Do you want to be fashionable? Do you want to hide your savings together with those of the most powerful men on earth? Do you want somewhere exotic, with a sea view, full of sunshine? Then go to Tortola, in the Virgin Islands, and you will find the busiest tax haven on the planet.

A premise: tax havens have existed since the 1930s. However, with the globalisation of the economy, these hideaways are becoming a major concern for tax and economic policy: the number of scams increases, digitalisation makes the link between a jurisdiction and the flow of money more opaque. Most tax havens are concentrated in small archipelagos. The British Virgin Islands (BVI), in particular, are a favourite destination for organised crime, and not only to hide tax evasion[1].

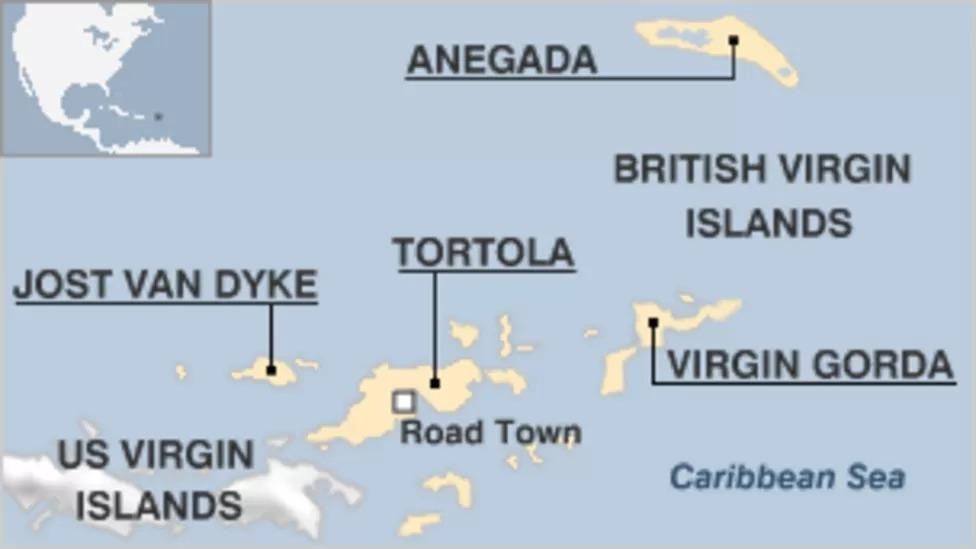

The 60 or so islands and islets, 16 of which are inhabited, are located in the Eastern Caribbean, east of Puerto Rico and northeast of the US Virgin Islands[2]. They are an overseas territory of the United Kingdom with limited sovereignty[3]. Tortola, the largest of the inhabited islands, is home to more than three quarters of its population[4]. Everyone does business here, from Chinese officials to Russian oligarchs, from big Western companies to hedge funds seeking lower taxes and secrecy. British tax havens are responsible for 29% of the $245 billion in taxes the world loses due to the concealment of profits.

Tax Justice Network ranks the BVI, the Cayman Islands and Bermuda as the top three tax abusers on the planet[5]. With the 2007 financial crisis, however, the good times are over. Rich nations now exert diplomatic pressure. NGOs, furious at the theft of hundreds of billions of pounds from poor countries, have exposed them to the press, and what was most secret slowly leaks out: SwissLeaks, the HSBC files, the Panama Papers, the Paradise Papers, all have consolidated the public perception that offshore financial centres exist to help the powerful evade their obligations to the rest of us humans, and governments must at least pretend to punish them. In May 2022, the British government voted to impose transparency on its Caribbean islands: a painful blow for offshore havens[6].

History of the Virgin Islands

The tiny but mighty British Virgin Islands[7]

The history and culture of the Virgin Islands is one, bringing together the British and American sides. Although the BVI is part of the Commonwealth, Washington’s influence is very strong, from the popularity of basketball to the official currency, the US dollar. The Islands have been inhabited since 1500 BC, but the first officially documented residents are the Arawaks, who arrived from South America in huge canoes, landing on St. Croix between 50 and 650 AD[8]. The warlike Caribs, a tribe from the Lesser Antilles, fought and drove the Arawaks away during the 15th century. The Caribbean Sea is named after them[9]. Not long after, in 1493, Christopher Columbus discovered the Virgin Islands during his second voyage to the Americas[10].

Columbus called the islands Santa Ursula y las Once Mil Virgenes (‘Saint Ursula and the Eleven Thousand Virgins’)[11]. The name comes from the number of pristine islands that reminds him of the legend of Saint Ursula. The exuberant European princess who lived in the 4th century and the 11,000 virgins who formed her army were raped and murdered by a Hun prince and his henchmen[12]. In 1555 the Habsburg Holy Roman Emperor Charles V sent a Spanish fleet to claim the islands. In 1596 most of the Caribs fled or were killed[13].

The conquerors used the islands as fishing bases[14], and it was the Dutch who established the first permanent settlement, during the mid-1600s[15]. The Dutch West India Company considered the Virgin Islands to have important strategic value, as they were roughly halfway between the Dutch colonies in South America (now Surinam) and the most important Dutch settlement in North America, New Amsterdam (New York)[16]. During the 17th century, the archipelago became a haunt for buccaneers and pirates. One of the most infamous in history, Blackbeard, settled on Tortola[17] , colonised in 1648 by the Dutch.

