A wild, swampy and inhospitable island until two hundred years ago, Singapore is now a place where glass and concrete skyscrapers coexist with alleys teeming with rickshaws. It is the planet’s economic capital, futuristic par excellence, the one that boasts the most records for design, efficiency, safety, and strict adherence to the rules of courtesy and coexistence between peoples and traditions. Known as the Lion City[1] , it has the largest concentration of millionaires in Asia[2]. It is the fourth global financial centre[3], the third richest in the world[4].

Yet, despite all these firsts, its reputation is put at stake by the financial collapse of a major trading company: at the end of August 2022, the Singapore authorities impose heavy sanctions on the Noble Group (NGL), a multinational commodities company. Stern warnings are issued to the former directors of its subsidiary, Noble Resources International (NRI), after it was discovered that both companies had inflated their reported profits and net worth[5].

For the entire Lion City, this is a huge blow: not only to its pride and credibility, but because Noble is a group with which banks have risked staggering sums of money, and many investors have staked their money. An eventual bankruptcy of Noble may generate a domino effect and drag with it a part of the city’s economy that no one can assess, but it would certainly be tremendous – comparable to the Wall Street crash of 2008. For this reason, the state’s handling of this crisis is an important chapter in the history of our time.

History of the Noble Group

Richard Samuel Elman, founder of Noble Group Limited[6]

Noble Group is a Singapore-listed company. Founded in Hong Kong in 1986 by CEO Richard Samuel Elman[7], it is one of the world’s leading commodity procurement, processing and transportation companies[8]. It builds and controls oil pipelines, transporting (mainly from South America and Australia) to high-demand growth markets, including China and India. The company operates more than 20 product lines, such as oil and its derivatives, cereals, sugar, steel, coal, coffee, iron ore[9], chromium, manganese, aluminium[10], cotton – with revenues reaching USD 10.1 billion in the second quarter of 2007.

Over the years, the group has seen its global network reach more than 40 countries with over 80 offices, employing around 10,000 people. Some of Noble’s executives have been operating in China for over 35 years and are among the “prime movers” of Ethanol and Carbon Credits[11], major industrial projects with the aim of reducing and absorbing greenhouse gases[12]. The company recorded the best share performance in the world from 2001 to 2005. In 2007, it was included for the second year running in the ‘Forbes Fabulous’ 50 public companies in Asia and was named ‘Best Employer’ in 2003 and 2005 by Hewitt Associates[13].

The founder, Richard Samuel Elman has worked in the scrap industry in India, Thailand, Japan and America[14]. He was the first to sell Daqing crude oil from China to the US and the first to dock a foreign merchant ship in Vladivostok, Russia. Prior to setting up Noble Group, he was also regional director of operations in Asia for 10 years, including two years as a board director in New York, for Philipp Brothers[15] (Phibro[16] ), a global commodities company in Connecticut[17]. Elman first came to Asia in the mid-1960s from England[18]. At the tender age of 15, fed up, he dropped out of school[19]. His father, a lawyer, helped him get a job as a labourer in a scrap metal yard[20]in London[21] to earn a living[22].

In 1972 he sold his first company, Metal Ore Asia, to Phibro, and started Noble Group with a personal investment of only $100,000[23]. But he was very capable. Under his leadership, in two decades, Noble Group’s revenues grew steadily to $13.7 billion in 2006, a 20-fold increase from $677.5 million in 1996. In 2004, he received the management award from the Hong Kong Institute of Directors and joined the billionaire club of the Singapore Stock Exchange. Noble topped the Forbes Global 2000 list as the world’s best-performing stock from 2001 to 2005[24].

