When, after hours of flying, you get off at Curaçao International Airport (the largest and most beautiful in Central America), the first indelible impression is that of being at the seaside in August, with your senses full of the delicious smell of salt and in your eyes a beach of fine sand and an expanse of dazzling emerald green. After that, the waterfront town of Willemstad is a succession of beautiful Dutch houses, but taken from a Vincent Van Gogh painting: none of the brick red and dark brown of the weathered wood of the Brabant or Limburg countryside, but all painted in strong colours and pastels, as if we were in a chic version of Cuba.

Welcome to Curaçao, the pearl of the Antilles, a Dutch province where musicians, footballers and smugglers come from, a land where you have to speak Papiamento, which is a mixture of Dutch, Spanish and who knows what else, dribble past the iguanas that roam freely in the streets, and you will always feel like a foreigner. A country from which you run away if you are young and looking for a job, to which you return out of nostalgia, or because you need not an earthly paradise, but a fiscal paradise, in which to carry out, undisturbed, business that elsewhere could cause you great trouble.

But Curaçao is not only this: it is an island full of contradictions and social tensions that, in many ways, if it were not for the strength of Holland to support the local economy, could be compared to Cuba, Haiti or the Dominican Republic. A land where agriculture and pastoralism are struggling, and fishing, for centuries the main activity of the local population, is effectively prevented by the powerful ships of multinationals. A paradise for tourism which, unfortunately, is increasingly being ruined by the high crime rate and the explosion of mining and oil interests which, in the last quarter of a century, have completely changed its face. That is why, if you ask the opinion of an Antillan, it is much better to exchange the dollars of tax evaders than to see the islands destroyed little by little.

What is a tax haven?

The Buoyant Casino (Monte Carlo) in 1895, the world’s first example of an OFC zone[1]

But what exactly is a tax haven or, more correctly, an OFC (Offshore Financial Centre)? Why does the mere mention of one arouse indignation, because it (rightly) conjures up images of exotic lands where a corrupt elite pass billions covered by compliant legislation that makes capital of criminal origin legal? An OFC is a jurisdiction where transactions are legally favoured between people and companies that do not reside within it and that avoid any fiscal and police control as long as they limit themselves to doing business that does not touch the territory of the OFC itself[2]: for this reason they are small areas, closely linked to western countries, organised to increase state revenues by attracting foreign companies and investors[3].

Curaçao confirms this prejudice: a group of Caribbean islands, with an arid climate[4], located just outside the hurricane belt[5] and which, together with Aruba and St. Maarten constitute the autonomous nations of the Kingdom of the Netherlands (and therefore members of the European Union as overseas territories)[6]. The Constitution currently in force is dated 2010, and before that Willemstad was the capital of all the Netherlands Antilles, a semi-autonomous region created in 1954 from the partial dissolution of the union of Dutch colonies in the West Indies, the largest of which is Suriname – or Dutch Guiana, which borders Brazil to the south[7].

The idea of generating tax revenue from rich foreigners dates back to the 19th century. In 1856, Charles III of Monaco, with a starving population and a ruined household, had a casino built in which games such as roulette, which are prohibited in France, were allowed. The prince was not disappointed: the revenue from the Buoyant casino, following the construction of a railway link to Nice (1868) and the prohibition of gambling in Germany (1872), allowed him to abolish all direct taxes on winnings[8] and, in 1911, after transforming the State into a constitutional monarchy[9], to encourage the opening of banks specialising in the management of private portfolios[10].

The Americans were enthusiastic: New Jersey, in order to attract New York companies, introduced similar legislation in 1889, which was not very restrictive on monopolies, mergers, acquisitions and trusts, resulting in the relocation across the Hudson of, among others, the giant Standard Oil Trust[11]. Delaware, induced by the collapse of the state budget, imitated its neighbour, enacting very permissive laws, which eluded all controls, with the result that the number of companies registered in Wilmington grew from 1400 in 1902 to 4800 in 1919, contributing 40% to state revenues[12].

The reason is simple: being based in Delaware means you save between 15 and 24% in taxes (depending on which country you come from) and the law allows the actual recipient of the money to remain anonymous[13]. In 2011, Delaware had more corporations (945,000) than residents (898,000), each paying a flat tax regardless of turnover, for a total tax revenue of about $860 million – about 25% of the state budget[14]. But the exponential growth of the OFCs took place between 1919 and 1944, when first the finance and industry of Germany, and then gradually that of all the other great nations, needed to hide, even before private capital, the secret trade in arms and mineral resources[15].

Small havens grow: birth and development of Willemstad offshore

The Smeets Trust in 1952, Willemstad office of the Shell Group[16]

Curaçao’s history as an OFC is much more recent: it began in 1951, when the Netherlands Antilles introduced legislation to tax the profits of foreign companies at between 2.4% and 3%, about one-tenth of the taxes paid in Europe and America[17]. The decision was taken under the influence of the largest Dutch credit institution, the NHM Nederlandsche Handel-Maatschappij[18], in order to attract foreign money to a small, politically stable jurisdiction, autonomous in fiscal matters and close to the United States: already during the Second World War Willemstad was the headquarters of more than 140 fictitious companies that used the island to carry out administrative formalities[19].

After the end of the war these were closed, but the idea of Curaçao as a suitable place for speculative activities remained intact: according to a note from the management of NHM in May 1950, in order to protect the capital that was fleeing due to the very high taxes in the years of post-war reconstruction, it was necessary to break the link between investment and owner, by placing a trust or a holding company in a third country; in this case, the Dutch who invested in the USA needed a safe haven, they chose Curaçao, where everyone spoke their language[20]. In the autumn of that year, Deputy Director Willem A. Van Ravesteyn was sent to Willemstad to investigate the feasibility of the operation[21].

The island’s government was no slouch: since 1912 it had been negotiating with Royal Dutch Shell, which set up in Curaçao the holdings that controlled its oil business in Venezuela – a country located only 50 km by sea from the Netherlands Antilles[22]. Thanks to an agreement with the US company General Asphalt, which held the concession and management rights to those fields, Shell formed the Burlington Investment Group in 1913, acquiring those rights (through the acquisition of the CPC Caribbean Petroleum Company[23]) in exchange for the funds needed by General Asphalt to start drilling[24].

After the discovery of the first well, Henri Detering, director of Shell, decides to install a refinery in a place close to that of extraction, but outside of Venezuela, as the port of Maracaibo is too shallow to accommodate tankers[25] and Venezuela is politically very unstable[26]; the “Isla” refinery is built in Curaçao in 1915[27], thanks also to the exemption from import, export and transit duties that the local government guarantees to Shell[28]. In 1938, Isla is the group’s largest refinery and the third largest in the world[29].

In February 1940, Royal Dutch set up its own office in Willemstad in order to maintain its freedom in the event of a German military attack, which would take place on the following 10 May; the head of legal affairs, A.S. Oppenheim, then moved to Curaçao and, with the help of the local notary Anton A.G. Smeets, moved Shell’s head office from The Hague to Willemstad, and subsequently also moved 140 of the group’s subsidiary companies between the summer of 1940 and the winter of 1942[30]. All these holdings and sub-holdings, which serve to prevent the Nazis from getting their hands on Shell’s money, are liquidated after the end of the war[31].

But, as mentioned above, nobody in Amsterdam forgets this experience. Less than a decade later, when van Ravensteyn was sent to the island, in addition to meeting the most influential politicians, he went to talk to notary Smeets, who founded the Nederlandsche Handel-Maatschappij Trustkantoor Curaçao, the first local company dedicated exclusively to tax evasion[32]. In April 1951, the island’s governor presented a bill guaranteeing a 90% tax exemption on company dividends[33]. As of 1952, on the initiative of Anton Smeets, the tax on corporate holdings is reduced to 2.4%[34].

1860: the Amsterdam headquarters of NHM, then one of the world’s largest trading companies. In 1964, after a series of mergers, it became ABN AmRo, one of the largest banks in the Netherlands[35]

These laws alone are not enough: there is a need for international agreements that accept the fact that large corporations escape taxation in large countries and can continue to operate in the global market[36]. The turning point came in 1955, when Curaçao ratified a reform of the tax treaty that had been in place since 1948 between the Netherlands and the United States, whereby interest payments to Curaçao companies were exempt from the US 30% withholding tax[37] and the rate for dividend payments was reduced to 15%[38]. From this point on the number of offshore companies in Willemstad grows from 180 in 1956 to about 400 the following year[39].

