As the Latins and American Indians used to say, it is the name that forges destiny, and Evergrande’s name seems to have been made for the group that was aiming to be the largest construction industry in the history of mankind. It is a western name for westerners, founded by businessman Hui Ka Yan (in Cantonese), known as Xu Jiayin (in Mandarin Chinese)[1]. A man with years of experience and big dreams, he started out by trading rice, straw and coal from one village to another in his home province of Henan, where he was born in 1958, the son of a soldier who had been away for years in the war against Japan[2]. After his teenage years, when he was already working, Xu attended college in the city of Wuhan and graduated in 1982. In order to earn the money he needed to start his career, he worked in a steel mill in addition to continuing his trade[3]. Truly a man who came from nothing thanks only to his tenacity and intelligence.

In the 1990s, just a few years after the Tiananmen Square massacre and during the first phase of China’s great economic expansion under Deng Xiaoping, Xu focused on the huge shortage of homes for China’s rising middle class and, in 1996, founded a small real estate development company in Guangzhou, the Hengda Group[4], with himself and a few employees: just in time to ride the wave of China’s great real estate boom of the 2000s. In just 13 years, after changing the name of the small Hengda to Evergrande and moving its fiscal headquarters to the Cayman Islands, Xu raised more than $720 million in 2009 by listing his property company on the Hong Kong stock exchange[5].

But Evergrande’s main source of funding is the banks. When the company went public, we were in the midst of the crisis triggered by the collapse of Lehman Brothers. Frightened, Chinese banks were directing their investments and loans to the domestic market and, in particular, to the high yields of a young, booming real estate company. Xu enjoys important political contacts, which facilitate his access to credit[6]. He is a member of the Political Consultative Conference, an elite group of advisers close to the top echelons of power[7], so much so that the brother of Prime Minister Wen Jiabao (in office from 2003 to 2013) became a director of Evergrande in 2001 and bought 16% of the group’s shares[8].

