What happened to Iceland’s financial system after the 2008 sinking, when the country was struck by an iceberg that destroyed the entire economy overnight[1] ? How is it possible that a nation of less than 400,000 inhabitants, but as large as Bulgaria or Greece, managed in the course of a single generation to become disproportionately rich and then fail twice? One would think: it should not be so difficult to have no surprises on a volcanic island floating close to the Arctic, so small that its financial and political leaders can all fit in the same bus.

It could have avoided the economic debacle with only $20 billion, but it does not have it. It suffers a crisis that devastates its citizens, financial institutions and the foundations of its culture[2] . A quarter of the population is losing their savings and the country is experiencing the largest wave of emigration since the end of the 20th century[3] . But this is nothing new. Iceland has a long history of currency volatility, having spent almost a quarter of its post-independence history flying, like Tarzan in the jungle, from crisis to crisis[4] .

Icelandic culture loves risk, and in 2008 it became the first victim of the global financial collapse, which began in this lonely, cold outpost and then exploded worldwide. The inequality between bank loans and the economic size of the population became so great that almost no bank loans were payable any more, and foreign debt also exceeded the gross domestic product many times over[5] . At that point, to prevent the collapse, new diversified forms of income would have been needed (as it had been with oil for Norway) – but they were not found.

Nevertheless, the Icelanders are also a proud people. It was years before the speculative bubble, created by Prime Minister Davíð Oddsson with the privatisation process of banks and investment funds, imploded[6] : the credit institutions were not sold off to foreign banking groups, as is the case in Eastern Europe[7] , but to private Icelanders very close to the governing parties[8] . The (perhaps somewhat romantic) idea was that it was the richest who paid everyone’s debts.

Oddsson would also have to find a way to quickly generate new sources of income, diversify an economy based solely on fishing and financial speculation. In fact, having come to power, he sold a state-owned fishing company without running into opposition from Iceland’s 14 most powerful and wealthiest merchant families, a group scornfully nicknamed ‘the Octopus’ (Kolkrabbinn). They, realising that privatisation would make them richer, welcome the idea. But these are old ideas, the economy is still about fishing, Oddsson can’t really think of anything new.

The dream is that, by privatising trade and speculation on it, new market niches and new prospects will automatically open up for Icelandic companies operating abroad – another romantic idea, typical of Icelandic culture, which became epos in Auður Ava Ólafsdóttir’s splendid novel ‘White Rose’[9] . So privatisation began even before the collapse of 2008, in the early years of the very long era of Oddsson and his Reagan theories, namely in 1999, with the sale of the investment bank FBA, followed by Landsbanki and Bunadarbanki[10] .

Davíð Oddsson, Prime Minister from 1991 to 2004[11]

This process leads to a great concentration of economic power. Soon a new group, nicknamed ‘the Orca’ (Háhyrningurinn), starts making large purchases of bank shares to challenge the Octopus for control of the banks. The banks, in turn, begin to pay off politicians to defuse regulatory control and allow speculation to amortise the outlays incurred in the purchase of the banks themselves[12] .

Thorvaldur Gylfason, professor of economics[13] , believes that the groundwork for the disaster was laid at that time: instead of inviting international bankers with experience in privatisation, the Icelandic government ‘handed the banks over on a silver platter to local cronies. It only took a few years for the banks to collapse. That is why the Icelandic banks collapsed. It had little to do with Lehman Brothers…. That was just the spark that lit the fire”[14] .

Taking its cue from the Irish financial model, the country, due to its low taxation, becomes a base for foreign finance and investment. Traders from all over the world flock to the Nordic island[15] . The banking boom is an economic phenomenon created by the carry trade, whereby colossal sums of money are borrowed in places like Japan, where interest rates are effectively zero, to be lent to high-interest economies like Iceland. For years this seemed like a no-loss deal[16] , bringing Iceland the highest per capita wealth in the world[17] . Until 2008, no one realised how slippery the ground on which the speculative economy lay.

The krona became a major trading currency, soaring 900% between 1994 and 2008[18] . Aided by free market reforms, fish production, and a stock market based on stable pension funds, Icelandic entrepreneurs hoard international credits[19] . They unwisely make deposits at the Landsbanki bank in a speculative programme called ‘Icesave’[20] . Icesave offered interest rates much higher than those prevailing on the market at the time, often 50% higher than those offered by British banks. This attracts £4.5 billion from the UK and almost £1 billion from the Netherlands[21] .