In 1955 the Dutch government approves a proposal negotiated in 1951 that the Netherlands Antilles receive full administrative autonomy while retaining the laws of the Netherlands[40]. The approval is essential to give Willemstad an aura of trustworthiness, and allows Curaçao to adhere to tax treaties concluded by the Netherlands with other states[41]. In 1965 the Dutch law prohibits double taxation between the Netherlands and Curaçao[42]: exemption from withholding tax is granted for dividends paid from the Netherlands to Curaçao[43]. This new measure opens up new opportunities for tax optimisation: multinationals can choose to concentrate their worldwide dividend or royalty payments in a holding company in Amsterdam and from there send the money tax-free to Curaçao[44].

Great success in America

Anton Smeets (centre, in tailcoat) at a Dutch Navy charity gala in 1951[45]

In the 1960s, rising social spending and the costs of the war in Vietnam put pressure on the US capital market[46]. The 30% ‘withholding tax’ on interest payments to foreign entities[47] is a major obstacle to the trend for multinationals to use government options and loans (like Eurobonds today) to finance their activities[48], a trend created by an uncontrollable rise in interest rates on the banking market[49]. The tax treaty with the United States rescinds interest payments to Antilles companies for this tax: so the Willemstad branch of a US company could, for example, sell the bonds it bought on the London market and return the income to the company without having to pay the interest due if an American, Dutch or London company sold the bonds[50].

To increase the attractiveness of its jurisdiction, Curaçao’s Ministry of Finance introduces ‘anonymous bearer shares’: there is no longer a register of shareholders, only secret contracts between lawyers, who are the only ones who know who the real owners of a given company are – a key element, for example, for Middle Eastern investors concerned about the possible consequences of the 1973 oil embargo on their properties in the United States[51]. The Netherlands helps: every guilder earned by Willemstad is one less guilder in Dutch subsidies. He signs as many bilateral tax treaties as possible, directing an increasing flow of money to Curaçao[52].

Over the years, the U.S. Treasury Department realizes that the advantages of the tax treaty with the Netherlands Antilles benefit companies all over the world: wherever you are, you only need to send the earnings made in America to Curaçao to avoid the infamous withholding tax[53]; this causes the failure of any treaty negotiation by Washington with other countries[54]. In 1965, the U.S. government forced Willemstad to revise the tax treaty; the result was a document stating that, from then on, U.S. tax benefits would only apply to dividends, interest and royalties paid to companies wholly owned by Dutch residents[55]. When you make the law, you find the loophole: companies now need an official document from the tax authorities in the Netherlands stating that they are entitled to US tax benefits in accordance with the new legislation: these documents are issued even though the authorities are unable to check who actually owns the companies concerned due to the secrecy rules in force[56]. So, nothing changes.

In 1979, the United States asked for a new revision of the treaty, motivated by two fundamental issues: a low dollar value and high stock market returns increased investments in the US real estate sector, creating concerns about foreign ownership of agricultural land, since a substantial part of these investments were made through Curaçao real estate and financial companies that took advantage of US and Antilles tax exemptions on real estate capital gains[57]. The second reason is the discovery that the 230,000 or so inhabitants of the Antilles, in 1978, received no less than 13% of all the interest paid by US borrowers to foreign creditors: there is a suspicion that a large part of that money goes into the pockets of those who have no right to receive it[58].

Curaçao defends itself, as it has a monopoly on issuing EU bonds to US companies, worth $10.3 billion in 1982[59]. To overcome the stalemate, in 1984, Congress repealed the 30% withholding tax on interest payments to foreign investors, thus rendering superfluous those shell companies in the Antilles that had been set up to avoid that tax[60]. In August 1986, a limitation on the benefits of the treaty for citizens and companies of other countries was added[61]: international mutual funds created in the Antilles or the United States[62] and foreign real estate companies took advantage of the treaty, and could choose between being exempt from the withholding tax on dividends or being treated as domestic companies[63]. The obligation to provide information on ownership is introduced: in this way Curaçao, in practice, ceases to be a tax haven[64].

The end of the golden age

June 2020: Curaçao citizens demonstrate against new tax agreements with the Netherlands and the USA[65]

Of course, not everyone in Willemstad is happy. An exodus of companies requiring absolute secrecy began to move to the neighbouring islands of Aruba and Sint Maarten, which maintained the old laws and renounced international treaties[66]. Washington issued an ultimatum to the Antilles government: failure to accept the new agreement would have led to the cancellation of the treaty, which was ratified on 29 June 1987[67]. After all, there was no alternative: the percentage of money from tax savings of multinational companies had become derisory in the face of criminal capital, and the United States was fighting against this capital all over the world, especially in Switzerland[68].

While the new treaties with the Swiss are achieving encouraging results[69], in Curaçao the Transparency Act does not reveal the real owners of a company, who are now hiding, through a system of Chinese boxes, in other tax havens[70]. The Dutch government put the brakes on, raising the tax on dividends from 0% to 10.5% in order to stem both Dutch tax losses and complaints from other governments[71]: Willemsted still remains a convenient OFC, because the rate in Holland remains at 25%[72].

In 1989, the Antilles government tries to attract foreign pensioners by offering tax rates around 5%[73]: many elderly Dutch emigrate to Curaçao – really, or only on paper – including some who transfer their pensions to offshore companies on the island[74]. The Hague reacts: first, in 1994, it enacts a law raising taxes on pension funds collected abroad to 60%[75], and then, in 1997, it imposes further changes to curb the exodus of pensioners[76]. By then the game was lost: with the entry into force in 1992 of the European Union’s directive on “parent subsidiaries”, clients moved to Luxembourg or Dublin and Willemstad’s financial income fell from one billion Dutch guilders in 1993 to 200 million in the second half of the 1990s[77]. Finally, in 1997, the Dutch government passes a law that encourages multinationals to bring their holdings back to the Netherlands[78].

Curaçao does not recover from this blow. As the government has invested heavily in infrastructure, the state finds itself up to its neck in debt[79]. Dependence on Dutch subsidies is growing dramatically, with more and more young people leaving the island for the large industrial cities of the Netherlands[80]: in 1986 Aruba separated from the Antilles and obtained the status of an autonomous country of the Kingdom of the Netherlands[81]. The citizens of Curacao were asked to decide on the fate of the island. In 1993, 74% of voters chose to remain within the Federation of the Netherlands Antilles[82], but the worsening economic situation led to a second referendum in 2005 calling for the dissolution of the Caribbean federation[83]. After ratification by the Dutch parliament, Curaçao became quasi-independent on 10 October 2010, leaving the management of diplomacy and justice to The Hague[84]. Sint Maarten follows the same path as Curaçao, while the islands of Bonaire, Saba and Sint Eustatius become special municipalities within the Netherlands[85].

The collapse of Antilles society

With the sunset of the tax haven, Curaçao now focuses on the tourist beauty of its towns and beaches[86]

The economic collapse of the 1990s brought more and more Antilles to the Netherlands[87], many of whom sought work in the European Union[88]. The unemployment rate in Curaçao in 2005 is 18%, with peaks of 44% among young people, who are among the protagonists of the migratory processes[89]; but there is not only the economic crisis: from neighbouring countries, such as Venezuela, Colombia, Haiti and the Dominican Republic, Curaçao fills up with hungry illegal immigrants[90]. They don’t stand a chance, and either join the ranks of organised crime or form an underclass, close to slavery, working in tourism and oil trading – while the little money they do have is all in the hands of the whites[91]. From 2014 onwards, waves of Chinese and Indians arrive[92], and the prices of houses and consumer goods skyrocket[93].

The number of poor people is growing, more and more parents (especially single mothers) are forced to leave their children on the street because they have to work at two low paid jobs to make ends meet[94]. In 2009, over 33% of children dropped out of school[95]. Juvenile prostitution, alcoholism and drug addiction have become a national tragedy: a survey conducted in 2010 by the Maneho de Adikshon Foundation (FMA) in collaboration with Curaçao’s Public Health Service confirms that 79% of primary school pupils and 76% of secondary school pupils regularly consume alcohol[96].

The Antilles became one of the world’s top areas for cocaine seizures; about 100 times more than in the United States in 2004 – over nine tonnes, or 50 grams of cocaine for every man, woman and child[97]. About 60% of all cocaine seized in the Caribbean is seized in Curaçao[98]. The drugs arrive by sea from Colombia and Venezuela and continue by sea to Holland and the USA[99]. Violent gangs of minors spring up[100], and the Center for Latin American and Caribbean Studies at Utrecht University says that in 1999, 25,000 people in poor neighbourhoods were living in appalling conditions – in hovels with no sanitation, no drinking water, no electricity and no heating[101].

