Until a few years ago, criminals hid their illegal business and the resulting income in tax havens close to their homes, where clients, lawyers and bankers spoke the same language: Zurich, Amsterdam, Vaduz, Monte Carlo, Luxembourg, Gibraltar, Lugano, Panama[1]. Then the Egmont Group[2] was born, and with it a whole host of international anti-corruption organizations, like the Financial Action Task Force[3]. Governments were now unintentionally forced to fight offshore jurisdictions; those places where business become a complete European secret, silently protected from the demands of justice and international authorities[4].

Each tax haven created a second tier of tax havens to protect the worst part of its business: Cyprus, Malta, Macau, Montevideo, Andorra, Cayman Islands, Virgin Islands, Liberia, and so on[5], until these areas were also attacked by justice and administrators declared these “obscure” havens had to be further curbed. By this time, Abu Dhabi and Dubai, the largest of the seven United Arab Emirates, were becoming the tip of the iceberg of international[6] evils – places where political, financial, industrial, commercial and military power is concentrated in the hands of families which don’t care about international blacklists, embargoes, sanctions and threats, because they keeps everyone in check with oil and military alliances on the world’s most sensitive chessboard: the Persian Gulf.

Hussain Jasim Al-Nowais, one of the richest and most powerful men in the United Arab Emirates for over thirty years, was the forerunner and the “primus inter pares” of a new elite of global corruption that was no longer secretly managed by obscure lawyers, but by politicians acting in the full light of day[7]. Hussain Al-Nowais is good friends with Sheikh Khalifa bin Zayed Al Nahyan, his brother Mohammed, who is currently in power due to Khalifa’s serious illness, and the Sheikh of Abu Dhabi, Mohammed bin Rasheed Al Maktoum[8]. Al-Nowais was at the center of power in the Emirates and one of the most influential men in the world.

He is the founder, president and principal shareholder of Al-Nowais Investments LLC and AMEA Power, the largest industrial company for the development of thermal and renewable energies in Africa, the Middle East and Asia. He is a director of the international tourism chain Rotana Hotel Management Corporation and, for a long time, vice president of ADCB Abu Dhabi Commercial Bank. Al-Nowais was previously President of Waha Capital (2006 to 2018), which he still owns[9]. He is a man famous for his political influence, his heritage, his role in the politics and economy of the Emirates, his philanthropic initiatives[10], but also for the scams, scandals and deceptions of which he is the protagonist from Italy to Russia, from the Far East to the United States, from Australia to the Persian Gulf[11].

In the years when his career peaked, the United Arab Emirates became the curtain behind which “the Afghan warlords, the Russian mafia, the Nigerian kleptocrats, the European money launderers, the Iranian sanctions and the gold traffickers from East Africa[12]” could do business. “Dubai’s real estate market is a depraved money magnet designed to attract foreign buyers. The emirate is dominated by towers of luxury apartments and man-made islands with luxury villas”, with few controls or transparency in the property market.[13] Dubai is the place where “artisanal gold is hidden and recycled, especially from the conflict regions of East and Central Africa[14]” and the place where kafala[15], a modern version of the slave trade, is practiced[16].

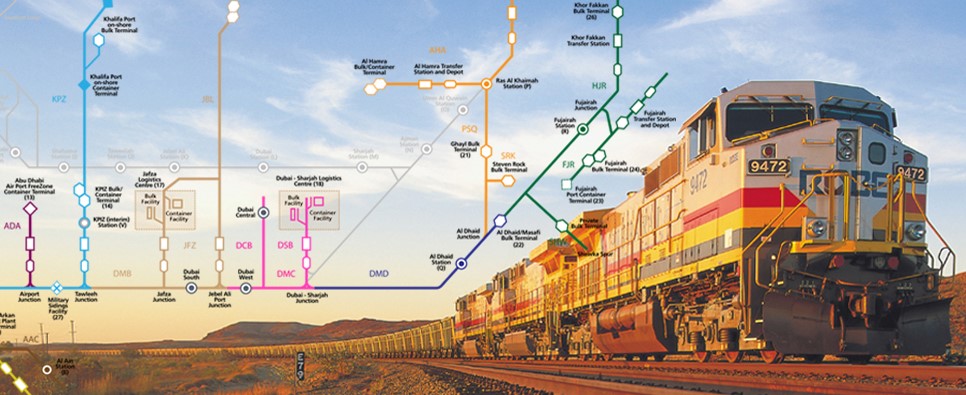

Alstom and Union Railway, allies of modern world railways

The eastern part of the pharaonic Etihad Rail project – 1200 km of railroad through the countries of the Persian Gulf: the largest joint project between Alstom and Hussain Al-Nowais[17]

The Alstom group[18] is one of the main pillars of the French industrial system. It has nearly two hundred years of history; it was founded in 1836 by engineer André Koechlin in Mulhouse[19] and is the company that electrified French railways and built modern electric locomotives after 1928[20]. The company has a long history of industrial success, but also of scandals[21], starting with the fact that it was fined in 2006 for failing to remove asbestos in some of its infrastructures as promised in 1986, which according to the Lille court has left at least 10 dead and nearly 100 seriously ill[22]. Lille was only the first conviction; that judgement was followed by similar sanctions in other industrial sites that Alstom had not detoxified[23].

Other scandals relate to the establishment of anti-competitive cartels, for which Alstom was fined 750 million euros by the European Union[24]. The corruption cases often involves sensitive projects like construction. One such was the installation and management by the State of Israel of the tram line which was to cross the Palestinian Territories but was found by the court in Nanterre to be an act of hostility comparable to a military invasion[25]. The court ordered Alstom’s management to abandon the contract[26] and imposed a fine on the company, which was then overturned on appeal[27].

Corruption cases against Alstom are linked to calls for tenders for contracts worth several billion in various countries around the world. Such are the findings of criminal investigations by the courts of Tunisia, Malaysia, Latvia[28], Zambia, Indonesia, Egypt, Saudi Arabia, Bahamas, Taiwan[29] and Brazil[30]. Alstom was first convicted in 2015[31], when a US federal court imposed a fine of $770 million. To this first judgment another fine of £16.4 million (around 17.5 million euros) was added in 2019, imposed by a UK court for bribing Tunisian officials[32]. In 2011, Switzerland added the Alstom group to the blacklist of companies that use corruption as a “system of commercial practice” and fined the company 38.9 million francs (around 31.5 million euros)[33].