The birth of an empire

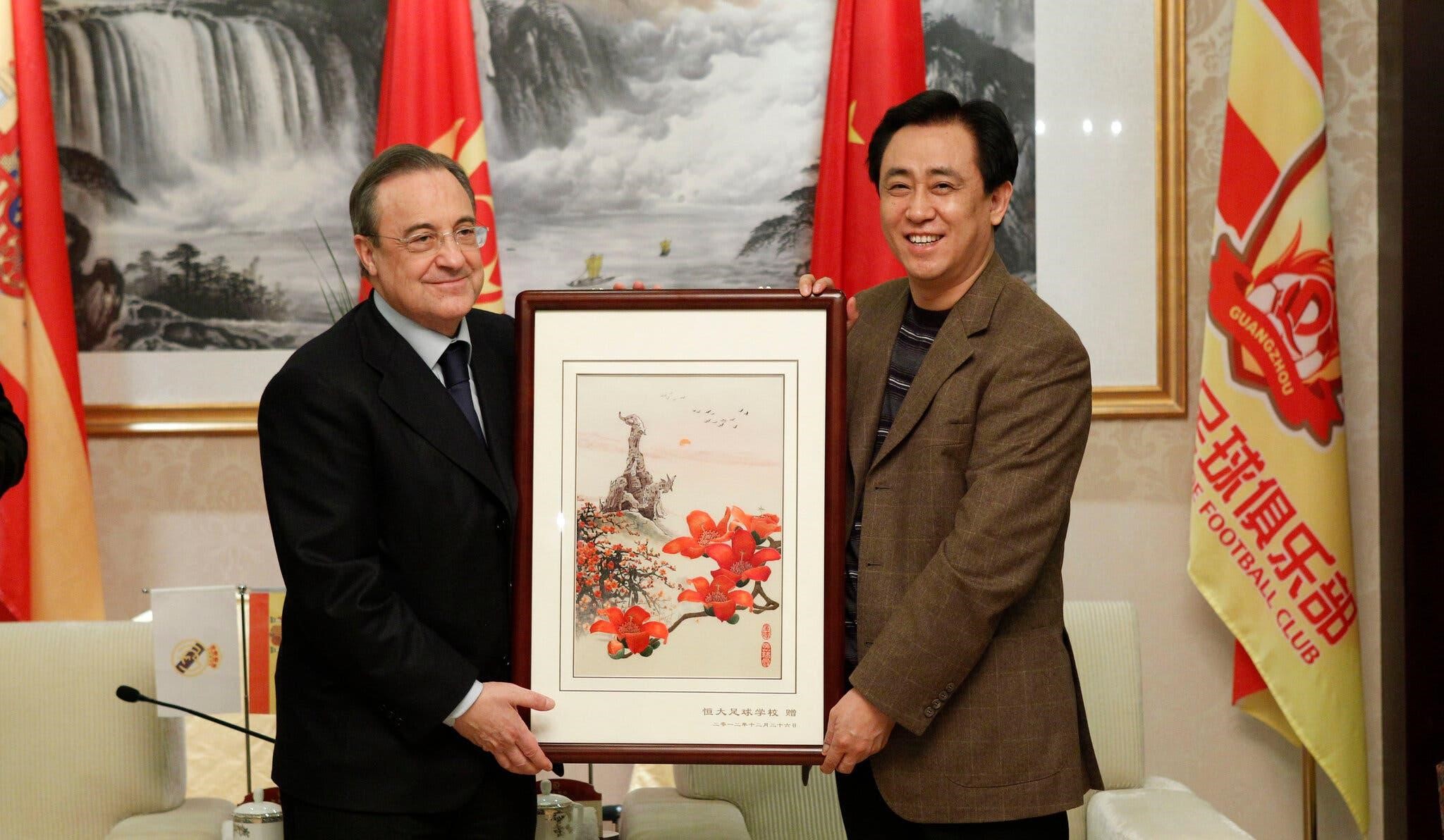

Mr Xu with Florentino Pérez, the president of Real Madrid, in 2012. Evergrande once owned China’s top professional football club[9]

The figures are impressive: with 125,000 employees and an exponentially growing turnover, in the second decade of the century Evergrande is one of the largest real estate companies in China and one of the two thousand largest companies in the world[10]. Financial expansion has brought with it a tumultuous diversification: Evergrande manufactures cars, administers homes, is a giant in the entertainment, tourism, healthcare, technology, finance and sports industries, builds more than 1300 construction sites in more than 280 Chinese cities and partners with more than 860 well-known companies worldwide[11]. It is part of a triad of new Chinese giants, with the nickname Wan Heng Bi, alongside the two real estate giants Vanke and Country Garden[12].

The focus is on innovation, but also on the widest possible range of consumers, making products available also to those with less economic strength, as has been requested for years by the party leadership, which needs to considerably broaden the base of the new bourgeoisie, in order to be able to reinvest in wealth the enormous surplus that the banks have created in foreign currencies thanks to the glittering success of Chinese exports in the last quarter of a century[13].

But not all promises are broken. In 2009 Evergrande New Energy Automobile offered a range of new electric or semi-electric vehicles, highly advanced in chassis architecture, powertrain, battery power, electronics and other details – at extremely low prices that brought this branch of the business a turnover of 74 billion euros from orders alone[14]. Today, after most of the targets have been missed, the company has lost the equivalent of $741 million and is worth only $6.5 billion[15].

The tourism branch functions thanks to the ‘Evergrande Children’s World’[16] amusement park and the artificial ‘China Hainan Sea Flower Island’[17], which is one of the company’s cultural tourist attractions. which is one of the world’s most popular cultural tourist attractions. In the healthcare sector, the Chinese group is targeting the wealthiest retirees (with success) with the Evergrande Health Care Valley and the Boao Evergrande International Hospital in Hainan [18]. Guoheng Smart Energy Service, founded at the same time as State Grid Corporation of China, develops new products for energy infrastructures and the management of the network of smart energy services, so it does not yet give appreciable results, while the food branch, despite the millions spent on advertising campaigns[19], closed its doors in 2016 with a final loss of 4 billion yuan[20].

But it is with football that Evergrande has gained worldwide attention, first by buying the Guangzhou Evergrande Football Club, which won the Asian Cup in 2013 and 2015, managed in co-ownership with the Chinese e-commerce giant, Alibaba[21] , then by building, in April 2020, the immense Guangzhou Evergrande Football Stadium in the village of Xi, near Canton [22]. When Evergrande’s very serious problems became known, its shareholders also got into serious trouble: among them, with over two billion dollars in losses, is the Suning group, which is the current owner of Inter Milan[23] .