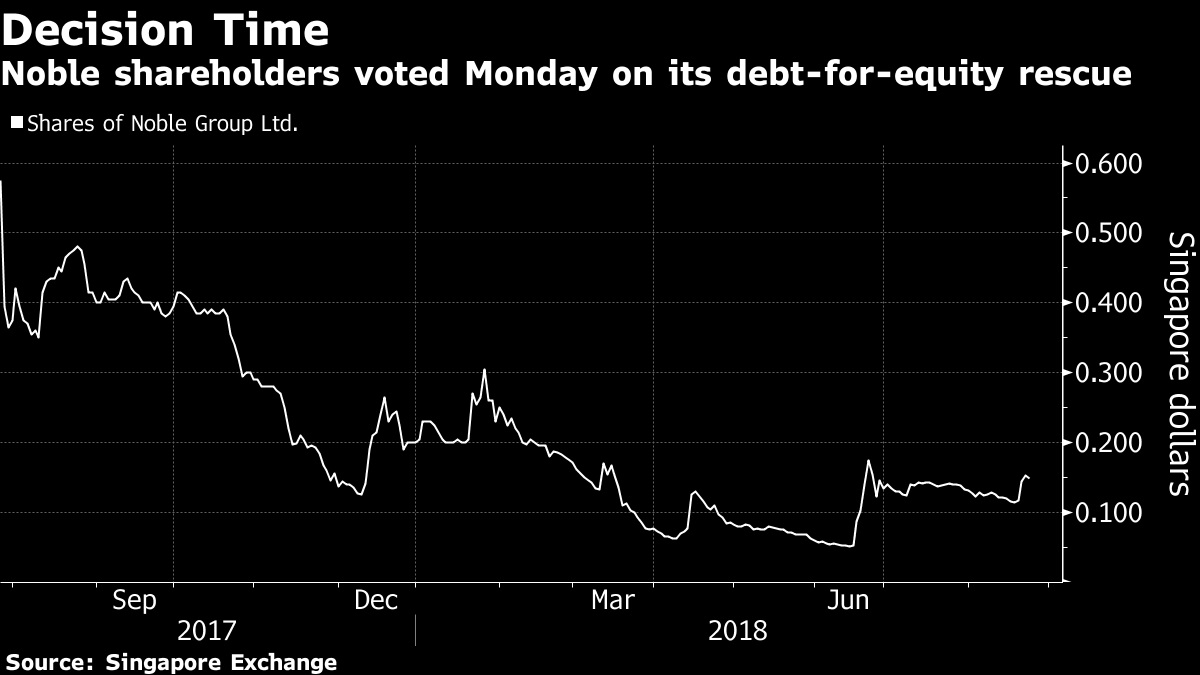

In recent years, his fortunes ended due to low commodity prices and expensive infrastructure investments, such as completing the construction of oilseed crushing factories in Brazil, Ukraine and South Africa. The descent into hell begins in 2015. Noble is accused of accounting fraud by Iceberg Research[25] , a (unnamed) research firm that claims to specialise in ‘revealing financial manipulation and accounting fraud’. Iceberg questions the multinational company’s accounts in a series of reports published on its website[26]. This triggers a share price collapse, credit downgrades, a series of property write-downs, as well as desperate fundraising[27].

At the beginning of 2016, the company sold its stake in an agricultural joint venture with Cofco for USD 750 million to the Chinese grain trader[28], but it was not enough. Noble Group’s losses in the first six months of 2017 rose to $1.88 billion, up from a loss of $14.4 million a year earlier. S&P Global Ratings and Moody’s downgrade Noble Group citing increased risk of default[29]. Standard & Poor’s announces that the group’s debt burden is unsustainable and signals a risk of default within a year[30], triggering a mass sell-off of the company’s shares and bonds[31]. The agency lowers the Noble Group’s long-term corporate credit rating, followed by Moody’s[32].

The dizzying fall in Noble’s share price over the three-year period June 2014-2017[33]

Elman is under pressure and hires as new chairman Paul Brough – a restructuring specialist who worked on the liquidation of Lehman Brothers Holdings and gets help from Morgan Stanley and Moelis[34]. Brough is forced to sell the energy business in North America to the Mercuria Group for USD 248 million and the oil trading business to Vitol for USD 580 million[35]. Noble’s market value collapses to less than $400 million, thus losing over 90% of its value[36]. After two years of crisis that forced it to cut jobs and sell assets, Noble was reduced to a company operating only in Asia and focused mainly on coal[37].

In November 2017, Iceberg-Research published an open letter to the Group’s creditors in which Noble was described as a company run by bandits and incompetents. It also accuses the auditors of EY, Ernst and Young, of intentionally misrepresenting the company’s financial statements and performance. Iceberg particularly lashes out at managers who earned tens of millions[38]: Co-CEO Will Randall, chairman Paul Brough, and founder Richard Elman pocketed about $15 million a year, CEO Jeff Frase took as much as $20 million[39], and EY was paid $35 million. As did the credit agency Fitch, paid to assign a rating to the new bond issue[40].

Also under indictment was SGX, the ‘supposed regulator’ of the Singapore stock exchange, which benefits financially from the large trading volumes of Noble’s shares and has no interest in auditing the financial statements. Many people made good money. Others, the creditors, got screwed. Iceberg complains that those who burned through $1.9 billion in three years remained at the helm of the group. And there are highly suspicious operations, such as the sales to Agri and Energy Resources, which allegedly enjoyed lower and lower off-market prices[41].

