We at IBI World have avoided, as far as possible, talking about the Russian invasion of Ukraine. Whatever is said, we are talking in circles, because we do not know the truth about anything: neither about the military actions, nor about what triggered them (although experience teaches us that, in Moscow as in Washington, one wages war abroad when one is unable to deal with problems at home), nor about who the enemy is (given the effects, it is to be feared that the European Union will be directly implicated), nor even about the real effects that the war has brought with it: a global rearmament process, the energy crisis, the collapse of cereal supplies to developing countries, the burial of the timid environmentalist policy to which governments around the world had sworn allegiance over the past decade.

What we know for sure is that the prices of hydrocarbons, and consequently of electricity, have exceeded the threshold of costs that European families can afford without falling into poverty and need – and this is causing a dangerous recession throughout the European Union[1]. Economic sanctions have so far enriched many countries (including the United States and Russia) and hit developing countries and the European Union hard[2] – the real losers in this war. Not only that. We know that, this winter, we will still have problems heating our cities and refuelling our cars, not least because the OPEC countries have decided to decrease oil production, instead of increasing it, as the United States had demanded[3], because Saudi Arabia, the Arab Emirates and various enemies of Washington finally see a chance to take revenge for almost a century of stars-and-stripes arrogance[4].

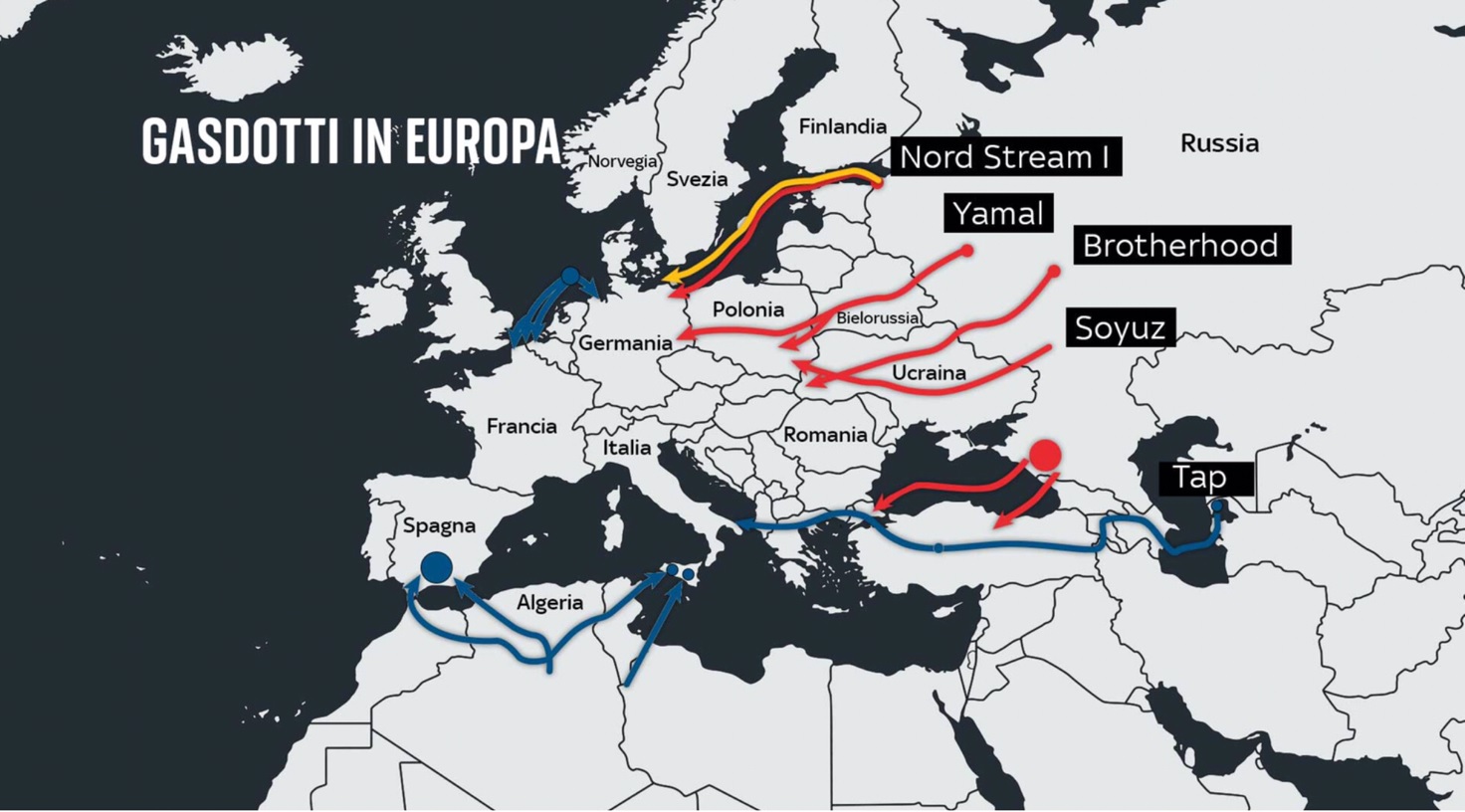

Europe is left alone, caught between the Atlantic alliance and dependence on Russian gas, to hastily search for an alternative. Not least because the Russians are not standing idly by, and after several reductions in supplies there are now suspicious incidents at the submarine pipelines connecting St. Petersburg to Germany. The European Union is crushed by NATO’s wishes, and the individual EU countries decide in no particular order, jeopardising even the survival of a united Europe.

The conflict between Washington and Brussels

Despite the agreements made with Russia 30 years ago, this is how NATO is expanding[5]

The blitzkrieg invasion of Ukraine has failed, this is there for all to see. The conflict has turned into a war of trenches: the military, the diplomatic, but above all the economic and industrial. NATO’s strategy has been to impose economic sanctions on Russia – a decision that has split Western public opinion, so that, today, we do not know for sure whether the sanctions are making the Putin regime so difficult that it will implode or force the Russian president to withdraw militarily. Rather, one gets the impression that Russia, on the blood-covered poker table, is willing to do anything not to lose.

For now, the consequence we are experiencing on our skin is the need for a plan to progressively disengage European countries from Russian gas: something that pleases first and foremost the Americans, who considered us too friendly towards the Russian government. It is no mystery to anyone that, for decades, the interests of the EU and NATO have been deeply divergent[6]. This is what Russia has been banking on, entering into convenient multi-year supply agreements with EU countries, financing joint gas pipeline construction projects, and planning oil pipelines that do not cross Ukraine, a country that is increasingly close to NATO and, therefore, a danger to Russia because of its strategic location.