The only market that works is the drug market[102]. In order to defend themselves against the desperate outsiders, some young people in Curaçao set up a ruthless gang, the NLS (No Limit Soldiers) [103]. Starting out as a street gang, the NLS is now a complex criminal organisation dedicated to international drug trafficking, murder for hire, arms trafficking and sales, prostitution, extortion, illegal gambling and money laundering – in collusion with some of America’s most violent gangs: Miami Zoe Pound in Haiti, the drug cartels of Colombia and the Zetas of Mexico[104].

Taking advantage of their status as EU citizens, NLS members commute between Willemstad and the Netherlands: the gang has cells in Rotterdam, The Hague, Amsterdam, Lelystad and Dordrecht, acting in cahoots with the fearsome local gang called Penose[105] and other criminal groups active on Dutch soil[106]. NLS members wear diamond-encrusted medallions, dress like the most notorious US gangs and speak the same language in the music videos they produce[107]. They shoot, above all, at their rivals in the drug trade, represented by the Buena Vista City gang, with whom they have an ongoing feud that has cost dozens of lives[108].

5 May 2013: Antillan opposition leader Helmin Wiels is shot dead in the streets of Willemstad[109]

Contract killings are a thriving market, as in the case of Helmin Wiels, leader of the independence party Pueblo Soberano and member of parliament, who was murdered in Willemstad on 5 May 2013[110]; in 2016, NLS killer Elvis ‘Monster’ Kuwas was sentenced to life imprisonment for the crime[111]. Prosecutor Gert Rip describes Wiels, who is committed against corruption and illegal gambling, as representing the hopes of a large section of the population[112]. In 2018, Burney ‘Nini’ Fonseca was sentenced on appeal to 26 years’ imprisonment for having acted as an intermediary between the instigators and the perpetrator of the crime[113], and in March 2021, George Jamaloodin, a former finance minister in the government led by Gerrit Schotte, was sentenced to 30 years as the instigator of the murder[114].

The investigation shows that both Jamaloodin and Schotte have links to corruption and gambling: for example, Robbie Dos Santos, the half-brother of the former finance minister, is the owner of Robbie’s Lottery, Curaçao’s largest betting chain[115]. Shortly before his death, Wiels announced the publication of documents proving Dos Santos’ involvement in illegal gambling: Dos Santos was arrested twice, in 2014 and 2019, as a suspected instigator of the murder, but was released[116] until he was cleared of all charges in November 2021[117]. Elmer Wilsoe, Minister of Justice in the Schotte government, was also investigated for a long time, and then acquitted in 2020[118].

The opponent of Wiels, who gains the most from his death, is Gerrit Schotte, leader of the MFK party: on October 10, 2010, the day the new status of autonomous nation became executive, Schotte was appointed Curaçao’s first prime minister, called to lead a coalition government that includes the parties Movementu Futuro Kòrsou (MFK), Pueblo Soberano and MAN[119]. Schotte remained in office until 3 August 2012[120]. In 2016 he was sentenced in first instance to 3 years’ imprisonment and 5 years’ disqualification from holding public office for forgery, corruption and money laundering[121], a sentence upheld on appeal the following year[122], and in 2019, his seat in parliament was finally revoked[123].

Links with the Sicilian Mafia

Mafia boss Francesco Corallo (right) with guests at his casino Atlantis in Sint Maarten[124]

The trial against him shows that he received more than $213,000 from the Sicilian Francesco Corallo to finance the MFK, in exchange for participating in the decisions of the new government[125]. Corallo, called the ‘king of slot machines’, is the son of Gaetano Corallo, the right-hand man of the godfather Nitto Santapaola – the boss of the so-called loser mafia, who since the 1980s, in order to escape capture and enemies, has been hiding in Sint Maarten, where Gaetano founded companies that manage hotels, resorts and, above all, gambling houses[126].

Following in his father’s footsteps, Francesco owns several casinos in Sint Maarten, where he resides and from where he controls his criminal empire[127] through Atlantis Casino On Line Curaçao N.V. (then B Plus Giocolegale Ltd London[128]), a company which, in 2004, became the concessionaire for Italy for the operation of slot machines and video lotteries[129]. In this way he controlled 30% of a sector that generated a turnover of more than 15 billion euros in the first six months of 2010[130]. Corallo’s troubles began in 2012, when his concession from the State Monopolies was revoked by order of the Prefecture of Milan, due to his convictions for criminal association of a mafia-like nature and corruption as part of an investigation into Banca Popolare di Milano[131].

In August 2014, BetPlus was placed under commission by the Prefect of Rome, Giuseppe Pecoraro, on the instructions of ANAC, chaired by Raffaele Cantone, while Corallo was indicted in the BPM investigation[132]. In order to avoid bankruptcy, Corallo linked up with the British company Global Starnet Ltd London[133], a manager of which, Dutchman Rudolf Baetsen[134], is head of Atlantis World Group of Companies Ltd. Cyprus, a company under Cypriot law[135] from which €85 million in unpaid taxes passed, ending up in a bank account in the name of one of Corallo’s companies in Sint Maarten and then reinvested together with another €150 million paid by Atlantis into accounts in Curaçao, Sint Maarten and Saint Lucia[136].

In December 2016 Corallo was arrested in Sint Maarten at the same time as Amedeo Laboccetta, an Italian PdL MP[137] and former legal representative of Atlantis, and Rudolf Baetsen[138]. He is accused of being a Mafia boss[139]. Giancarlo and Sergio Tulliani, respectively brother-in-law and father-in-law of former Italian Chamber of Deputies President Gianfranco Fini, are also under investigation: According to what has been ascertained by the magistrates, Giancarlo Tulliani would have created for Baetsen two offshore companies through which to transit money destined for the Antilles, plus 2.6 million euros of illegal origin destined for Corallo[140]; Baetsen himself would have purchased a flat in Monte Carlo in the name and on behalf of two of the Tulliani companies, Printemps Ltd Saint Lucia and Timara Ltd Saint Lucia [141], paying with Corallo’s money[142]. In December 2021, the trial, in which Gianfranco Fini, his partner Elisabetta Tulliani, his brother Giancarlo and father Sergio, Francesco Corallo and Amedeo Laboccetta are accused of money laundering, is still in progress[143].

At the end of 2010 Corallo proposed to Prime Minister Schotte to appoint Rudolf Baetsen as head of the supervisory board of the Central Bank of Curaçao[144]. As the scandal unfolded, Baetsen withdrew, but by now the police were investigating Schotte and his partner Cicely van der Dijs for a bank transfer of 800,000 dollars from International Financial Planning Services Ltd British Virgin Islands (another Corallo company) to the Swiss bank account of No Brand Ltd Majuro, a Marshall Islands company owned by Schotte[145]. According to the Antilles magistrates, the murder of Helmin Wiels was decided in order to stem this judicial avalanche: thanks to this murder, the Sicilian Mafia and the No Limit Soldiers gained in influence.

The US government sets up a military centre FOL (Forward Operating Locations), the purpose of which is to militarily combat the Antilles, Colombian and Venezuelan drug traffickers[146]. The population is frightened by this: the gangs are so powerful that it is not impossible to think of them attacking the FOL at Hato airport[147]. A few fathoms of sea away, or the clash between President Nicolas Maduro and opposition leader Juan Guaido has brought Venezuela, in misery and dependent on oil revenues[148], exhausted by the pandemic[149] and sanctions imposed by the Trump government[150], to starvation and on the brink of civil war[151].

A country with limited sovereignty

Members of organised crime in Antilles pull Venezuelan stowaways ashore after arriving by sea[152]

While Guaido is recognised by the United States and other countries as the legitimate leader of the country[153], Maduro can count on the support of Russia, Iran and Turkey[154]. The poverty rate in Caracas reaches 94.5% of the population, who earn on average less than two euros per month[155]; people are fleeing. More than seven million citizens have left the country in the last year[156]: Colombia, Peru, Ecuador, Chile, Brazil, Panama, Dominican Republic, Mexico – and Curaçao, which will host more than 16,000 Venezuelan migrants in October 2021[157]. Amnesty International points the finger at the fact that the local government has never thought of such an eventuality and, therefore, does not allow people to formally seek asylum and has only one answer: imprisonment and deportation[158]. After the Red Cross abandoned the camp in 2017, those who land in Curaçao are detained in the SDKK (Sentro di Detenshon i Korekshon Korsou) or in the cells of police stations, waiting to be repatriated[159]. The living conditions of refugees, as revealed by the new Amnesty International report “Still no Safety – Venezuelans denied protection in Curaçao” (2021) are defined as inhuman: overcrowding, lack of privacy and hygiene, forced separation of children, abuse and violence[160].