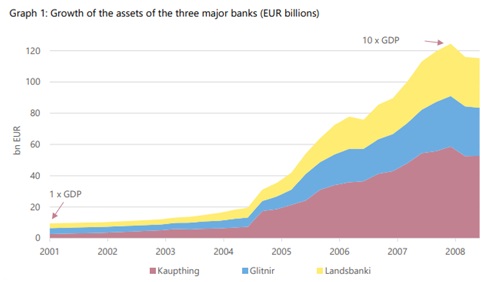

Caught up in the euphoria of easy money, 70,000 Icelandic families go into debt up to their ears to treat themselves to a nice 4×4 SUV or a spacious new house[22] . In 2004, islanders spent £894 million on shares in British companies. In five years, the average family sees its wealth increase by 45%. The island’s billionaires buy everything from the West Ham United football team to the Somerfield supermarket chain, Hamleys toy shops and the House of Fraser[23] . Iceland’s three largest banks – Landsbanki, Glitnir and Kaupthing – control assets worth 10 times Iceland’s GDP[24] .

Asset growth of the three largest banks until the great crisis of 2008 (in billion euros)[25]

Like households, banks, with the unprecedented influx of capital to the financial sector, embarked on a mad spending spree, fuelled by debt. One example: the Harpa Concert Hall, a mammoth project financed by Landsbanki, inside which a complex of luxurious shops and restaurants was planned, but never realised. Advertised as the largest glass building in Europe, it looms as a reminder of Iceland’s excesses and the reckless behaviour of its banks[26] .

But the goose that laid the golden eggs became sick and died in the fateful October 2008, when Prime Minister Geir Haarde announced that Iceland was on the brink of bankruptcy. When the United States and the European Union reduce credit and demand that Iceland immediately repay its loans, Iceland defaults, destroying its credit rating and causing the country’s economy to plummet[27] . International banks no longer send money and foreign currency stocks run out. Queues at banks to withdraw cash are huge, while people move their savings into safer accounts[28] .

Unlike the United States, which considers major financial institutions ‘too big to fail’, Iceland on the contrary considers its banks ‘too big to be bailed out’. And he is right[29] . The inexperienced and mismanaged system becomes unsustainable and begins to collapse under the weight of expansive growth. With fiscal decline echoing around the world, the Icelandic economy has no hope of saving itself from implosion.

It is the third biggest bankruptcy in history. Within a few days, the krona collapses[30] . The Icelandic currency loses 50% of its value between 2007 and 2010[31] , and is now valued just above those of Zimbabwe and Turkmenistan[32] . More than 80 per cent of Iceland’s financial system collapses and almost all companies on the island go bankrupt. The stock market collapses by 95%, interest on loans rises to over 300%. More than 60% of bank assets are wiped out within a few months and interest rates rise to 18% to curb inflation rates[33] . The Icelandic banking sector is so large compared to the small local economy that a bailout is impossible.

The turning point

The Harpa concert hall in Reykjavik, financed by Landsbanki before the crisis, is a reminder of the reckless behaviour of the country’s banks[34]

The authorities responded with an unexpected gesture: they let the country’s three largest banks go bankrupt. Shocking as it was, it was the best move the Icelandic authorities could have made[35] . Overnight they enacted the Emergency Act and the three main measures formed the legal basis for the resolution process. The first measure authorises the Ministry of Finance to provide funds and capital for the establishment of new banks or the restructuring of existing ones. The second measure authorises the supervisory authority to take control of failing banks. The third measure changes the hierarchy of claims by giving customer deposits priority for payment over claims in bankruptcy proceedings.

Other measures involve economic and financial assistance from an International Monetary Fund programme, the introduction of capital controls and the restructuring of the bank[36] . In 30 years, it is the first country in the developed West to ask the IMF for assistance[37] . Although the banks are not bailed out, the government needs a capital injection to survive. Iceland receives a loan of USD 2.1 billion plus USD 5 billion from the Swedish National Bank and the Bank of Japan[38] . In this way, the government is able to protect citizens’ deposits and prevent the krona from depreciating further.