The inhabitants make a living from banditry. Strategically important, the islands are fought over by the French, Spanish, Dutch and British. In 1672, at the outbreak of the Third Anglo-Dutch War, England took control of the British Virgin Islands and retained possession from then on[18]. With the Treaty of Westminster of 1674, the war ended and the previous territorial conquests were restored. The treaty gave the Dutch the right to the islands but, being at war with the French, fear of their attack prevented their return.

They are never returned to the Dutch. The British, therefore, occupy the island with the claim of having discovered Tortola first[19]. The first English residents were the planters, who were granted civil government of the islands in 1773[20]. On the plantations, slave labour became essential and their presence grew year by year[21]. With the destruction of some mills by hurricanes, and after the prohibition of slavery in 1834, the sugar cane and cotton industry collapsed[22].

A Caribbean peculiarity: the colourful houses on the Main Street of Road Town, Tortola[23]

Freed slaves are forced into a forced apprenticeship, which lasts four years for domestic slaves and six years for those in the fields. They are obliged to work without pay for 45 hours a week and cannot leave without permission. However, over time some manage to accumulate small savings[24] and buy the properties in the fields[25]. In 1872 the archipelago became part of the British possessions of the Leeward Islands[26]. In 1917 the US government, worried that the Germans would use some of the islands as bases, bought them from the Danes for 25 million dollars. A large part of the population approves, happy about the promised American investment in education and health[27].

Thus the U.S. Virgin Islands (USVI) were born[28]. Meanwhile in the British Virgin Islands, dissatisfaction with the British government begins to make itself felt. The effect is contagious: by the 1930s, most USVI citizens are equally disillusioned with the United States – the expected improvements have not taken place and the islands have become a naval base with the problem of undisciplined sailors. Thanks to a visit by President Roosevelt in 1934, major improvements to the infrastructure soon took place.

In 1968, the islands gained a form of independence and the right to elect their own government. The USVI is US territory and has a seat in Congress. The islanders are US citizens and pay taxes, but cannot vote for the US President[29]. The two world wars of the 1900s distracted Britain’s attention. The people of the BVI, in 1949, have a hero, Theodolph H. Faulkner, a fisherman who arrived on Tortola with his pregnant wife. With his oratory he starts a movement against the government. At the head of 1,500 inhabitants he marches to the Commissioner’s office with the demand to know the laws and presidential policies[30]. Following the demonstrations, the Legislative Council is restored by the British government in 1950 with a new constitution, partly elected and partly appointed[31].

In 1953, the Hotel Aid Act was enacted to boost the fledgling tourism industry. Until 1958 the Territory had only 12 miles of paved roads, in the following decade the network was greatly improved, linking the West End to the East End of Tortola and joining Tortola to Beef Island with a new bridge. The Beef Island Airport (renamed Terrance B. Lettsome) was built shortly afterwards. In 1956, the Federation of Leeward Islands was abolished and became part of the BVI. Jealous of its acquired powers, in 1958 the Council refused to join the new West Indian Federation[32] in order to maintain economic ties with the US islands[33]. A move that would later be crucial in the development of offshore finance.

Since 1960, the BVI has had a true national government. A process that led to them becoming an autonomous territory in 1967, with Prime Minister Lavity Stoutt[34]. The 1960s marked the rebirth of tourism, when Laurence Rockefeller[35] , philanthropist and ecologist, built the territory’s first luxury resort and the US Virgin Islands National Park[36]. In 1977 and 1994, the constitution was amended towards independence: the British Overseas Territory Act of 2002 changed the status of the colony to that of an overseas territory and granted British citizenship to the population. A new constitution promulgated in 2007 brings greater self-government to the islands[37]. Today, almost half of the British Virgin Islands’ national income comes from tourism and its residents are among the wealthiest in the Caribbean[38].

History of the tax haven

In 2017, the BVI are responsible for global tax losses of USD 37.5 billion[39]

The islands export rum and fruit. Hundreds of thousands of tourists disembark each year from private yachts and cruise ships to bask on the white sandy beaches[40]. Entering the tiny capital Road Town, one notices the marina and the cruise ship terminal. Offices are located in modest low-rise buildings, many of which house shops on the street. Impossible to notice the gigantic offshore financial industry[41] from which more than half of the government’s revenue comes[42].

The 373,000 companies registered in the BVI administer a significant slice of global wealth. The International Monetary Fund estimates Tortola’s wealth at between $8.7 and $36 billion – a range that shows how little is known for sure. The ease of the process of setting up a company in the BVI, together with the guarantee of privacy, makes this paradise popular[43]. There are no famous banks, but it is the presence of offshore companies that brings in the money[44]. There is no fertile land for agriculture. The runway of the main airport is too short, which rules out mass tourism. In the 1980s, in order to make itself competitive, the government focuses on a mix of financial services and luxury travel, presenting itself as the ‘yachting capital of the world’.

In 1984, the International Business Companies Act was adopted[45]. The islands’ economy took off, especially after the US invasion of Panama in 1990, as a result of which much capital fleeing Hong Kong and Panama came to Tortola[46]. In 2004, the reformulation of the financial services model led to the adoption of the International Business Companies Act[47], merging ‘offshore’ and local financial activities[48]. Registration fees provide growing revenues for the government, which contracts with wealthy lawyers, consultants and accountants from around the world.