In October 2021, Amnesty International stepped up the pressure and called for the Dutch government to intervene, when it was discovered that the Coast Guard was being encouraged to push migrants back into the sea[161]. The Hague government is responsible for the total disregard[162]. It is of no use: Curaçao continues to put up a wall, the illegal immigrants, despite the repatriations and expulsions decided in court[163], continue to arrive – even those who have been sentenced to a three-year ban from the island[164]. In 2016, Curaçao’s governor Lucille George-Wout accuses Venezuelan migrants as carriers of delinquency, illegal work and prostitution[165] – the same words that Dutch populists use against migrants from Curaçao[166].

In this climate of neglect, politics in the Antilles is made by the United States, which maintains military bases in Curaçao and Aruba, an outpost for possible actions of political and military interference in Latin America[167], as is also the case in Colombia, and in any case in agreement with the Dutch government[168]. As far as border surveillance is concerned, this is delegated to the US Navy, which acts in agreement with FRONTEX agents, the special troops against illegal immigration, while the possibility of creating hotspots on the islands of the Netherlands Antilles is being considered, as has been done in Greece and Italy[169].

With such a weak government, now that Willemstad is no longer an OFC, and with tourism severely damaged by the pandemic, political and social instability and the fact that most of the hotels belong to the Sicilian mafia or South American gangs, Curaçao is a country with limited sovereignty, forced to accept any imposition from the EU, the US or organised crime. There would still be the option of exploiting the mineral deposits, but even this has now been played in favour of others: first and foremost, the Interoceanmetal consortium, based in Poland, whose major shareholders are in Russia[170].

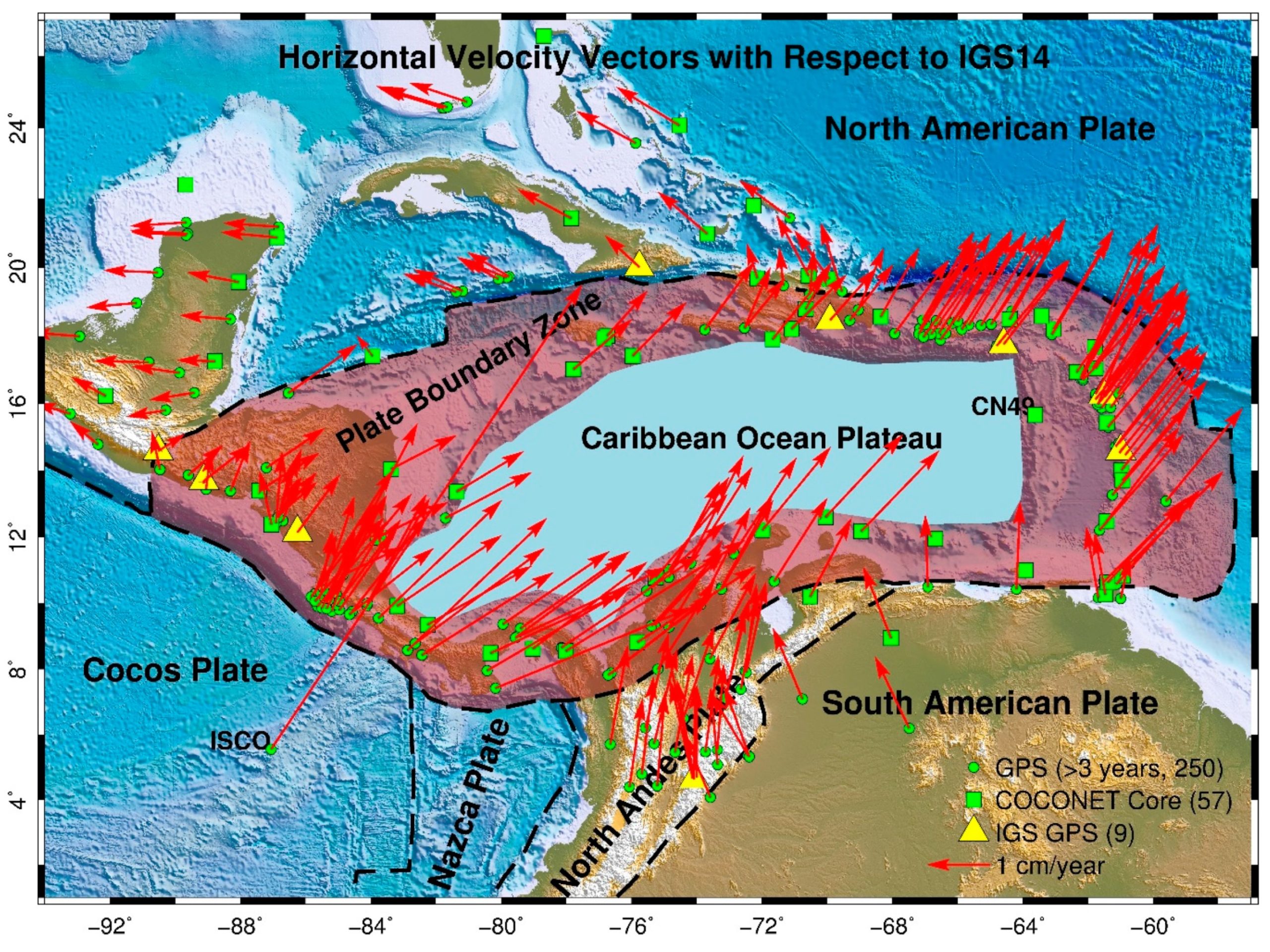

The area of the Caribbean Sea where GWL and Spec Partners intend to exploit seabed mineral deposits[171]

The consortium has a licence for exploration and exploitation in the Pacific Ocean issued by the International Seabed Authority – a licence that expired in 2016, was extended until 2021 and is now awaiting another time extension[172]. Interoceanmetal is a huge project, divided into sectors, one of which is coordinated by Spec Partners Ltd., a British company with Norwegian shareholders[173] that, for the moment, is inactive[174].

Spec participates in a second consortium: GWL Geology Without Limits[175], set up for the exploitation of the Caribbean Sea. Transparency: zero. In 2015, its shareholders, in addition to Spec Partners, are Geofisicos Marinos Ltd. Belize City[176], GWL Technologies LLP Sheffield[177] and Projectos Ecologicos Ltd. Belize City[178] – all companies whose owners are not known. In 2016, the Belize companies were replaced by Global Geophysical Research N.A. Limited Limassol[179] and GWL Overseas Ltd. Limassol[180] – apparently controlled by Russian oligarch Egor Krasinskiy[181]. In short: whatever the wealth hidden in the waters around Curaçao, it will not be the islanders who benefit.

Better alone or in a bad company?

30 May 1969: The centre of Willemstad in flames during the riots against the Dutch army[182]

In such a context, the question of independence becomes almost irrelevant, even though the issue has been on the table since 2010. The Movement for the Future of Curaçao (MFK), founded by Gerrit Schotte, is a populist party with a strong independence vocation, which did not end with the conviction of its founder: in the last elections, in March 2021, the formation led since 2017 by Gilmar Pisas asserted itself as the first party, winning nine seats in Parliament[183]; the other major independence party, Pueblo Soberano, which is on the left, is unable to maintain the consensus achieved when Helmin Wiels was still alive (and in the 2012 elections was the first party[184]). At the last elections it did not even enter Parliament[185]; the same fate befell the independentist formation Kòrsou di Nos Tur (KNT), which won three seats in 2016[186], two in 2017[187] and none in 2021[188].

Pisas’ position is very clear: the Caribbean Entity for Reform and Development (COHO), a reform programme agreed with The Hague, which the outgoing Prime Minister Rhuggenaath has undertaken to sign up to in exchange for substantial interest-free loans, is the buoy around which the political debate revolves[189]. Before the vote, Pisas railed against the agreement, saying he wanted to renegotiate the right of the people of Curaçao to go it alone, but in September he changed his mind and supported COHO, betraying the trust of those voters who wanted less interference from the Netherlands in domestic affairs[190].