In the following years, little by little, the Icelandic government reduces interest rates, down to 4.25 % (2011), and then reduces them further to reach the low inflation target set by the government. Strict capital controls, austerity measures and a series of reforms arrived with which Iceland tried to reinvent itself. Contrary to the misgivings of critics, the controversial model seems to work[39] . The bailout takes place at the expense of international creditors, who are ‘left in the lurch’ without being paid an amount equal to four times Iceland’s GDP[40] . England and the Netherlands, compensate their savers, convinced that they can then get back at the ‘guilty party’, i.e. the Icelandic bank, which, however, is now state-owned. Put simply, the debt of the banks, after the ‘compulsory nationalisation’, becomes Iceland’s public debt and is added to the debt to the IMF.

The two nations propose a programme to Iceland for the repayment of almost 3.4 billion over 15 years. The Icelandic government ‘turns over’ the hot potato to the citizens, asking them for just over 100 euros per month for fifteen years. It is early 2009. Spontaneous movements and organised protest committees spring up among the citizens. In the capital Reykjavík, street protests are ignited. The Icelanders demand that the real culprits pay, they call for and obtain the resignation of Prime Minister Geir Hilmar Haarde, and with a collection of signatures they ask the President of the Republic to stop the repayment of the debt with the Netherlands and England. The President of the Republic gives in to the demands and blocks the bill, proposing a referendum: in March 2010, 93% of Icelanders confirm that they do not want to take on that debt[41] .

People want someone to pay, and not just in money[42] . They obtain justice in February 2015, when the Supreme Court upholds the four convictions for market manipulation for the former executives of the failed Kaupthing bank: Hreidar Mar Sigurdsson, Sigurdur Einarsson, Magnus Gudmundsson and Olafur Olafsson. The former CEOs of two other large banks, Glitnir and Landsbanki, were also convicted on charges ranging from fraud to market manipulation[43] . The so-called ‘Corporate Vikings’ are found guilty of a number of financial crimes and misdeeds.

Reykjavik 16 April 2016: Demonstration against Icelandic Prime Minister Sigmundur Gunnlaugsson[44]

In 2018, the count of those convicted amounts to 36 prominent bankers and financiers for a total of 96 years in prison[45] . The verdict is the heaviest (for financial fraud) in Iceland’s history. Voters suffering from post-crisis austerity conditions, however, believe that the bankers got off lightly[46] , and they believe with good reason that they are governed by corrupt and colluding people: in 2016, on the blacklist published on the basis of the Panama Papers, there are 600 Icelanders out of a population of less than half a million. By comparison, Ukraine has 20[47] .

Thorvaldur Gylfason states[48] : ‘There were five European ministers whose names appeared in the Panama Papers. Of these, three were from Iceland. And one of them is still Minister of Finance. This is a clear sign that the political and judicial aspect of the recovery was less ambitious and less successful than the economic recovery‘[49] . Prime Minister Sigmundur Gunnlaugsson only resigned after documents leaked by the law firm Mossack Fonseca revealed that he failed to declare the ownership of an offshore company worth millions of dollars when he entered parliament in 2009[50] .

Former Icelandic lead investigator Jared Bibler and his team discovered that, every year since 2004, Glitnir, Landsbanki and Kaupthing had engaged in illegal large-scale share support operations[51] . These securities frauds were carried out with banks making large loans to shell companies based in the British Virgin Islands[52] companies set up for the sole purpose of secretly purchasing the banks’ shares and inflating the prices, using only the shares themselves as collateral. According to Bibler, these crimes normalised corruption throughout the operations of the three institutions – and indeed throughout Icelandic society. He also makes it clear that they were by no means victimless.

Led to believe that these three ‘crown jewels’ of Icelandic finance were safe, shareholders lost everything when the banks’ share prices fell to zero in October 2008[53] . The bankruptcies, coupled with the British government’s decision to use anti-terrorism legislation to freeze Landsbanki’s assets in the UK in an attempt to protect British bank customers[54] , brought the country to its knees. Activities ancillary to the illegal backstop programmes have been swept under the carpet. Some of the worst crimes – including the alleged use of false invoices to defraud the Icelandic central bank of its foreign exchange reserves – persisted in the industry for at least six years after the official end of the banking crisis. Bibler also believes that since many of the guilty bankers were released early, that they made their illicit assets disappear[55] .

And then what?