Chronology of the disaster

Arnaud Vagner is the man behind Iceberg Research, a former Noble employee furious at being fired[42]

In reality, things go wrong as early as 2015: commodity traders such as Noble suffer from falling prices for oil, coal and other commodities, while big banks[43] including Citigroup[44] manage to make significant profits from dumping. Noble Group, at the time, is the largest commodities trader in Asia by revenue[45], but it does not recover from the loss of investor confidence beginning in February 2015[46].

The blame lies with Iceberg Research, which publishes several reports with criticism of the trading company’s accounting[47]. Iceberg’s initial report accuses Noble of inflating its profits through over-optimistic price projections, claims that Noble dismisses and dismisses as the work of a frustrated and disgruntled former employee[48]. The articles compare the company’s accounting practices to the bankruptcy of the US oil company Enron[49]. In practice, Noble Group is allegedly overvaluing its assets and contracts[50] (at least $3.8 billion[51]), and undervaluing its debt[52].

Iceberg explains the fraudulent mechanism: according to Vagner, founder of Iceberg, the Noble Group plays with the dates and valuations of commercial or financial trades. For example, by avoiding a $603 million write-down of Yancoal, an Australian coal producer that is 78% owned by Yanzhou Coal Mining, a company linked to the government of Shandong Province, China[53]. Noble holds a 13% stake in Yancoal and classifies the company as an ‘associate’ in its financial statements. Yancoal’s book value in 2013 is $678 million. In 2015, it drops to $614 million, of which only $11 million belongs to Noble, which also adds the other $603 million to its balance sheet[54].

According to Iceberg, in 2015, Noble lied about commodity contracts to the tune of $1.1 billion[55]. Arnaud Vagner, a former employee of Noble, working in the company manages to get a lot of information[56]. Employed as a credit analyst in April 2011, he was fired by Noble ‘for cause’ in June 2013′[57] because he conspired against the company by anonymously spreading false and misleading information[58]. Some rumours say that he tried to destroy the company in retaliation for his dismissal[59]. What is certain is that Vagner is a partner in Iceberg-Research[60]. Iceberg sends its reports to analysts, who send them to fund managers.

The shares collapse rapidly, frightening the banks and analysts. Noble disputes the content of the reports and, in March 2015, files a lawsuit against the former employee[61]. According to them, Arnaud Vagner and a Seychelles company, Enlighten Ace Ltd. conspired to drive Noble’s share price down with their false information[62]. In August, Noble released a lengthy report by PriceWaterhouseCoopers, which guarantees the correctness of the accounts, and called a shareholders’ meeting to answer questions from those who were frightened or furious[63].

Map of the Australian Yancoal mine[64]

But the loss of confidence in accounting is a fact[65]. In December Moody’s and later Standard & Poor’s downgraded the company’s rating to ‘junk’ status[66] , signalling that it is a very risky investment. The stock is removed from Singapore’s key stock index, taking away even more liquidity. Iceberg, for its part, continues to publish reports, but remains relatively anonymous. The company’s website does not have a phone number, information on its researchers or the location of its headquarters, but welcomes the departure of CEO Alireza: ‘We believe the resignation is long overdue as the share price has plummeted 76% since Alireza was elected’[67].

On 6 March 2016, Noble Group plans a capital increase (to raise about USD 500 million) and a series of cost-cutting initiatives. Of the total 6.54 billion shares to be issued, major shareholder and chairman Richard Elman agrees to take 625.5 million shares, while China Investment Corp (CIC) takes 630.6 million. CIC thus obtains the second seat on Noble’s board of directors. The remaining new shares are subscribed by a group of banks including HSBC, Morgan Stanley Asia, DBS Bank, Société Générale and ING. The issue of the shares, together with the sale of Noble Americas Energy Solutions (NAES) together generate $2 billion of additional cash, Noble says[68].

As part of a cost-cutting programme, Noble is laying off staff after selling low-yielding assets. The company announces that Elman wants to step down from his position within 12 months. Noble’s board set up a sub-committee – chaired by David Eldon, a non-executive director – to examine options for his succession and identify a successor to take over as non-executive chairman. Elman’s plan to step down follows the surprise resignation of CEO Yusuf Alireza[69]. Against a background of deepening crisis, Elman resigned in May 2017[70]. Less than two weeks later, Sinochem International Corporation, a major Chinese state-owned enterprise, terminated business relations with Noble[71]. He was the last major customer; his departure is an epitaph.

The Yusuf Alireza era

Former Noble Group CEO Alireza sued founder Elman for $58 million[72]

According to Iceberg-Research, the evils of Noble Resources began with the arrival of Yusuf Alireza. He was hired as CEO on 8 February 2012, arriving from Goldman Sachs[73]. The announcement came as a surprise. Alireza left Goldman in mid-November 2011. A few days later, the resignation of previous CEO Ricardo Leiman took place[74]. Previously Alireza was co-chairman of Goldman Sachs’ Asian operations and a member of the firm’s global management committee.