The islands prosper, and international regulators are starting to worry. Alarmed at the loss of tax revenues, they tighten the rules, and the BVIs are forced to change their tax and corporate rules. In 2016, the publication of the Panama Papers marks a turning point in public attitudes. Millions of files leaked by the law firm Mossack y Fonseca reveal information on 214,000 offshore entities, more than half of which were located in the BVIs[49]. The following year, the BVIs introduced the BOSS Act[50], a computer system requiring agents to submit the names of beneficial owners in the records of all offshore companies[51]. But the Fahie government was reluctant to introduce it[52].

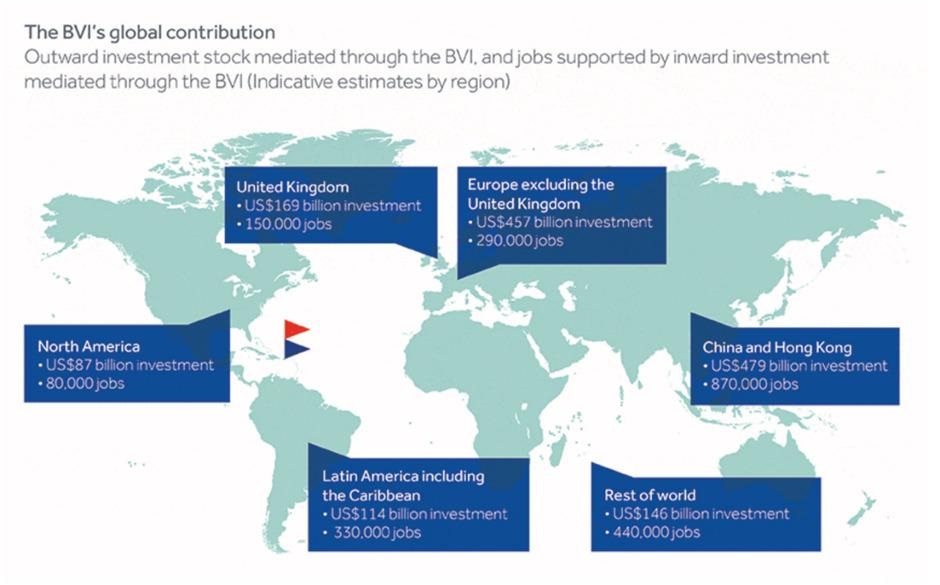

A myriad of websites have sprung up advertising the financial services of the BVIs. According to the 2017 Capital Economics report, 42% of the beneficial owners of BVI companies come from Asia, 18% from Latin America, 10% from the UK, 8% from the EU and 7% from the US and Canada. Russians account for 3%[53]. The British Virgin Islands administer $1.5 trillion in invested assets worldwide[54], which translates into 2.2 million jobs and $15 billion in tax revenues[55].

Millionaires’ yachts in Paraquita Bay, Tortola, British Virgin Islands[56]

At first London encourages this development, as it did with the Isle of Man, Jersey and the Guernsey Islands – so that less aid is paid[57]. In the BVI it is not secrecy that is important, but zero per cent taxation: no capital gains tax, gift tax, inheritance tax, sales tax or value added tax[58]. This allows for tax evasion elsewhere. The richest countries, which set the global tax standards, are actually responsible for most of the world’s tax abuses. The Corporate Tax Haven Index 2021, which ranks the countries ‘most complicit in helping multinationals pay less tax’, points the finger at six jurisdictions: the BVI, Cayman Islands, Bermuda, the Netherlands, Switzerland and Luxembourg[59].

With wealth comes corruption

The documents of oligarch Alexei Mordashov and his wife Marina Mordashova[60]

The island costs money, not least because it is defenceless against the force of nature. When Hurricane Irma struck in 2017 with 220 mph winds, five people died and more than 80 per cent of the buildings were damaged[61]. And it was in the reconstruction work that the first scandals were uncovered. After months of gossip, in 2021, shortly before leaving office as governor, Augustus Jasper, with the support of the British Foreign Office, ordered the establishment of an independent commission of enquiry[62] headed by British judge Sir Gary Hickinbottom[63].

He verifies the correctness of all government contracts[64], and learns of the state of degradation in which the archipelago finds itself[65]. The striking cases are many: £5 million disappeared in a non-existent airline[66]; the squandering for the construction of a wall around a school that cost almost a million pounds; tens of millions more for a hospital and a cruise ship pier[67]; a $40 million fund that was supposed to be used for families struggling with Covid, actually distributed among local politicians[68]. But it is not only the public service that is delinquent, it is organised crime that worries the citizens: in November 2020, more than 3.6 tonnes of cocaine were found in the house of a police officer[69], with a market value of $250 million[70], more than the annual GDP of the BVI. It is a sign that something is wrong, and has become part of the system.

1201 companies are identified as being involved in 237 cases of corruption and money laundering – of these, 1107 (92%) are registered in the BVI[71]. Prime Minister Andrew Fahie says: ‘It is regrettable that the former governor has made some unfounded allegations against the islands that can damage our reputation. (…) We call on the former governor to apologise”[72]. A lie, and everyone knows it.