The long wave of China’s socio-economic programme

The President of the People’s Republic of China, Xi Jinping, proclaims himself a communist, but advocates a policy of extending the wealth of the Chinese and the emergence of a large middle-class base[24]

The People’s Bank of China, as of 15 December, reduced the proportion of bank deposits to be held as reserves by 0.5%, to an average of 8.4%, to encourage banks to lend more to assets[25]. There was a similar reduction in reserves in July and this is in contrast to Western countries: the reduction in reserves, which are known as the required reserve ratio (RRR), will distribute 1.2 trillion yuan throughout the economy[26].

The reason for this is the slowdown in construction growth and a GDP that grew by 4.9% in the third quarter of 2021, following +7.9% in the second quarter. The exponential growth of the Chinese economy was already in decline before the pandemic: from a peak of 15% in 2007, it fell to 6% in the first quarter of 2019[27] . This growth is based on four pillars: construction, infrastructure, exports and domestic consumption. The real estate sector is worth around 27% of GDP and is in trouble: due to the collapse of Evergrande, prices of new homes are plummeting and construction of new properties is slowing down[28] .

The central bank’s strategy is to plug Evergrande’s debt hole to avoid a contagion effect on related companies[29]. Thus, one of the main objectives for 2022 will be to resume at any cost the race towards “shared prosperity”, both in material and cultural terms, with a reduction in the gap between regions, urban and rural areas – to achieve which the government is working on three main fronts: reducing housing costs, increasing household income and giving the population more opportunities to create wealth[30]. In practice, China wants to do what the western world is trying to do: put a limit to the power of tech companies (Facebook, Google, Apple, Amazon, Tencent, Alibaba, etc.) and focus on small and medium-sized enterprises specialising in niche markets: a project called “crackdown”, which involves a series of laws, controls and bans that slow down the race of these giants[31].

One example: the ‘shared welfare’ programme costs Alibaba $15 billion. China’s leading e-commerce giant has responded to President Xi Jinping’s call for redistribution and has earmarked 100 billion yuan ($15.5 billion) for middle class wealth rebalancing programmes. The news about the e-commerce giant immediately went around the world: the resources will be disbursed by 2025, and will serve SMEs and the development of rural areas[32]. One by one, China’s big tech companies are following suit: Tencent and Pinduoduo have also lined up to contribute to Xi Jinping’s new strategy, providing $15 billion and $1.3 billion respectively[33].

All this is not an impromptu decision, but the result of a 30-year-long process that began in 1992 when, during a visit to southern China, Deng Xiaoping realised that China had to focus on developing the coastal regions and then help the central and western regions. It was only after a decade of growth that the Tenth Five-Year Plan (2001-2005) began to work on reducing misery, and up to the Thirteenth Five-Year Plan (2016-20), China had built a society that overcame the most brutal misery: now it is the turn to take a quantum leap and bring all Chinese people the prosperity we Westerners know[34]. Thanks to huge investments, but also thanks to one of the great successes of the Xi Jinping era: the achievement of technological independence[35].

The most important outcome of the Lianghui[36] (the annual parliamentary meetings in Beijing during which legislators and advisors review annual targets[37]) in March 2021, is the launch of the 14th Five-Year Plan[38] . Its central theme is the so-called ‘dual circulation strategy’: a stronger role for domestic demand in driving growth and, at the same time, attracting foreign investment and technology by opening China’s financial markets[39] . Over the next five years, research spending will outstrip GDP growth – but it is rural policies that are the real litmus test of the whole ‘dual circulation’: the value of the digital economy is to increase from 7.8% in 2020 to 10% in 2025, and the tax deduction for research costs of manufacturing companies is to be increased by 100%[40]. China plans to set up a number of national laboratories in fields such as quantum physics, photonics, micro-nano technologies, artificial intelligence, innovative energy sources and the prevention and control of infectious diseases[41].

The hall where the Lianghui Assembly meets to assess the results of the five-year plans and prepare the new ones[42]

One of the central nodes is that of maintaining technological independence, to be supported by favouring the entry into China of foreign companies and the granting of visas for specialised foreign technicians[43]. Not only to make more money, but to radically and quickly combat China’s serious pollution[44]. But it is not enough. It is not enough to have exceeded 1.90 dollars a day in almost the entire territory (the minimum calculated by the World Bank to define the state of poverty) and to have reached an annual net income per capita of 14,617 yuan (1881 euro) in the countryside and 39,251 yuan (5071 euro) in the city: in order to win the bet of the “dual circulation”, it is necessary to turn the rural population into an army of consumers and it has therefore been decided to include the project of “rural revitalisation” in the new five-year plan[45].