Pisas admitted it without hesitation: without aid from the Kingdom, there were no funds to meet the needs of the state, keep the companies afloat, provide food cards for 26,000 poor people, and keep 2,000 civil servants in their jobs[191]. The economic, social and political situation of the island (as well as Aruba and Sint Maarten) does not allow for realistic thoughts of independence, as confirmed by the Secretary of State for the Interior Raymond Knoops[192].

The Dutch Prime Minister, Mark Rutte, speaks of aid that is not due to countries in difficulty, whose conditions are not negotiable[193]; the pandemic crisis is bringing economies to their knees, such as those of the former Caribbean colonies, already tried by decades of inexorable decline[194], so that independence is very, very far away, even if only to be imagined. The real problem is common to all tax havens: what happens if international laws and treaties suddenly prevent them from prospering? What if the only economic sector that works is organised crime, or an extractive industry that has always been in the hands of foreign owners?

This question is of paramount importance for the future of the entire Caribbean region, which is teeming with OFCs: Bahamas, Turks & Caicos, Bermuda, St. Kitts & Nevis, Antigua, Guadeloupe, Montserrat, Barbados, Grenada, Cayman Islands and British Virgin Islands, all competing OFCs covering an area of sea only a third the size of the Mediterranean. Analysing the situation with a cool head, one cannot fail to understand that the choice of Castroism in Cuba was the only viable solution at the time to prevent that island from suffering the same fate – given that, when the revolution came, Cuba was controlled by American industry, finance and, above all, organised crime.

[1] http://www.bizarrejournal.com/2015/03/the-suicide-table-of-monte-carlo.html

[2] Christian Chavagneux, Ronen Palan and Richard Murphy, “Tax havens: How globalization really works“, London: Cornell University Press, 2010, p. 45

[3] Christian Chavagneux, Ronen Palan and Richard Murphy, “Tax havens: How globalization really works“, London: Cornell University Press, 2010, p. 151 e pp. 124-125

[4] https://www.meteo.cw/climate.php

[5] https://abcnews.go.com/Lifestyle/caribbean-islands-generally-hit-hurricanes/story?id=40407011

[6] https://www.netherlandsandyou.nl/your-country-and-the-netherlands/united-states/about-us/curacao-and-you/about-curacao

[7] https://www.bbc.com/news/world-latin-america-11511355

[8] Thierry Godefroy and Pierre Lascoumes, «Le capitalisme clandestin: l’illusoire régulation des places offshore«, La découverte, 2004, p. 29

[9] https://www.conseil-national.mc/linstitution/histoire-du-conseil-national/

[10] Ronen Palan, The offshore world: sovereign markets, virtual places, and nomad millionaires. Cornell University Press, 2006, pp. 112-114

[11] Christian Chavagneux, Ronen Palan and Richard Murphy. Tax havens: How globalization really works. London: Cornell University Press, 2010, pp. 109-110

[12] Ronen Palan, “The offshore world: sovereign markets, virtual places, and nomad millionaires“, Cornell University Press, 2006, pp. 101, 102; Christian Chavagneux, Ronen Palan and Richard Murphy, “Tax havens: How globalization really works“, London: Cornell University Press, 2010, pp. 110-111

[13] [13] Christian Chavagneux, Ronen Palan and Richard Murphy, “Tax havens: How globalization really works“, London: Cornell University Press, 2010, p. 110

[14] https://www.nytimes.com/2012/07/01/business/how-delaware-thrives-as-a-corporate-tax-haven.html

[15] Robert Liefmann, “Die Geldvermehrung im Weltkriege und die Beseitigung ihrer Folgen. Eine Untersuchung zu den Problemen der Übergangswirtschaft“, Deutsche Verlag-Anstalt, Stuttgart / Berlin, 1918; Robert Liefmann, „Kartelle, Konzerne und Trusts“, Deutsche Verlag-Anstalt, Stuttgart 1927; Stefanie Knetsch, „Das konzerneigene Bankinstitut der Metallgesellschaft im Zeitraum von 1906 bis 1928“, Frank Steiner Verlag, Stuttgart 1998, pp. 227-240

[16] https://nl.pinterest.com/pin/631700285213435818/

[17] “Financial Secrecy Index 2020 – Narrative Report on Curaçao”, Tax Justice Network, p.1

[18] https://historiek.net/nederlandsche-handel-maatschappij-nhm-1824/83034/

[19] https://www.ftm.nl/artikelen/society-notaris-en-nederlandse-bank-lieten-de-zon-opkomen-op-belastingparadijs-curacao?share=841WV8PdbG6AJXCCa34bq1huKlTawHH9gud91yI2Kyv0ydfGauH8OSFtKniAKA%3D%3D

[20] Nationaal Archief, Den Haag, Nederlandsche Handel-Maatschappij (NHM), nummer toegang 2.20.01, inventarisnummer 13887, vertrouwelijke nota Trustmaatschappij Curaçao, 15 mei 1950

[21] https://www.ftm.nl/artikelen/society-notaris-en-nederlandse-bank-lieten-de-zon-opkomen-op-belastingparadijs-curacao?share=i3MyOjJtfvq%2BF%2BbuyH%2BDofqZkyWF2OEshmvKFJbr19pzUCwKbsEFvEC7R5qrHA%3D%3D ; https://pure.uva.nl/ws/files/26111338/2.pdf ; https://www.cambridge.org/core/services/aop-cambridge-core/content/view/9553E156539D00E52F8EC687EBBBD39E/S096856502000013Xa.pdf/div-class-title-a-perfect-symbiosis-curacao-the-netherlands-and-financial-offshore-services-1951-2013-div.pdf ;

[22] https://www.curacaohistory.com/

[23] Tomás Straka, Guillermo Guzmán Mirabal, Alejandro E. Cáceres, “Historical Dictionary of Venezuela”, Rowman & Littlefield, 2017, p. 317

[24] https://www.curacaohistory.com/

[25] “Venezuela Up-to-date”, vol. III, n°1, December 1951, p. 3

[26] https://www.curacaohistory.com/

[27] https://www.ejatlas.org/print/shells-toxic-legacy-in-curacao

[28] https://www.ftm.nl/artikelen/society-notaris-en-nederlandse-bank-lieten-de-zon-opkomen-op-belastingparadijs-curacao?share=i3MyOjJtfvq%2BF%2BbuyH%2BDofqZkyWF2OEshmvKFJbr19pzUCwKbsEFvEC7R5qrHA%3D%3D

[29] J. L. Van Zanden, J. Jonker, S. Howarth & K. Sluyterman, “A History of Royal Dutch Shell” OUP Catalogue, 2007, pp. 447-449

[30] J. L. Van Zanden, J. Jonker, S. Howarth & K. Sluyterman, “A History of Royal Dutch Shell.” OUP Catalogue, 2007, p. 29

[31] Melinda N. Whyte, “De offshore sector op Curaçao: niet alleen een begrip in zee” Katholieke Universiteit, Sociologisch Instituut, 1985, p. 22

[32] NL-HaNA, NHM, 2.20.01, inv. no. 13887: Notities, rapporten en correspondentie betreffende de oprichting van de NHM, Trustkantoor Curaçao NV, 18 Okt. 1950

[33] https://www.cambridge.org/core/journals/financial-history-review/article/perfect-symbiosis-curacao-the-netherlands-and-financial-offshore-services-19512013/9553E156539D00E52F8EC687EBBBD39E#fn8

[34] https://fee.org/articles/the-rise-and-fall-of-curaaos-offshore-financial-sector/

[35] https://historiek.net/nederlandsche-handel-maatschappij-nhm-1824/83034/

[36] https://www.cambridge.org/core/journals/financial-history-review/article/perfect-symbiosis-curacao-the-netherlands-and-financial-offshore-services-19512013/9553E156539D00E52F8EC687EBBBD39E#

[37] https://www.irs.gov/pub/irs-trty/nether.pdf ; “Financial Secrecy Index 2020 – Narrative Report on Curaçao”, Tax Justice Network, p.2

[38] https://www.cambridge.org/core/journals/financial-history-review/article/perfect-symbiosis-curacao-the-netherlands-and-financial-offshore-services-19512013/9553E156539D00E52F8EC687EBBBD39E#

[39] https://www.ftm.nl/artikelen/society-notaris-en-nederlandse-bank-lieten-de-zon-opkomen-op-belastingparadijs-curacao?share=TGezH485dPnIh9BMnHBac15fW0V1ddDaiRqsDkLl8%2BJVhwhK8uBqTVqLiu2UCQ%3D%3D