Yusuf Alireza joined Goldman Sachs in New York in 1992, moving to its London office in 1997 and to Hong Kong in 2008, where he managed the Asia-Pacific securities division. He holds a master’s degree and a bachelor’s degree from the Edmund A. Walsh School of Foreign Service at Georgetown University in the US, and has completed several master’s degrees in international relations and business[75]. For four years, Alireza has been considered the successor, in effect, to the founder of Noble Resources. On 30 May 2016, Alireza unexpectedly resigned ‘for family reasons’[76].

At the same time, Noble announces the sale of its US retail energy unit, North Americas Energy Solutions , formerly called Sempra Energy Solutions[77], acquired by Noble in 2010 for $582 million. Its sale was motivated by the urgent need for liquidity[78] and was, according to Alireza, a signal that his resignation was now ripe[79]. Commenting on the management changes, Mr Elman says: ‘I am delighted that Will Randall and Jeff Frase will lead Noble Group’s operations in the next chapter of the company. Their commodity expertise will be extremely valuable in our future”[80].

Randall, a Hong Kong resident, began his career with Noble in Australia in February 1997 in the coal sector. He was also a director of Noble Energy before being appointed global head of coal in 2006 and board member in 2008, and executive director in 2012. Frase joined Noble from JP Morgan in New York, where he was managing director and global head of oil trading. Prior to JP Morgan, he spent 17 years at Goldman Sachs, where he was managing director and global head of oil trading[81].

Although Alireza played an important role in Noble’s collapse, the dubious accounting practices did not start with him. The level was already suspiciously high under the previous CEO, Ricardo Leiman. He too found Noble in bad shape, after his predecessor had made investments in sugar at the wrong time. However, Alireza could have abandoned a company increasingly dependent on accounting alchemy to hide bad results. Instead, according to Iceberg, he manipulated the financial statements even more aggressively. Together with the auditor, Ernst & Young. He certainly enriched himself: during his time at Noble, Alireza received no less than 75 million in stock options[82], i.e. the right of option on the purchase of shares that the company grants to its managers[83].

Alireza’s substitutes, William Randall (left) and Jeff Frase[84]

When the Iceberg publications began, Alireza defended the company by hiring the world’s most famous public relations agency Bell Pottinger[85]. Alireza’s reaction to criticism is particularly aggressive, which suggests that there is indeed something wrong. For journalists who ask critical questions, Noble has only one response: a letter from his lawyers. Even an NGO receives legal threats. It is very difficult for the press to uncover the company’s wrongdoings. Alireza claims he wants to defend the shareholders from Iceberg. In reality, he wants to stifle freedom of speech, and forbids the disclosure of individual executive pay[86].

A year after his dismissal, in June 2017, Alireza filed a lawsuit against Richard Elman for non-payment of dividends amounting to millions of dollars. In an indictment filed on 13 June in the Hong Kong High Court, Alireza alleges that Elman and the company Fleet Overseas (New Zealand), allegedly controlled by Elman, failed to pay (as due) Noble Group shares after his departure[87]. According to the writ, Elman gave Alireza six months’ notice and fired him after the latter raised ‘concerns about the future profitability’ of the Noble Group[88].

Alireza claims that he entered into an agreement that would have seen him receive approximately 63.9 million fully-paid shares in Noble for starting work at the company, and a further 52.3 million shares at the end of his employment, but denies that these shares were transferred to him[89]. The document states that Alireza owes the two batches of shares totalling 1.4 per cent of Noble Group’s shares, which he says have a combined value of $79.2 million[90]. Alireza is seeking at least $58 million in personal damages[91] and for damages resulting from “delayed delivery”[92].

Alireza’s lawsuit is the second filed by a former Noble CEO. His predecessor, Ricardo Leiman, filed a lawsuit in Singapore in 2012 because he is claiming $12.9 million in bonuses and rights to 67.7 million restricted shares and options in a trust. Noble claims that Leiman is not owed any compensation because he wanted to create a competing company while he still had a $350,000 a year consulting contract[93].

The epilogue to the disaster

The continuous free-fall over time of Noble Group shares[94]

On 18 March 2018, reduced to a shadow of its former self, battered by trading losses and massive write-downs, the company, in order to ensure its survival, is working with the Bermuda court on a $3.5 billion restructuring agreement[95] in which its creditors acquire 70% of its capital[96]. The shareholders will get 20 per cent shares in the new company, New Noble[97]. But this is not enough. The decision not to pay a $379 million bond, due on 9 March, on $750 million of bonds due in March 2022[98], renders the negotiations pointless and puts Noble Resources on course for its first default[99].