Hussain Al-Nowais took part in these operations not out of friendship, but because he was chairman of the board of the URC Union Railway Company, the state-owned railway company of the United Arab Emirates, which has been in crisis for years because orders are insufficient to maintain profitability[34].

Hussain Al-Nowais has paid bribes himself and, in cooperation with Alstom, has repeatedly won contracts worth billions of dollars for them[35], like the 3 billion euro contract for the modernization of Moroccan railways[36] which includes among the institutional partners the ADFD Abu Dhabi Fund for Development, the investment fund of the government of the Emirates which invests in more than 50 developing countries[37]. The ADFD has invested $ 1 billion in the project[38].

In the case of the gigantic Etihad Rail project, a 1200 km long railway line that will connect all the countries of the Persian Gulf to the borders with Oman, Al-Nowais brought in his friends from Alstom for an initial billion dollar contract, the full cost of which has not yet been finalized but which will surely exceed the 60 billion dollar mark[39]. Etihad Rail company is state-owned and controlled by the United Arab Emirates[40].

The Etihad Rail project should have been completed in 2021 but been considerably delayed. It has already cost 60 billion dirhams (16.3 billion dollars) and is not expected to pay off before 2040[41]. The first phase of the project ended in 2014 with the construction of Shah, Shaban and Al Rowais stations[42]. Liquidity was increased through participation in the ADNOC Abu Dhabi National Oil Company[43] investment in exchange for Al-Nowais’ active role in acquiring ADNOC contracts overseas[44].

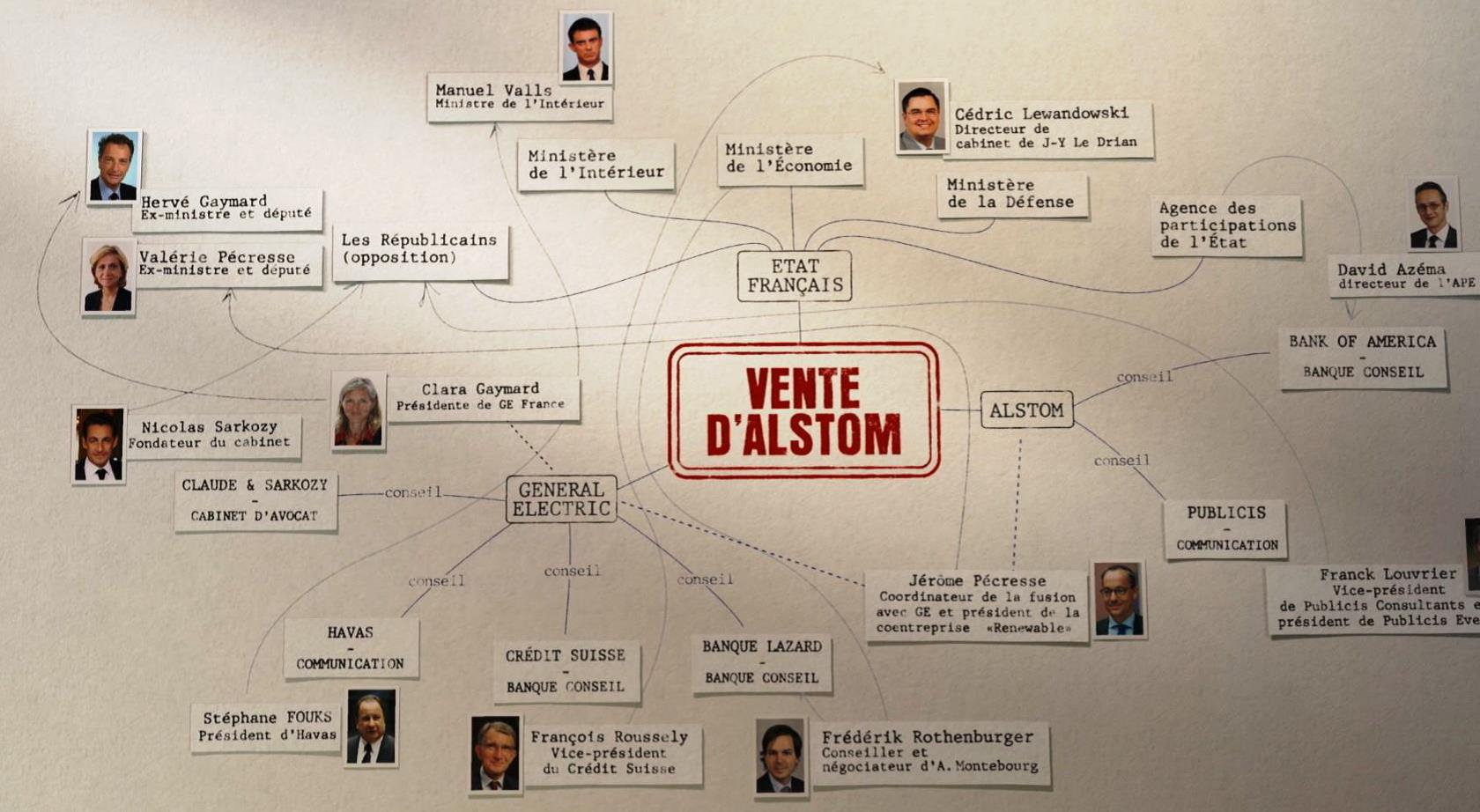

The Alstomgate explosion

The proposed sale of an Alstom business unit to General Electric, the biggest financial scandal in French industrial history of the last quarter of a century, is at the origin of the hidden amounts of the accounts, which were then used with Hussain Al-Nowais in subsequent corruption deals[45]

The most famous case, known as Alstomgate, emerged from a 2008 report published by the NGO Transparency International which concerned corruption cases involving various multinational companies associated with the military and transport industries[46]. The scandal overwhelmed Italy, where the national electricity company (ENEL), through Hussain Al-Nowais and four executives responsible for negotiating orders abroad, favored Alstom USA for various contracts in Lombardy and Sardinia[47].

Hussain Al-Nowais confirmed at his trial that he was speaking to ENEL executives on behalf of Alstom. He was both a co-defendant and witness against former ENEL Power CEO Luigi Giuffrida[48]. Giuffrida was investigated for bribery in relation to the Ansaldo[49] company during that period, and was subsequently convicted in both cases[50]. Al-Nowais confessed everything before the judge, convinced that he was in the right[51]. He was ordered by the Milanese court to reimburse the amount of the bribe (597,220 euros) to the Italian state, to spend three days in prison and pay a fine of 240,000 euros[52]. The fine was paid by the company on whose behalf he was acting, owned by the family of Sheikh Al-Nahyan.