It is no mystery that Gorbachev agreed to German reunification in exchange for a promise (unfortunately not sealed by a written agreement) that the United States would never incorporate the satellites of the USSR into NATO – an agreement blatantly betrayed[7], given that the borders of the Atlantic Alliance, today, reach as far as Russia[8] – all accessions, like the very recent one of North Macedonia[9], which the local governments justified with the shower of money and infrastructure contracts guaranteed by the West[10], and which Washington wanted in order to prevent NATO’s extension, in time, becoming smaller than that of the European Union.

For Washington, today as in 1944, we Europeans are nations of limited sovereignty, and must remain so. Something that Putin, by invading Ukraine, has perhaps miscalculated, because he is forcing us Europeans to choose between Moscow and Washington, and over a hundred years of history make it clear that we will choose the United States, and that we do not trust the Russians. Therefore, the real losers in the war fought between Russians and Americans in Ukraine are we Europeans, who have no gas with which to heat ourselves and no oil with which to fuel our cars. At the same time, in Brussels, those who lead the Union have made an even more fatal mistake: believing that European money for Russian gas was so existential as to force Putin to change policy.

The unresolved problem in Brussels is that of the inability to make autonomous decisions and, it seems, very few steps have been taken to solve it – such as the contract signed on 22 January 2019 by Angela Merkel and Emmanuel Macron in Aachen, a bilateral treaty that obliges France and Germany to take joint diplomatic, political, military and economic decisions, including vis-à-vis the European Union, with a view to achieving total independence from the United States[11]. In this context, the debate on the possible common European army has also been heated: should it include NATO countries or just the EU? Even EU countries with openly Eurosceptic governments? Even though the Americans have repeatedly stated that they do not agree[12]?

Again, Putin’s decision to invade Ukraine, and the resulting fear of the European peoples, does not help us to emancipate ourselves. That is why, today, in Brussels, as in every European capital, people are reacting in panic to the winter energy shortage, and are wondering whether to reactivate coal-fired power stations or even take the decision to invest in nuclear energy again. As for renewables: sure, we would like them, but in the situation we are in, who can really think of diverting resources away from covering the emergency in order to really venture an investment?

The sabotage of Nordstream

Nord Stream, gas from the pipeline[13]

On 26 September 2022, due to violent explosions, methane pipelines 90 metres deep in the Danish waters of the Baltic Sea began poisoning the surrounding waters[14]. It is difficult to know who is to blame: the sabotage is in the interests of the Russians (who thus further strangle the gas-needy European Union[15]) and the United States (which has always seen that pipeline as a threat to its power in Europe)[16]. But there are also other countries that benefit from this sabotage, and we have no convincing data to argue that anyone is to blame. What can easily be said, however, is that the disaster only and only affects the countries of the European Union.

On the first of October this year, the stop of Russian gas also came for Italy: the incoming flows at Tarvisio, the point of entry of supplies between Friuli and Austria, suddenly came to zero, as ENI announced: ‘Gazprom has communicated that it cannot confirm the delivery of the gas volumes requested for today due to the declared impossibility of transporting the gas through Austria. Today, therefore, Russian gas flows destined for ENI through the Tarvisio entry point will be nil’[17]. It is thought to be a retaliation against Italian support for Ukraine, but according to ENI’s first communiqué the problems are between Russia and Austria, and are mainly of a technical nature[18]. Only later will it be possible to understand that the problem was a 20 million Euro guarantee and the uncertainty as to who was to answer for it – a problem that was resolved in a few days[19], but one that makes it clear how precarious the certainty of supply is for the Mediterranean countries.

An important part of the conflict therefore concerns a long-standing economic issue: oil supplies are calculated in dollars, and this underpins the value of the American currency – something the Russians reject, demanding payment in roubles, and which now also finds the agreement of the OPEC+ countries (thirteen countries including Iran, Kuwait, Saudi Arabia, Venezuela and Russia): They decide on a production cut of two million barrels per day, which will further increase prices and, according to Washington, favours Moscow, which, despite selling less gas, makes the same gains as before the war[20]. President Biden therefore asked Congress to approve an increase in domestic oil production that would allow prices to be rebalanced[21]. A necessary measure, because the agreement made in September by the G7 weights on the ceiling for Russian oil prices will come too late[22].

The G7 agreement provides for a series of measures to limit the price of Russian oil exports in order to reduce the Kremlin’s ability to finance its war in Ukraine and protect consumers from soaring energy costs, a measure to which Moscow has responded by threatening to stop selling crude oil to countries that approve the restrictions[23]. According to the agreement reached, purchases will only be allowed if Russian oil costs a price equal to or less than that ‘determined by the broad coalition of adhering countries’[24] and comes into force on 5 December[25]: the governments of the G7 countries have requested the unanimous approval of all EU member states[26].

Confusion reigns supreme, because no one can influence the possible agreements of countries like India and China, which deal with Russia and not with the G7, and which will set prices and quantities independently, and international trading companies based in Switzerland, Singapore or elsewhere, and which are therefore not affected by the measures[27]. Not only that: there is nothing to prevent G7 countries from buying oil at a higher price from a non-Russian seller who, in turn, may have bought it from Moscow, circumventing the G7 measures. But the agreement remains. As German Finance Minister Christian Lindner explained, the price cap on Russian oil exports is designed to ‘curb the rise in global energy prices’ and ‘reduce global inflation’[28]. But this is a house of cards, because the required unanimity of the European Union has not been achieved, at least for the time being[29], given the open opposition of Hungary and Cyprus[30].

An oil tanker flying a Marshall Islands flag but loaded with Russian oil, anchored in the North Sea – in Amsterdam, dock workers refuse to unload it[31]

Enforcing the ban is theoretically possible thanks to the fact that 95% of the world’s shipping insurance contracts are concentrated in London, but even this piece risks finding ways to be circumvented, as China[32] and India[33] are doing, and soon all the others will do[34]. And in the meantime, as the International Energy Agency explains, ‘despite Russia’s declining oil export volumes, June export revenues increased by $700 million compared to May, thanks to higher prices due to the war in Ukraine’[35].

If the sanctions, as announced, become a total embargo on Russian hydrocarbons, oil could skyrocket to prices above $140 per barrel: it has fluctuated for years between $40 and $60 and then, after a few months of madness due to the global crisis of 2008, it fluctuated between $60 and $80 per barrel[36]. What was supposed to be a signal of G7 unity to the world turned out to be a sign of its inherent weakness, because those who do not adhere to G7 decisions already buy at a price below USD 100 per barrel, and have no intention of stopping[37] , not least because the Russian oil industry earns enough even if it sells oil at less than USD 40 per barrel, and can therefore drop in price again, if politically useful[38].