We need to redistribute wealth, facilitate internal mobility and further encourage the transfer of people from the countryside to the cities, seeking a solution to the hukou system[46], introduced in the 3rd century BC, which for over 800 years has forced farmers to live and die where they were born[47]. Taxes must be increased on luxury products and those that require large amounts of energy or pollution for their production, and decreased on essential products.

The situation is so serious that some cities are often closed because of excessive air and water poisoning, and factories are forced to suspend production until levels have fallen[48]. In all industries, according to the government’s plans, it is no longer enough to exercise wage dumping and reduce costs as much as possible, at the expense of the population’s well-being and the damage to the ecosystem. Today, those who want to get rich in China must do so by consuming less energy, stopping polluting, paying their employees better, offering them spaces of time and freedom to take pleasure in life, and thus supporting the growth of the domestic consumer market[49].

What to do about Evergrande?

The monstrous anthills built by Evergrande[50]

According to economists, China’s property market bubble began with the 2008 financial crisis, when the government decided to support the economy with a different measure from those adopted by Western governments: injecting a lot of liquidity into the economy and lowering the cost of loans, to encourage investment and protect employment. This led to an explosion in property speculation and the birth of so-called ghost cities: huge anthills that have never been inhabited or are underused. The Economist estimates[51] that one fifth of all housing in China is empty[52].

This is how Evergrande swelled, committing a sin of vanity: it expanded far beyond its core business and spent billions on football, building a stadium and hiring the coach of Italy’s 2006 World Cup champion, Marcello Lippi[53] . The main branch, construction, puts Evergrande in second place for square metres built: in 2020 the group’s revenue amounted to 507.2 billion yuan (66.8 billion euros), and the founder is one of the top five Chinese businessmen, with assets of around 34 billion dollars[54].

Lauded by the Chinese Communist Party as one of the entrepreneurs who have contributed most to the fight against poverty, the group’s colossal debt, estimated at 2,000 billion yuan (262.6 billion euros)[55], is a source of concern. This is something that worries everyone, starting with Xi Jinping, who warned in 2017 that he did not like the speculative bubble that was keeping Evergrande afloat: “houses are made for living in, not for speculation,” he said[56]. In the summer of 2020, the People’s Bank of China changed the guidelines of the national regulatory system for the construction sector: a maximum debt-to-asset ratio of 70%, a debt-to-equity ratio ceiling of 100% and liquidity at least equal to short-term debts – all conditions that Evergrande would never, ever be able to meet[57]. With these three ‘red lines’ in place, Evergrande’s moment of truth came[58].

The management tried to sell. It tried to lower its housing costs by 14%. It put some of its companies on the market. It tried to sell the electric car business to Xiaomi. No dice: on 13 September 2021 Evergrande announced that it was in a severe liquidity crisis and that the outlook for sales was negative for the coming months: the cap had been popped[59].

The company has unpaid invoices for over 300 billion dollars and has failed to repay bonds to foreign investors, sending the whole world into a panic: is China running into the same disaster experienced by the United States in 2008 with the collapse of Lehmann Brothers? The government is in crisis: if it saves Evergrande, it risks sending a message of impunity to those who do not respect the rules; if it does not, 1.6 million buyers, waiting for unfinished flats, and hundreds of small businesses, creditors and banks will lose all their money[60].

Beijing decided not to intervene and feverishly tried to avert a domino effect. The central bank has reduced the amount of reserves that banks are obliged to keep on deposit at the central bank, a way of increasing liquidity and lending capacity, and has injected the equivalent in yuan of 166 billion euros of cash into the system[61]. In October, Forbes warned that Fantasia Holdings, another property developer, had defaulted on a $206m bond payment. Another company, Sunshine 100, said it could not honour a $170m bond. China Ayouan Property Group said it was unsure whether it could meet a $651.2 million bond. Even more worrying is the case of Kaisa Group Holdings, which is negotiating to extend $400m maturities and is at risk of default[62].