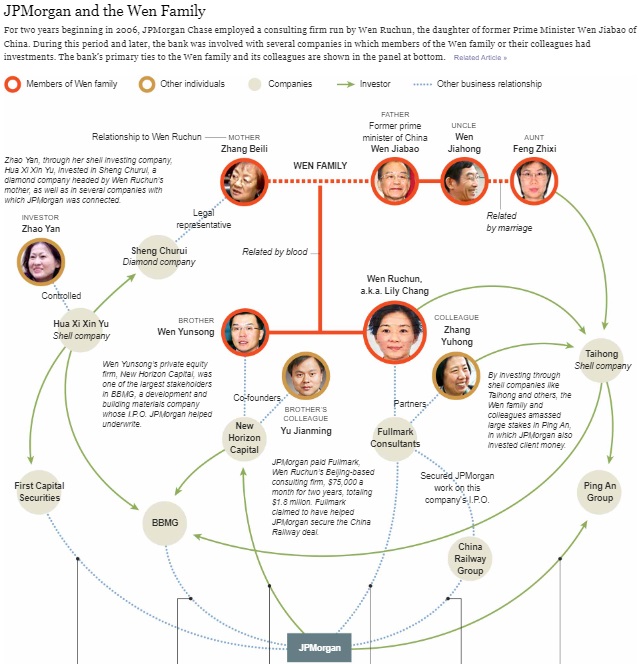

Since 2014, thanks to the journalistic investigation Offshore Leaks, it has been discovered that the eldest daughter of the late Philippine dictator, Ferdinand Marcos, is the beneficiary of a USD 5 billion fund that her father accumulated through corruption[73]. PricewaterhouseCoopers, UBS and other Western banks and audit firms play key roles as intermediaries in helping Chinese clients set up trusts and companies in the BVI, Samoa and other offshore centres. Swiss financial giant Credit Suisse is helping the son of former Prime Minister Wen Jiabao set up his own company in the BVI[74].

The documents include details of a BVI company 50% owned by President Xi’s brother-in-law Deng Jiagui[75]. Wen Jiabao’s son, Wen Yunsong, set up a company registered in the BVI, Trend Gold Consultants, with the help of Credit Suisse’s Hong Kong office in 2006[76]. The uncovered files also shed light on the BVI’s role in a scandal involving Wen Jiabao’s daughter, Wen Ruchun, also known as Lily Chang[77]. The New York Times reports that JPMorgan Chase & Co. paid a company she managed, Fullmark Consultants, $1.8 million in consulting fees[78]. Her husband Liu Chunhang, a former Morgan Stanley finance guru, created Fullmark Consultants in the BVI in 2004 and was the company’s sole director and shareholder until 2006, the same year he accepted a government position with the agency that regulates China’s banking sector. Liu Chunhang transferred control of the company to a friend of the Wen family, Zhang Yuhong, a wealthy businesswoman and colleague of Wen Jiabao’s brother. The Times reported that Zhang also helped control other Wen family assets, including diamond and jewellery companies[79].

The graph with the entanglements between JPMorgan and the Wen family[80]

In 2015, the Swissleaks investigation shows that HSBC Private Bank in Switzerland helps clients set up shell companies in Panama and the BVI in order to avoid certain European taxes, especially the EU Savings Directive, a withholding tax introduced in 2005. HSBC allegedly hid more than EUR 5.7 billion in tax havens for French clients alone. Many of those with Swiss bank accounts further protected their identity by using the name of a BVI company instead of their own[81]. Tortola is the jurisdiction chosen by clients of the Panama law firm Mossack y Fonseca, to which the islands have granted a licence despite knowing that it does not comply with legal obligations[82].

Mossack y Fonseca has established more than 113,000 companies in the BVI, exceeding the figure registered in Panama[83]. Clients include former Ukrainian Prime Minister Yulia Tymoshenko, Alaa Mubarak (son of former Egyptian President Hosni Mubarak) and Gennady Timchenko, under sanctions for providing financial support to Vladimir Putin[84]. The BVI was also in the spotlight in 2017 when millions of documents from the law firm Appleby (the so-called Paradise Papers) were disclosed, linking the firm to money laundering and terrorist financing[85].

The ‘register of politically exposed persons’ of the Paradise Papers contains more than 150 politicians and businessmen from all over the world, including China, Russia and Greece[86]. In 2018, the US Department of Justice states that BVI companies were also used by North Korea to circumvent sanctions[87]. In 2020, the BVIs feature prominently in the ‘FinCen Files’ leaks, in which $2 trillion of dirty money flowed freely through major international banks. The scandal involves more than 2500 leaked documents that banks sent to the Financial Crimes Enforcement Network (FinCen) between 2000 and 2017[88].

In this case, at least 20% of the reports contain a customer with an address in the BVI[89]. Some of the international banks named in the scandal are Barclays Bank of London, Deutsche Bank and Bank of New York Mellon[90]. In many cases, the banks conduct transactions but do not even know the holders of these accounts. Among them is a UK company, NoviRex Sales, which claims to be in the household appliances business: the owners of the company are two BVI companies, which own thousands of other companies in the UK. That is, it is a trust company that makes payments of hundreds of thousands of dollars (perhaps for strange purchases, such as underwear) to different customers, but always using the same corporate funnel[91].

Under investigation: Ukrainian oligarchs Andriy Klyuyev, Viktor Yanukovych (top), Yulia Tymoshenko, Rinat Akhmetov (top), Serhiy Kurchenko, Yuriy Ivanyushchenko (top) and Ihor Kolomoisky[92]

The FinCen Files leak also reveals that famous Ukrainian oligarchs and politicians moved dirty money, aided by international banks. Leaked documents show that Deutsche Bank transferred $240 million from December 2015 to May 2016 to a shell company registered in the BVI that is controlled by Ihor Kolomoisky and one of his associates. Kolomoisky, a powerful Ukrainian oligarch and former associate of President Volodymyr Zelensky, has been controlled for years by the Ukrainian and American secret services: in 2016 he embezzled $5.5 billion from his PrivatBank customer accounts, and when the fraud was discovered, the state nationalised the bank[93].