[40] https://www.britannica.com/place/Netherlands-Antilles

[41] https://www.ftm.nl/artikelen/society-notaris-en-nederlandse-bank-lieten-de-zon-opkomen-op-belastingparadijs-curacao?share=TGezH485dPnIh9BMnHBac15fW0V1ddDaiRqsDkLl8%2BJVhwhK8uBqTVqLiu2UCQ%3D%3D

[42] https://www.eerstekamer.nl/wetsvoorstel/33955_belastingregeling_nederland

[43] https://www.ftm.nl/artikelen/society-notaris-en-nederlandse-bank-lieten-de-zon-opkomen-op-belastingparadijs-curacao?share=TGezH485dPnIh9BMnHBac15fW0V1ddDaiRqsDkLl8%2BJVhwhK8uBqTVqLiu2UCQ%3D%3D

[44] https://www.cambridge.org/core/journals/financial-history-review/article/perfect-symbiosis-curacao-the-netherlands-and-financial-offshore-services-19512013/9553E156539D00E52F8EC687EBBBD39E#

[45] https://knipselkrant-curacao.com/oud-notaris-gerard-smeets-overleden-antilliaans-dagblad/

[46] https://www.barrons.com/articles/what-happened-in-1968-can-show-us-why-the-market-is-rising-now-51591178401

[47] https://taxsummaries.pwc.com/united-states/corporate/withholding-taxes

[48] John A. MATHIESON, Paul A. Laudicina, and W. B. Bader, “The Netherlands Antilles: The Impact of Offshore Financial Activities“, SRI International, 1982, p. 5

[49] https://www.macrotrends.net/2015/fed-funds-rate-historical-chart

[50] https://www.leidenlawblog.nl/articles/the-antilles-route-is-back

[51] https://fee.org/articles/the-rise-and-fall-of-curaaos-offshore-financial-sector/

[52] Cornelis Abraham (Flip) de Kam, “Betalen is voor de dommen: over de miljardenmazen in ons belastingstelsel“, Bakker, 1978,

[53] M. J. C. van Beurden, “De Curaçaose offshore: Ontstaan, groei en neergang van een belastingparadijs, 1951-2013“, PhD dissertation, University of Amsterdam, 2018, p. 97

[54] Scott B. Macdonald, “Handbook of Caribbean Economies”, edited by Robert E. Looney, Routledge, 2021, pp. 451-52

[55] John A. MATHIESON, Paul A. Laudicina, and W. B. Bader, “The Netherlands Antilles: The Impact of Offshore Financial Activities“, SRI International, 1982, pp. 67-68

[56] M. J. C. van Beurden, “De Curaçaose offshore: Ontstaan, groei en neergang van een belastingparadijs, 1951-2013“, PhD dissertation, University of Amsterdam, 2018, p. 100

[57] “Statement of William J. Anderson, Director General Government Division before the Subcommittee on Commerce, Consumer and Monetary Affairs, Committee on Government Operations – House of Representatives on federal efforts to define and combat the Tax Haven problem, United States General Accounting Office – Washington D.C. 20548, April 12, 1983, pp. 38-39 ; Anton A. G. Smeets, “Opstellen ter gelegenheid van het 100-jarig bestaan van de Kamer van Koophandel en Nijverheid te Curaçao” edited by O. B.Linker, Curaçao 1984, pp. 241-43

[58] Richard A. Gordon “Tax havens and their use by United States taxpayers-An overview“, Washington, DC: U.S. Internal Revenue Service (IRS), 1981, p. 151

[59] M. J. C. van Beurden, “De Curaçaose offshore: Ontstaan, groei en neergang van een belastingparadijs, 1951-2013“, PhD dissertation, University of Amsterdam, 2018, p. 157-58

[60] Marilyn Doskey Franson, “Repeal of the Thirty Percent Withholding Tax on Portfolio Interest Paid to Foreign Investors”, 6 Nw. J. Int’l L. & Bus. 930, 1984-1985, p. 930

[61] Press Releases of the United States Department of the Treasury: Volume 275, p. 135

[62] Press Releases of the United States Department of the Treasury: Volume 275, pp. 135-36

[63] Press Releases of the United States Department of the Treasury: Volume 275, p. 136

[64] Mark B. Schoeller, “The Termination fo the United States-Netherlands Antilles Income Tax Convention: a Failure of U.S. Policy”, Journal of international business law, Vol. 10, 1988, p. 369

[65] https://www.marxist.com/uprising-in-curacao-against-vicious-austerity.htm

[66] https://fee.org/articles/the-rise-and-fall-of-curaaos-offshore-financial-sector/

[67] Frith Crandall, “The Termination of the United States-Netherlands Antilles Tax Treaty: What Were the Costs of Ending Treaty Shopping”, 9 Nw. J. Int’l L. & Bus. 355, 1988-1989, p. 355

[68] Mark B. Schoeller, “The Termination fo the United States-Netherlands Antilles Income Tax Convention: a Failure of U.S. Policy”, Journal of international business law, Vol. 10, 1988, p. 496

[69] Mark B. Schoeller, “The Termination fo the United States-Netherlands Antilles Income Tax Convention: a Failure of U.S. Policy”, Journal of international business law, Vol. 10, 1988, p. 496

[69] Mutual Assistance in Criminal Matters, May 25, 1973, United States-Switzerland, 27 U.S.T. 2019, T.I.A.S. No. 8302 (entered into force Jan. 23, 1977) [69] Memorandum of Understanding, Aug. 31, 1982, United States-Switzerland, 22 I.L.M. I.; Mark B. Schoeller, “The Termination fo the United States-Netherlands Antilles Income Tax Convention: a Failure of U.S. Policy”, Journal of international business law, Vol. 10, 1988, p. 504; Mark B. Schoeller, “The Termination fo the United States-Netherlands Antilles Income Tax Convention: a Failure of U.S. Policy”, Journal of international business law, Vol. 10, 1988, p. 496; Mutual Assistance in Criminal Matters, May 25, 1973, United States-Switzerland, 27 U.S.T. 2019, T.I.A.S. No. 8302 (entered into force Jan. 23, 1977); Memorandum of Understanding, Aug. 31, 1982, United States-Switzerland, 22 I.L.M. I.[70] Mark B. Schoeller, “The Termination fo the United States-Netherlands Antilles Income Tax Convention: a Failure of U.S. Policy”, Journal of international business law, Vol. 10, 1988, p. 504

[71] “Financial Secrecy Index 2020 – Narrative Report on Curaçao”, Tax Justice Network, p.2

[72] Steve R. Vanenburg, Arne Kattouw, “Het nieuw fiscaal raamwerk op de Nederlandse Antillen 1: de Antillen als” nieuwe” vestigingsplaats voor de internationale financiële dienstensector”, Kluwer, 2002, p. 15

[73] “Financial Secrecy Index 2020 – Narrative Report on Curaçao”, Tax Justice Network, p.2

[74] M.J.C. van Beurden, „De Curaçaose offshore. Oorzaken van ontstaan, groei en neergang van een belastingparadijs, 1951-2013“, University of Amsterdam; https://aihr.uva.nl/binaries/content/assets/uva/en/research/phd/summaries/2018/06/summary-beurden-van-tijn.pdf

[75] Parliamentary Papers, the Netherlands, Second Chamber 1994/95, 23046, no. 18

[76] Faroe Metry, “De geschiedenis van de belastingen in de kolonie Curaçao en de Nederlandse Antillen: een onderzoek naar historische gegevens omtrent de wording van de belastingen in eerst de kolonie Curaçao en daarna de Nederlandse Antillen omvattende de periode 1634-2005: tevens een vastlegging van gebeurtenissen op het gebied der belastingen, de bronnen daarvan en conclusies hierover” Stichting Publicaties KPMG Tax and Legal Services, 2006, p. 686

[77] M. J. C. van Beurden, “De Curaçaose offshore: Ontstaan, groei en neergang van een belastingparadijs, 1951-2013”, PhD dissertation, University of Amsterdam, 2018, p. 212

[78] M. J. C. van Beurden, “De Curaçaose offshore: Ontstaan, groei en neergang van een belastingparadijs, 1951-2013”, PhD dissertation, University of Amsterdam, 2018, p. 219-20

[79] T. J. Haan, “Antilliaanse instituties. De economische ontwikkeling van de Nederlandse Antillen en Aruba 1969-1995”, 1998, pp. 218-19

[80] https://fee.org/articles/the-rise-and-fall-of-curaaos-offshore-financial-sector/