Xu Jiayin, Evergrande’s founder, in 2009. The company has almost 800 unfinished projects across China[63]

To try to cover its losses, Evergrande used billions of dollars from small investors and its own employees: it put enormous pressure on workers to buy their employer’s financial products, exposing itself to a real tragedy[64]. The greatest danger is posed by the hundreds of thousands of people who, with their life savings, have made a down payment on a house that Evergrande generally completes through bank loans or the issue of bonds, often in foreign currency – money that is no longer there[65] . All in vain: the money borrowed under false pretences is not enough to close the loophole created by years of mounting debt[66].

On 9 December 2021, the Fitch rating agency rated Evergrande as ‘DR’, or restricted default[67]. Evergrande is, in fact, in default, but has not yet started the procedure, so it is like a burning ship sailing blindly into a port. The Chinese government prohibits creditors from taking legal action[68], but this only applies to the Chinese: the bulk of the $82.5 million loan that Evergrande was due to repay on 9 December is owed to foreign individuals and companies[69]. Xu Jatin announced he was selling personal assets worth $1.1 billion, including houses and private jets – nothing compared to the more than $300 billion hole[70].

It was the Zhang family that avoided bankruptcy by taking out a loan of around 2.6 billion euros through Suning, and announces that it will wait for its debt to be repaid – but Suning is already close to collapse, and this loan is nothing more than a creative accounting measure to create fictitious assets: a move that Beijing has never liked, and which now risks attracting a further 3 billion euros in debt due to the new regulations of the state economy[71].

The domino effect began: Fitch declared a “restricted default” also for the Kaisa group, which had not repaid a $400 million bond. The bonds of the two groups account for 15% of all foreign currency bonds issued by Chinese real estate companies. Among the holders of Evergrande bonds are giants such as Blackrock, UBS, Allianz, Ashmore, HSBC, Pictet and, albeit for derisory amounts, the Italian Fideuram and Mediobanca[72]. Junk bonds, which will have to be booked as net losses, since Beijing is unlikely to reimburse foreign bondholders[73]. But all the Chinese billionaires have lost money: according to the Bloomberg Billionaires Index, this amounts to $46 billion[74].

The markets do not believe in Evergrande’s salvation, and they know that its bankruptcy, in addition to creating an army of 200,000 people out of work, would jeopardise the entire Chinese economy. Traders no longer believe in the prospects of debt restructuring either. The banks have turned their backs on the Chinese group[75]. The fear is growing, because Evergrande is not the only Chinese construction industry overwhelmed by a liquidity crisis: overall, the sector owes $19.8 billion in offshore debt alone and only for the first quarter of 2022[76].

Despite the fact that on 1 January chairman Xu Jayin said he was “optimistic” about the future, claiming that 91.7% of the blocked construction sites had been reopened, that 89,000 people had resumed work and that 53,000 homes[77] had been delivered in the fourth quarter, the Chinese stock exchange halted trading in Evergrande’s shares: the order to demolish 39 buildings in Hainan province, issued because building permits were obtained illegally – an order that also turns the futuristic Ocean Flower project, the resort built on islands off Hainan, into rubble[78].

Summary table of 2021 balance sheet losses of the heads of major Chinese industrial groups[79]

In short: we are at the epilogue. Will Xi Jinping save Evergrande? Will the president find a way to reduce the damage to the middle class, which is already suffering from the pandemic and the economic slowdown[80]? Is it possible that Evergrande’s collapse is a sign that there are dozens of large companies throughout China in a similar condition[81]? The dangers of contagion are low for the West, since the vast majority of Evergrande’s debt is with a single Chinese bank, which, moreover, belongs to the State[82].

Then there are the political repercussions. Elections for the Chinese Communist Party congress will be held in the autumn of 2022. Although Xi Jinping’s reappointment seems a foregone conclusion at the moment, the authorities want to rule out any possibility of the party’s infallibility being questioned by people angry about a financial crisis[83]. Since the economic neo-liberalism that China has arrived at with astonishing rapidity has taken central control of the economy away from President Xi Jinping, he is now motivating all his decisions with the alleged priority of restoring that control.