Not only that: nobody knows what Vladimir Putin will do, and if he decides to reduce exports further, this will lead to a collapse of the entire European industrial and welfare system in a few months[39]. The three main branches of energy consumption (industry, heating and road traffic) each use slightly less than 30 per cent of oil and gas[40], while electricity consumption by industry is slightly higher[41]. If all this is reduced by even 10%, and this is not passed on to households and the commercial system, this automatically means a decrease in industrial production and thus in the gross domestic product, with a significant increase in unemployment figures.

The tragic mistakes of European governments

30 September 2022: meeting of the Council of the European Union in Brussels[42]

On 30 September 2022, the EU Council meeting in Brussels ended in a deadlock. The introduction of the cap on the price of hydrocarbons was not even discussed, which forces each individual country to make individual choices[43]. The German government wants to spend EUR 200 billion, increasing the national public debt, in order to compensate the market price with the price bearable by private citizens, the commercial system and – above all – industry[44].

Countries that are already in debt up to their necks, such as Italy, Greece and Portugal, are proposing the compulsory reduction of electricity demand, the introduction of a limit on the revenues of electricity companies, and a solidarity contribution from fossil fuel producers – all of which we do not know whether or not they will be applicable[45]. In any case, this solution creates, within the European Union, an illegitimate advantage of companies operating in Germany in comparison to those operating in countries where those EUR 200 billion to spend do not exist – and which will therefore be forced to produce at prices completely outside the market[46]. As for the lives of citizens outside Germany, the only one on the horizon is that of consumption rationing[47].

A crisis of such proportions as to call into question the euro’s ability to continue to exist[48], and one that pleases those who are opposed on principle to the birth of a real United Europe. But Germany has an existential need for the European common market, so the new federal government, internally divided and gravely uncertain about what to do, confines itself to Chancellor Scholz’s statement: ‘We all agree that gas prices are too high and we need to discuss with Norway, the United States, Japan and Korea how to lower them’[49]: a statement that speaks for itself. Angela Merkel, when asked today what she thinks about all this, replies that in the end a common European decision will be reached anyway, because our economies are now so interconnected that if anyone were to choose selfishness, the whole Union would collapse in a domino effect[50].

Ursula Von der Leyen writes a letter to governments, which reads: “Although gas prices have come down in recent weeks, they remain very high and are weighing heavily on people and our economy”, which calls for “protecting our single market, which has repeatedly shown resilience in the face of the crisis”. Ms. Von der Leyen is thinking of a decisive intervention in the ‘European wholesale market’ for energy, which is the Dutch virtual hub called TTF (Title Transfer Facility)[51], which brings together suppliers and buyers for immediate and future gas deliveries on the basis of prices set in euros per megawatt-hour – prices that change on a daily basis and are the main benchmark for the entire European energy sector[52].

Those familiar with the TTF object: ‘The prices that emerge from this daily gambit have nothing to do with gas production costs but simply with financial speculation on European gas. In fact, it is good to remember that while the price of oil is determined on a global scale, the price of gas is determined on a ‘regional’ (specifically European) scale and that the problem is all European and artificially produced by European policies. In this situation of ‘price volatility’, as the experts say, all problems are amplified: the resumption of post-Covid production was the first major opportunity for speculation and the war in Ukraine the second’[53]. Among the elements that favour speculation, which also concerns liquefied gas, there is obviously the apprehension of European governments as winter approaches, which allows speculators to raise prices to the limit[54]. The proposal also calls for even more stringent plans to reduce gas use, including a reduction in consumption beyond the 15% agreed in July this year[55].

Algeria’s mighty liquid gas (LNG) storage infrastructure on its way to Europe[56]

In Ms Von der Leyen’s letter, the cost of electricity is discussed: Since in the free market the price of electricity is set by the price of the most expensive energy source needed to produce it (nowadays: gas), the Commission is willing to discuss a cap on the price gas-fired power plants have to pay for their supplies[57]. This, in principle, excludes gas used for other purposes, such as industrial production and house heating. The measure is reminiscent of the so-called ‘Iberian model’, adopted by Spain and Portugal, consisting of a massive programme of state aid to compensate for the high costs incurred by gas-fired plants, which should last for twelve months and should prevent the limit of EUR 40 per megawatt-hour from being exceeded in the first six months, and EUR 70 in the second[58]. A solution that, according to some experts, could lead to higher gas consumption[59].

If we think in a European perspective, the only real solution is to set up a joint purchasing programme that would allow the Union to act as a single buyer, while promoting investment in green technologies and energy efficiency, in order to drastically reduce dependence on imported fossil fuels[60]. This would be possible by expanding the public funds allocated to the REPower EU programme – the EU’s response to the market disruptions caused by the invasion of Ukraine – which aims to save fuel, increase clean energy and diversify the common energy supply[61]. It is a programme backed by financial and legislative measures to build new infrastructure and aims to raise up to EUR 300 billion by the end of the decade, of which EUR 225 billion will apparently come from unused loans from the Coronavirus Recovery Fund[62]. The question is whether there is sufficient strength to convince all EU countries to choose this path – a strength that would probably arise from the failure of any other common or individual strategy.

The growing role of liquid gas (LNG)

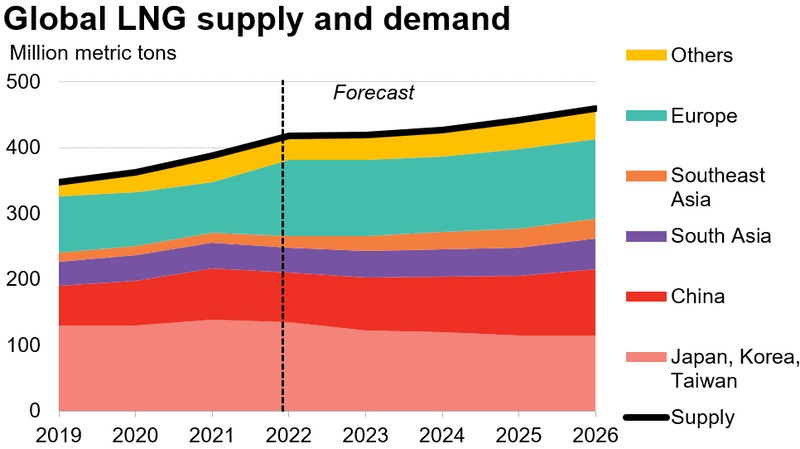

Developments in LNG supply and demand as estimated by Bloomberg experts[63]

In spite of any discussion of climate change, the war in Ukraine or the strategies of OPEC+ countries, the world’s fastest growing market is liquid gas (LNG)[64]. This is liquefied natural gas, mostly methane, which has been cooled to liquid form to make it easier and safer to store or transport unpressurised[65]. It occupies about 1/600th of the volume of natural gas and is odourless, colourless, non-toxic and non-corrosive. The liquefaction process involves removing residual dust, acid gases, helium, water and heavy hydrocarbons, which could cause difficulties, after which the gas is condensed into a liquid at near-atmospheric pressure, which is much less polluting than other hydrocarbons[66]. After regasification, the product can be distributed through the usual networks.