On 22 March, Richard Elman resigned following the news that the Noble Group was taken to court by Goldilocks Investment Company, a major shareholder (8.1%[100]), which accused the managers of inflating the value of Noble’s assets[101]. Elman, no longer chairman, remains one of the company’s major shareholders[102]. Noble Group’s shares fell more than 60%, reducing the group’s market value to $145 million. At its peak, Noble Group’s capitalisation was almost $12 billion. On 20 November, the Commercial Affairs Department (CAD) of the Singapore Police, the Monetary Authority of Singapore (MAS) and the Accounting and Corporate Regulatory Authority (ACRA) announced that they are jointly investigating Noble Group Limited (NGL) and Noble Resources International (NRI)[103] , which is a wholly-owned subsidiary of NGL[104].

In October 2019, claiming to have accomplished the rescue work, Paul Brough resigned. Jim Dubow, Alvarez & Marsal’s head of Asia, is appointed as the new non-executive chairman. Dubow has lived in Asia since 2005 and has more than two decades of industry experience[105]. On 5 April 2022 Noble Group completes its second $1.3bn financial restructuring in three years[106], reducing debt to $550m[107]. On 31 May 2022, the company is in negotiations to postpone the repayment of its last bond, due the following month, asking for a postponement of at least two years, which will force the major shareholder, Alumina Holdings, to ask for help from its owner, the State of Jamaica[108].

After the restructuring, Noble Group Holdings owns only two assets: a majority stake in the Jamaican alumina refinery Jamalco and an 8.3% indirect stake in Harbour Energy Plc. Jamalco’s production was halted a year ago after a major fire. And since the stake in Harbour Energy is held through an investment partnership with private equity group EIG Partners, this has limited Noble’s ability to sell it. The rest of the Singapore giant is now engulfed in oblivion[109].

Jim Dubow[110]

On 24 August 2022, the Monetary Authority of Singapore imposes a penalty of $9.03 million[111] (the largest such penalty in the city’s history[112]) on NGL for publishing misleading information in its financial statements. ACRA, in consultation with the Attorney-General’s Chambers, admonished two former NRI directors for failing to present annual financial statements. The Public Accountants Oversight Committee (PAOC), which administers the Practice Monitoring Program (PMP), issues orders against Ernst & Young in relation to financial statements from 31 December 2012 to 31 December 2016[113].

The investigations reveal that Noble entered into long-term agreements with mining producers, but then treated these agreements as if they were speculative financial instruments, instead of service contracts, effectively recording earnings in its financial statements before any money was generated[114]. This inflated the profits and net worth of NGL and NRI. NGL’s publication of substantially misleading financial statements from 2016 to 2018 prompted the sale or purchase by investors of NGL’s securities listed on the Singapore Stock Exchange (SGX)[115].

Arnaud Vagner, creator of Iceberg, claims that the fine represents only 0.15 per cent of the market capital lost since then. The fine is a miniscule fraction of the gains made by the company’s directors and auditors between 2008 and 2017, Vagner adds. It was imposed on shareholders and creditors post-restructuring, who were not involved in the fraud’[116].

Who are the losers, what are the prospects

Even in the richest country in Asia, if you lose your job or invested capital you end up on the street[117]

The collapse of Noble Resources showed a hitherto unknown endemic weakness of the Lion City. Those who are part of the financial elite are protected even if they commit crimes, while those who invest their savings, or are employees, have no protection. There is not a single line in the Singapore newspapers about the fate of those who, with Noble Resources, have lost everything. There is only talk about the fate of the company.

For this one, of course, the restructuring was very hard. Today the company is operational and, if the Bermuda court had not appointed a provisional liquidator, it would have been forced into compulsory liquidation, its business terminated and its creditors would have received an insignificant dividend[118]. The former managers emerged from the adventure unscathed, and with pockets full of money. None of them were prosecuted. The same happened to the auditing firm Ernst & Young. Thousands of individual investors were left high and dry. Their life savings, invested in the company, disappeared, used to finance the lifestyle of Noble’s managers[119].

What is particularly shocking is that auditing institutions such as the SGX and MAS allowed Noble to raise money on the basis of its fictitious balance sheet and deceive even more investors. Noble raised $500 million from shareholders in June 2016 and a $750 million bond in March 2017. It raised billions from banks, which knowingly financed what was only an accounting illusion[120]. In the mediaeval technocracies we live in, this is how crises are solved.