In March 2022, with sanctions imposed by the West in response to the war in Ukraine, many Russian tycoons diverted their capital abroad. The sanctions imposed by the EU and the UK against Aleksej Mordashov, one of the world’s richest industrialists, forced him to resign from the board of TUI and sell his 34% stake[94]. TUI is the German conglomerate that runs airlines, hotels and travel agencies around the world. Mordashov, whose fortune is estimated at $29 billion, is also the majority shareholder and chairman of Severstal, one of the world’s largest steel companies, and is an indirect shareholder of Rossiya Bank, described by the US government as ‘the personal bank for senior officials of the Russian Federation’, including Putin’s inner circle[95].

In 2014, the bank was blacklisted by the US after the Russian annexation of Crimea. Unifirm, TUI’s shareholder, transferred its 4.1% stake to Mordashov’s conglomerate Severgroup. At the same time, the Russian investor transferred ownership of its Unifirm group to a British Virgin Islands company called Ondero, which then became a 29.9% shareholder in TUI. The stake is valued at around $1.4 billion. Ondero Ltd., turned out to be owned by another British Virgin Islands entity, Ranel Assets Ltd., itself owned by Marina Mordashova, the mother of the Russian tycoon’s children[96].

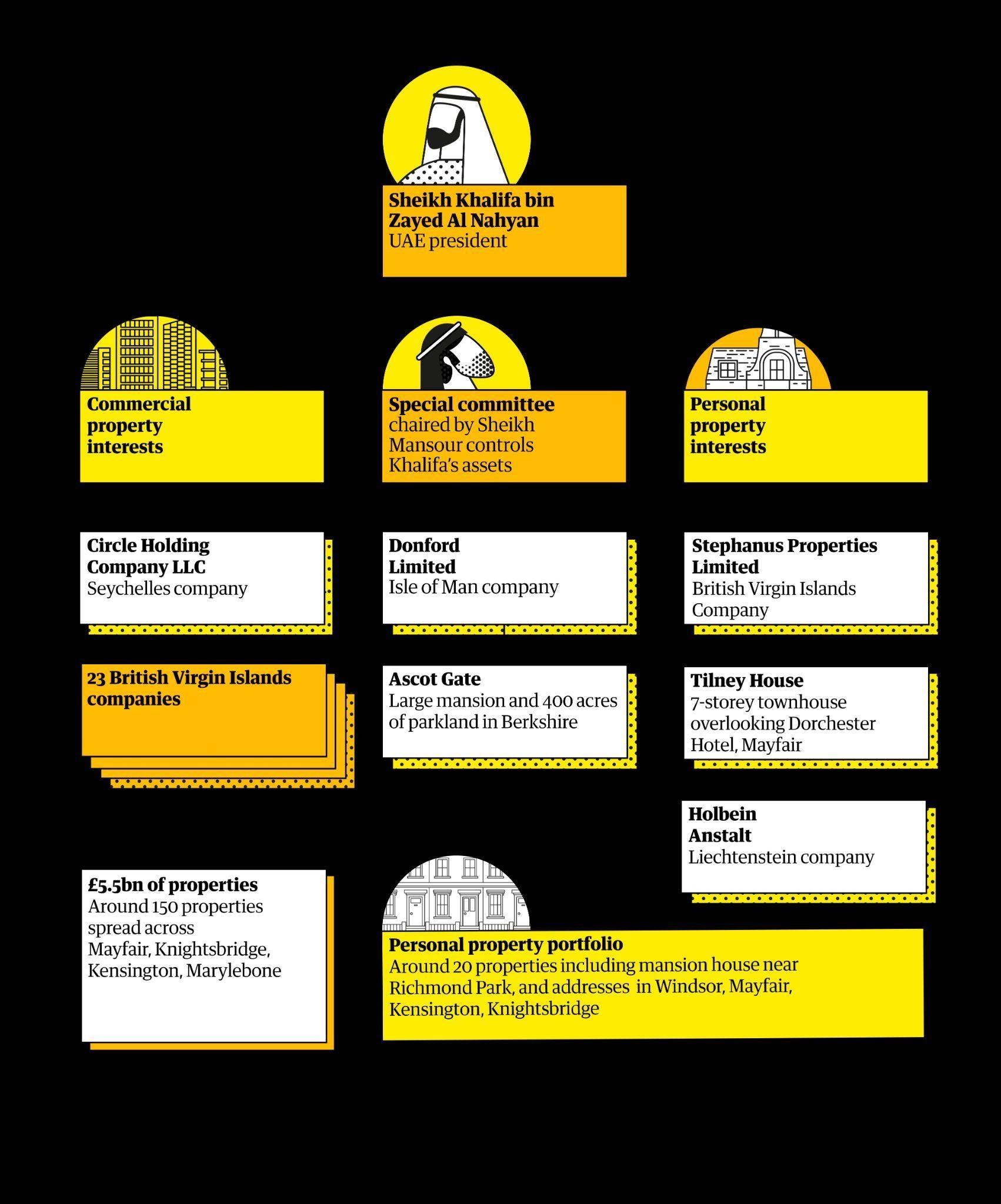

For decades, the identity of the owner of dozens of properties in London’s most expensive neighbourhoods was a jealously guarded secret. The properties, managed by a company owned by the Abu Dhabi-based investment fund ADFG, are part of a secret £5.5 billion real estate empire of one of the world’s richest heads of state[97], Sheikh Khalifa bin Zayed Al Nahyan[98] , former president of the United Arab Emirates and Emir of Abu Dhabi, who died in May 2022. Business was conducted secretly through a constellation of companies in the British Virgin Islands, run by a small army of discreet intermediaries including lawyers from elite British firms such as Eversheds and Fox Williams[99].