The EU is the world’s largest importer of natural gas, and since there are so many producers in all parts of the world, it is the ideal product to invest in when some oil and gas producing countries stop exporting: Western European countries with LNG terminals are much more resilient to possible supply disruptions[67]. Currently, the LNG market constitutes about a quarter of the total energy market: about 26% of this gas is used in power generation and about 23% in industry – the rest is used mainly for heating buildings[68]. The European Union’s current demand for gas is about 400 billion cubic metres per year[69], and experts are divided between those who believe the market will remain stable[70] and those who believe it will soar from $30.3 billion in 2020 to $66.1 billion in 2027[71].

Until the outbreak of war, the Union produced about half of its needs and imported mainly from Norway (30%), Russia (39%) and Algeria (13%) the rest[72]. In the current situation, European governments have started knocking on the door of new possible suppliers: Qatar, Malaysia, Australia, Nigeria, Indonesia, Trinidad and Oman[73]. Some developing countries are gearing up to become exporters (Papua New Guinea, Mozambique, Brunei, Angola and Tanzania)[74]. All this is not happening without Moscow noticing, so the Russians are trying to make up for lost time by focusing on gas pipelines alone[75]. So the picture has changed quickly: based on 2021 figures, Australia (108.1 billion cubic metres) is the most important LNG exporter, followed by Qatar, the US and many others[76]. A new production of 487.7 billion cubic metres could exceed the current needs of the whole of Europe and make China the world’s largest LNG importer[77]. A fact that rightly frightens Brussels: ‘while in north-western Europe the markets are competitive and well connected, with a series of terminals with a considerable LNG import capacity – the gas markets in the Baltic, central-eastern, south-eastern and south-western regions are less developed’, so it is necessary to build new regasifiers and new storage infrastructure, and to do so as quickly as possible[78]. In Italy, the Draghi government made a forced choice: it bought them ready-made[79]: two regasifier ships added to the three plants already available[80].

The cold, hard winter ahead

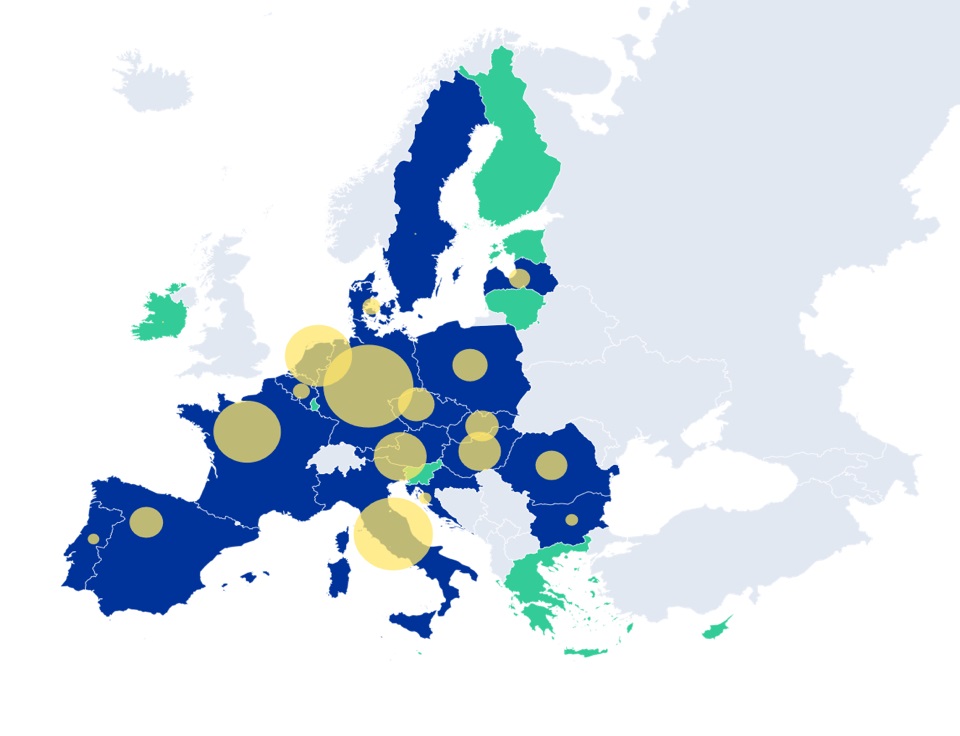

Quantities of LNG stored in individual EU countries ahead of winter[81]

In the days immediately following the invasion of Ukraine, we were all rightly overwhelmed by outrage and fear. The decision of sanctions against Russia met with the same popular consensus that made possible the miracle of welcoming five million Ukrainians fleeing the war in the space of a few days. Yet not even in those early days, when outrage was at its peak and people thought they had to be prepared to pay a price to stop Putin, did anyone think of completely blocking gas and oil imports from Russia. The main reason is that not all EU countries have enough gas to get through the coming winter[82].

The Kremlin’s use of gas as a weapon against NATO is the (effective) core of Moscow’s military strategy. In recent weeks, Putin has tried to prevent the EU countries from negotiating with one voice, as Mario Draghi has been suggesting for months. In the meantime, things have changed, and Moscow is able to place 16 billion cubic metres of gas in China with a new Siberian facility. This is only a start (Russia sells 200 billion cubic metres of gas per year to the European Union) but it is a signal picked up by the weaker countries: ‘a country that depends on Russian gas and has an energy-intensive industrial sector is in a very different situation from one that depends little on Russian gas and has a large service sector. Solidarity between these two countries is not easy to pursue’[83].

One example out of many: at the centre of the first reduction in flows via NordStream in June was a Siemens pumping turbine, which had been shipped to a Canadian division of the German giant for maintenance work and which, according to Gazprom, could not be delivered due to Western sanctions that had blocked its shipment from Canada. Shortly afterwards, Ottawa announced that it would ship the part, in the name of European energy security[84]. This gave Putin an opportunity to test the West’s determination to support Kiev when the inescapable national interests of individual countries come into play[85].

The same applies to the other EU countries. Leaving aside small countries such as North Macedonia, Bosnia, and Moldova, which are 100% dependent on Russian gas, Moscow’s largest customers have historically been Finland (94%), Latvia (93%), Bulgaria (77%), Germany (49%), Italy (46%), Poland (40%), and France (25%), and it is by acting on the parties of these countries that Putin tries to sabotage attempts at solidarity among us Westerners[86], knowing moreover that countries like the Netherlands, with its TTF, does not perceive much need to be in solidarity with anyone[87]. Incidentally, production at the Groningen site reached a peak of 88 billion cubic metres in 1976 and had almost reached 40 billion cubic metres just five years ago (2017), only to fall sharply afterwards. Following the aggression against Ukraine, the Dutch government is considering doubling gas production from the Groningen field to 7.6 billion cubic metres[88].