[81] https://www.aruba.com/us/our-island/history-and-culture/history

[82] Rose Mary Allen, “The Complexity of National Identity Construction in Curaçao, Dutch Caribbean”, in European Review of Latin American and Caribbean Studies 89, October 2010, p. 118

[83] Rose Mary Allen, “The Complexity of National Identity Construction in Curaçao, Dutch Caribbean”, in European Review of Latin American and Caribbean Studies 89, October 2010, p. 118

[84] https://www.netherlandsandyou.nl/your-country-and-the-netherlands/united-states/about-us/curacao-and-you/about-curacao

[85] https://www.government.nl/latest/news/2010/10/10/10-10-10-a-new-start-for-the-islands-of-the-netherlands-antilles

[86] https://www.tripadvisor.de/Restaurant_Review-g147278-d1046226-Reviews-Iguana_Cafe-Willemstad_Curacao.html

[87] Evelyn Ersanilli, “Focus Migration”, Country Profile n°11 – Netherlands, November 2014, p. 2

[88] https://what-europe-does-for-me.eu/en/portal/1/NL998

[89] Josine Junger-Tas, Ineke Haen Marshall, Dirk Enzmann, Martin Killias, Majone Steketee, Beata Gruszczynska, “Juvenile Delinquency in Europe and Beyond: Results of the Second International Self-Report Delinquency Study”, Springer Science & Business Media, 2009, p. 411

[90] Josine Junger-Tas, Ineke Haen Marshall, Dirk Enzmann, Martin Killias, Majone Steketee, Beata Gruszczynska, “Juvenile Delinquency in Europe and Beyond: Results of the Second International Self-Report Delinquency Study”, Springer Science & Business Media, 2009, p. 411; https://esa.un.org/miggmgprofiles/indicators/files/Curacao.pdf

[91] Josine Junger-Tas, Ineke Haen Marshall, Dirk Enzmann, Martin Killias, Majone Steketee, Beata Gruszczynska, “Juvenile Delinquency in Europe and Beyond: Results of the Second International Self-Report Delinquency Study”, Springer Science & Business Media, 2009, p. 412

[92] https://www.cbs.cw/population-tables

[93] https://www.numbeo.com/cost-of-living/compare_countries_result.jsp?country1=Netherlands&country2=Curacao

[94] Josine Junger-Tas, Ineke Haen Marshall, Dirk Enzmann, Martin Killias, Majone Steketee, Beata Gruszczynska, “Juvenile Delinquency in Europe and Beyond: Results of the Second International Self-Report Delinquency Study”, Springer Science & Business Media, 2009, p. 412

[95] “The Situation of Children and Adolescents in Curaçao”, United Nations Children’s Fund (UNICEF), 2013, p. 49

[96] “The Situation of Children and Adolescents in Curaçao”, United Nations Children’s Fund (UNICEF), 2013, p. 43

[97] “Crime, Violence, and Development: Trends, Costs, and Policy Options in the Caribbean”, A Joint Report by the United Nations Office on Drugs and Crime and the Latin America and the Caribbean Region of the World Bank, March 2007, p. 94

[98] “Crime, Violence, and Development: Trends, Costs, and Policy Options in the Caribbean”, A Joint Report by the United Nations Office on Drugs and Crime and the Latin America and the Caribbean Region of the World Bank, March 2007, p. 94

[99] “Crime, Violence, and Development: Trends, Costs, and Policy Options in the Caribbean”, A Joint Report by the United Nations Office on Drugs and Crime and the Latin America and the Caribbean Region of the World Bank, March 2007, p. 101

[100] http://curacaochronicle.com/columns/curacao-small-island-big-problems-part-3-war-against-drugs-or-the-curacao-connection/

[101] http://retro.nrc.nl/W2/Nieuws/1999/11/16/Vp/05.html

[102] http://retro.nrc.nl/W2/Nieuws/1999/11/16/Vp/05.html

[103] https://eenvandaag.avrotros.nl/item/wie-zijn-de-no-limit-soldiers/

[104] http://nazaritze-lionzman.blogspot.com/2016/06/the-no-limit-soldiers-organized-crime.html

[105] https://soualigayouth.wordpress.com/2021/04/07/shurendy-tyson-quant-and-his-no-limit-soldiers/

[106] https://ocindex.net/country/netherlands

[107] https://www.youtube.com/watch?v=g_sQKNf1mJE

[108] https://revu.nl/artikel/2827/de-gangs-buena-vista-city-en-no-limit-soldiers-voeren-oorlog-op-curacao

[109] http://curacaochronicle.com/main/half-million-guilders-for-murder-helmin-wiels/

[110] https://www.bbc.com/news/world-latin-america-22424009

[111] http://curacaochronicle.com/judicial/life-sentence-for-murder-helmin-wiels-stands-in-court-of-cassation/

[112] https://magazines.openbaarministerie.nl/opportuun/2018/01/de-zaak

[113] http://curacaochronicle.com/judicial/fonseca-gets-26-years-in-prison-on-appeal-for-the-murder-of-helmin-wiels/

[114] https://netherlandsnewslive.com/former-minister-curacao-gets-30-years-in-prison-on-appeal-for-the-murder-of-helmin-wiels/104862/

[115] https://stmaartennews.com/judicial/insufficient-evidence-robbie-dos-santos/

[116] https://caribischnetwerk.ntr.nl/2019/11/18/loterijbaas-aangehouden-voor-betrokkenheid-moord-helmin-wiels/ ; https://www.thedailyherald.sx/islands/robbie-greeted-upon-his-release

[117] https://blazetrends.com/justice-in-curacao-stops-prosecution-of-lottery-king-in-helmin-wiels-murder-case/

[118] https://www.curacaochronicle.com/post/local/elmer-wilsoe-once-a-suspect-in-murder-case-helmin-wiels-wants-compensation/

[119] http://caribbeanelections.com/knowledge/biography/bios/schotte_gerrit.asp

[120] http://curacaochronicle.com/fs/schotte-mfk-will-not-participate-in-elections-anymore/

[121] https://www.ieyenews.com/former-curacao-pm-appeals-corruption-conviction-and-sentence/

[122] https://apnews.com/article/007da10b9ecb4391b048ba655433c79b

[123] https://stmaartennews.com/dutch-news/schotte-loses-appeal-no-longer-mp/

[124] https://sxmgovernment.com/2015/06/05/francesco-corallo-owner-of-starz-beach-plaza-casino-in-st-maarten-to-be-prosecuted-june-16th-with-13-other-defendents/

[125] https://stmaartennews.com/dutch-news/supreme-court-upholds-schottes-conviction/

[126] https://ricerca.repubblica.it/repubblica/archivio/repubblica/1988/07/01/preso-il-manager-della-mafia-braccio-destro.html

[127] https://www.laregione.ch/cantone/luganese/1221211/estradato-in-italia-francesco-corallo-aveva-conti-anche-in-banche-di-lugano

[128] https://www.companysearchesmadesimple.com/company/uk/05738632/global-starnet-limited/

[129] http://enricodigiacomo.org/2010-10-linchiesta-quel-paradiso-delle-slot-machine-che-i-monopoli-italiani-ignorano-coincidenze-la-atlantis-ha-sede-a-saint-lucia-con-un-fatturato-di-30-miliardi-di-euro-lazienda-off-shore-supera-an/

[130] https://www.senato.it/japp/bgt/showdoc/showText?tipodoc=Sindisp&leg=16&id=509369

[131] https://www.huffingtonpost.it/2012/12/07/i-monopoli-ritirano-la-concessione-per-le-slot-machine-alla-bplus-di-francesco-corallo_n_2256063.html?utm_hp_ref=it-francesco-corallo

[132] https://st.ilsole24ore.com/art/notizie/2014-08-08/giochi-bplus-commissariata-063848.shtml?uuid=ABZNuRiB

[133] https://opencorporates.com/companies/gb/05738632

[134] https://www.lettera43.it/corallo-limpero-del-re-delle-slot/?refresh_ce

[135] https://opencorporates.com/companies/cy/HE288055

[136] https://www.ilcorrieredelgiorno.it/riciclaggio-chiesto-processo-per-gianfranco-fini-e-la-famiglia-tulliani/

[137] Il partito guidato da Silvio Berlusconi

[138] https://roma.repubblica.it/cronaca/2016/12/13/news/roma_riciclaggio_arrestati_il_re_mida_dei_giochi_e_amedeo_laboccetta-154013735/ ; https://nicolettaforcheri.wordpress.com/2013/08/04/roma-si-consegna-il-re-delle-slot-machine-francesco-corallo-era-latitante-dal-2012/