Asian modernisation, particularly in China, has surprised us in the West. They are now first in renewables, telecommunications, advanced technologies and artificial intelligence[84], but now, for the first time, they are showing the flaws associated with the very fast growth of the system, the symbols of which are certainly the very high rate of pollution, the pandemic (which comes from China), the failure of the lending policy encouraged over the last 20 years by the central government. Xi Jinping had promised prosperity, but now risks going down in history as the man who, having failed to learn his lesson about Western capitalism and its endemic weaknesses, repeated 140 years later the collective collapse that Europe experienced at the end of the 19th century, when the big German banks, one after the other, swept away by the first great property bubble, went bankrupt, throwing an entire population into misery and despair. In addition to reading Machiavelli, the Chinese leader should also have read Giambattista Vico.

[1] https://www.affaritaliani.it/economia/evergrande-chi-e-xu-jiayin-il-magnate-che-nacque-sotto-un-tetto-di-paglia-760523.html

[2] Guo Hongwen; Xu Yahui, “恒大许家印 “, Taiwan Strait Publishing, Beijing 2017; https://sports.qq.com/a/20131106/012443_all.htm

[3] https://www.epochtimes.it/news/la-storia-del-fondatore-di-evergrande-e-cosa-significa-per-il-futuro-dellazienda/

[4] https://www.companieshistory.com/evergrande-group/

[5] Guo Hongwen; Xu Yahui, “恒大许家印 “, Taiwan Strait Publishing, Beijing 2017, p. 56; https://www.bfmtv.com/immobilier/international-etranger/comment-xu-jiayin-a-bati-en-chine-evergrande-un-empire-immobilier-aujourd-hui-au-bord-du-gouffre_AD-202109130083.html

[6] https://www.askanews.it/economia-estera/2021/09/22/evergrande-ecco-come-%c3%a8-nata-la-crisi-che-fa-tremare-i-mercati-pn_20210922_00027/

[7] https://www.nytimes.com/article/evergrande-debt-crisis.html

[8] https://www.affaritaliani.it/economia/evergrande-chi-e-xu-jiayin-il-magnate-che-nacque-sotto-un-tetto-di-paglia-760523.html

[9] https://www.nytimes.com/article/evergrande-debt-crisis.html?

[10] https://www.companieshistory.com/evergrande-group/

[11] https://www.companieshistory.com/evergrande-group/

[12] https://www.sanmarco.capital/blog/la-questione-cinese/

[13] https://www.tuttocina.it/Mondo_cinese/124/124_dall.htm

[14] https://www.companieshistory.com/evergrande-group/

[15] https://therealdeal.com/2021/08/29/property-wing-of-worlds-most-indebted-developer-posts-rare-earnings-loss/

[16] https://blooloop.com/theme-park/news/evergrande-childrens-world-china/

[17] http://www.l-a-v-a.net/projects/hainan-ocean-flower-resort/?locale=en_US

[18] https://www.companieshistory.com/evergrande-group/ ; https://www.sanmarco.capital/blog/la-questione-cinese/

[19] https://www.companieshistory.com/evergrande-group/

[20] https://www.sanmarco.capital/blog/la-questione-cinese/

[21] https://www.companieshistory.com/evergrande-group/

[22] https://www.sanmarco.capital/blog/la-questione-cinese/

[23] https://www.youtube.com/watch?v=NlwJWkKF3ac ; https://www.fcinternews.it/copertina/evergrande-evita-il-default-pagati-835-mln-di-dollari-anche-suning-respira/ ; https://www.fcinter1908.it/primo-piano/evergrande-cina-apre-al-salvataggio-pubblico/

[24] http://tesi.luiss.it/24378/1/081772_MANZONI_DAVIDE.pdf ; https://www.lantidiplomatico.it/dettnews-in_cina_la_linea_di_xi_jinping_viaggia_ad_una_velocit_superiore/38601_43345/ ; https://www.econopoly.ilsole24ore.com/2018/12/30/rivoluzione-cina-deng-xiaoping-xi-capitalismo/?refresh_ce=1 ; https://www.dagospia.com/rubrica-3/politica/xi-jinping-bunker-ndash-presidente-cinese-non-esce-cinea-288053.htm

[25] https://ilcaffegeopolitico.net/936558/leconomia-cinese-si-affaccia-al-2022

[26] https://ilcaffegeopolitico.net/936558/leconomia-cinese-si-affaccia-al-2022

[27] https://ilcaffegeopolitico.net/936558/leconomia-cinese-si-affaccia-al-2022

[28] https://ilcaffegeopolitico.net/936558/leconomia-cinese-si-affaccia-al-2022

[29] https://www.nytimes.com/article/evergrande-debt-crisis.html

[30] https://ilcaffegeopolitico.net/936558/leconomia-cinese-si-affaccia-al-2022

[31] https://www.econopoly.ilsole24ore.com/2021/11/01/cina-evergrande-xi-india

[32] https://www.orafinanza.it/it/alibaba-15-5-miliardi-di-dollari-per-la-prosperita-comune