[1] https://www.aresviaggi.com/viaggi/viaggio-a-singapore/

[2] https://www.millionaire.it/singapore-la-piu-grande-concentrazione-di-milionari-in-asia/

[3] https://www.longfinance.net/programmes/financial-centre-futures/global-financial-centres-index/gfci-publications/global-financial-centres-index-26/

[4] https://eu.usatoday.com/story/money/2019/07/07/richest-countries-in-the-world/39630693/

[5] https://www.channelnewsasia.com/singapore/noble-group-mas-acra-spf-penalties-2896911

[6] https://internationalfinance.com/noble-group-founder-richard-elman-resigns-company/

[7] http://edition.cnn.com/2007/BUSINESS/09/21/noble.facts/index.html

[8] https://www.risk.net/commodities/2462827/noble-group-founder-to-step-down

[9] http://edition.cnn.com/2007/BUSINESS/09/21/noble.facts/index.html

[10] https://www.forbes.com/companies/noble-group/?sh=73cabd5ea63b

[11] http://edition.cnn.com/2007/BUSINESS/09/21/noble.facts/index.html

[12] https://www.reteclima.it/crediti-di-carbonio/

[13] http://edition.cnn.com/2007/BUSINESS/09/21/noble.facts/index.html

[14] https://www.celebfamily.com/business/richard-elman-family.html

[15] http://edition.cnn.com/2007/BUSINESS/09/21/elman.biog/index.html

[17] https://www.risk.net/commodities/2462827/noble-group-founder-to-step-down

[18] http://edition.cnn.com/2007/BUSINESS/09/21/elman.biog/index.html ; https://www.celebfamily.com/business/richard-elman-family.html

[19] http://edition.cnn.com/2007/BUSINESS/09/21/boardroom.elman/

[20] http://edition.cnn.com/2007/BUSINESS/09/21/boardroom.elman/

[21] https://www.celebfamily.com/business/richard-elman-family.html

[22] http://edition.cnn.com/2007/BUSINESS/09/21/boardroom.elman/

[23] https://www.celebfamily.com/business/richard-elman-family.html

[24] http://edition.cnn.com/2007/BUSINESS/09/21/elman.biog/index.html

[25] https://www.reuters.com/article/us-noble-grp-restructuring/noble-group-to-sell-oil-liquids-unit-to-vitol-flags-1-2-billion-loss-idUSKBN1CR0ZH

[26] https://qz.com/695098/how-a-tiny-secretive-research-shop-exposed-one-of-the-worlds-biggest-commodity-traders

[27] https://www.arabnews.com/node/1182151/business-economy

[28] https://www.world-grain.com/articles/5988-noble-group-investors-approve-sale-of-noble-agri

[29] https://www.spglobal.com/marketintelligence/en/news-insights/blog/highlighting-the-top-regional-aftermarket-research-brokers-by-sector-coverage

[30] https://www.bqprime.com/amp/business/noble-group-s-2-billion-loan-deal-prompts-default-swap-question

[31] https://bondadviser.com.au/news-and-insights/market-commentary/case-study/noble-group-the-cost-of-default-risk/

[32] https://www.spglobal.com/marketintelligence/en/news-insights/blog/highlighting-the-top-regional-aftermarket-research-brokers-by-sector-coverage

[33] https://bondadviser.com.au/news-and-insights/market-commentary/case-study/noble-group-the-cost-of-default-risk/

[34] https://www.bqprime.com/amp/business/noble-group-s-2-billion-loan-deal-prompts-default-swap-question

[35] https://www.reuters.com/article/us-noble-grp-restructuring/noble-group-to-sell-oil-liquids-unit-to-vitol-flags-1-2-billion-loss-idUSKBN1CR0ZH

[36] https://www.arabnews.com/node/1182151/business-economy

[37] https://www.business-standard.com/article/reuters/fitch-lowers-noble-group-rating-says-default-appears-probable-117111700634_1.html

[38] https://iceberg-research.com/2017/11/28/open-letter-to-noble-groups-creditors/

[39] https://www.straitstimes.com/business/companies-markets/noble-group-paid-co-ceo-us20m-as-company-lost-billions

[40] https://www.straitstimes.com/business/companies-markets/noble-group-paid-co-ceo-us20m-as-company-lost-billions

[41] https://iceberg-research.com/2017/11/28/open-letter-to-noble-groups-creditors/

[42] https://hecstories.fr/en/i-exposed-a-huge-groups-fraud/

[43] https://qz.com/695098/how-a-tiny-secretive-research-shop-exposed-one-of-the-worlds-biggest-commodity-traders

[44] http://www.businessfinancenews.com/28684-citigroup-inc-a-notch-above-peers-in-commodities/

[45] https://www.bloomberg.com/news/articles/2015-03-23/noble-group-sues-former-credit-analyst-for-conspiracy-to-injure