A similar criminal trial took place in Germany around the same period. This time Siemens was involved in the corruption system created by ENEL, Alstom and Hussein Al-Nowais. The Arab businessman negotiated with the German multinational for the account of one of Siemens financial intermediaries, MEEISCO (Middle East Energy & Industrial Service) Llc Abu Dhabi[53], which had an offshore bank account in the Principality of Monaco (the Zaghy 12[54]) through which money from UAE companies, Daimler Chrysler[55], ENEL[56] and Alstom was transferred[57].

Once again, Al-Nowais publicly admitted the charges, leading to the conviction of all the German leaders involved[58]. The scandal also reached Poland; at the end of the 1990s, Bohdan Zun, managing director of MetroProjekt[59], the public company responsible for the construction and management of the Warsaw metro[60], placed an order with Alstom worth 105 million euros for the delivery of wagons with a rigged contract and in exchange for bribes[61]. The same happened in Barcelona in 2010, where an Alstom adviser, Tadeusz Nowak, was arrested in Barcelona on the same charges[62].

Dubai, crossroads of the international underworld

The awe-inspiring skyline view of the DMCC Dubai Multi Commodities Center, the world’s largest and richest tax haven, the epicenter of international crime which is tenaciously protected by the government of the United Arab Emirates[63]

Al-Nowais’ vicissitudes on the global corruption chessboard did not frighten the government of the United Arab Emirates precisely because of his ties to the industrial leaders of the UAE, the United States and the European Union. Instead, these ties increased his access to the most secret and influential areas of power of the Sheikhs of Dubai and Abu Dhabi. In 2006, even while Al-Nowais was under legal investigation in Switzerland, Italy, Germany and the United States, United Arab Emirates regent Mohammed Bin Zayed Al-Nahyan appointed him head of the Khalifa Fund, the investment fund for small and medium-sized businesses of the royal family which bears the name of the regent’s father[64].

That’s not all. The government of the UAE appointed him to the board of directors of the Abu Dhabi Economic Development Council: the body that has absolute power over decisions of the financial, industrial, commercial and military policy of the UAE and its council of the administration[65], and which, with the exception of Hussein Al-Nowais, only included members of the royal family[66]. Within this organization, Al-Nowais has been responsible for making decisions regarding large international investors who are invited to do business in or with the Emirates[67]. When Mohammed Bin Zayed Al Nahyan met friendly heads of state like president of Pakistan, Pervez Musharraf ,and Prime Minister of the government of Islamabad, Shawkat Aziz, Hussain Al Nowais was part of the representative delegation of the State[68].

The list of his government positions seems endless: Family Business Council Gulf, Asia Business Council, Arab Business Council of the World Economic Forum, Wilson Center Global Advisory Council (GAC), MENA Infrastructure Fund, ZonesCorp, Etihad Rail, Abu Dhabi Ports Company, KIZAD Khalifa industrial area Abu Dhabi, Abu Dhabi Stock Exchange, Al Dhafra Insurance Company, InvestBank, Abu Dhabi Chamber of Commerce and Industry, United States Arab Chamber of Commerce, Khalifa University of Science, Technology and Research[69]: Almost all the appointments were made by Mohammed Bin Zayed Al-Nahyan, who considered him one of his most trusted men[70].

The position of these two men on corruption is very clear, as Al Nowais explained to the Davos World Economic Forum[71] panel on corruption[72], PACI Vanguard[73]: Al Nowais participated as chairman of the board of his investment company Al Nowais[74] and argued that bribery is a real force in business, which, like the legitimate deal making side, is also subject to the laws of supply and demand which are essential for business and always have been. He argued that there is nothing wrong with using bribery as a method of capitalist competition[75].

The Abraaj scandal and ties to Pakistan

A cartoon symbolizing the collapse of the Abraaj Group, a Pakistani mutual fund based in Dubai whose partner and board member is Al Nowais, which burned $ 385 million in clients between 2009 and 2018 and became the biggest scandal of any private equity group in history[76]

The meeting of the President and Prime Minister of Pakistan with Mohammed Bin Zayed Al Nahyan and Hussain Al Nowais on January 19, 2020 was not a coincidence[77]. In May 2006, the Pakistani government and the government of the United Arab Emirates jointly set up the $ 1 billion private Karachi-based ENSHAANLC Developments (Pvt.) Limited, controlled by Abraaj Capital Dubai[78], of which Al Nowais was vice chairman[79]. Abraaj has invested $ 1 billion annually in an equity fund of health products around the world[80].

The Abraaj group was founded in 2002 by Al Nowais together with the Pakistani businessman Ariq Naqvi[81], who holds a Saint-Kitts passport, and who, thanks to his partner in Dubai, convinced a large group of wealthy investors to invest in its funds including the Melinda & Bill Gates Foundation[82]. In the early years, one of the reasons for the market downturn in Abraaj’s business was the very close relationship with KPMG – so strong that the son of a KPMG Global executive also became a partner of Abraaj Capital[83].

The Abraaj Group invested unprecedented figures in insurance, retirement and health systems in Africa: $ 375 million in North Africa[84] and $ 990 million in sub-Saharan Africa[85]. In 2018, international rating agencies and some clients begin to suspect that the figures reported by management were inaccurate and that in reality there were speculative losses and even fraud on the part of the group’s executives[86].

The whole case came to a bitter end[87]. In April 2019, at the request of the FBI, the British authorities arrested Abraaj manager Sev Vettivetpillai[88]. In July, authorities in Dubai fined Ariq Naqvi and his manager Mustafa Abdel-Wadood[89] $315 million, after discovering they had pocketed millions of dollars from clients[90]. Before Naqvi went bankrupt, he took a desperate step and tried to persuade Mohammed Bin Zayed Al-Nahyan to buy the whole Abraaj group through his private industry, the Mudabala group[91] but no one in Dubai was willing to pay out to save their Pakistani partner[92].

