa=X&ved=2ahUKEwjcldGr4aXxAhUnhP0HHbxaAQoQ6AEwBXoECAwQAw#v=onepage&q&f=false

[143] https://www.equaltimes.org/in-cote-d-ivoire-it-s-toxic?lang=en#.YOhGP-gzbIV

[144] https://www.theafricareport.com/549/cote-divoire-puma-energy-fills-up-on-petroci-deal/

[145] Diaby ha lavorato alla Petroci dal 1984 al 1989 prima di essere nominato consigliere dell’allora ministro del petrolio e dell’energia Adama Toungara. L’ex direttore degli idrocarburi al ministero del petrolio e del gas ha anche fatto parte della squadra del governo ivoriano che ha contestato senza successo il confine con il Ghana, see more: https://energycouncil.com/event-speakers/ibrahima-diaby/

[146] https://www.theafricareport.com/549/cote-divoire-puma-energy-fills-up-on-petroci-deal/

[147] https://www.theafricareport.com/549/cote-divoire-puma-energy-fills-up-on-petroci-deal/

[148] https://www.jeuneafrique.com/mag/591123/economie/cote-divoire-petroci-sort-de-la-zone-rouge/

[149] https://www.theafricareport.com/549/cote-divoire-puma-energy-fills-up-on-petroci-deal/

[150] https://www.linkedin.com/in/denis-marie-auguste-gokana-7849a960/?originalSubdomain=cg

[151] https://minbane.wordpress.com/tag/denis-gokana/

[152] https://minbane.wordpress.com/tag/denis-gokana/ ; https://www.africaintelligence.com/oil–gas_state-strategy/2020/11/26/trafigura-and-snpc-s-cosy-arrangement-on-fuel-sales,109623663-eve ; https://www.africaintelligence.com/oil–gas/2018/09/18/denis-christel-sassou-nguesso-tries-desperately-to-cling-onto-slipping-hold-of-trading-sector,108324104-bre

[153] https://www.globalwitness.org/en/archive/7563/

[154] https://www.reuters.com/article/congo-mining-trafigura-idUKL8N2GZ63U

[155] https://www.spglobal.com/platts/en/market-insights/latest-news/metals/033121-state-company-to-buy-all-drc-artisanally-mined-cobalt-partners-with-trafigura

[156] https://www.ft.com/content/c7f82d16-7986-4fb9-b40a-eb319881016b

[157] https://www.lastampa.it/topnews/primo-piano/2020/06/17/news/tesla-fa-shopping-di-cobalto-in-congo-seimila-tonnellate-all-anno-per-le-due-nuove-gigafactory-1.38977239 ; https://www.ispionline.it/it/pubblicazione/repubblica-democratica-del-congo-le-risorse-che-fanno-gola-al-mondo-29424

[158] https://www.theguardian.com/world/2012/feb/08/trafigura-in-south-sudan-oil-row

[159] https://www.bnpparibas.it/it/2014/07/01/bnp-paribas-annuncia-un-accordo-esaustivo-riguardante-laccertamento-di-alcune-transazioni-usd-ad-opera-delle-autorita-statunitensi-2/

[160] https://www.ilpost.it/2014/06/07/multa-bnp-paribas/

[161] https://www.swissinfo.ch/eng/bnp-paribas-said-to-curb-commodity-trade-finance-to-trafigura/40595374

[162] https://www.swissinfo.ch/eng/bnp-paribas-said-to-curb-commodity-trade-finance-to-trafigura/40595374

[163] https://www.reuters.com/article/us-bnp-paribas-fines-trading-idUSKBN0ER1GA20140616

[164] https://www.reuters.com/article/us-southsudan-security-oil-idUSKBN0G145520140801

[165] https://www.reuters.com/article/us-southsudan-security-oil-idUSKBN0G145520140801

[166] https://www.trafigura.com/press-releases/south-sudan-fuel-supply-agreement-signed-with-trafigura

[167] https://www.facing-finance.org/en/database/cases/trafigura-support-for-sudanese-regime/

[168] https://www.consilium.europa.eu/it/press/press-releases/2016/01/16/iran-council-lifts-all-nuclear-related-eu-sanctions/

[169] https://www.reuters.com/article/us-trafigura-iran-idUSKCN0ZM1QN

[170] https://www.facing-finance.org/en/database/cases/trafigura-support-of-iranian-regime/

[171] https://www.trafigura.com/about-us/leadership/christophe-salmon/

[172] https://www.theguardian.com/world/2012/feb/08/trafigura-in-south-sudan-oil-row

[173] https://www.theguardian.com/world/2012/feb/08/trafigura-in-south-sudan-oil-row

[174] Final report of the Panel of Experts on South Sudan submitted pursuant to resolution, 2018, see: https://undocs.org/pdf?symbol=en/S/2019/301 , pag 16

[175] https://www.hrw.org/news/2021/04/14/south-sudan-government-reshuffle-emboldens-rights-abusers

[176] https://www.globalwitness.org/en/campaigns/south-sudan/capture-on-the-nile/#chapter-1/section-0

[177] https://www.globalwitness.org/en/campaigns/south-sudan/capture-on-the-nile/#chapter-1/section-0

[178] https://africatimes.com/tag/nilepet/

[179] https://www.globalwitness.org/en/campaigns/south-sudan/capture-on-the-nile/#chapter-1/section-0

[180] https://www.globalwitness.org/en/campaigns/south-sudan/capture-on-the-nile/#chapter-1/section-0 ; Republic of South Sudan, Ministry of Finance and Economic Planning, Q4 Fiscal Report, 2016/17, December 2017, p.8