Germany and France, following up on the Treaty of Aachen, are studying a common plan that disregards the Brussels debate, accepting to pay the price of renouncing the principle of complementarity of energy sources and effectively halting programmes of conversion to renewable energy, so as to use the planned resources to avoid a further explosion of inflation[89]. In this sense, Poland, a major coal producer, has officially requested the indefinite suspension of the Kyoto environmental agreements[90]. The Czech Republic, Slovakia, and Romania, which fear a tightening of Moscow’s restrictive measures and spending the winter freezing, are for a détente process vis-à-vis Russia – a process in any case led by the Hungarian government, which is very close to Moscow’s positions and rejects the introduction of a cap on gas prices[91].

At the borders of the European Union everyone does what they can: London, for example, draws half of its gas supply from domestic sources and imports from Norway and Qatar, while Italy and Spain have chosen similar alliances with Algeria and the United States – this in a situation where Rome has decided to invest in Mediterranean offshore drilling, which is promising[92]. Norway, which is the continent’s largest producer of hydrocarbons, has earned dream figures in the months of the war[93]: there are even those who reason that the entire population could benefit from these gains by distributing a dividend of around 4,000 euros for each individual citizen[94]. If Equinor, the state oil giant, was earning around 200 million euros per month in 2021, today it is close to two billion in monthly revenues[95].

Italy’s position

Areas where Italy has authorised new oil and gas drilling[96]

Italy, within the European framework, is in a special position – on the one hand because it possesses untapped hydrocarbon deposits in its territorial waters[97], on the other because Enrico Mattei, by taking over the inactive oil agency of fascist Italy, had turned it into a multinational giant – and this vocation has remained despite the assassination of its first president: ENI (which is 30.6% state-owned[98]) drills in Nigeria, Congo, Algeria and (while Gaddafi was in power) in Libya, but also in several Asian countries, Kazakhstan foremost among them[99].

The government has so far been aware that Italy is a country that potentially escapes Russian and American control, and in fact the army guards the Tarvisio compressor plant on the borders of Austria, which is the most delicate and important infrastructure in our supply system, because it is the point at which ENI’s oil and gas, arriving from Asia, enters our country[100]. Italy imported only 10% of its energy needs from Russia, while the largest suppliers are Algeria and Azerbaijan[101]. There is a problem of insufficient regasifier capacity, but if government plans are adhered to, from next spring Piombino will be able to store the LNG we need to achieve independence from the war zones for the next few years[102].

Thanks to the Draghi government’s action, this will be joined by 20 billion cubic metres of Algerian gas, which, from now on, will completely replace what Italy was buying from Moscow[103]. The government has not limited itself to this, but has successfully negotiated 4 billion cubic metres from Northern Europe for this winter, and then new LNG supplies immediately from Egypt[104], and further supplies from Qatar, Congo, Angola and Nigeria[105]. In short, thought has been given not only to contingency, but also to the future. The only weak point is Kazakhstan, in which it has been operating for years, has invested colossal sums, but falls within Russia’s area of influence and therefore shows a serious degree of instability[106].

NurSultan’s government trades with Moscow but complies with Western sanctions, did not support the invasion of Ukraine and did not recognise the Donbass republics (provoking the wrath of the Kremlin): hence a series of obstacles to the operations of the Caspian Pipeline Consortium (CPC), such as the arbitrary blockade of food cargoes in March[107]. The affair, which arose from a legal action brought by Russian Vice-Premier Viktoria Abramchenko, appears to be yet another case in which Russia has used the legal system as a smokescreen to influence the markets[108]. If the blockade had not been lifted, it would have been Europe, which buys two-thirds of the volumes exported from the CPC and distributed through the port of Trieste, that would have suffered[109].

Libyan militiamen, hired by NOC, guarding the Sharara fields[110]

For years, thanks to the political relationship forged between Italy and Gaddafi, the country’s 48 billion cubic metres of reserves (the amount was probably even greater then) were at the disposal of ENI and the Italian mediator, thanks to whose services the Libyan dictator had transformed an immense desert into a modern and prosperous country. Gaddafi’s death has brought anarchy, which seems unsolvable, and this has repeatedly caused the paralysis of exports[111]. Most recently, in April 2021, NOC (National Oil Corporation) was forced to shut down the wells of the Sharara field (in the desert south of Tripoli) by armed militias that had surrounded the facilities[112]. The fall of Gaddafi is the joint responsibility of France and the United States, envious of the Italian industrial relationship. What has resulted is an endless civil war, in which mercenaries paid by Moscow play the main role of destabilisers[113]. Libyan deliveries are currently scarce, uncertain and intermittent[114].

Without an agreement between the factions, Libya has reverted to being a desert, and a bloodstained one at that. At the NOC stabilisation talks, France, the US and Egypt were invited by the UN (Italy was excluded) and there was a chorus of complaints about Russia[115]. President Mustafa Sanallah calls for the establishment of a NOC military force capable of defending oil fields, pipelines and export terminals[116]. Despite everything, the only way to deliver Libyan gas is through the Greenstream pipeline, operated by ENI, which lands in Sicily and could add up to 10 billion cubic metres per month to Italy’s supply[117]. An increasingly unsafe system: 2690 km of oil and gas pipelines pass through Italy, some of which (such as the Transmed coming from Algeria and Tunisia, and those coming from Nigeria and crossing Libya) were built more than half a century ago, and are constantly under attack by robbers, both in Africa and in Europe – another reason to shift supplies, despite promises on the Green Economy, to shipping[118].

Dangerous selfishness

27 October 1962: ENI chairman Enrico Mattei’s plane crashes following sabotage, burning with it the hope of a common European energy policy[119]

In almost all key issues, the individual EU countries are going in circles. There are certainly cultural reasons for this, and also the current weakness of party systems, which chase electorates instead of offering them direction. No one can be trusted any more, because every national government is ready to relativise any stance – as long as social networks show signs of disruption.

Actually, there is nothing new: after the Cold War ended, the United States worked hard to recreate it, for reasons we do not know, but presumably internal. Now they have succeeded, and the price to pay has remained on the table for Western Europe, which shows that it still enjoys limited sovereignty almost a century after the end of the Second World War. A very dangerous, astonishing, depressing situation. Putin’s Russia, which at a time when it was still very close was our natural ally, is now threatening to unleash World War III and generate a nuclear holocaust. Economic sanctions have brought us to our knees. Recession, rising misery and unemployment, and social disintegration bring to power (democratically) parties whose militants openly recall fascism and Nazism. Religious fundamentalism becomes not only a cancer of the Arab world, but also of the Christian world. All this at a time when planet Earth is showing it can no longer cope and is sending out unmistakable catastrophic signals.