In the spring of 2019, Ariq Naqvi was arrested by order of the American judicial authorities[93]. In August, a Dubai court sentenced him in absentia to three years in prison[94]. The entire Abraaj group was then liquidated and the UAE government has been taking the necessary steps to discover how much the country’s many institutional investors have lost due to the Pakistani giant’s bankruptcy[95].

For Al-Nowais, this is not the first disaster in Asia. In 2010, faced with the crisis of his Osian group[96], which had turned out to be a fraud[97] and therefore failed[98], art dealer Neville Tuli[99] launched a new project called India Asian Arab Art Fund with the noble intention of transforming and reviving the artistic landscape of the Persian Gulf region of India, in painting, sculpture and cinema, with funding from the patriotic billionaires of the Persian Gulf[100].

Ariq Naqvi and Hussain Al-Nowais decide to believe in him and in 2013 Abraaj Capital joined the Osian group with a massive injection of cash of $20 million, or 9.4% of Osian’s capital[101]. Both groups end up losing. Abraaj Investment Management Ltd. Dubai, the Abraaj group company which operated the acquisition and contractually guaranteed additional assistance for the implementation of the Tuli Fund archives, was not repaid[102]. Equally, the money paid to Tuli did not end up in the India Asian Arab Art Fund, but in the bank accounts of another Tuli company, Bregawn Jersey Limited, and from there it disappeared. Al-Nowais took legal action against Tuli in a court in Mumbai[103]. Soon after, the lawsuit moved to London, where Abraaj Capital fought to recover $ 23 million from Tuli[104].

Global capitalism and the Arab medievalism

Hussain Al Nowais announces his resignation as Chairman of the Board of Directors of Waha Capital and his move to Cyprus[105]

All this fell by the wayside when Hussain Al Nowais’ protector Mohammed Bin Zayed Al-Nahyan was forced to make a pragmatic and opportunistic decision[106]. On January 23, 2015, King Abdullah Al-Saud, seriously ill for several years[107], fell ill with pneumonia and died[108]. A merciless struggle to seize power in Saudi Arabia began, as the first in the line of succession, Prince Sultan, was already 82 years old and himself ill[109].

The Al-Sa’ud family then elected the next brother, Prince Salman, who was then 79 years old but in good health[110]. Salman’s son, Prince Mohammed Bin Salman, who has just been elected Minister of Defense and Secretary General of the Royal Court[111], became Crown Prince but had a formidable opponent in Mohammed Bin Nayef, Minister of the Interior. Bin Nayef benefited from the support of the elders of the Al-Sa’ud family[112], while Mohammed bin Salman, who was 31 at the time, was seen as too young and unprepared for government office[113].

The old men are wrong. Within two years, Mohammed Bin Salman staged a coup d’état in the hearts of his family and ousted Bin Nayef and all those loyal[114] to him, ostensibly to control corruption. Bin Salman ordered the arrest of more than 200 important, influential and very wealthy people, including Prince Al Waleed Bin Talal, the richest man in Arabia, and several military leaders[115].

Mohammed Bin Salman then reversed the economic policies of the countries of the Persian Gulf and declared as forever closed the era in which bribes were paid and received to obtain favours or contracts. He froze an estimated $400 to $800 billion[116]. Two years later, after trials in front of 110 new judges, specially appointed by King Salman[117] for this purpose, the result was the confiscation of $108 billion and no jail time for anyone[118] but with a strengthened Mohammed bin Salman becoming the autocratic and undisputed Saudi leader[119].

The prince has his own ideas on the future of Saudi Arabia and quickly put them into practice. Upon taking office, he produced a project, Vision 2030, with far-reaching reforms ranging from industry to finance, from military to social affairs, and at only 33, became the “de facto” leader of Saudi Arabia[120]. While some of these reforms are seen as progressive – for example since 2017, Saudi women have been able to play sports and go to stadiums, drive cars and study science at university[121] – the Prince’s obvious goal is to neutralize royal competitors who might develop the political and economic strength to question his autocratic power. At the same time, bin Salman decided to open up to foreign investments, transforming Saudi Arabia into an international cultural hub and implementing financial reforms towards greater transparency[122].

Mohammed Bin Salman meets Donald Trump[123]

A few weeks later, Hussain Al Nowais resigned from the presidency of his financial group Waha Capital[124] and moved to Nicosia, where he took Cypriot nationality[125]. ZonesCorp, one of the most sensitive companies he ran on behalf of the Emirates royal family, was dissolved and merged with the agency that controls the port of Dubai, Abu Dhabi Ports[126]. His holding company, which controls the shares of the Waha group, was relocated to the Netherlands and became a cooperative, Waha AC Coöperatief UA Amsterdam, which from March 2018 brought under its umbrella all the disparate companies of Al-Nowais and the Arab partners, which were previously based in tax havens [127]. It was not until 2020, after this restructuring, that Mohammed Al Nowais, son of Hussain, returned to the head of Waha Capital[128].

Al Nowais also resigned as chairman of ADCB Abu Dhabi Commercial Bank after ADCB’s Jersey branch was fined £475,000 by a London court for neglecting due diligence and assisting some customers to launder money[129]. His position within the bank became even more untenable when he was forced to reveal that he had lost $1 billion in one of the biggest scams of this century – that of the Indian businessman B.R. Shetty and his group NMC[130]. Finally, for the sake of transparency, all Al Nowais affiliates have publicly declared the nature of their relationship with Abraaj Capital and the extent of the sums lost in this financial disaster[131].

All of this shows the deep contradictions in the economic system of the Gulf States, which grew rapidly on oil revenues and, now that the fossil fuel age is coming to an end just as rapidly, is trapped in a reality where the region’s monarchs and their vassals must find alternative solutions. They must invest in technology, but also in culture, social and financial openness, in image and, ultimately, in transparency and democracy but they don’t know how to do it; they don’t want to do it and they try by all possible means to avoid it.

If on the one hand they seem to offer moderation, tolerance and more credible control of the economy, on the other hand they invest in violence, in repression, and in political intrigues which come almost to the verge of military escalation, such as Mohammed Bin Salman and Mohammed Bin Zayed Al-Nahyan wanting a dispute between Saudi Arabia, the Emirates, Israel and Egypt on the one hand, and Qatar, Turkey and Iran on the other hand.

What is most worrying from a Western perspective is that the economies of some Persian Gulf countries, Abu Dhabi and Dubai are based primarily on respect for and complicity with organized crime around the world, as well as refusal to comply with international control rules. This is an even more explosive mixture that could sooner or later lead to a rupture between these states, the European Union and the United States of America.