[46] https://www.lesechos.fr/2017/07/noble-group-senfonce-dans-la-crise-177060

[47] https://www.businesstimes.com.sg/companies-markets/noble-group-braces-first-bond-default-pressure-mounts

[48] https://www.businesstimes.com.sg/companies-markets/noble-stock-sinks-ex-ceo-sues-founder-hk450m

[49] https://splash247.com/noble-restructuring-gets-crucial-shareholder-approval/

[50] https://icebergresearch.files.wordpress.com/2015/02/report-1-associates-and-agri-15022015.pdf pag. 2

[51] https://www.reuters.com/article/uk-noble-group-debt-timeline-idUKKCN1LK0H2

[52] https://icebergresearch.files.wordpress.com/2015/02/report-1-associates-and-agri-15022015.pdf pag. 2

[53] https://www.ig.com/sg/news-and-trade-ideas/shares-news/yancoal-seeks-to-object-over-restructuring-terms–noble-group-181010

[54] https://icebergresearch.files.wordpress.com/2015/02/report-1-associates-and-agri-15022015.pdf pag.2

[55] https://iceberg-research.com/2017/08/03/noble-group-is-sinking-this-saga-reveals-the-complete-failure-of-the-regulators-in-singapore/

[56] https://www.reddit.com/r/WallStreetbetsELITE/comments/qfsfv2/time_to_send_iceberg_out_to_sea_iceberg_is_a_tiny/

[57] https://www.reddit.com/r/amcstock/comments/ocm4d8/iceberg_research_director_arnaud_vagner/

[58] https://www.bloomberg.com/news/articles/2015-03-23/noble-group-sues-former-credit-analyst-for-conspiracy-to-injure

[59] https://www.reddit.com/r/amcstock/comments/ocm4d8/iceberg_research_director_arnaud_vagner/

[60] https://www.marketswiki.com/wiki/Iceberg_Research

[61] https://qz.com/695098/how-a-tiny-secretive-research-shop-exposed-one-of-the-worlds-biggest-commodity-traders

[62] https://www.bloomberg.com/news/articles/2015-03-23/noble-group-sues-former-credit-analyst-for-conspiracy-to-injure

[63] https://www.reuters.com/article/noble-group-review-idUKL3N0ZN08S20150707

[64] https://australianminingreview.com.au/news/production-payoff-for-big-spender-yancoal/

[65] https://qz.com/695098/how-a-tiny-secretive-research-shop-exposed-one-of-the-worlds-biggest-commodity-traders

[66] https://www.reuters.com/article/uk-noble-group-debt-timeline-idUKKCN1LK0H2

[67] https://qz.com/695098/how-a-tiny-secretive-research-shop-exposed-one-of-the-worlds-biggest-commodity-traders

[68] https://pro.fastmarkets.com/scoop/?id=114573&v=0&lang=en&cid=275270&type=1

[69] https://pro.fastmarkets.com/scoop/?id=114811&v=0&lang=en&cid=275652&type=1

[70] https://www.businesstimes.com.sg/companies-markets/noble-stock-sinks-ex-ceo-sues-founder-hk450m

[71] https://www.reuters.com/article/noble-ma-sinochem-idUSL4N1IO2KH

[72] https://www.bloomberg.com/news/articles/2017-06-14/ex-noble-group-ceo-alireza-sues-founder-elman-for-58-million

[73] https://www.goldmansachs.com/worldwide/italy/

[74] https://uk.linkedin.com/in/ricardo-leiman-8428657

[75] https://www.hambroperks.com/team/view/120

[76] https://qz.com/695098/how-a-tiny-secretive-research-shop-exposed-one-of-the-worlds-biggest-commodity-traders

[77] https://pro.fastmarkets.com/scoop/?id=114584&v=0&lang=en&cid=275296&type=1

[78] https://www.straitstimes.com/business/companies-markets/noble-group-ceo-yusuf-alireza-resigns

[79] https://qz.com/695098/how-a-tiny-secretive-research-shop-exposed-one-of-the-worlds-biggest-commodity-traders

[80] https://qz.com/695098/how-a-tiny-secretive-research-shop-exposed-one-of-the-worlds-biggest-commodity-traders

[81] https://www.straitstimes.com/business/companies-markets/noble-group-ceo-yusuf-alireza-resigns

[82] https://iceberg-research.com/2016/05/31/resignation-of-noble-groups-ceo-yusuf-alireza/

[83] https://www.obiettivoprofitto.it/stock-option/

[84] https://www.straitstimes.com/business/companies-markets/noble-group-ceo-yusuf-alireza-resigns

[85] https://www.prweek.com/article/1344546/noble-group-calls-bell-pottinger-crisis-comms