[139] https://curacaochronicle.com/tag/francesco-corallo/ ; https://www.occrp.org/en/daily/5894-italy-s-king-of-slots-arrested ; https://sxmgovernment.com/2016/12/14/full-story-the-richest-dutch-citizen-francesco-corallo-mob-boss-arrested-warrants-issued-by-the-italian-authorities-early-morning-raids-baestsen-also-arrested/ ; https://knipselkrant-curacao.com/blog-jr-the-real-corallo-story-call-me-francesco-or-call-me-the-godfather/ ; https://international.sp.nl/nieuws/2019/08/another-threatening-letter-from-a-gambling-boss-in-curacao

[140] https://www.lettera43.it/corallo-limpero-del-re-delle-slot/?refresh_ce

[141] https://www.avvenire.it/attualita/Pagine/arrestato-re-delle-slot-ai-caraibi ; https://www.ilpost.it/wp-content/uploads/2010/09/contratto-tulliani.jpg?x15283 ; https://amp.ilgiornale.it/news/montecarlo-scatole-cinesi-coprire-mister-x.html

[142] https://www.ilprimatonazionale.it/cronaca/la-casa-di-montecarlo-era-dei-tulliani-fini-allora-sono-un-coglione-54468/; https://www.ilreggino.it/cronaca/2021/04/21/rinascita-scott-la-pubblicita-non-richiesta-al-coimputato-di-fini-tulliani-e-corallo/

[143] https://www.pressgiochi.it/rouge-et-noir-il-6-dicembre-si-decide-sulla-richiesta-di-stralcio-presentata-dai-legali-di-fini/96610

[144] https://stmaartennews.com/dutch-news/supreme-court-upholds-schottes-conviction/

[145] https://drugtrade.wordpress.com/2018/12/03/the-saga-of-gerrit-schotte-and-francesco-corallo-2018-curacao-and-sint-maarten/

[146] https://www.southcom.mil/Media/Special-Coverage/Cooperative-Security-Locations/

[147] https://www.law.ox.ac.uk/research-subject-groups/centre-criminology/centreborder-criminologies/blog/2021/04/breaking-borders

[148] https://www.ispionline.it/it/tag/venezuela

[149] https://globalmonitor.us/product/venezuela-oil-and-gas-market-report

[150] https://www.nytimes.com/2019/08/06/us/politics/venezuela-embargo-sanctions.html

[151] https://www.reuters.com/article/us-venezuela-politics-idUSKBN1W100J

[152] https://www.bbc.com/news/world-latin-america-42657370

[153] https://www.venezuelablog.org/interactive-map-degrees-of-diplomatic-recognition-of-guaido-and-maduro/

[154] https://sicurezzainternazionale.luiss.it/2021/12/22/turchia-venezuela-discutono-dei-futuri-sviluppi-della-cooperazione/

[155] http://www.vita.it/it/article/2021/10/11/venezuela-lesodo-del-25-della-popolazione/160695/

[156] https://www.europapress.es/internacional/noticia-venezuela-supera-umbral-seis-millones-migrantes-refugiados-20210910101210.html

[157] https://www.r4v.info/en/refugeeandmigrants

[158] “Detained and Deported – Venezuelans denied protection in Curaçao”, Amnesty International, 2018, p. 9

[159] “Detained and Deported – Venezuelans denied protection in Curaçao”, Amnesty International, 2018, pp. 11, 24

[160] “Still no Safety – Venezuelans denied protection in Curaçao”, Amnesthy International, 2021, pp. 36-37

[161] https://www.dolfijnfm.com/tweede-kamer-wil-dat-regering-curacao-aanspreekt-op-mensenrechtensituatie/?fbclid=IwAR3qhbAifUkMCMdUsc_kQCh28AaDiCv3gHfYcazN0vFKcka9tZUL3dRs3QM ; https://www.facebook.com/dolfijnfmnieuws/photos/a.479047102265709/1756660387837701/

[162] https://www.amnesty.org/en/latest/news/2021/10/curacao-authorities-continue-deny-protection-people-fleeing-crisis-venezuela/ ; government.aw/news/news_47033/item/the-netherlands-helps-aruba-with-109-million-florins-to-cope-with-venezuelan-crisis_44593.html ; https://www.facebook.com/dolfijnfmnieuws/photos/a.479047102265709/1756660387837701/

[163] https://www.law.ox.ac.uk/research-subject-groups/centre-criminology/centreborder-criminologies/blog/2021/01/welcome-reception

[164] https://www.independent.co.uk/news/world/americas/venezuela-shipwreck-latest-updates-curacao-dead-missing-sink-boat-sank-a8154106.html ; https://www.bbc.com/news/world-latin-america-48607330

[165] https://curacaochronicle.com/local/venezuelans-in-curacao-respond-to-governors-remarks-during-opening-parliamentary-year/

[166] https://www.law.ox.ac.uk/research-subject-groups/centre-criminology/centreborder-criminologies/blog/2021/04/breaking-borders

[167] https://mronline.org/2019/04/23/intervention-in-venezuela-a-tour-of-u-s-military-bases-in-curacao-and-aruba/

[168] https://www.tni.org/es/art%C3%ADculo/bases-avanzadas-de-los-estados-unidos-en-aruba-y-curacao

[169] https://ibiworld.eu/2021/12/25/grecia-nascono-i-nuovi-campi-di-concentramento/ ; https://www.etiasvisa.com/etias-news/frontex-regulation-european-border ; https://nos.nl/artikel/2358807-baas-europese-grensbewaking-in-het-nauw-door-illegaal-terugzetten-migranten ; https://www.etiasvisa.com/etias-news/eu-hotspot-system

[170] https://ibiworld.eu/2021/04/27/basi-militari-e-miniere-il-volto-nuovo-del-fondo-delloceano/

[171] https://www.mdpi.com/2072-4292/11/6/680/htm

[172] https://www.isa.org.jm/exploration-contracts/interoceanmetal-joint-organization

[173] http://www.specpartners.net/aboutus.html

[174] 2019.12.31 Spec Partners Ltd. Bedford

[175] http://www.specpartners.net/files/GWL_Pan-Caribe_2015.pdf

[176] 2011.04.12 GWL Technologies LLP Sheffield, page 3

[177] http://www.specpartners.net/files/GWL_Pan-Caribe_2015.pdf

[178] 2013.04.21 GWL Technologies LLP Sheffield, page 3

[179] 2016.08.13 GWL Technologies LLP Sheffield

[180] 2018.02.17 GWL Technologies LLP Sheffield

[181] https://www.rosgeo.com/subdivision/ymg/#popup-person-enterprise-1904 ; 2016.02.03 Geology Without Limits Ltd. Horsham

[182] https://www.curacaohistory.com/detail/1969-trinta-di-mei

[183] https://atlanticsentinel.com/2021/03/curacao-election-result-will-set-off-alarm-bells-in-netherlands/

[184] http://www.caribbeanelections.com/cw/elections/cw_results_2012.asp

[185] https://atlanticsentinel.com/2021/03/curacao-election-result-will-set-off-alarm-bells-in-netherlands/

[186] http://www.caribbeanelections.com/cw/elections/cw_results_2016.asp

[187] http://www.caribbeanelections.com/cw/elections/cw_results_2017.asp

[188] https://atlanticsentinel.com/2021/03/curacao-election-result-will-set-off-alarm-bells-in-netherlands/

[189] https://caribbeannetwork.ntr.nl/2021/03/20/mfk-leader-pisas-brings-upon-major-shift-in-politics-on-curacao/

[190] https://www.curacaochronicle.com/post/main/pisas-cabinet-officially-agrees-with-coho-has-voter-fraud-been-committed/

[191] https://www.curacaochronicle.com/post/main/pisas-cabinet-officially-agrees-with-coho-has-voter-fraud-been-committed/

[192] https://caribischnetwerk.ntr.nl/2021/09/05/kabinet-pisas-officieel-akkoord-met-coho-is-er-kiezersbedrog-gepleegd/

[193] https://caribischnetwerk.ntr.nl/2020/09/11/premier-rutte-geen-onderhandeling-over-coronaleningen-aruba-diep-teleurgesteld/

[194] https://caribischnetwerk.ntr.nl/2020/08/10/coronaleningen-komen-de-eilanden-en-den-haag-er-toch-samen-uit/ ; https://caribischnetwerk.ntr.nl/2020/08/13/coronacrisis-legt-verslechterde-relatie-curacao-en-nederland-bloot/

Leave a Reply