[1] http://www.worldoffshorebanks.com/history-of-offshore-banking-does-it-really-have-a-future.php ; http://www.historyandpolicy.org/policy-papers/papers/history-of-tax-havens ; https://www.bloomberg.com/news/articles/2013-05-03/offshore-tax-havens-in-spotlight-after-200-year-history

[2] https://egmontgroup.org/en ; https://egmontgroup.org/en/membership/list ; https://egmontgroup.org/en/fiu

[3] https://www.fatf-gafi.org/

[4] https://www.imf.org/external/np/mae/oshore/2000/eng/back.htm

[5] https://escholarship.org/content/qt74t975kk/qt74t975kk_noSplash_9260f61c475e4ac6dfd6bf1f4e511b5c.pdf ; https://www.imf.org/external/pubs/ft/wp/2007/wp0787.pdf ; https://www.imf.org/external/pubs/ft/fandd/2018/06/inside-the-world-of-global-tax-havens-and-offshore-banking/damgaard.htm

[6] Matthew T. Page, Jodi Vittori, Shawn Blore, Marcena Hunter, “Dubai’s role in facilitating corruption and global illicit financial flows”, Carnegie Endowment for International Peace, Washington DC 2020, pages XI-XII – see also https://carnegieendowment.org/files/PageVittori_DubaiCorruption_final.pdf ; https://www.dmcc.ae/ ; http://businessdxb.com/dubai-multi-commodities-centre-dmcc-freezone/

[7] https://www.ameapower.com/board-management/

[8] https://hussainalnowais.net/blog/

[9] https://peoplepill.com/people/hussain-al-nowais/

[10] https://hussainalnowais.net/info-about-career/

[11] https://www.nytimes.com/2017/10/21/world/europe/russia-bribery-vladimir-putin-igor-sechin.html

[12] Matthew T. Page, Jodi Vittori, Shawn Blore, Marcena Hunter, “Dubai’s role in facilitating corruption and global illicit financial flows”, Carnegie Endowment for International Peace, Washington DC 2020 – see also https://carnegieendowment.org/files/PageVittori_DubaiCorruption_final.pdf, page XI

[13] Matthew T. Page, Jodi Vittori, Shawn Blore, Marcena Hunter, “Dubai’s role in facilitating corruption and global illicit financial flows”, Carnegie Endowment for International Peace, Washington DC 2020 – see also https://carnegieendowment.org/files/PageVittori_DubaiCorruption_final.pdf, page XI, pages 59-66

[14] Matthew T. Page, Jodi Vittori, Shawn Blore, Marcena Hunter, “Dubai’s role in facilitating corruption and global illicit financial flows”, Carnegie Endowment for International Peace, Washington DC 2020 – see also https://carnegieendowment.org/files/PageVittori_DubaiCorruption_final.pdf, page XI, pages 35-48

[15] Originariamente, la Kafala era la legge coranica che regolava l’affidamento dei minori in caso di perdita dei genitori. Nei Paesi del Golfo, nel nuovo secolo, il suo significato è stato esteso alla regolamentazione del diritto del lavoro e delle relazioni d’affari – il termine viene utilizzato anche in relazione alla limitazione degli investimenti diretti esteri e delle attività commerciali. L’applicazione della Kafala affida al datore di lavoro la patria potestà e l’esercizio dei diritti umani dei suoi dipendenti stranieri: questo crea rapporti di dipendenza, abusi e gravi violazioni dei diritti umani – see also https://www.spiegel.de/politik/ausland/libanon-wie-auslaendische-arbeitskraefte-unter-dem-kafala-system-leiden-a-a808eae2-66e2-401a-a11f-359b85c23a55 ; https://trace.tennessee.edu/pursuit/vol6/iss1/10/ ; https://www.amnesty.org/en/latest/campaigns/2019/04/lebanon-migrant-domestic-workers-their-house-is-our-prison/ ; https://www.spiegel.de/panorama/katar-unmenschliche-bedingungen-fuer-hausangestellte-laut-amnesty-bericht-a-3d3be42f-ca35-426d-87ff-d1d436b63be7 ; https://www.arabnews.com/news/445349

[16] Matthew T. Page, Jodi Vittori, Shawn Blore, Marcena Hunter, “Dubai’s role in facilitating corruption and global illicit financial flows”, Carnegie Endowment for International Peace, Washington DC 2020 – see also https://carnegieendowment.org/files/PageVittori_DubaiCorruption_final.pdf, page XI, pages 79-84

[17] https://www.efgconsulting.it/news/2015/etihad-rail-iniziera-i-lavori-del-progetto-ferroviario-in-oman-arabia-saudita/

[19] http://www.archivesnationales.culture.gouv.fr/camt/fr/egf/donnees_efg/1997_018/1997_018_INV.pdf

[20] http://archive.wikiwix.com/cache/index2.php?url=http%3A%2F%2Fwww.alstom.com%2Ffrance%2Ffr%2FDecouvrez-nous%2Fhistorique-fr%2F

[21] https://www.nytimes.com/2010/03/30/business/global/30alstom.html

[22] https://www.lefigaro.fr/actualite/2006/09/04/01001-20060904ARTWWW90502-amiante_alstom_condamne_a_la_peine_maximale.php

[23] https://www.lexpress.fr/actualite/societe/salaries-exposes-a-l-amiante-alstom-condamne_470832.html ; https://www.lemonde.fr/societe/article/2015/07/28/amiante-alstom-condamne-a-verser-5-000-euros-a-54-ex-salaries_4702303_3224.html ; https://www.lesechos.fr/2015/07/amiante-alstom-condamne-pour-lexposition-danciens-salaries-268604

[24] https://ec.europa.eu/commission/presscorner/detail/en/IP_07_80

[25] https://www.business-humanrights.org/en/latest-news/plainte-de-lolp-contre-les-entreprises-fran%C3%A7aises-du-projet-de-tramway-%C3%A0-j%C3%A9rusalem/ ; https://www.lemonde.fr/international/article/2007/10/22/plainte-de-l-olp-contre-les-entreprises-francaises-du-projet-de-tramway-a-jerusalem_969668_3210.html