What is needed is a completely opposite signal to those sent by Moscow and Washington, and to those bounced back by Beijing, Ankara, Riyadh and Tel Aviv – for example: to invite Russia to join, if not the European Union, at least the European Economic Area. For example: show clearly that NATO and the European Union are not synonymous. For example: invest enthusiastically and consistently in renewable energies, and not think about starting again with coal, nuclear power and American fracking gas (a disaster for the ecosystem). For example: to negotiate with one face, and not to play off each other as in Libya.

But these are perhaps the dreams of an old man. Perhaps things have already gone too far, and Western democracies are no longer able to find the strength to stand up again. Or, as John Belushi used to say, when the going gets tough, the tough get going. Not those who shoot at each other, which everyone is capable of doing, but those who find complex solutions where others cannot even see them. The real tough guys. We are waiting for them impatiently.

[1]https://www.hal-privatbank.com/news/2022/rezession-im-euroraum

[2]https://unstats.un.org/unsd/snaama/Index

[3]https://www.cnbc.com/2022/10/05/oil-opec-imposes-deep-production-cuts-in-a-bid-to-shore-up-prices.html ; https://www.npr.org/2022/10/11/1128197689/opec-plus-oil-production-cuts-could-signal-a-rift-between-saudi-arabia-and-the-u

[4]https://www.aljazeera.com/news/2022/10/6/why-is-opec-cutting-global-oil-production

[5]https://www.limesonline.com/lespansione-verso-est-della-nato-2/115632

[6]https://ec.europa.eu/commission/presscorner/detail/en/SPEECH_12_796 ; https://ecfr.eu/publication/the-crisis-of-american-power-how-europeans-see-bidens-america/

[7]https://theconversation.com/ukraine-the-history-behind-russias-claim-that-nato-promised-not-to-expand-to-the-east-177085 : https://www.france24.com/en/russia/20220130-did-nato-betray-russia-by-expanding-to-the-east

[8]https://www.limesonline.com/lespansione-verso-est-della-nato-2/115632

[9]https://it.euronews.com/my-europe/2022/07/22/macedonia-del-nord-e-albania-si-avvicinano-allunione-europea

[10]https://www.nato.int/cps/en/natohq/topics_37356.htm

[11]https://www.bundesregierung.de/breg-de/suche/deutschland-und-frankreich-schliessen-vertrag-von-aachen-1566838

[12]https://www.baks.bund.de/de/arbeitspapiere/2015/die-europa-armee-pro-und-kontra

[13]https://reccom.org/nord-stream-gas-uscito-dal-gasdotto/

[14]https://www.corriere.it/economia/consumi/22_settembre_29/nord-stream-quarta-falla-cosa-succede-davvero-quali-rischi-corre-l-europa-9494b806-3fc1-11ed-bc84-39595de415e4.shtml?refresh_ce-cp

[15]https://www.corriere.it/esteri/22_ottobre_02/nord-stream-sabotaggio-226417e8-41bc-11ed-b75b-b72dca12f1fd.shtml

[16]https://www.lindipendente.online/2021/02/18/biden-minaccia-leuropa-stop-al-gasdotto-nordstream-2-con-la-russia-o-ci-saranno-sanzioni/ ; https://www.agenzianova.com/a/60108552eef6a9.80026475/3287758/2021-01-26/energia-casa-bianca-biden-ritiene-nord-stream-2-un-cattivo-affare-per-l-europa ; https://pipelinenews.it/il-parlamento-ue-vota-una-risoluzione-per-bloccare-il-gasdotto-nord-stream-2/ ; https://www.notizieflash24.it/2021/01/24/chi-e-alexey-navalny-loppositore-di-putin-che-piace-tanto-alloccidente/

[17]https://www.corriere.it/economia/consumi/22_ottobre_01/gas-stop-forniture-russe-italia-flussi-azzerati-entrata-tarvisio-9f6ec604-4183-11ed-b75b-b72dca12f1fd.shtml

[18]https://www.corriere.it/economia/consumi/22_ottobre_01/gas-stop-forniture-russe-italia-flussi-azzerati-entrata-tarvisio-9f6ec604-4183-11ed-b75b-b72dca12f1fd.shtml

[19]https://www.borsaitaliana.it/borsa/notizie/teleborsa/economia/eni-descalzi-a-lavoro-per-sbloccare-gas-fermo-in-austria-spero-in-una-soluzione-in-settimana-159_2022-10-03_TLB.html?lang=it

[20]https://www.wired.it/article/opec-taglio-petrolio/ ; https://www.agi.it/economia/news/2022-10-05/opec-taglio-produzione-petrolio-18336020/

[21]https://www.wired.it/article/opec-taglio-petrolio/ ; https://www.agi.it/economia/news/2022-10-05/opec-taglio-produzione-petrolio-18336020/

[22]https://www.wired.it/article/petrolio-russia-terro-prezzo-europa/ ; https://www.reuters.com/business/energy/g7-finance-chiefs-seen-advancing-russian-oil-price-cap-plan-2022-09-02/

[23]https://www.wired.it/article/petrolio-russo-prezzo-tetto-g7/

[24]https://www.reuters.com/business/energy/g7-finance-chiefs-seen-advancing-russian-oil-price-cap-plan-2022-09-02/

[25]https://www.reuters.com/business/energy/g7-finance-chiefs-seen-advancing-russian-oil-price-cap-plan-2022-09-02/

[26]https://www.wired.it/article/petrolio-russo-prezzo-tetto-g7/

[27]https://www.reuters.com/business/energy/g7-finance-chiefs-seen-advancing-russian-oil-price-cap-plan-2022-09-02/

[28]https://www.reuters.com/business/energy/g7-finance-chiefs-seen-advancing-russian-oil-price-cap-plan-2022-09-02/

[29]https://www.reuters.com/business/energy/g7-finance-chiefs-seen-advancing-russian-oil-price-cap-plan-2022-09-02/

[30]https://www.startmag.it/energia/unione-europea-embargo-petrolio-russo/

[31]https://www.wired.it/article/petrolio-russia-terro-prezzo-europa/

[32]https://www.reuters.com/business/energy/exclusive-russias-state-owned-rnrc-reinsure-russian-oil-shipments-sources-say-2022-06-10/

[33]https://www.reuters.com/world/india/exclusive-russian-oil-tankers-get-india-safety-cover-via-dubai-company-2022-06-22/

[34]https://it.marketscreener.com/notizie/ultimo/Perche-imporre-tetto-a-prezzi-di-petrolio-e-gas-Russia-piu-facile-a-dirsi-che-a-farsi–41682684/

[35]https://www.reuters.com/business/energy/g7-finance-chiefs-seen-advancing-russian-oil-price-cap-plan-2022-09-02/