The controversial Finance Minister Bjarni Benediktsson[56]

The financial implosion led to the introduction of strict state capital controls until 2017. From the ashes of the three big Icelandic banks, others were born. From the domestic operations of Glitnir arises Íslandsbanki[57] , which as of 2016 is wholly owned by the state and is one of the three largest banks in the country. In December 2020, the state financial holding company, ISFI Icelandic State Financial Investments, proposed that the government sell a slice of Islandsbanki in a public offering – as proposed by Finance Minister Bjarni Benediktsson[58] .

In May 2021, Iceland will start the privatisation of Islandsbanki, marking its financial recovery after the collapse of its banks in the 2008 crisis. Benediktsson says the listing is ‘an important first step in reducing the Icelandic state’s significant stake in the banking sector’ and provides ‘a clear path for the state to sell its remaining shares in the bank in the near future’. Citigroup, Islandsbanki and JP Morgan are the joint global coordinators of the public offering[59] . One month later, Íslandsbanki[60] sells 35 per cent of itself for 55.3 billion Icelandic Kroner (USD 457 million)[61] .

It sounds like a lot of money, but experts suspect that the price was deliberately undervalued to help the usual cronies of the powerful[62] . Opposition MPs criticise the low share price and the lack of transparency in the sale[63] . Domestic investors hold about 24 per cent of Íslandsbanki, with international investors holding the remaining 11 per cent. The market capitalisation of Íslandsbanki at that time was Icelandic Kroner 158 billion (USD 1.3 billion)[64] . The suspicions became more serious when, in March 2022, the government sold a second 22.5 per cent stake in Íslandsbanki to a secret list of 209 persons[65] .

Whereas the previous year’s sale was a public offer, it is now only open to professional investors. Bidders obtain the shares at a five per cent discount to the market price[66] . Benediktsson oversees this process as finance minister, although an independent agency has been set up to carry out the privatisation. To calm the waters, he swears that only hedge funds and pension funds are among the buyers[67] . But then it turns out that some bank employees are involved in the deal[68] . Under pressure, the Ministry of Finance publishes the list[69] . Two of the successful bidders are Benedikt Sveinsson, father of the finance minister[70] , and Þorsteinn Már Baldvinsson, the managing director of Samherji, who was involved in the Glitnir crash[71] .

A bad sign: Þorsteinn Már Baldvinsson is also the subject of the criminal investigation in the Fishrot case, about Samherji’s operations in Namibia. In 2016, Íslandsbanki exposed the bank’s illegal sale of the oil companies Skeljungur and P/F Magn. One of the men under indictment, Kári Þór Guðjónsson, is the owner of Nolt, who bought 45 million kroner in shares from Íslandsbanki at a 5 per cent discount to the official price[72] . Going back to the secret list of buyers of Íslandsbanki, it turns out that there are foreign and domestic investment funds that have asked to participate in the auction but whose e-mails are never answered[73] .

The opaque sale of Islandsbanki has infuriated Icelandic citizens [74]

There are allegations of insider trading, as a significant number of investors sold their shares a few days after the price increase[75] . Opposition MPs denounce the lack of transparency of the sale and the discount given to investors[76] . They claim that the ‘secret’ sale created a Wild West atmosphere that brought in investors of dubious reputation at discounted prices[77] . The secret list includes many old names from the 2008 crash, including people who ended up in prison[78] .

In 2008, it was common knowledge who was to blame for the collapse of the economy: it was the symbol of Iceland’s elite, the Independence Party, which had ruled the country for decades, represented by Oddsson, who after serving as prime minister was appointed to head the central bank as a retirement present. Oddsson did not resign as central bank governor until six months after the collapse.

That year, every day throughout the winter[79] in Reykjavik there were people outside the parliament demonstrating in the so-called pots and pans revolution: thousands of Icelanders noisily banging their kitchen utensils, angrily demanding the resignation of the centre-right government[80] . They want new elections, and they get them, bringing new parties into government. But it is a flash in the pan: in 2013 everything goes back to the way it was before, and so the foundations are laid for a new wave of scandals and privatisation[81] .

This is why, in April 2022, the uproar surrounding the sale of state shares in Íslandsbanki triggered a new wave of protests and led the government to curb further divestments, as well as to announce the dismantling of Bankasýsla ríkisins (Icelandic State Financial Investments) and the creation of a new structure for the management of state assets in financial companies[82] . The situation is particularly problematic because Bankasýsla ríkisins was established during the banking crisis with the explicit purpose of managing, and potentially selling, state assets in the banking and financial sector in a transparent and non-political manner in the interests of Icelandic taxpayers.