[26] https://www.france-palestine.org/Communique-de-l-AFPS-sur-l-etat-de

[27] http://www.crif.org/fr/actualites/tramway-de-j%C3%A9rusalem/36858

[28] https://www.latribune.fr/actualites/economie/international/20120223trib000684517/la-banque-mondiale-place-une-filiale-suisse-d-alstom-sur-liste-noire.html

[29] https://www.lemonde.fr/economie/article/2014/12/22/alstom-condamne-aux-etats-unis-a-une-amende-de-630-millions-d-euros_4545069_3234.html

[30] https://www.lemonde.fr/ameriques/article/2016/03/30/cinq-cadres-d-alstom-poursuivis-au-bresil-pour-attribution-irreguliere-de-marches_4892053_3222.html

[31] https://www.justice.gov/opa/pr/alstom-sentenced-pay-772-million-criminal-fine-resolve-foreign-bribery-charges

[32] https://www.sfo.gov.uk/2019/11/25/sfos-alstom-case-concludes-with-sentencing-of-alstom-network-uk-ltd/ ; https://www.lefigaro.fr/flash-eco/alstom-grande-bretagne-condamne-a-une-amende-de-17-5-millions-d-euros-pour-corruption-en-tunisie-20191125

[33] https://www.admin.ch/gov/fr/start/dokumentation/medienmitteilungen.msg-id-42300.html ; https://www.lesechos.fr/2011/11/alstom-condamne-dans-trois-affaires-de-corruption-403697

[34] https://www.emirates247.com/eb247/companies-markets/aviation/funding-fully-available-for-union-railway-2009-10-13-1.25608

[35] https://www.nytimes.com/2010/03/30/business/global/30alstom.html

[36] https://www.srm-med.com/p/morocco-a-large-scale-railway-project-with-african-countries-has-been-launched-investments-for-3-billion-euros/

[37] https://www.adfd.ae/english/ABOUTADFD/OurHistory/Pages/history.aspx

[38] https://www.srm-med.com/p/uaemorocco-abu-dhabi-fund-for-development-invests-one-billion-dollars-in-projects-in-morocco/

[39] https://gulfnews.com/business/gulf-rail-projects-could-exceed-60b-1.513890 ; https://www.skyscrapercity.com/threads/project-etihad-railway-1-200-km.541672/page-4

[40] https://www.etihadrail.ae/the-etihad-rail-network/

[41] https://www.globalrailwayreview.com/article/66216/railway-developments-regulations-middle-east/ ; https://www.constructionweekonline.com/article-7949-building-tracks?amp ; https://www.railway-technology.com/projects/etihad-rail/ ; http://www.dubaimetro.eu/gulf-rail-projects-could-exceed-60b/

[42] https://www.railjournal.com/in_depth/tremendous-potential-for-middle-east-rail

[44] https://www.reuters.com/article/petrofac-contract/petrofac-says-abu-dhabi-national-oil-co-ends-1-65-bln-dalma-gas-contracts-idUSL3N2C41W7

[45] Olivier Cousset, Nicolas Moinet, “Extension du domaine de la prédation. La vente d’Alstom à Général Electric”, in “Revue Française de Gestion” No. 285, volume 8, Paris 2019, pages 211-227 – see also https://hal.archives-ouvertes.fr/hal-02498820/document, page 14

[46] https://www.transparency.org/en/press/20080623-mixed-messages-on-fighting-foreign-bribery-says-ti-report

[47] http://www.astrid-online.it/static/upload/protected/CdC_/CdC_114-2006-enel-power-s.p.a..pdf ; https://ricerca.gelocal.it/lanuovasardegna/archivio/lanuovasardegna/2003/06/07/SL3PO_SL302.html ; https://www.milanofinanza.it/news/tangenti-e-appalti-truccati-a-milano-13-arresti-tra-cui-un-dirigente-atm-202006231046278057 ; https://ricerca.repubblica.it/repubblica/archivio/repubblica/2003/07/25/siemens-alstom-sotto-accusa.html

[48] Sabine Fütterer, „Logik und Problematik der Antikorruption: Deutschland und Italien im Vergleich“, Springer Verlag, Düsseldorf 2018, Seiten 358-360

[49] https://www.ilfattoquotidiano.it/2011/09/20/confiscati-98-milioni-ad-ansaldo-presunte-tangenti-per-la-controllata-di-finmeccanica/158665/

[50] http://www.astrid-online.it/static/upload/protected/CdC_/CdC_114-2006-enel-power-s.p.a..pdf ; https://sentenze.laleggepertutti.it/sentenza/cassazione-civile-n-11552-del-02-05-2019

[51] https://www.thenationalnews.com/business/wef-unleashes-a-new-acronym-in-campaign-against-corruption-1.592077

[52] http://www.astrid-online.it/static/upload/protected/CdC_/CdC_114-2006-enel-power-s.p.a..pdf ; https://sentenze.laleggepertutti.it/sentenza/cassazione-civile-n-11552-del-02-05-2019

[53] https://www.regjeringen.no/globalassets/upload/fin/statens-pensjonsfond/recommendation_on_siemens.pdf

[54] http://www.assonime.it/sezioni/Documents/75%20Trib._Milano_28_ottobre_2004.pdf

[55] https://www.daimler.com/en/

[56] http://www.astrid-online.it/static/upload/protected/CdC_/CdC_114-2006-enel-power-s.p.a..pdf

[57] http://www.studiolegaletosello.it/wp-content/uploads/2013/10/OrdinanzaSIMENS.pdf ; https://olympus.uniurb.it/index.php?option=com_content&view=article&id=9015%3Atribunale-di-milano-sez-del-riesame-ordinanza-28-ottobre-2004-modello-di-organizzazione-e-pericolo-di-commissione-di-illeciti-della-stessa-indole&catid=134%3Agiurisprudenza-sul-dlgsn-&Itemid=61

[58] http://www.assonime.it/sezioni/Documents/75%20Trib._Milano_28_ottobre_2004.pdf ; https://docplayer.it/20214416-Tribunale-di-milano-27-04-2004-ord-g-i-p-salvini-imp-siemens-a-g-in-le-societa-2004-10-1275.html ; https://www.penalecontemporaneo.it/upload/Trib.%20Milano,%2025.7.2006%20_sent._,%20GUP%20Varanelli%20_Confisca_.pdf

[59] https://www.tampabay.com/archive/1995/04/07/finally-warsaw-will-get-a-subway/