[36]https://www.quotidianomotori.com/automobili/prezzo-del-petrolio/

[37]https://www.reuters.com/business/energy/why-russian-oil-gas-price-cap-is-easier-said-than-done-2022-06-28/

[38]https://www.reuters.com/business/energy/why-russian-oil-gas-price-cap-is-easier-said-than-done-2022-06-28/

[39]https://it.investing.com/news/commodities-news/price-cap-su-petrolio-russo-piu-facile-a-dirsi-che-a-farsi-2067758

[40]https://www.bundestag.de/resource/blob/644154/889aae5fb78d87042e942a3774f4df1d/WD-5-033-19-pdf-data.pdf, pag. 7; https://www.umweltbundesamt.de/sites/default/files/medien/384/bilder/dateien/4_abb_eev-sektoren-et_2022-03-25.pdf

[41]https://www.bmwk.de/Redaktion/DE/Publikationen/Energie/energieeffizienz-in-zahlen-entwicklungen-und-trends-in-deutschland-2021.pdf?__blob=publicationFile&v=6

[42]https://www.rainews.it/articoli/2022/09/lunione-europea-ha-raggiunto-un-accordo-sul-gas-senza-il-tetto-al-prezzo-di-importazione-0341a04a-a0cb-45cc-9538-310339936cd6.html

[43]https://www.rainews.it/articoli/2022/09/lunione-europea-ha-raggiunto-un-accordo-sul-gas-senza-il-tetto-al-prezzo-di-importazione-0341a04a-a0cb-45cc-9538-310339936cd6.html

[44]https://www.rainews.it/articoli/2022/09/lunione-europea-ha-raggiunto-un-accordo-sul-gas-senza-il-tetto-al-prezzo-di-importazione-0341a04a-a0cb-45cc-9538-310339936cd6.html

[45]https://www.panorama.it/economia/massaro-su-gas

[46]https://www.panorama.it/economia/massaro-su-gas

[47]https://www.panorama.it/economia/massaro-su-gas ; https://www.lastampa.it/economia/2022/08/20/news/torlizzisubito_il_razionamento_dei_consumi_la_guerra_dellenergia_ormai_e_persa-6940296/

[48]https://www.panorama.it/economia/massaro-su-gas

[49]https://www.panorama.it/news/politica/europa-vertice-praga-gas-draghi

[50]https://www.panorama.it/news/politica/europa-vertice-praga-gas-draghi

[51]https://it.euronews.com/my-europe/2022/08/30/come-funziona-il-ttf-il-mercato-del-gas-di-amsterdam

[52]https://it.euronews.com/my-europe/2022/10/06/la-commissione-europea-apre-al-tetto-sul-prezzo-del-gas

[53]https://www.ilfattoquotidiano.it/2022/08/31/crisi-energetica-un-disastro-europeo-eppure-esiste-una-strada-semplicissima/6786770/ ; https://it.euronews.com/my-europe/2022/08/30/come-funziona-il-ttf-il-mercato-del-gas-di-amsterdam

[54]https://it.euronews.com/my-europe/2022/08/30/come-funziona-il-ttf-il-mercato-del-gas-di-amsterdam

[55]https://it.euronews.com/2022/08/09/ue-al-via-il-piano-per-ridurre-domanda-e-consumo-di-gas-naturale

[56]https://energycapitalpower.com/sinopec-to-construct-179-million-lng-storage-tank-in-algeria/

[57]https://it.euronews.com/my-europe/2022/10/06/la-commissione-europea-apre-al-tetto-sul-prezzo-del-gas

[58]https://www.panorama.it/economia/europa-paesi-tetto-prezzo-gas-italia

[59]https://it.euronews.com/my-europe/2022/10/06/la-commissione-europea-apre-al-tetto-sul-prezzo-del-gas

[60]https://it.euronews.com/my-europe/2022/10/06/la-commissione-europea-apre-al-tetto-sul-prezzo-del-gas

[61]https://ec.europa.eu/info/strategy/priorities-2019-2024/european-green-deal/repowereu-affordable-secure-and-sustainable-energy-europe_it

[62]https://it.euronews.com/my-europe/2022/10/06/la-commissione-europea-apre-al-tetto-sul-prezzo-del-gas

[63]https://www.bloomberg.com/professional/blog/global-lng-outlook-overview-tight-supply-expected-until-2026/

[64]https://www.shell.com/energy-and-innovation/natural-gas/liquefied-natural-gas-lng/lng-outlook-2022.html#iframe=L3dlYmFwcHMvTE5HX291dGxvb2tfMjAyMi8

[65]https://www.engineeringtoolbox.com/liquefied-natural-gas-lng-d_1092.html

[66]https://www.ncbi.nlm.nih.gov/pmc/articles/PMC3962073/

[67]https://ec.europa.eu/commission/presscorner/detail/hu/MEMO_16_310

[68]https://ec.europa.eu/commission/presscorner/detail/hu/MEMO_16_310

[69]https://ec.europa.eu/commission/presscorner/detail/hu/MEMO_16_310

[70]https://www.tgcom24.mediaset.it/economia/i-consumi-ue-di-gas-e-il-piano-dell-unione-per-ridurli_53378629-202202k.shtml

[71]https://www.mordorintelligence.com/industry-reports/global-lng-market-industry

[72]https://ec.europa.eu/commission/presscorner/detail/hu/MEMO_16_310

[73]https://formiche.net/2016/03/gas-naturale-liquefatto-energia-lng-mercato/

[74]https://formiche.net/2016/03/gas-naturale-liquefatto-energia-lng-mercato/

[75]https://formiche.net/2016/03/gas-naturale-liquefatto-energia-lng-mercato/

[76]https://www.statista.com/statistics/274528/major-exporting-countries-of-lng/

[77]https://www.statista.com/statistics/274528/major-exporting-countries-of-lng/ ; https://ec.europa.eu/commission/presscorner/detail/hu/MEMO_16_310

[78]https://ec.europa.eu/commission/presscorner/detail/hu/MEMO_16_310

[79]https://luce-gas.it/attualita/italia-indipendenza-gas-russo-entro-2024

[80]https://www.ilsole24ore.com/art/rigassificatori-l-italia-cerca-due-navi-metaniera-tempi-e-costi-dell-operazione-AEYiwLNB?refresh_ce=1

[81]https://www.consilium.europa.eu/en/infographics/gas-storage-capacity/

[82]https://www.bruegel.org/blog-post/how-serious-europes-natural-gas-storage-shortfall ; https://www.statista.com/statistics/1294025/quarterly-gas-in-storage-in-the-european-union/