History repeats itself. More than a thousand people demonstrate in front of Alþingi against the rampant corruption within the political class. The protest is peaceful but passionate: people demand the cancellation of the sale of the bank shares and the resignation of Finance Minister Benediktsson. The protest, originally proposed by the youth movements of the opposition parties, goes on for several weeks. The fear is that the entire economy is about to collapse again, just like in 2008.

Until twenty years ago, an inconceivable scene: Icelanders in misery queuing for a hot meal from the Church [83]

For this reason, the government blocks further privatisations and places the banks under the control of an ISFI agency whose task is to monitor regularity of operations and transparency – the Bankasýsla ríkisins[84] , which promises to make sure that any divestment benefits everyone[85] . But this was not the case. On 3 February of this year, Kvika Banki (born at the turn of the century from a rib of an insurance company[86] ), contacted Íslandsbanki[87] to start negotiations on the merger[88] of the two companies. Kvika banki claims that the new combined entity would be able to offer soundness and diversified services to consumers, increase competition in the financial services sector and present an intriguing investment opportunity[89] .

But how can citizens trust them? If global regulators do not play their role efficiently, autonomously and impartially, the scams will continue, and not only in Iceland[90] . Moreover, if at the time of the disaster the only salvation for the banking system was nationalisation, why should one now, a few years later, change strategy and privatise everything, moreover in such a non-transparent manner? Questions that remain unanswered. Despite the protests, politics does not bend. The recent past has not helped, the two banks will be merged, unless Íslandsbanki’s balance sheets turn out to contain nasty surprises.

In 2021, after several years of investigation, the EFTA (European Free Trade Association) dismissed a complaint against Íslandsbanki that came from a competitor bank, which claimed that the Icelandic state had provided illegal support to prevent the public from noticing mistakes by Íslandsbanki’s management[91] . He rejected it because he found no evidence, but the suspicion remained[92] . The sale of the 22.5 per cent stake is the subject of a criminal investigation by the Central Bank of Island[93] , and the International Monetary Fund opened a parallel investigation into the same transaction in March 2023[94] .

Above all, the curtain on which this play is being performed has not changed. Iceland’s GDP has grown at a steady pace in recent years (except during the pandemic period), but we are talking about derisory figures compared to those of the large European nations: less than 25 billion dollars[95] (Germany’s GDP in 2021 exceeded 3600 billion dollars[96] ). Tourism accounts for 42% of income construction, fishing (which used to account for more than half of Iceland’s earnings) is now down to 17%, aluminium production to 16%[97] . All this is sufficient; there is no need for financial speculation. On the contrary, this can only damage the balance of the national economy. But Iceland is inhabited by landlubbers, and they, of course, are ready to do anything, even destroy a nation, just to have an extra bit of power and to be able to show off a bigger, roaring car.

[1] https://www.worldfinance.com/strategy/the-untold-story-of-icelands-financial-meltdown

[2] https://www.economist.com/media/pdf/meltdown-iceland-boyes-e.pdf p. 2

[3] https://www.france24.com/en/20180909-10-years-ago-icelands-massive-financial-crisis-erupted

[4] https://www.cb.is/library/Skraarsafn—EN/Working-Papers/WP%2086%20net.pdf p. 4

[5] https://www.economist.com/media/pdf/meltdown-iceland-boyes-e.pdf p. 2

[6] http://genova.erasuperba.it/islanda-rivoluzione-crisi-banche-debito-icesave

[7] https://www.meridian.org/alm/david-oddsson/

[8] http://genova.erasuperba.it/islanda-rivoluzione-crisi-banche-debito-icesave

[9] https://www.einaudi.it/catalogo-libri/narrativa-straniera/altre-narrative/rosa-candida-audur-ava-olafsdottir-9788806222208/

[10] https://www.economist.com/media/pdf/meltdown-iceland-boyes-e.pdf

[11] https://www.visir.is/g/2013131009111/david-oddsson-tjair-sig-um-bankahrunid

[12] https://www.economist.com/media/pdf/meltdown-iceland-boyes-e.pdf p. 3

[13] https://cepr.org/about/people/thorvaldur-gylfason

[14] https://knowledge.wharton.upenn.edu/article/icelands-economic-recovery/

[15] https://www.worldfinance.com/special-reports/failing-banks-winning-economy-the-truth-about-icelands-recovery