[86] https://iceberg-research.com/2016/05/31/resignation-of-noble-groups-ceo-yusuf-alireza/

[87] https://www.reuters.com/article/us-noble-court-idUSKBN19509Z

[88] https://www.reuters.com/article/us-noble-court-idUSKBN19509Z

[89] https://www.businesstimes.com.sg/companies-markets/noble-stock-sinks-ex-ceo-sues-founder-hk450m

[90] https://www.bloomberg.com/news/articles/2017-06-14/ex-noble-group-ceo-alireza-sues-founder-elman-for-58-million

[91] https://www.bloomberg.com/news/articles/2017-06-14/ex-noble-group-ceo-alireza-sues-founder-elman-for-58-million

[92] https://www.reuters.com/article/us-noble-court-idUSKBN19509Z

[93] https://www.businesstimes.com.sg/companies-markets/noble-stock-sinks-ex-ceo-sues-founder-hk450m

[94] https://www.mining.com/web/noble-group-shareholders-back-rescue-plan-brough-exit/

[95] https://globalinsolvency.com/headlines/noble-group-braces-first-bond-default-pressure-mounts

[96] https://www.reuters.com/article/us-noble-debt-restructuring/creditors-to-take-70-percent-of-noble-group-in-3-5-billion-debt-restructuring-idUSKBN1FI256

[97] https://www.ig.com/en/news-and-trade-ideas/shares-news/noble-group-to-apply-for-restructuring-with-bermuda-court-181211

[98] https://www.afr.com/markets/commodities/noble-group-braces-for-first-bond-default-as-pressure-mounts-20180319-h0xolp

[99] https://globalinsolvency.com/headlines/noble-group-braces-first-bond-default-pressure-mounts

[100] https://www.cnbc.com/2018/03/22/noble-group-halts-share-trading-after-bond-default.html

[101] https://internationalfinance.com/noble-group-founder-richard-elman-resigns-company/

[102] https://internationalfinance.com/noble-group-founder-richard-elman-resigns-company/

[103] https://www.mas.gov.sg/news/media-releases/2018/joint-statement-by-spf-mas-and-acra

[104] https://www.mas.gov.sg/regulation/enforcement/enforcement-actions/2022/singapore-authorities-take-actions-against-noble-group-limited-and-former-directors-of-noble-resources-international-pte-ltd

[105] https://www.consultancy.asia/news/2627/alvarez-marsal-asia-boss-jim-dubow-new-chairman-of-noble

[106] https://www.kirkland.com/news/press-release/2022/04/kirkland-represents-noble-on-restructuring

[107] https://globalrestructuringreview.com/article/noble-group-completes-its-second-restructuring

[108] https://jamaica-gleaner.com/article/business/20200909/jamaica-clears-debt-owed-alumina-partner-noble-group ; https://www.alcircle.com/news/jamaica-government-pays-off-outstanding-debt-to-alumina-partner-noble-group-58034

[109] https://www.bloomberg.com/news/articles/2022-05-31/embattled-noble-group-can-t-repay-remaining-bond-on-time

[110] https://www.consultancy.asia/news/2627/alvarez-marsal-asia-boss-jim-dubow-new-chairman-of-noble

[111] https://www.mas.gov.sg/regulation/enforcement/enforcement-actions/2022/singapore-authorities-take-actions-against-noble-group-limited-and-former-directors-of-noble-resources-international-pte-ltd

[112] https://www.gtreview.com/news/asia/singapore-regulator-under-fire-for-response-to-noble-group-scandal/

[113] https://www.mas.gov.sg/regulation/enforcement/enforcement-actions/2022/singapore-authorities-take-actions-against-noble-group-limited-and-former-directors-of-noble-resources-international-pte-ltd

[114] https://www.gtreview.com/news/asia/singapore-regulator-under-fire-for-response-to-noble-group-scandal/

[115] https://www.mas.gov.sg/regulation/enforcement/enforcement-actions/2022/singapore-authorities-take-actions-against-noble-group-limited-and-former-directors-of-noble-resources-international-pte-ltd

[116] https://www.gtreview.com/news/asia/singapore-regulator-under-fire-for-response-to-noble-group-scandal/

[117] https://theindependent.sg/why-are-there-so-many-elderly-homeless/

[118] https://www.mondaq.com/insolvencybankruptcy/1260484/americas-restructuring-review-2023

[119] https://iceberg-research.com/2022/08/29/how-singapores-regulators-have-failed-nobles-investors/

[120] https://iceberg-research.com/2017/08/03/noble-group-is-sinking-this-saga-reveals-the-complete-failure-of-the-regulators-in-singapore/

Leave a Reply