Sheikh Khalifa bin Zayed Al Nahyan, President of the United Arab Emirates, was one of the richest property owners in London[100]

In April 2022 a new scandal[101]: BVI Premier Andrew Fahie is arrested in the US[102] on charges of drug trafficking and money laundering[103]. Joining him in jail are senior port official Oleanvine Maynard and his son Kadeem Stephan Maynard[104]. Credit goes to the US Drug Enforcement Agency (DEA) officials in Florida who posed as cocaine traffickers. The trio was charged with conspiracy to import more than 5 kg of cocaine into the US and conspiracy to launder money[105].

Fahie demanded his immediate release, claiming diplomatic immunity from arrest and detention. But Christopher Malcolm, former Attorney General, said the Constitution does not describe the BVIs as a separate state. He added: “BVI leaders have no diplomatic status or passport”[106]. Fahie agreed to a $700,000 bribe to allow traffickers to use the ports to transport thousands of kilograms of cocaine from Colombia through Tortola[107]. The agents pretended to be cocaine traffickers from the Mexican Sinaloa cartel[108]. The largest supplier of drugs to the US market, which was formerly run by drug kingpin Joaquín ‘El Chapo’ Guzmán, now in prison[109].

The enquiry into corruption in the islands, published by Governor John Rankin, calls for the BVI constitution to be suspended and for the islands to be returned to direct UK control[110]. It also recommends a review of government welfare payments, the sale of public land and law enforcement in the islands[111], but the proposal is opposed by BVI politicians. The Organisation of the Seven Eastern Caribbean States issued a firm warning against the request: ‘Direct colonial rule is ill-advised and the history of such impositions in the Caribbean has never led to the desired results’[112].

The then British Foreign Secretary Amanda Milling[113] decided to give the BVI an opportunity to ‘demonstrate its commitment to reform’[114] and will allow a new administration to implement it in the next two years. She justified the decision with the progress made including the removal of Fahie from his role and the creation of a new government of national unity, which has launched criminal investigations. But he added: ‘If it becomes clear that this approach will not lead to the reform that the people of the BVI want and deserve, we will take action[115].

The former Prime Minister Andrew Fahie[116]

What these measures might be, it is hard to tell. The UK also promotes tax evasion in Belfast, in Guernsey, Man and Jersey, in Gibraltar, everywhere. To close only Tortola is ridiculous. The solution of direct control of London reveals how little thought there is in the UK. Sovereignty was the banner that drove the Brexit campaign, but when it comes to accepting the sovereignty of others, as in Scotland and Northern Ireland, Britain is refractory. It is undeniable that a change in governance structures is needed in the Virgin Islands, but the change must come from an independent state. Corruption is not a new problem in the Islands, quite the contrary. In small jurisdictions, anywhere in the world, where everyone knows each other, political power becomes a family affair. In short: nothing changes for the time being. London is full of dogs that bark and, therefore, do not bite.

[1] https://www.transparency.org.uk/british-virgin-islands-corruption-money-laundering-inquiry-latest-news

[2] https://www.offshore-protection.com/bvi-british-virgin-islands-tax-havens

[3] https://commonslibrary.parliament.uk/research-briefings/cbp-9538/

[4] https://www.bbc.com/news/world-latin-america-20211990

[5] https://www.reuters.com/business/finance/british-treasure-island-tax-havens-face-tempest-2021-06-07/

[6] https://www.theguardian.com/news/2018/jul/12/nevis-how-the-worlds-most-secretive-offshore-haven-refuses-to-clean-up

[7] https://www.bbc.com/news/world-latin-america-20211990

[8] https://web.archive.org/web/20070928094414/http://dg.ian.com/index.jsp?cid=54918&action=viewLocation&formId=105392

[9] http://www.bvi.gov.vg/content/our-history

[10] https://www.britannica.com/topic/Carib

[11] https://www.britannica.com/place/British-Virgin-Islands/Government-and-society

[12] https://web.archive.org/web/20070928094414/http://dg.ian.com/index.jsp?cid=54918&action=viewLocation&formId=105392

[13] https://www.britannica.com/place/British-Virgin-Islands/Government-and-society

[14] http://www.bvi.gov.vg/content/our-history

[15] https://www.iexplore.com/articles/travel-guides/caribbean/british-virgin-islands/history-and-culture

[16] http://www.bvi.gov.vg/content/our-history

[17] https://www.iexplore.com/articles/travel-guides/caribbean/british-virgin-islands/history-and-culture

[18] http://www.bvi.gov.vg/content/our-history

[19] http://www.bvi.gov.vg/content/our-history

[20] https://www.britannica.com/place/British-Virgin-Islands/Government-and-society