[181] https://www.globalwitness.org/en/campaigns/south-sudan/capture-on-the-nile/#chapter-1/section-0

[182] https://www.globalwitness.org/en/campaigns/south-sudan/capture-on-the-nile/#chapter-1/section-0

[183] The Indian Ocean Newsletter, Issue 1438, November 2016: https://www.africaintelligence.com/ion/business-circles/2016/11/11/trafigura-manipulates-to-win-oil-marketing-contract,108189364-art

[184] https://www.globalwitness.org/en/campaigns/south-sudan/capture-on-the-nile/#chapter-1/section-0 ; https://www.publiceye.ch/fr/thematiques/negoce-de-matieres-premieres/les-avances-explosives-de-trafigura-au-soudan-du-sud

[185] https://www.publiceye.ch/fr/thematiques/negoce-de-matieres-premieres/les-avances-explosives-de-trafigura-au-soudan-du-sud

[186] https://www.publiceye.ch/fr/thematiques/negoce-de-matieres-premieres/les-avances-explosives-de-trafigura-au-soudan-du-sud

[187] https://search.usa.gov/search?utf8=%E2%9C%93&affiliate=treas&query=Israel+Ziv&commit=Search ; https://home.treasury.gov/news/press-releases/sm574

[188] [188] https://home.treasury.gov/news/press-releases/sm574 ; https://www.energyvoice.com/oilandgas/africa/212383/trafigura-scrutinised-over-south-sudan-arms-for-cash-link/

[189] https://www.publiceye.ch/fr/thematiques/negoce-de-matieres-premieres/les-avances-explosives-de-trafigura-au-soudan-du-sud

[190] https://yle.fi/uutiset/osasto/news/terrafame_admits_more_widespread_groundwater_contamination_fights_stricter_environmental_rules/9602479

[191] https://yle.fi/uutiset/osasto/news/media_talvivaara_minority_owner_suspected_of_corruption/11381328 ; https://yle.fi/uutiset/osasto/news/commodities_firm_takes_15_percent_stake_in_troubled_mine/9453306

[192] https://it.wikinew.wiki/wiki/Ahtium

[193] https://www.terrafame.com/news-from-the-mine/news/2017/02/terrafame-secured-private-financing.html ; https://yle.fi/uutiset/osasto/news/commodities_firm_takes_15_percent_stake_in_troubled_mine/9453306

[194] https://yle.fi/uutiset/osasto/news/criticism_for_terrafame_investor_russian_ties_suspected_tax_evasion_and_toxic_waste_scandals/9455577

[195] https://yle.fi/uutiset/osasto/news/ministers_silent_on_terrafame_owners_suspected_money_launderinglinks/11555220

[196] https://www.trafigura.com/press-releases/trafigura-group-to-provide-new-financing-for-terrafame-to-support-future ; https://www.trafigura.com/press-releases/new-financing-package-from-the-owners-for-terrafame-s-development

[197] https://www.terrafame.com/news-from-the-mine/news/2017/02/terrafame-secured-private-financing.html

[198] https://www.metalbulletin.com/Article/3955460/Trafigura-building-stake-in-Europes-battery-nickel-future.html

[199] https://www.amm.com/Article/3955536/Trafigura-builds-stake-in-battery-Ni-future.html

[200] https://www.hs.fi/kotimaa/art-2000002510390.html ; https://yle.fi/uutiset/3-7256191 ; https://www.nature.com/articles/s41598-017-11421-8 ; https://www.sciencedirect.com/science/article/pii/S0269749118330860 ; https://www.sciencedirect.com/science/article/abs/pii/S0269749119321529

[201] https://yle.fi/uutiset/3-7314614

[202] https://www.hs.fi/kotimaa/art-2000002578543.html

[203] https://www.terrafame.com/news-from-the-mine/news/2017/02/terrafame-secured-private-financing.html

[204] https://www.paivanlehti.fi/terrafamen-merkittava-omistaja-rahanpesusotkussa-ministerit-eivat-muista-tai-kommentoi/

[205] https://yle.fi/uutiset/3-11554432

[206] https://yle.fi/uutiset/3-11554432

[207] https://www.icij.org/tags/mossack-fonseca/ ; https://panamapapers.sueddeutsche.de/articles/56febf8da1bb8d3c3495adec/

[208] https://www.ilsole24ore.com/art/chiude-mossack-fonseca-studio-legale-centro-panama-papers-AEGSLHHE?refresh_ce=1

[209] https://www.helsinkitimes.fi/finland/finland-news/domestic/18100-yle-finnish-government-s-mining-partner-linked-to-suspicious-financial-transactions.html ; https://yle.fi/uutiset/3-11554432 ; https://finnwatch.org/fi/blogi/769-trafigura-kohu-on-uusi-merkki-kaivosveron-tarpeellisuudesta

[210] https://nord.news/2020/09/21/minister-finland-is-investigating-trafigura-for-money-laundering-lawsuits/

[211] https://www.ejinsight.com/eji/article/id/377130/20140523-sichuan-tycoon-liu-han-death-sentence

[212] https://yle.fi/uutiset/3-11554432

[213] https://cenozo.org/phantom-tanzanian-company-flagged-moving-620-million/

[214] https://yle.fi/uutiset/3-11554432

[215] https://cenozo.org/phantom-tanzanian-company-flagged-moving-620-million/

[216] https://cenozo.org/phantom-tanzanian-company-flagged-moving-620-million/

[217] https://www.bbc.com/news/world-asia-china-31284702 ; https://www.smh.com.au/world/chinese-billionaire-mining-tycoon-liu-han-is-executed-over-his-links-to-a-mafiastyle-gang-20150209-139w2z.html

[218] https://yle.fi/uutiset/3-11554432