[60] https://www.latimes.com/archives/la-xpm-1995-04-06-mn-51567-story.html

[61] https://www.lemonde.fr/economie/article/2011/11/18/la-suisse-est-sur-le-point-de-condamner-alstom_1606024_3234.html ; https://www.nytimes.com/2010/03/30/business/global/30alstom.html

[62] http://serbiannewsnetwork.blogspot.com/2010/03/alstom-at-center-of-web-of-bribery.html

[63] Matthew T. Page, Jodi Vittori, Shawn Blore, Marcena Hunter, “Dubai’s role in facilitating corruption and global illicit financial flows”, Carnegie Endowment for International Peace, Washington DC 2020, pages 35-47 – see also https://carnegieendowment.org/files/PageVittori_DubaiCorruption_final.pdf ; https://www.dmcc.ae/ ; http://businessdxb.com/dubai-multi-commodities-centre-dmcc-freezone/

[64] http://wam.ae/en/details/1395227745953

[65] https://www.adced.gov.ae/en/About/About-Us ; https://www.apollo.io/companies/Abu-Dhabi-Council-for-Economic-Development/54a1346469702d46f0a90c00?chart=count ; https://www.albawaba.com/abu-dhabi-council-economic-development

[66] https://www.albawaba.com/abu-dhabi-council-economic-development

[67] https://www.arabianbusiness.com/foreign-ownership-likely-be-more-than-70–120173.html

[68] https://theseoultimes.com/ST/?url=/ST/db/read.php%3Fidx=4634

[69] https://www.ameapower.com/board-management/

[70] https://gulfnews.com/business/new-members-to-join-abu-dhabis-economic-board-1.657045

[72] https://www.thenationalnews.com/business/wef-unleashes-a-new-acronym-in-campaign-against-corruption-1.592077

[73] http://www3.weforum.org/docs/WEF_PACI_Vanguard.pdf

[75] https://www.thenationalnews.com/business/wef-unleashes-a-new-acronym-in-campaign-against-corruption-1.592077?videoId=5766484581001

[76] https://www.economist.com/finance-and-economics/2019/05/18/the-biggest-collapse-in-private-equity-history-will-have-a-lasting-impact ; https://www.economist.com/finance-and-economics/2019/05/18/the-biggest-collapse-in-private-equity-history-will-have-a-lasting-impact

[77] https://theseoultimes.com/ST/?url=/ST/db/read.php%3Fidx=4634

[78] https://www.linkedin.com/company/the-abraaj-group

[79] https://hussainalnowaisbiography.com

[80] http://www.enshaanlc.com/home.htm

[81] https://www.wsj.com/articles/u-k-judge-grants-bail-to-abraaj-founder-arif-naqvi-11556889082

[82] https://www.gatesfoundation.org

[83] https://home.kpmg/it/it/home/about.html

[84] https://www.bloomberg.com/news/articles/2015-08-24/abraaj-group-raises-375-million-for-north-africa-investments

[85] https://www.reuters.com/article/abraaj-africa-funds/private-equity-house-abraaj-closes-990-mln-sub-saharan-africa-fund-idUSL5N0X90G120150413

[86] https://www.arabnews.com/node/1313271 ; https://www.axios.com/the-1522167159-8ebfe0cb-7dcd-4385-8a00-27cf68cd39f2.html ; https://www.wsj.com/articles/abraaj-investors-hire-auditor-to-trace-money-1517598630 ; https://www.ameinfo.com/industry/business/abraaj-2

[87] https://www.wsj.com/articles/private-equity-firm-abraaj-fined-a-record-315-million-in-dubai-11564476002

[88] https://www.bloomberg.com/news/articles/2019-04-18/third-abraaj-official-vettivetpillai-arrested-on-u-s-charges?srnd=technology-vp

[89] https://www.bloomberg.com/news/articles/2019-08-07/what-s-been-learned-who-s-charged-in-abraaj-collapse-quicktake

[90] https://pitchbook.com/news/articles/abraaj-hit-with-record-315m-fine-by-dubai-regulators

[91] https://www.wsj.com/articles/abraaj-seeks-buyer-for-private-equity-business-1522068315

[92] https://mondediplo.com/2019/11/09abraaj

[93] https://www.reuters.com/article/us-abrraj-usa-crime-idUSKCN1RN2P5

[94] https://www.dawn.com/news/1498798/abraaj-founder-sentenced-to-3-years-in-prison-by-uae-court-report

[95] https://www.bloomberg.com/news/articles/2018-06-14/the-downfall-of-arif-naqvi-s-abraaj-group-dubai-s-star-investor

[96] https://www.thehindu.com/archive/print/2005/07/02/

[97] https://www.thehindu.com/archive/print/2005/07/02/

[98] https://economictimes.indiatimes.com/osians-art-fund-approaches-tribunal-against-sebi-order/articleshow/19787727.cms ; https://economictimes.indiatimes.com/sebi-directs-yatra-art-fund-to-refund-investors-money/articleshow/49691377.cms ; https://economictimes.indiatimes.com/sat-allows-investor-to-be-part-of-osian-art-fund-case/articleshow/36774354.cms

[99] https://wap.business-standard.com/article-amp/beyond-business/newsmaker-neville-tuli-108032101027_1.html ; https://www.bloomberg.com/profile/person/15038978

[100] https://timesofindia.indiatimes.com/tech-news/Osians-announces-search-engine-exclusively-for-arts-cinema/articleshow/18132271.cms?referral=PM ; https://www.thehindubusinessline.com/info-tech/Osian-search-engine-for-arts-cinema/article20567410.ece?ref=wl_industry-and-economy ; https://timesofindia.indiatimes.com/entertainment/hindi/bollywood/news/Archiving-Indian-cinema-and-more-through-Osianama/articleshow/18133844.cms?referral=PM ; https://www.hollywoodreporter.com/news/indias-osians-group-launches-online-648154 ; https://www.business-standard.com/article/pti-stories/an-auction-with-animals-as-theme-114111700722_1.html ; https://www.dailypioneer.com/2014/vivacity/a-rare-date-with-animals.html

[101] https://www.business-standard.com/article/press-releases/abraaj-takes-9-4-stake-in-osian-s-for-20mn-108031701108_1.html ; https://fr.reuters.com/article/osians-stake-idINBOM13716520080317

[102] https://wap.business-standard.com/article-amp/beyond-business/newsmaker-neville-tuli-108032101027_1.html