[16] https://www.bbc.co.uk/blogs/thereporters/robertpeston/2008/10/creditors_call_time_on_iceland.html

[17] https://www.theguardian.com/world/2008/oct/05/iceland.creditcrunch

[18] https://www.worldfinance.com/special-reports/failing-banks-winning-economy-the-truth-about-icelands-recovery

[19] https://www.theguardian.com/world/2008/oct/05/iceland.creditcrunch

[20] https://www.worldfinance.com/special-reports/failing-banks-winning-economy-the-truth-about-icelands-recovery

[21] https://cepr.org/voxeu/columns/first-casualty-crisis-iceland-0

[22] https://www.france24.com/en/20180909-10-years-ago-icelands-massive-financial-crisis-erupted

[23] https://www.theguardian.com/world/2008/oct/05/iceland.creditcrunch

[24] https://www.economist.com/media/pdf/meltdown-iceland-boyes-e.pdf

[25] https://www.bis.org/fsi/fsicms1.pdf p. 9

[26] https://www.worldfinance.com/special-reports/failing-banks-winning-economy-the-truth-about-icelands-recovery

[27] https://www.economist.com/media/pdf/meltdown-iceland-boyes-e.pdf p. 2

[28] https://www.theguardian.com/world/2008/oct/05/iceland.creditcrunch

[29] https://knowledge.wharton.upenn.edu/article/icelands-economic-recovery/

[30] https://www.worldfinance.com/special-reports/failing-banks-winning-economy-the-truth-about-icelands-recovery

[31] https://knowledge.wharton.upenn.edu/article/icelands-economic-recovery/

[32] https://www.theguardian.com/world/2008/oct/05/iceland.creditcrunch

[33] https://www.bis.org/fsi/fsicms1.pdf p. 6

[34] https://www.worldfinance.com/special-reports/failing-banks-winning-economy-the-truth-about-icelands-recovery

[35] https://www.worldfinance.com/special-reports/failing-banks-winning-economy-the-truth-about-icelands-recovery

[36] https://www.bis.org/fsi/fsicms1.pdf p. 5-6

[37] https://cepr.org/voxeu/columns/first-casualty-crisis-iceland-0

[38] http://genova.erasuperba.it/islanda-rivoluzione-crisi-banche-debito-icesave

[39] https://www.worldfinance.com/special-reports/failing-banks-winning-economy-the-truth-about-icelands-recovery

[40] https://knowledge.wharton.upenn.edu/article/icelands-economic-recovery/

[41] http://genova.erasuperba.it/islanda-rivoluzione-crisi-banche-debito-icesave

[42] https://knowledge.wharton.upenn.edu/article/icelands-economic-recovery/

[43] https://www.cnbc.com/2015/02/12/iceland-convicts-bad-bankers-and-says-other-nations-can-act.html

[44] https://www.foreignaffairs.com/articles/iceland/2016-04-11/arctic-mutiny

[45] https://icelandmag.is/article/10-year-anniversary-2008-crash-last-criminal-case-against-icelandic-bankers-brought-court

[46] https://www.cnbc.com/2015/02/12/iceland-convicts-bad-bankers-and-says-other-nations-can-act.html

[47] https://knowledge.wharton.upenn.edu/article/icelands-economic-recovery/

[48] https://cepr.org/about/people/thorvaldur-gylfason

[49] https://knowledge.wharton.upenn.edu/article/icelands-economic-recovery/

[50] https://www.bbc.com/news/world-europe-35966412

[51] https://www.ft.com/content/a5ba550f-2bcc-4947-b152-afe9bf5b0107

[52] https://www.bbc.com/news/business-25349240

[53] https://www.ft.com/content/a5ba550f-2bcc-4947-b152-afe9bf5b0107

[54] https://www.theguardian.com/politics/2009/jan/06/iceland-uk-banking-landsbanki

[55] https://www.ft.com/content/a5ba550f-2bcc-4947-b152-afe9bf5b0107

[56] https://www.icelandreview.com/politics/state-sells-22-5-stake-in-islandsbanki/