[33] https://www.orafinanza.it/it/alibaba-15-5-miliardi-di-dollari-per-la-prosperita-comune

[34] https://www.ilsole24ore.com/art/la-cina-prossimi-cinque-anni-piu-autosufficienza-economica-e-tecnologica-ADfnLEz

[35] https://merics.org/en/short-analysis/chinas-14th-five-year-plan-strengthening-domestic-base-become-superpower ; https://www.fujian.gov.cn/english/news/202108/t20210809_5665713.htm

[36] https://www.ilfattoquotidiano.it/2021/03/14/la-cina-disegna-il-suo-futuro-dei-prossimi-5-anni-il-pilastro-del-mercato-interno-prosperita-comunista-e-indipendenza-tecnologica/6131996/

[37] https://www.straitstimes.com/asia/east-asia/two-sessions-or-lianghui-chinas-biggest-political-gathering-in-a-nutshell

[38] https://www.ilfattoquotidiano.it/2021/03/14/la-cina-disegna-il-suo-futuro-dei-prossimi-5-anni-il-pilastro-del-mercato-interno-prosperita-comunista-e-indipendenza-tecnologica/6131996/

[39] https://www.bluerating.com/mercati/175933/cina-la-nuova-strategia-della-doppia-circolazione

[40] https://merics.org/en/short-analysis/chinas-14th-five-year-plan-strengthening-domestic-base-become-superpower ; https://www.fujian.gov.cn/english/news/202108/t20210809_5665713.htm

[41] https://www.ilfattoquotidiano.it/2021/03/14/la-cina-disegna-il-suo-futuro-dei-prossimi-5-anni-il-pilastro-del-mercato-interno-prosperita-comunista-e-indipendenza-tecnologica/6131996/

[42] https://www.scmp.com/topics/two-sessions-2021-lianghui

[43] https://merics.org/en/short-analysis/chinas-14th-five-year-plan-strengthening-domestic-base-become-superpower ; https://www.fujian.gov.cn/english/news/202108/t20210809_5665713.htm

[44] https://merics.org/en/short-analysis/chinas-14th-five-year-plan-strengthening-domestic-base-become-superpower ; https://www.fujian.gov.cn/english/news/202108/t20210809_5665713.htm

[45] https://www.ilfattoquotidiano.it/2021/03/14/la-cina-disegna-il-suo-futuro-dei-prossimi-5-anni-il-pilastro-del-mercato-interno-prosperita-comunista-e-indipendenza-tecnologica/6131996/

[46] https://emplus.egeaonline.it/it/140/china-watching/1195/la-svolta-di-pechino-e-la-strategia-della

[47] https://www.china-files.com/lhukou-e-il-controllo-sociale/

[48] https://www.pambianconews.com/2021/11/21/la-cina-perde-il-suo-slancio-e-le-nuove-politiche-economiche-fanno-tremare-il-lusso-334898/

[49] https://merics.org/en/short-analysis/chinas-14th-five-year-plan-strengthening-domestic-base-become-superpower ; https://www.fujian.gov.cn/english/news/202108/t20210809_5665713.htm

[50] https://www.businessinsider.com/what-is-evergrande-china-real-estate-giant-scale-perspective-2021-9?r=US&IR=T

[51] https://www.economist.com/finance-and-economics/2021/01/25/can-chinas-long-property-boom-hold

[52] https://www.ilpost.it/2021/02/14/cina-bolla-immobiliare-crisi/

[53] https://www.the-afc.com/en/club/afc_champions_league/news/former_china_pr_guangzhou_evergrande_boss_lippi_announces_retirement_from_coaching.html

[54] https://hurun.com.au/hurun-china-rich-list-2020 ; https://www.hurun.net/en-US/Info/Detail?num=LWAS8B997XUP

[55] https://economictimes.indiatimes.com/markets/stocks/news/evergrande-explained-one-off-crisis-or-chinas-version-of-lehman-bros/articleshow/86363903.cms?from=mdr