[103] https://indiankanoon.org/doc/5738413/ ; https://indiankanoon.org/doc/93901847/ ; https://www.legitquest.com/case/abraaj-investment-management-ltd-v-neville-tuli-others/782CE

[104] https://www.telegraph.co.uk/luxury/art/sale-one-mans-multi-million-dollar-collection-tells-us-middle/

[105] https://www.entrepreneur.com/article/304587 ; https://exbulletin.com/politics/328876/

[106] https://www.washingtoninstitute.org/policy-analysis/rise-uae-and-meaning-mbz?CID=3289

[107] https://web.archive.org/web/20121117203654/http://www.washingtonpost.com/world/middle_east/saudi-king-abdullah-has-back-surgery-described-as-successful/2012/11/17/11d8c1ce-30c1-11e2-af17-67abba0676e2_story.html ; www.presstv.ir/detail/2012/09/03/259660/saudi-king-has-another-surgery-in-us/

[108] https://www.nytimes.com/2015/01/03/world/middleeast/saudi-king-abdullah-is-hospitalized-with-pneumonia.html?_r=0 ; https://www.bbc.com/news/world-middle-east-30945324 ; https://www.nytimes.com/2015/01/23/world/middleeast/king-abdullah-who-nudged-saudi-arabia-forward-dies-at-90.html

[109] http://news.bbc.co.uk/2/hi/middle_east/7035991.stm

[110] https://www.reuters.com/article/us-saudi-succession/saudi-king-abdullah-dies-new-ruler-is-salman-idUSKBN0KV2RQ20150122

[111] https://www.britannica.com/biography/Mohammed-bin-Salman

[112] https://www.middleeasteye.net/news/mohammed-bin-nayef-kingpin-new-saudi-arabia-country-experts

[113] https://tass.com/world/952543

[114] https://edition.cnn.com/2017/06/21/middleeast/saudi-arabia-crown-prince/index.html ; https://www.thenationalnews.com/world/saudi-royal-decrees-announcing-prince-mohammed-bin-salman-as-the-new-crown-prince-1.93194

[115] https://www.dailysabah.com/mideast/2017/11/05/alwaleed-bin-talal-two-other-billionaires-tycoons-among-saudi-arrests ; https://www.theguardian.com/world/2017/nov/05/royal-purge-shockwaves-saudi-arabia-elites-mohammed-bin-salman ; https://www.bbc.com/news/world-middle-east-41905942 ; https://web.archive.org/web/20171201031853/https://www.msn.com/en-us/news/world/saudi-crackdown-escalates-with-arrests-of-top-military-officials/ar-BBF6cP9

[116] https://www.economist.com/middle-east-and-africa/2017/11/05/saudi-arabias-unprecedented-shake-up ; https://web.archive.org/web/20171117203754/https://www.wsj.com/articles/saudi-crackdown-escalates-with-arrests-of-top-military-officials-1510950402 ; https://www.bloomberg.com/news/articles/2017-11-08/saudi-arrests-missiles-and-proxy-conflict-all-in-five-days

[117] https://www.arabnews.com/node/1371521/saudi-arabia

[118] https://www.reuters.com/article/us-saudi-arrests-idUSKCN1PO2O1

[119] Theodor Winkler, “The Dark Side of Globalization”. LIT Verlag Münster 2018, page 192; https://www.newsweek.com/jamal-khashoggi-secret-interview-saudi-murder-prince-mbs-islam-america-1178489

[120] https://web.archive.org/web/20190401034619/https://vision2030.gov.sa/sites/default/files/NTP_En.pdf

[121] https://www.hrw.org/news/2017/07/13/saudi-arabia-state-schools-allow-girls-sports ; https://www.nytimes.com/2017/09/26/world/middleeast/saudi-arabia-women-drive.html ; https://www.theguardian.com/world/2017/oct/30/saudi-arabia-to-allow-women-into-sports-stadiums-as-reform-push-intensifies

[122] https://www.mirror.co.uk/news/world-news/saudi-arabia-return-moderate-open-11400298 ; https://www.economist.com/middle-east-and-africa/2016/01/07/saudi-arabia-is-considering-an-ipo-of-aramco-probably-the-worlds-most-valuable-company ; https://www.wwe.com/worldwide/article/saudi-arabia-to-host-greatest-royal-rumble-april-2018 ; https://www.thenationalnews.com/arts-culture/music/i-don-t-have-to-leave-saudi-for-fun-anymore-mdl-beast-represents-a-paradigm-shift-in-the-kingdom-1.954878 ; https://edition.cnn.com/2018/10/15/opinions/how-the-saudis-played-trump-bergen/index.html

[123] https://www.zdf.de/dokumentation/zdfinfo-doku/mohammed-bin-salman–kronprinz-mit-zwei-gesichtern-100.html

[124] https://www.entrepreneur.com/article/304587

[125] https://www.aljazeera.com/news/2020/8/26/cyprus-cashes-in-as-haven-for-elites-fearful-of-home-countries ; https://exbulletin.com/politics/328876/

[126] https://www.gccbusinessnews.com/another-merger-in-uae-abu-dhabi-ports-absorbs-zonescorp/ ; https://www.zawya.com/mena/en/legal/story/UAE_dissolves_ZonesCorp_transfers_assets_to_Abu_Dhabi_Ports_Company-TR20200716nD5N2DS011X2/ ;

[127] https://sec.report/Document/0000950123-10-107875/

[128] https://www.arabnews.com/node/1509586/business-economy ; https://www.wahacapital.com/media-centre/news-insights/press-releases/details/waha-capital-appoints-mohamed-hussain-al-nowais-as-managing-director

[129] https://international-adviser.com/uae-bank-fined-600k-over-money-laundering-risk/

[130] https://m.marketscreener.com/quote/stock/ABU-DHABI-COMMERCIAL-BANK-9059322/news/Abu-Dhabi-Commercial-Bank-NMC-Scandal-And-Its-Corporate-Governance-30782956/ ; https://www.arabianbusiness.com/banking-finance/444150-abu-dhabi-commercial-bank-said-to-have-more-than-1bn-exposure-to-nmc ; https://www.bloomberg.com/news/articles/2020-04-15/adcb-starts-criminal-process-against-some-people-linked-to-nmc

[131] https://www.thenationalnews.com/business/markets/gulf-listed-companies-declare-their-exposure-to-the-abraaj-liquidation-latest-updates-1.748781

Leave a Reply