[57] https://www.ft.com/content/cb189dd8-343e-4338-b25e-9337f7b69441

[58] https://www.reuters.com/article/iceland-banks-islandsbanki-idINL8N2IY241

[59] https://www.ft.com/content/cb189dd8-343e-4338-b25e-9337f7b69441

[60] https://www.retailbankerinternational.com/news/kvika-banki-merger-with-islandsbanki/

[61] https://www.retailbankerinternational.com/news/islandsbanki-completes-largest-ipo-in-icelands-history/

[62] https://www.icelandreview.com/news/islandsbanki-sale-report/

[63] https://www.icelandreview.com/politics/state-sells-22-5-stake-in-islandsbanki/

[64] https://www.retailbankerinternational.com/news/islandsbanki-completes-largest-ipo-in-icelands-history/

[65] https://www.worldfinance.com/strategy/the-untold-story-of-icelands-financial-meltdown

[66] https://www.icelandreview.com/politics/state-sells-22-5-stake-in-islandsbanki/

[67] https://www.worldfinance.com/strategy/the-untold-story-of-icelands-financial-meltdown

[68] https://www.ruv.is/english/2022-04-26-islandsbanki-sale-protest-continues

[69] https://www.worldfinance.com/strategy/the-untold-story-of-icelands-financial-meltdown

[70] https://www.icelandreview.com/news/islandsbanki-sale-report/

[71] https://grapevine.is/news/2022/04/19/islandsbanki-sale-did-not-meet-expectations-of-government-isfi-to-be-shut-down/

[72] https://www.ruv.is/english/2022-04-08-islandsbanki-sale-controversy-escalates

[73] https://www.worldfinance.com/strategy/the-untold-story-of-icelands-financial-meltdown

[74] https://www.ft.com/content/cb189dd8-343e-4338-b25e-9337f7b69441

[75] https://www.icelandreview.com/news/islandsbanki-sale-report/

[76] https://www.icelandreview.com/politics/state-sells-22-5-stake-in-islandsbanki/

[77] https://www.ruv.is/english/2022-04-08-islandsbanki-sale-controversy-escalates

[78] https://www.worldfinance.com/strategy/the-untold-story-of-icelands-financial-meltdown

[79] https://www.worldfinance.com/strategy/the-untold-story-of-icelands-financial-meltdown

[80] https://www.france24.com/en/20180909-10-years-ago-icelands-massive-financial-crisis-erupted

[81] https://www.worldfinance.com/strategy/the-untold-story-of-icelands-financial-meltdown

[82] https://www.bloomberg.com/news/articles/2022-11-14/bungled-excel-sheet-hurts-profits-from-islandsbanki-sale#xj4y7vzkg

[83] https://www.telegraph.co.uk/expat/expatnews/7566576/Icelands-new-poor-line-up-for-food.html

[84] http://www.bankasysla.is/en/about-us/

[85] https://www.ruv.is/english/2022-04-26-islandsbanki-sale-protest-continues

[86] https://kvika.is/en/fjarfestaupplysingar/?category=financialInformation&subCategory=0

[87] https://www.retailbankerinternational.com/news/kvika-banki-merger-with-islandsbanki/

[88] https://www.globenewswire.com/news-release/2023/02/02/2600735/0/en/Kvika-banki-hf-Request-from-Kvika-banki-hf-to-%C3%8Dslandsbanki-hf-to-commence-merger-discussions.html

[89] https://www.retailbankerinternational.com/news/kvika-banki-merger-with-islandsbanki/

[90] https://www.ft.com/content/a5ba550f-2bcc-4947-b152-afe9bf5b0107

[91] https://www.eftasurv.int/newsroom/updates/esa-concludes-no-state-aid-was-provided-icelands-landsbankinn-and-islandsbanki

[92] https://www.eftasurv.int/state-aid/state-aid-register/alleged-unlawful-aid-granted-islandsbanki-hf-and-arion-bank-hf-through

[93] https://www.icelandreview.com/news/central-bank-investigating-islandsbanki-sale/

[94] https://www.centralbanking.com/regulation/banking/7950201/imf-warns-iceland-over-bank-privatisation-and-housing-market

[95] https://www.focus-economics.com/countries/iceland/

[96] https://www.focus-economics.com/countries/germany/

[97] https://www.arionbanki.is/library/skrar/Netpostur/Greiningardeild/Tenglar/Tourism%20in%20Iceland%20-%20Here%20to%20stay.pdf

Leave a Reply