[56] https://www.askanews.it/economia-estera/2021/09/22/evergrande-ecco-come-%c3%a8-nata-la-crisi-che-fa-tremare-i-mercati-pn_20210922_00027/

[57] https://www.idealista.it/news/2021/09/22/155754-evergrande-ecco-come-nata-la-crisi-che-fa-tremare-i-mercati

[58] https://www.askanews.it/economia-estera/2021/09/22/evergrande-ecco-come-%c3%a8-nata-la-crisi-che-fa-tremare-i-mercati-pn_20210922_00027/

[59] https://www.idealista.it/news/2021/09/22/155754-evergrande-ecco-come-nata-la-crisi-che-fa-tremare-i-mercati

[60] https://www.nytimes.cohttpsm/2021/09/28/business/china-evergrande-econ

[61] https://www.idealista.it/news/2021/09/22/155754-evergrande-ecco-come-nata-la-crisi-che-fa-tremare-i-mercati

[62] https://forbes.it/2021/12/06/evergrande-rischio-default-titolo-minimi-11-anni/

[63]https://www.nytimes.com/article/evergrande-debt-crisis.html

[64] https://www.huffingtonpost.it/entry/evergrande-ha-truffato-risparmiatori-e-dipendenti-con-lo-stesso-schema-delle-banche-venete_it_6149abace4b077b735ea5ed4

[65] https://forbes.it/2021/09/21/evergrande-perche-non-nuova-lehman-brothers/

[66] https://www.huffingtonpost.it/entry/evergrande-ha-truffato-risparmiatori-e-dipendenti-con-lo-stesso-schema-delle-banche-venete_it_6149abace4b077b735ea5ed4

[67] https://www.ilfattoquotidiano.it/2021/12/09/evergrande-lagenzia-di-rating-fitch-ufficializza-il-default-pechino-lavora-per-scongiurare-un-effetto-domino/6420180/

[68] https://www.nytimes.com/article/evergrande-debt-crisis.html

[69] https://www.ilfattoquotidiano.it/2021/12/09/evergrande-lagenzia-di-rating-fitch-ufficializza-il-default-pechino-lavora-per-scongiurare-un-effetto-domino/6420180/

[70] https://forbes.it/2021/12/06/evergrande-rischio-default-titolo-minimi-11-anni/

[71] https://www.fanpage.it/sport/calcio/perche-linter-e-coinvolta-nel-default-di-evergrande-suning-ha-bruciato-quasi-3-miliardi-di-euro/

[72] https://www.ilfattoquotidiano.it/2021/12/09/evergrande-lagenzia-di-rating-fitch-ufficializza-il-default-pechino-lavora-per-scongiurare-un-effetto-domino/6420180/

[73] https://www.lastampa.it/topnews/economia-finanza/2021/09/22/news/evergrande-ecco-la-lista-che-fa-tremare-i-colossi-1.40727113/

[74] https://www.bnnbloomberg.ca/chinese-property-tycoons-lose-46-billion-evergrande-update-1.1697212

[75] https://www.quotedbusiness.com/thm-21-corporate/paese-18-cina/art-8135-evergrande-ui-la-nuova-lehman-brothers-cinese

[76] https://www.finanzaonline.com/notizie/sospensione-in-borsa-e-ordine-di-demolizione-di-39-edifici-inizio-danno-choc-per-evergrande/

[77] https://it.investing.com/news/stock-market-news/evergrande-sospesa-dal-trading-in-arrivo-informazioni-interne-2034336

[78] https://www.finanzaonline.com/notizie/sospensione-in-borsa-e-ordine-di-demolizione-di-39-edifici-inizio-danno-choc-per-evergrande/

[79] https://www.bnnbloomberg.ca/chinese-property-tycoons-lose-46-billion-evergrande-update-1.1697212

[80] https://forbes.it/2021/09/21/evergrande-perche-non-nuova-lehman-brothers/

[81] https://www.econopoly.ilsole24ore.com/2021/11/01/cina-evergrande-xi-india/

[82] https://www.sanmarco.capital/blog/la-questione-cinese/

[83] https://www.econopoly.ilsole24ore.com/2021/11/01/cina-evergrande-xi-india/

[84] https://www.cina.ws/la-cina-diventa-seconda-potenza-economia-del-mondo.html

Leave a Reply