[21] http://www.bvi.gov.vg/content/our-history

[22] https://web.archive.org/web/20070928094414/http://dg.ian.com/index.jsp?cid=54918&action=viewLocation&formId=105392

[23] https://www.pinterest.de/pin/several-historical-landmarks-line-road-towns-main-street-including-the-mid19th-century-post-office-the-georgianstyle-britann–666884657307912167/

[24] http://www.bvi.gov.vg/content/our-history

[25] https://www.iexplore.com/articles/travel-guides/caribbean/british-virgin-islands/history-and-culture

[26] https://www.bbc.com/news/world-latin-america-20211990

[27] https://web.archive.org/web/20070928094414/http://dg.ian.com/index.jsp?cid=54918&action=viewLocation&formId=105392

[28] https://www.visitusvi.com/

[29] https://web.archive.org/web/20070928094414/http://dg.ian.com/index.jsp?cid=54918&action=viewLocation&formId=105392

[30] https://www.virginislandsnewsonline.com/en/news/theodolph-h-faulkner-unsung-protagonist-of-1949-great-march

[31] https://www.britannica.com/place/British-Virgin-Islands/Government-and-society

[32] http://www.bvi.gov.vg/content/our-history

[33] https://www.britannica.com/place/British-Virgin-Islands/Government-and-society

[34] http://www.bvi.gov.vg/content/our-history

[35] https://www.iexplore.com/articles/travel-guides/caribbean/british-virgin-islands/history-and-culture

[36] https://www.isoleverginiusa.it/curiosita/personaggi-famosi/laurance-rockefeller/

[37] https://www.britannica.com/place/British-Virgin-Islands/Government-and-society

[38] https://www.iexplore.com/articles/travel-guides/caribbean/british-virgin-islands/history-and-culture

[39] https://bviglobalimpact.com/global-contribution

[40] https://www.theguardian.com/world/2021/jan/25/british-virgin-islands-at-a-crossroads-as-outgoing-governor-decries-corruption

[41] https://www.ft.com/content/9f102a51-24a5-444e-b2a7-9de6749fbc75

[42] https://www.theguardian.com/world/2021/jan/25/british-virgin-islands-at-a-crossroads-as-outgoing-governor-decries-corruption

[43] https://www.ft.com/content/9f102a51-24a5-444e-b2a7-9de6749fbc75

[44] https://tfiglobalnews.com/2021/12/25/infamous-tax-havens-british-virgin-islands/

[45] https://www.ft.com/content/16b4c5a8-55ba-11e7-9fed-c19e2700005f?mhq5j=e3

[46] https://www.ft.com/content/9f102a51-24a5-444e-b2a7-9de6749fbc75

[47] https://www.harneys.com/insights/amendments-to-the-bvi-business-companies-act-2004/ ; https://www.offshore-protection.com/bvi-company-formation

[48] https://www.offshore-protection.com/bvi-company-formation

[49] https://www.icij.org/investigations/panama-papers/

[50] https://www.ft.com/content/9f102a51-24a5-444e-b2a7-9de6749fbc75

[51] https://www.offshore-protection.com/bvi-company-formation

[52] https://www.theguardian.com/world/2022/may/03/caribbean-states-warn-against-direct-rule-of-british-virgin-islands

[53] https://www.ft.com/content/9f102a51-24a5-444e-b2a7-9de6749fbc75

[54] https://www.ft.com/content/16b4c5a8-55ba-11e7-9fed-c19e2700005f?mhq5j=e3

[55] https://bviglobalimpact.com/global-contribution

[56] https://www.theguardian.com/world/2021/jan/25/british-virgin-islands-at-a-crossroads-as-outgoing-governor-decries-corruption

[57] https://taxjustice.net/2017/06/21/bvi-blagging-venal-income/

[58] https://www.tetraconsultants.com/blog/is-bvi-a-tax-haven-top-5-things-to-know/

[59] https://www.icij.org/inside-icij/2021/03/wealthy-countries-that-set-global-tax-rules-are-biggest-enablers-of-corporate-tax-abuse-report-finds/

[60] https://www.icij.org/investigations/russia-archive/pandora-papers-shed-light-on-1-4-billion-russian-sanctions-mystery/

[61] https://www.ft.com/content/9f102a51-24a5-444e-b2a7-9de6749fbc75

[62] https://researchbriefings.files.parliament.uk/documents/CBP-9538/CBP-9538.pdf pag.9

[63] https://news.sky.com/story/british-virgin-islands-should-have-constitution-suspended-says-corruption-report-raising-prospect-of-rule-from-london-12601859

[64] https://www.virginislandsnewsonline.com/en/news/gus-strikes-back-announces-commission-of-inquiry-aimed-elected-govt/

[65] https://www.bbc.com/news/uk-politics-55709515

[66] https://www.nevispages.com/british-virgin-islands-corruption-inquiry-launched/

[67] https://www.theguardian.com/world/2021/jan/25/british-virgin-islands-at-a-crossroads-as-outgoing-governor-decries-corruption

[68] https://news.sky.com/story/british-virgin-islands-inquiry-into-claims-of-corruption-and-political-interference-all-with-the-public-purse-12191823

[69] https://www.theguardian.com/world/2022/may/03/caribbean-states-warn-against-direct-rule-of-british-virgin-islands

[70] https://bvi.gov.vg/media-centre/statement-governor-augustus-jaspert-security-update