[83]https://www.panorama.it/economia/europa-paesi-tetto-prezzo-gas-italia

[84]https://formiche.net/2022/07/nord-stream-1-gas-germania-italia-stoccaggi/

[85]https://formiche.net/2022/07/nord-stream-1-gas-germania-italia-stoccaggi/

[86]https://www.panorama.it/economia/europa-paesi-tetto-prezzo-gas-italia

[87]https://www.rainews.it/articoli/2022/09/il-dilemma-del-gas-perch-i-paesi-europei-si-dividono-sulle-possibili-soluzioni-cc02be85-d072-4322-a2cc-5c1fdd8840cc.html

[88]https://www.qualenergia.it/articoli/caso-olanda-da-esportazione-gas-a-rinnovabili/

[89]https://www.rainews.it/articoli/2022/09/il-dilemma-del-gas-perch-i-paesi-europei-si-dividono-sulle-possibili-soluzioni-cc02be85-d072-4322-a2cc-5c1fdd8840cc.html

[90]https://www.rainews.it/articoli/2022/09/il-dilemma-del-gas-perch-i-paesi-europei-si-dividono-sulle-possibili-soluzioni-cc02be85-d072-4322-a2cc-5c1fdd8840cc.html

[91]https://www.rainews.it/articoli/2022/09/il-dilemma-del-gas-perch-i-paesi-europei-si-dividono-sulle-possibili-soluzioni-cc02be85-d072-4322-a2cc-5c1fdd8840cc.html

[92]https://www.panorama.it/economia/europa-paesi-tetto-prezzo-gas-italia

[93]https://www.corriere.it/economia/consumi/22_settembre_30/gas-norvegia-decuplica-incassi-paese-nato-piu-benefici-putin-cc037c58-40a9-11ed-8b65-55aa2f703574.shtml ; https://www.corriere.it/economia/finanza/22_settembre_22/sanzioni-russia-l-attivo-bilancio-mosca-si-ridotto-10-volte-100-giorni-cfa19c68-3a79-11ed-b03d-1f9e636121b9.shtml

[94]https://www.corriere.it/economia/consumi/22_settembre_30/gas-norvegia-decuplica-incassi-paese-nato-piu-benefici-putin-cc037c58-40a9-11ed-8b65-55aa2f703574.shtml

[95]https://www.corriere.it/economia/consumi/22_settembre_30/gas-norvegia-decuplica-incassi-paese-nato-piu-benefici-putin-cc037c58-40a9-11ed-8b65-55aa2f703574.shtml ; https://www.ilfoglio.it/eu-porn/2022/07/14/news/quanto-conta-per-l-ue-l-eccezione-norvegese-4215134/

[96]https://www.qualenergia.it/articoli/le-trivelle-sostenibili-del-ministro-cingolani-governo-draghi/

[97]https://www.open.online/2022/02/13/caro-bollette-mappa-pitesai-trivelle-cingolani/

[98]https://www.eni.com/en-IT/about-us/governance/shareholders.html

[99]https://www.eni.com/en-IT/eni-worldwide.html

[100]https://www.friulioggi.it/tarvisio/dopo-attacco-nord-stream-militari-anche-gasdotto-tarvisio-30-settembre-2022/

[101]https://www.corriere.it/economia/consumi/22_ottobre_01/gas-stop-forniture-russe-italia-flussi-azzerati-entrata-tarvisio-9f6ec604-4183-11ed-b75b-b72dca12f1fd.shtml

[102]https://www.corriere.it/economia/consumi/22_ottobre_01/gas-stop-forniture-russe-italia-flussi-azzerati-entrata-tarvisio-9f6ec604-4183-11ed-b75b-b72dca12f1fd.shtml

[103]https://www.corriere.it/economia/consumi/22_ottobre_01/gas-stop-forniture-russe-italia-flussi-azzerati-entrata-tarvisio-9f6ec604-4183-11ed-b75b-b72dca12f1fd.shtml

[104]https://www.corriere.it/economia/consumi/22_ottobre_01/gas-stop-forniture-russe-italia-flussi-azzerati-entrata-tarvisio-9f6ec604-4183-11ed-b75b-b72dca12f1fd.shtml

[105]https://www.corriere.it/economia/consumi/22_settembre_30/gas-norvegia-decuplica-incassi-paese-nato-piu-benefici-putin-cc037c58-40a9-11ed-8b65-55aa2f703574.shtml ; https://www.corriere.it/economia/consumi/22_ottobre_01/gas-stop-forniture-russe-italia-flussi-azzerati-entrata-tarvisio-9f6ec604-4183-11ed-b75b-b72dca12f1fd.shtml

[106]https://formiche.net/2022/07/cpc-kazakistan-petrolio-russia-europa/

[107]https://formiche.net/2022/07/cpc-kazakistan-petrolio-russia-europa/

[108]https://formiche.net/2022/07/cpc-kazakistan-petrolio-russia-europa/

[109]https://formiche.net/2022/07/cpc-kazakistan-petrolio-russia-europa/

[110]https://northafricapost.com/26816-libya-us-tells-gunmen-to-return-sharara-oil-field-to-noc.html

[111]https://www.repubblica.it/esteri/2022/07/03/news/libia_pozzi_di_petrolio_ostaggio_della_guerra_civile_tra_aggressioni_e_poca_produttivita-356356990/amp/

[112]https://www.repubblica.it/esteri/2022/07/03/news/libia_pozzi_di_petrolio_ostaggio_della_guerra_civile_tra_aggressioni_e_poca_produttivita-356356990/amp/

[113]https://www.repubblica.it/esteri/2022/07/03/news/libia_pozzi_di_petrolio_ostaggio_della_guerra_civile_tra_aggressioni_e_poca_produttivita-356356990/amp/

[114]https://www.agenzianova.com/news/libia-la-noc-comunica-limpossibilita-a-fornire-prodotti-raffinati-per-soddisfare-la-domanda/ ; https://www.repubblica.it/esteri/2022/07/03/news/libia_pozzi_di_petrolio_ostaggio_della_guerra_civile_tra_aggressioni_e_poca_produttivita-356356990/amp/

[115]https://formiche.net/2020/06/noc-petrolio-libia/

[116]https://formiche.net/2020/06/noc-petrolio-libia/

[117]https://www.repubblica.it/esteri/2022/07/03/news/libia_pozzi_di_petrolio_ostaggio_della_guerra_civile_tra_aggressioni_e_poca_produttivita-356356990/amp/

[118]https://www.ilsole24ore.com/art/oleodotti-italia-e-allarme-i-furti-carburante-AEq2FAb ; https://web.archive.org/web/20140307212852/http://www.agcm.it/stampa/news/3387-a358-enitrans-tunisian-pipeline-avvio-istruttoria.html

[119]https://www.vivienna.it/2018/09/04/il-caso-mattei-56-anni-dopo-foto-e-documenti-inediti-del-centro-internazionale-di-fotografia-di-palermo/

Leave a Reply