[71] https://www.transparency.org.uk/british-virgin-islands-corruption-money-laundering-inquiry-latest-news

[72] https://www.ft.com/content/9f102a51-24a5-444e-b2a7-9de6749fbc75

[73] https://www.icij.org/investigations/fincen-files/notorious-tax-haven-british-virgin-islands-to-introduce-public-register-of-company-owners/

[74] https://www.icij.org/investigations/offshore/leaked-records-reveal-offshore-holdings-of-chinas-elite/

[75] https://www.documentcloud.org/documents/1006058-excellence-effort-property-development-limited.html

[76] https://www.icij.org/investigations/offshore/leaked-records-reveal-offshore-holdings-of-chinas-elite/

[77] https://www.theguardian.com/world/2014/jan/22/china-haven-british-virgin-islands

[78] https://archive.nytimes.com/dealbook.nytimes.com/2013/11/13/a-banks-fruitful-ties-to-a-member-of-chinas-elite/

[79] https://www.icij.org/investigations/offshore/leaked-records-reveal-offshore-holdings-of-chinas-elite/

[80] https://archive.nytimes.com/www.nytimes.com/interactive/2013/11/14/business/dealbook/JPMorgan-and-the-Wen-Family.html

[81] https://www.lemonde.fr/en/archives/article/2022/03/14/swissleaks-the-backstory-of-a-worldwide-investigation_5978499_113.html

[82] https://www.theguardian.com/news/2016/apr/04/british-virgin-islands-failed-to-crack-down-on-mossack-fonseca-panama-papers

[83] https://www.icij.org/investigations/fincen-files/notorious-tax-haven-british-virgin-islands-to-introduce-public-register-of-company-owners/

[84] https://www.theguardian.com/news/2016/apr/04/british-virgin-islands-failed-to-crack-down-on-mossack-fonseca-panama-papers

[85] https://www.theguardian.com/news/2017/nov/07/paradise-papers-appleby-criticised-failures-terrorist-financing-rules-bermuda

[86] https://www.bbc.com/news/business-41878881

[87] https://www.theguardian.com/world/2020/oct/01/british-virgin-islands-commits-public-register-beneficial-owners-tax-haven

[88] https://bvinews.com/fincen-files-bvi-named-in-global-financial-scandal/

[89] https://www.internationalinvestment.net/news/4020740/bvi-named-fincen-files-leaks

[90] https://bvinews.com/fincen-files-bvi-named-in-global-financial-scandal/

[91] https://www.internationalinvestment.net/news/4020740/bvi-named-fincen-files-leaks

[92] https://www.kyivpost.com/post/7894

[93] https://www.kyivpost.com/ukraine-politics/fincen-files-leak-of-banks-secret-documents-exposes-ukrainians-in-dirty-money-moves.html

[94] https://www.theguardian.com/business/2022/mar/16/alexei-mordashov-russia-richest-man-may-have-avoided-freeze-on-1bn-tui-shares

[95] https://www.theguardian.com/business/2022/mar/16/alexei-mordashov-russia-richest-man-may-have-avoided-freeze-on-1bn-tui-shares

[96] https://www.icij.org/investigations/russia-archive/pandora-papers-shed-light-on-1-4-billion-russian-sanctions-mystery/

[97] https://www.theguardian.com/uk-news/ng-interactive/2020/oct/18/revealed-sheikh-khalifas-5bn-london-property-empire

[98] https://www.britannica.com/biography/Sheikh-Khalifa-ibn-Zayed-Al-Nahyan

[99] https://www.theguardian.com/uk-news/ng-interactive/2020/oct/18/revealed-sheikh-khalifas-5bn-london-property-empire

[100] https://www.theguardian.com/uk-news/ng-interactive/2020/oct/18/revealed-sheikh-khalifas-5bn-london-property-empire

[101] https://www.cityam.com/british-virgin-islands-fight-off-corruption-uk-must-learn-our-help-can-hurt/

[102] https://researchbriefings.files.parliament.uk/documents/CBP-9538/CBP-9538.pdf pag. 11

[103] https://www.reuters.com/world/uk/british-virgin-islands-ex-premier-fahie-pleads-not-guilty-drug-charges-2022-05-25/

[104] https://www.nytimes.com/2022/04/28/us/british-virgin-islands-premier-arrested.html

[105] https://www.bbc.com/news/uk-61266526

[106] https://www.theguardian.com/world/2022/may/03/caribbean-states-warn-against-direct-rule-of-british-virgin-islands

[107] https://www.nytimes.com/2022/04/28/us/british-virgin-islands-premier-arrested.html

[108] https://www.bbc.com/news/uk-61266526

[109] https://www.bbc.com/news/world-us-canada-49022208

[110] https://news.sky.com/story/british-virgin-islands-should-have-constitution-suspended-says-corruption-report-raising-prospect-of-rule-from-london-12601859

[111] https://www.bbc.com/news/uk-61736373

[112] https://www.theguardian.com/world/2022/may/03/caribbean-states-warn-against-direct-rule-of-british-virgin-islands

[113] https://www.gov.uk/government/people/amanda-milling

[114] https://researchbriefings.files.parliament.uk/documents/CBP-9538/CBP-9538.pdf pag. 14

[115] https://www.bbc.com/news/uk-61736373

[116] https://www.reuters.com/world/uk/british-virgin-islands-ex-premier-fahie-pleads-not-guilty-drug-charges-2022-05-25/

Leave a Reply